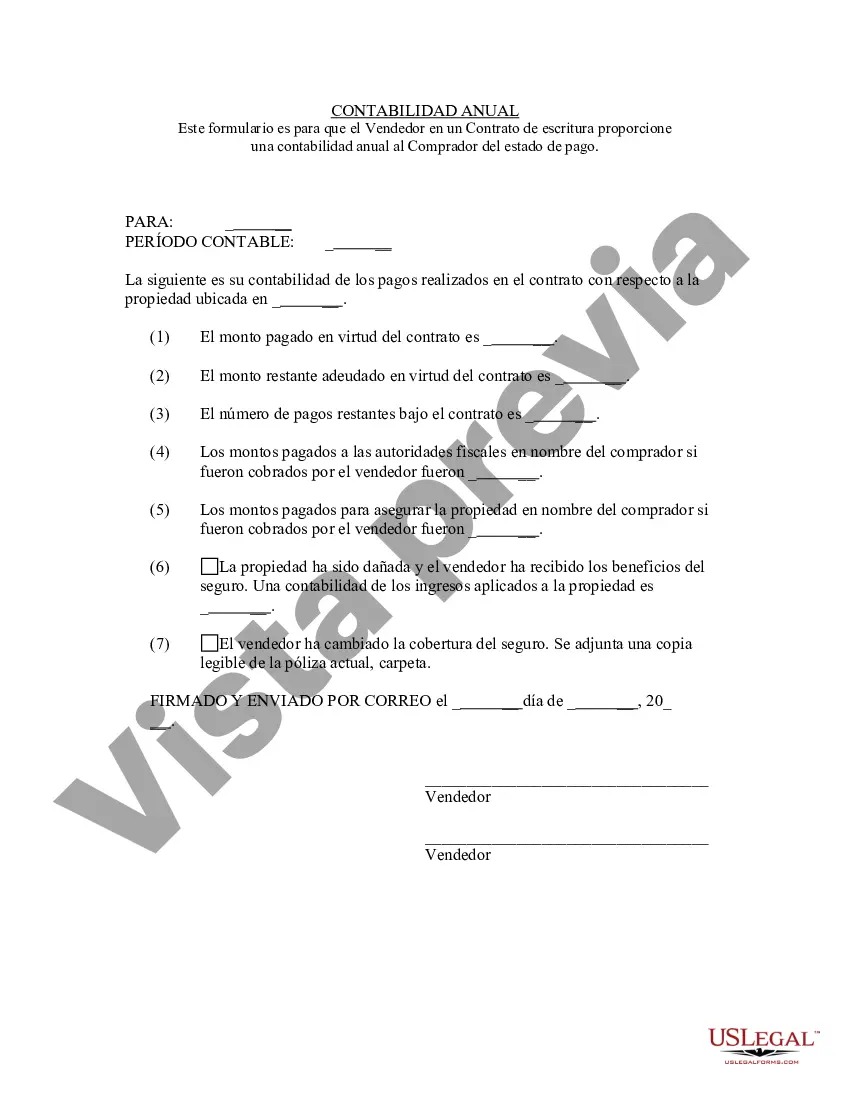

Allentown Pennsylvania Contrato de Escrituración Estado Contable Anual del Vendedor - Pennsylvania Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Pennsylvania Contrato De Escrituración Estado Contable Anual Del Vendedor?

We consistently aspire to minimize or avert legal complications when engaging with intricate legal or financial issues. To achieve this, we seek attorney services that are typically very expensive. However, not all legal matters are that complicated. Many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our platform empowers you to manage your issues independently without needing a lawyer's services. We offer access to legal form templates that are not always readily available. Our templates are specific to states and regions, which greatly eases the search process.

Benefit from US Legal Forms whenever you require the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement or any other form effortlessly and securely. Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always download it again from the My documents tab.

The process is just as simple if you’re new to the platform! You can set up your account in minutes.

For over 24 years, we've assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

- Ensure that the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your state and area.

- It's also essential to review the form’s description (if available) and if you notice any inconsistencies with what you were seeking initially, look for a different form.

- Once you’ve confirmed that the Allentown Pennsylvania Contract for Deed Seller's Annual Accounting Statement is suitable for your situation, you can select the subscription plan and continue to payment.

- After that, you can download the form in any available file format.