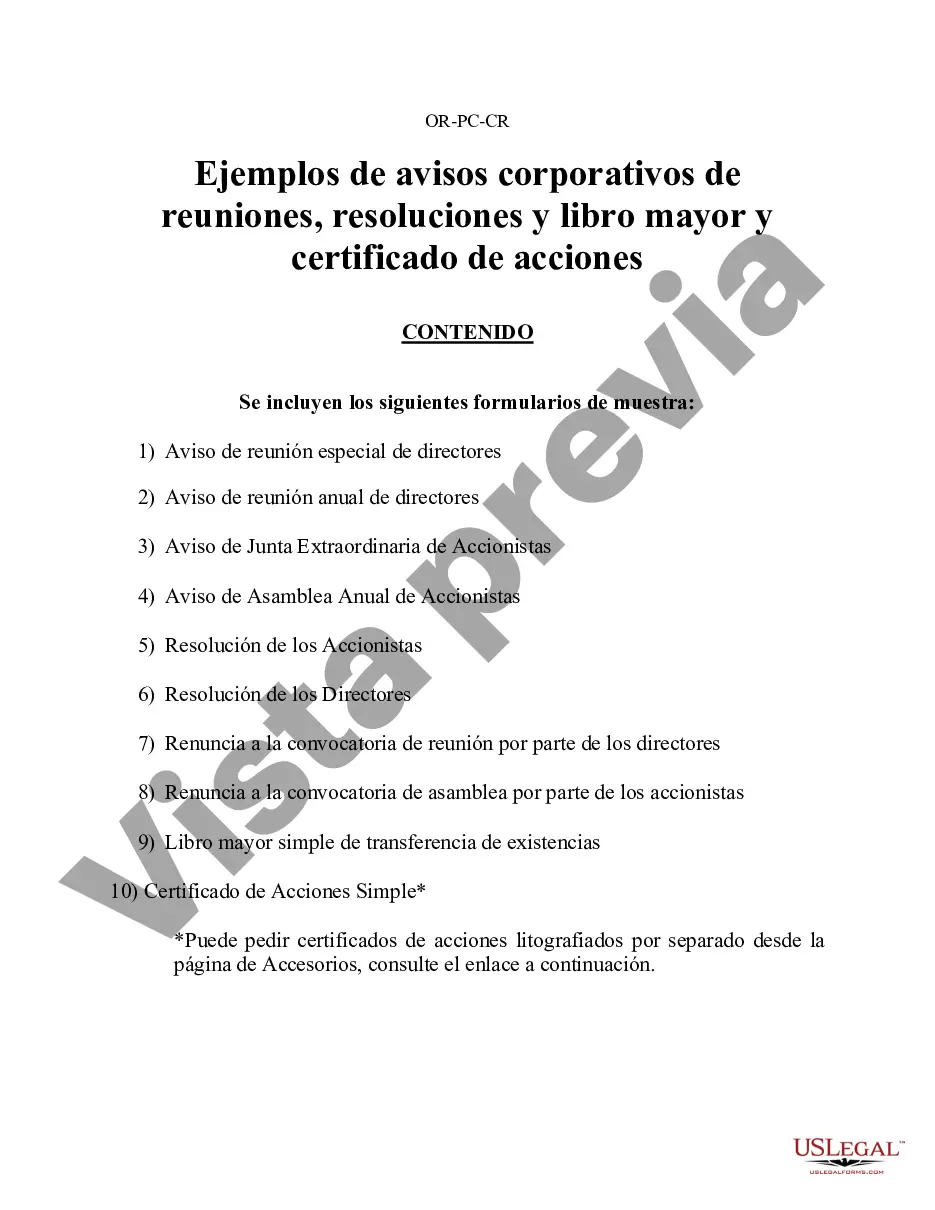

Gresham Sample Corporate Records for an Oregon Professional Corporation play a crucial role in ensuring transparent and organized operations for businesses in the state. These records serve as a comprehensive documentation of important company information, financial statements, meeting minutes, shareholder details, and more. Maintaining accurate and up-to-date corporate records is essential for legal compliance and can assist in facilitating smooth business transactions. Here are some key types of Gresham Sample Corporate Records that an Oregon Professional Corporation should maintain: 1. Articles of Incorporation: This document establishes the existence of the corporation and includes essential details such as the name, purpose, and registered office address. 2. Bylaws: These are the rules and regulations that govern the internal operations of the corporation, including the roles and responsibilities of its officers, directors, and shareholders. 3. Shareholder Agreements: These agreements outline the rights and obligations of the shareholders, including voting rights, share transfer restrictions, and dividend policies. 4. Meeting Minutes: Detailed records of board of directors and shareholders meetings, including topics discussed, decisions made, and any resolutions passed. These minutes help maintain transparency and ensure compliance with corporate governance requirements. 5. Financial Statements: Comprehensive financial records, including balance sheets, income statements, and cash flow statements. These statements provide an overview of the corporation's financial health and performance. 6. Annual Reports: Summaries of the corporation's activities, financial performance, and goals achieved during the previous year. These reports are often required by regulatory authorities and provide insight to shareholders and potential investors. 7. Stock Ledgers: These records track the ownership and transfer of company stock, including details such as shareholder names, share holdings, and any buy/sell transactions. 8. Employment Contracts: Agreements between the corporation and its employees, outlining terms of employment, compensation, benefits, and any non-disclosure or non-compete clauses. 9. Licenses and Permits: Documentation of any required licenses or permits obtained by the corporation to operate legally in Oregon. Having these Gresham Sample Corporate Records readily available and properly maintained is not only vital for regulatory compliance but also for demonstrating the corporation's credibility and transparency to stakeholders, potential partners, and investors. Additionally, these records can be essential during legal disputes or audits. By ensuring the accurate and organized documentation of their corporate affairs, Oregon Professional Corporations in Gresham can navigate the business landscape with ease, foster trust among stakeholders, and confidently pursue their growth objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gresham Oregon Ejemplos de registros corporativos para una corporación profesional de Oregón - Sample Corporate Records for an Oregon Professional Corporation

Description

How to fill out Gresham Oregon Ejemplos De Registros Corporativos Para Una Corporación Profesional De Oregón?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no legal education to create such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Gresham Sample Corporate Records for an Oregon Professional Corporation or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Gresham Sample Corporate Records for an Oregon Professional Corporation in minutes employing our trusted service. If you are presently an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are new to our library, ensure that you follow these steps prior to obtaining the Gresham Sample Corporate Records for an Oregon Professional Corporation:

- Ensure the template you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Review the document and go through a quick outline (if provided) of scenarios the document can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment method and proceed to download the Gresham Sample Corporate Records for an Oregon Professional Corporation as soon as the payment is completed.

You’re good to go! Now you can go on and print the document or fill it out online. In case you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.