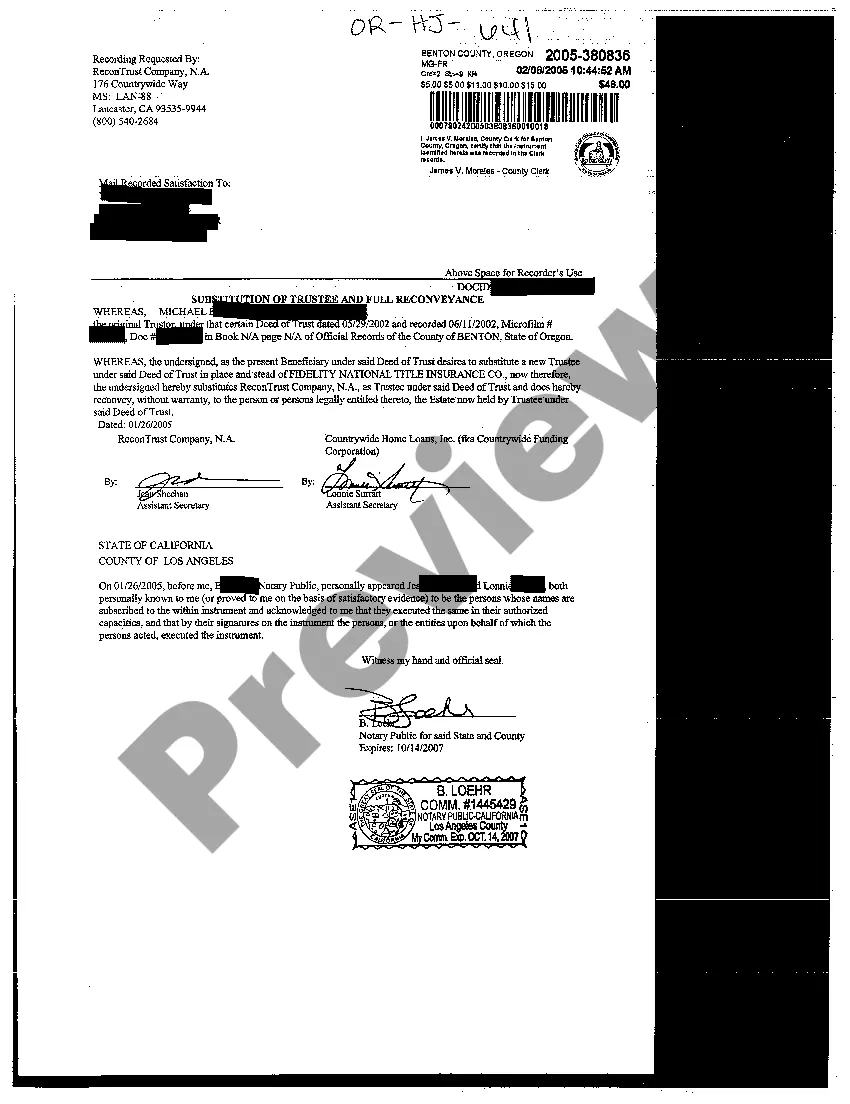

Eugene Oregon Substitution of Trustee and Full Re conveyance is an important legal process involving real estate transactions. When a property is financed through a mortgage or deed of trust, a trustee is appointed to hold the legal title of the property until the loan is paid off. In the event of a loan payoff, the Substitution of Trustee and Full Re conveyance procedure allows for the transfer of the property's title from the trustee back to the borrower or homeowner. This process involves several key steps. First, the borrower or homeowner is responsible for requesting a Substitution of Trustee and Full Re conveyance from the lender or the trustee appointed at the time of loan origination. This request typically requires submitting a formal application or letter to the lender stating the intention to pay off the loan in full. Once the lender receives the request, they review the loan account to ensure that all outstanding payments, including principal and any accrued interest, have been satisfied. If there are any remaining amounts due, they must be settled before the Substitution of Trustee and Full Re conveyance can proceed. Once the loan is verified as paid in full, the lender prepares a Substitution of Trustee document, which replaces the existing trustee with a new one or, in some cases, reverts the property's title directly to the homeowner. In Eugene, Oregon, there are a few variations of Substitution of Trustee and Full Re conveyance procedures, such as: 1. Standard Substitution of Trustee: This is the most common type, where the lender appoints a new trustee to hold the title of the property and ensures the loan is paid off. 2. Non-Judicial Full Re conveyance: Sometimes referred to as a release of lien, this procedure allows for the removal of the deed of trust from the property record without court involvement. It signifies that the loan has been fully repaid and releases the lender's interest in the property. 3. Court-Ordered Full Re conveyance: In some cases, a court's involvement is required to release the lien. This process might be necessary when there are disputes or legal complexities involved in the loan's repayment. It is crucial to follow the specific requirements and procedures outlined by the respective lender or trustee, as they may have unique guidelines for executing the Substitution of Trustee and Full Re conveyance. It is also recommended consulting with legal experts or professionals well-versed in real estate law to ensure compliance and to protect one's rights and interests throughout the process. In summary, the Eugene Oregon Substitution of Trustee and Full Re conveyance is a legal mechanism that facilitates the transfer of property title from a trustee back to the homeowner or borrower upon the full repayment of a loan. Various types of procedures exist, including standard Substitution of Trustee, non-judicial full reconveyance, and court-ordered full reconveyance, each with its own specific requirements and implications.

Eugene Oregon Substitution of Trustee and Full Reconveyance

Description

How to fill out Eugene Oregon Substitution Of Trustee And Full Reconveyance?

Benefit from the US Legal Forms and have instant access to any form template you require. Our useful platform with a huge number of documents makes it simple to find and obtain almost any document sample you require. It is possible to export, fill, and certify the Eugene Oregon Substitution of Trustee and Full Reconveyance in a few minutes instead of surfing the Net for many hours trying to find a proper template.

Using our library is a great strategy to improve the safety of your record filing. Our experienced lawyers regularly review all the documents to make certain that the templates are relevant for a particular state and compliant with new acts and polices.

How do you obtain the Eugene Oregon Substitution of Trustee and Full Reconveyance? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. Additionally, you can get all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Open the page with the form you need. Ensure that it is the template you were seeking: examine its name and description, and use the Preview option if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Pick the format to get the Eugene Oregon Substitution of Trustee and Full Reconveyance and modify and fill, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the Eugene Oregon Substitution of Trustee and Full Reconveyance.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!