The Eugene Oregon Foreclosure Avoidance Program is an initiative aimed at helping homeowners in Eugene, Oregon, prevent foreclosure and find alternatives to losing their homes. This program provides various resources, support, and options for homeowners who are facing financial hardships and are at risk of foreclosure. One of the key components of the Eugene Oregon Foreclosure Avoidance Program is counseling and education. Homeowners can receive guidance from certified housing counselors who provide personalized assistance, helping them understand their options and work towards a viable solution. These counselors offer financial advice, budgeting assistance, and foreclosure prevention strategies tailored to each homeowner's circumstances. Another vital aspect of the program is loan modification assistance. For eligible homeowners, the program helps negotiate with lenders to modify the terms of their mortgage loans, allowing them to make more affordable payments and avoid foreclosure. Loan modification options may include lowering interest rates, extending the loan term, or reducing the principal amount owed. Additionally, the Eugene Oregon Foreclosure Avoidance Program offers homeowners access to foreclosure mediation services. Mediators act as neutral third parties, facilitating communication between homeowners and lenders to find mutually agreeable solutions. Mediation provides an opportunity for negotiating repayment plans, loan modifications, or other alternatives that can help homeowners retain their properties. For homeowners who are unable to keep their homes even with assistance, the program also encompasses options such as short sales and deeds-in-lieu of foreclosure. These alternatives enable homeowners to sell their properties for less than the outstanding mortgage amount or transfer ownership to the lender, respectively, minimizing the negative impact on their credit scores compared to a full foreclosure. By participating in the Eugene Oregon Foreclosure Avoidance Program, homeowners gain access to foreclosure prevention resources, counseling, loan modification assistance, mediation services, and information on alternative options. Through this program, Eugene residents facing financial hardships have a better chance of avoiding foreclosure and finding a feasible solution to their mortgage difficulties. Keywords: Eugene Oregon, Foreclosure Avoidance Program, homeowners, foreclosure prevention, counseling, education, housing counselors, financial advice, budgeting assistance, loan modification, lenders, mortgage loans, repayment plans, foreclosure mediation services, short sales, deeds-in-lieu of foreclosure, credit scores, foreclosure prevention resources.

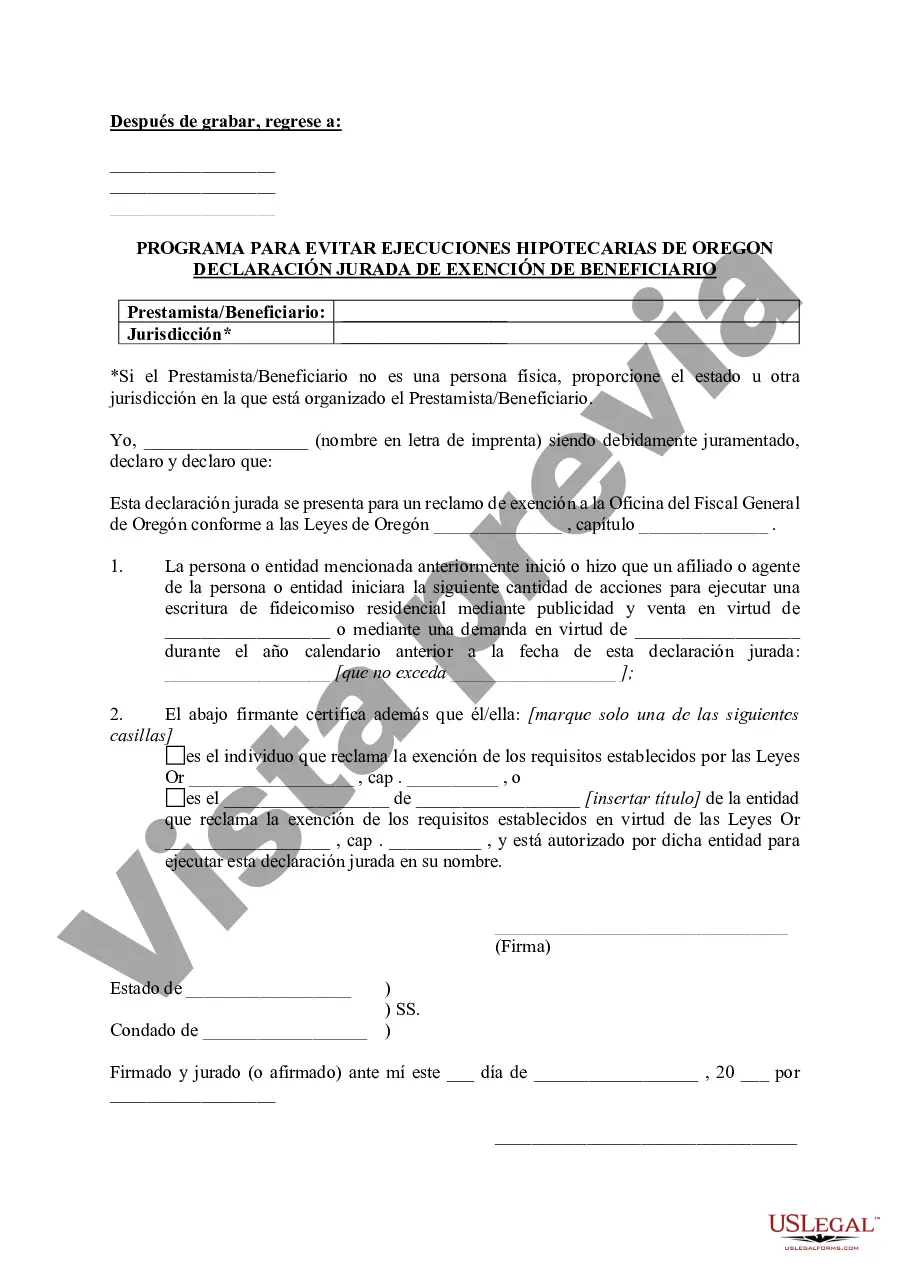

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Eugene Oregon Programa de Prevención de Ejecuciones Hipotecarias de Oregón - Oregon Foreclosure Avoidance Program Beneficiary Exemption Affidavit

Description

How to fill out Eugene Oregon Programa De Prevención De Ejecuciones Hipotecarias De Oregón?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Eugene Oregon Foreclosure Avoidance Program gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Eugene Oregon Foreclosure Avoidance Program takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Eugene Oregon Foreclosure Avoidance Program. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!