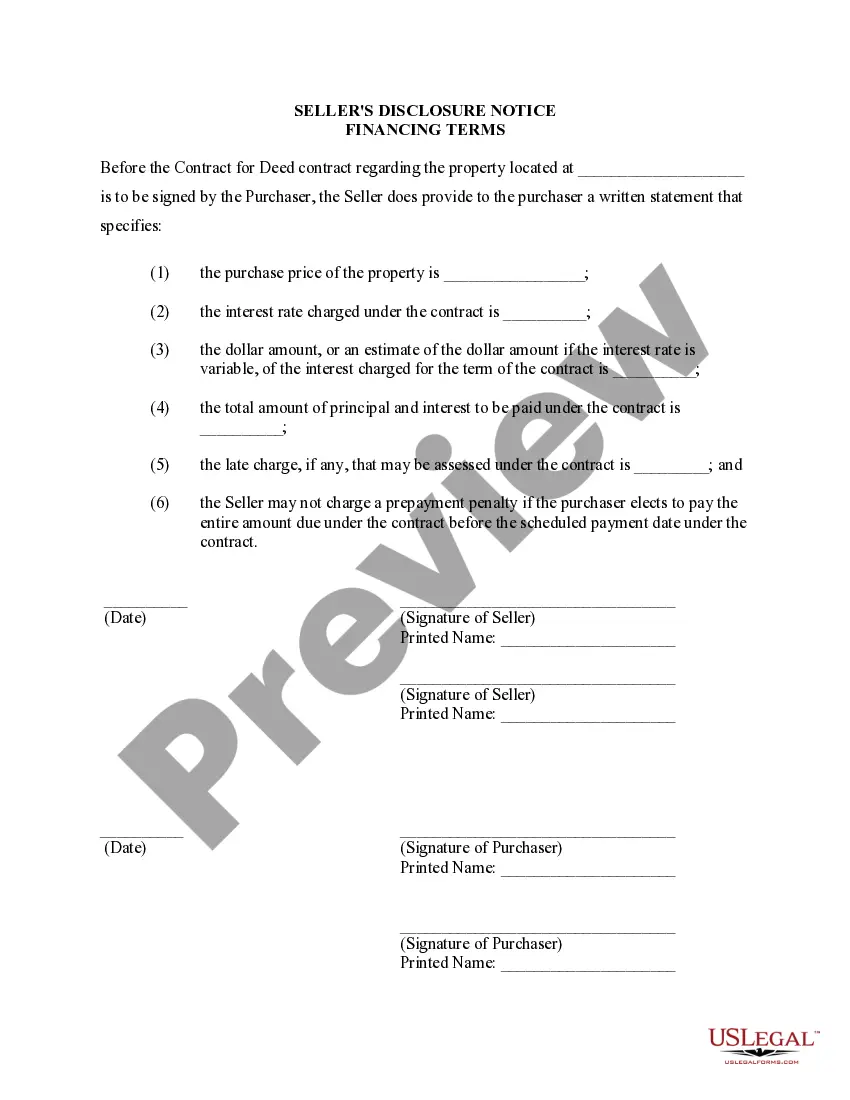

In Philadelphia, Pennsylvania, when entering into a Contract or Agreement for Deed, also commonly known as a Land Contract, it is essential for sellers to provide a Seller's Disclosure of Financing Terms for Residential Property. This disclosure serves as a crucial document in the real estate transaction process, ensuring transparency and clarity regarding the financing terms of the property being sold. The Philadelphia Seller's Disclosure of Financing Terms for Residential Property allows sellers to outline the financing details and terms associated with the property, enabling potential buyers to make informed decisions. This document ensures that buyers fully understand the financial obligations, conditions, and rights associated with the property they are purchasing under a Contract or Agreement for Deed. One of the types of Philadelphia Seller's Disclosure of Financing Terms for Residential Property is the "Fixed Rate Financing" disclosure. Under this arrangement, the seller and buyer agree on a fixed interest rate for the duration of the contract. This type of financing provides stability and predictability for the buyer, as the interest rate remains constant, resulting in consistent monthly payments and, potentially, long-term savings. Another type of Seller's Disclosure of Financing Terms for Residential Property in Philadelphia is the "Adjustable Rate Financing." With this option, the interest rate may fluctuate over time based on market conditions. Although the interest rate is typically lower initially, it can change periodically, resulting in potential payment adjustments. Buyers must carefully evaluate the risks and benefits associated with adjustable-rate financing before committing to such terms. Moreover, the disclosure form may include information about the "Term of the Financing." This section explains the duration of the contract or land agreement, specifying the length of time buyers have to fulfill their financial obligations. It may also outline any potential extensions or expiration dates associated with the agreement. Understanding the financing term is crucial for both buyers and sellers as it affects financial planning and future obligations. The Philadelphia Seller's Disclosure of Financing Terms for Residential Property may further outline specific clauses related to "Prepayment Penalties" if applicable. These penalties are charges imposed on buyers who pay off the contract or loan earlier than specified. It is important for buyers to comprehend any potential prepayment penalties to avoid any unexpected costs in case of early contract closure or refinancing. Additionally, the disclosure document may include details about "Forfeiture Clauses." In certain circumstances, if buyers fail to meet the terms or fulfill their financial obligations within the specified timeframe, a forfeiture clause allows the seller to regain ownership without refunds. Understanding forfeiture clauses is vital for buyers as it clarifies the potential consequences and risks associated with defaulting on the agreement. In conclusion, the Philadelphia Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a crucial document that ensures transparency and clarity for both sellers and buyers. Whether the financing terms involve fixed or adjustable rates, specific repayment periods, prepayment penalties, or forfeiture clauses, it is essential for all parties to have a comprehensive understanding of the financial obligations and conditions associated with the property being sold.

Philadelphia Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Philadelphia Pennsylvania Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you are looking for a valid form, it’s extremely hard to find a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can find a huge number of document samples for organization and individual purposes by categories and states, or keywords. With the high-quality search feature, discovering the most up-to-date Philadelphia Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is as elementary as 1-2-3. In addition, the relevance of each and every document is proved by a group of professional lawyers that on a regular basis check the templates on our website and update them in accordance with the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Philadelphia Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you want. Read its information and utilize the Preview feature to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the needed file.

- Confirm your choice. Click the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Select the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Philadelphia Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Each form you save in your user profile does not have an expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you can return and download it once again whenever you want.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Philadelphia Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract you were seeking and a huge number of other professional and state-specific samples on a single website!