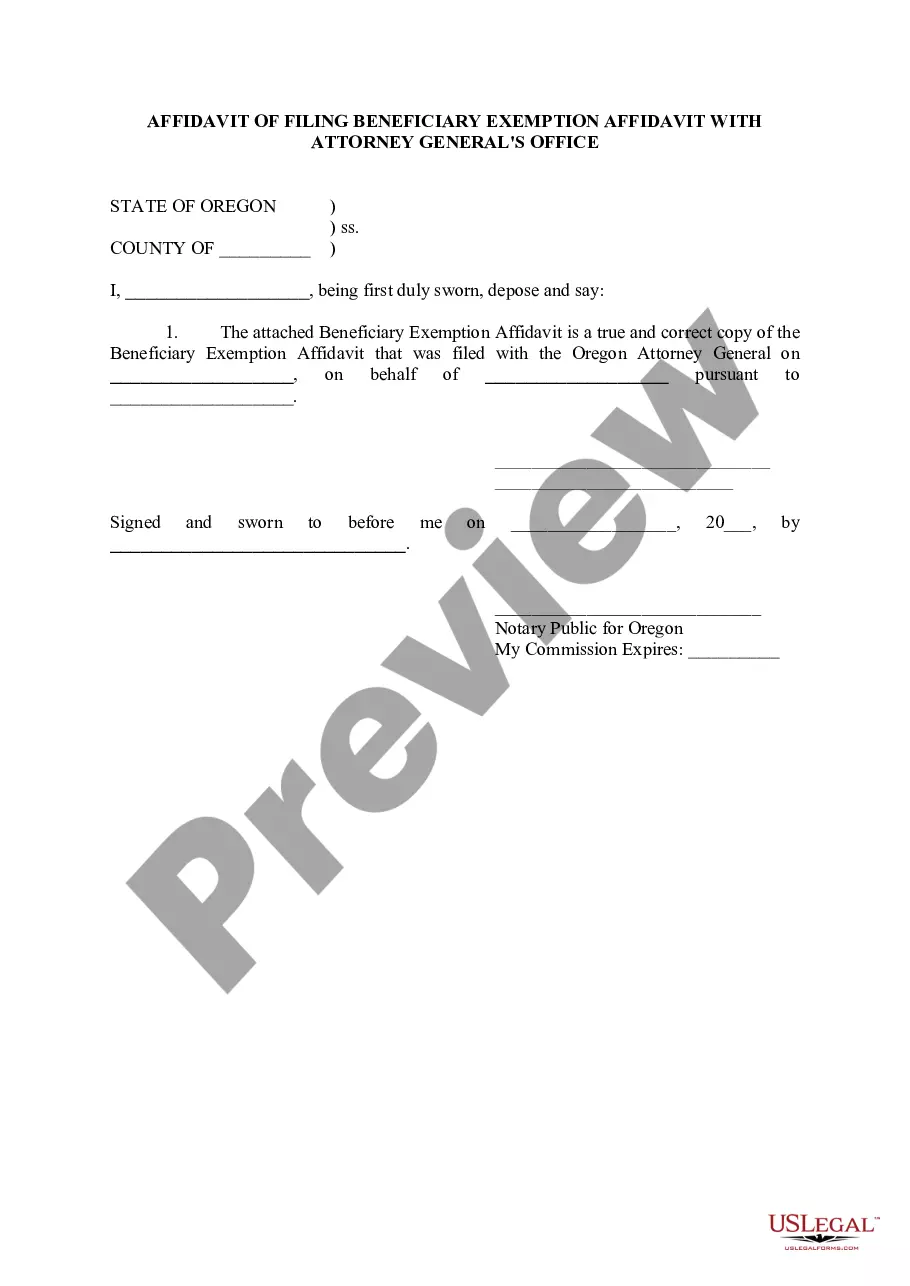

Portland Oregon Foreclosure Avoidance ProgramBeneficiary Exemption Affidavit

Description

How to fill out Oregon Foreclosure Avoidance ProgramBeneficiary Exemption Affidavit?

Take advantage of the US Legal Forms and gain instant access to any form template you need.

Our advantageous website featuring thousands of document samples enables you to locate and retrieve nearly any document template you seek.

You can download, fill out, and validate the Portland Oregon Foreclosure Avoidance Program in just minutes instead of spending hours online trying to find a suitable template.

Using our collection is an excellent approach to enhance the security of your form submissions.

If you have not yet created a profile, adhere to the steps below.

Feel free to utilize our service and make your document handling as user-friendly as possible!

- Our experienced attorneys continuously evaluate all documents to confirm that the templates are suitable for specific areas and adhere to current laws and regulations.

- How can you acquire the Portland Oregon Foreclosure Avoidance Program.

- If you already hold a subscription, simply Log In to your account.

- The Download option will be available on all the samples you view.

- Furthermore, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

In Oregon, lenders typically begin foreclosure proceedings after you miss three consecutive payments. However, each lender may have different policies concerning missed payments. It is crucial to consult the terms of your mortgage agreement and act promptly if you find yourself in this situation. Engaging with resources like the Portland Oregon Foreclosure Avoidance Program can help you address issues before reaching this point.

To stop a foreclosure in Oregon, you can participate in the Portland Oregon Foreclosure Avoidance Program. This program offers resources and tools to help you negotiate with your lender and find alternative payment solutions. It's essential to communicate quickly with your lender and explore loss mitigation options. Additionally, seeking assistance from qualified legal professionals can provide you with the guidance you need.

The 120 day rule for foreclosure is a requirement that lenders must wait 120 days after a borrower misses their first payment before initiating the foreclosure process. This rule allows homeowners time to explore options like the Portland Oregon Foreclosure Avoidance Program. Understanding this timeframe can empower you in your efforts to retain your home. Utilizing tools like the Beneficiary Exemption Affidavit can also be beneficial in these situations.

To dismiss a foreclosure, you can file a motion in court that requests the dismissal based on valid reasons such as improper procedures or changes in your financial situation. Engaging with the Portland Oregon Foreclosure Avoidance Program can provide essential guidance also on filing necessary paperwork. Furthermore, utilizing the Beneficiary Exemption Affidavit can help establish your position and improve your chances of success.

In Oregon, the foreclosure process can typically take anywhere from 6 months to over a year, depending on various factors involving the lender and the borrower. However, engaging in the Portland Oregon Foreclosure Avoidance Program may extend this timeline, allowing homeowners to explore options before foreclosure takes place. It's vital to understand the process to take informed steps.

To avoid foreclosure in Oregon, begin by reviewing your financial situation and exploring potential solutions with your lender. Programs like the Portland Oregon Foreclosure Avoidance Program offer resources to assist homeowners. Staying informed and proactive about your options is essential to maintaining your homeownership.

You can reach the Oregon foreclosure avoidance program by calling their dedicated phone line at 1-888-893-8767. This program provides valuable assistance to homeowners facing foreclosure. It’s crucial to have this number handy should you need support navigating your financial challenges.