Allentown, Pennsylvania Financial Statements Only in Connection with Prenuptial Premarital Agreement: A Comprehensive Guide for Couples Introduction: When preparing for marriage, it is important for couples in Allentown, Pennsylvania to consider the financial aspects of their union. Whether you are a high-net-worth individual or seeking to safeguard your financial assets, understanding the significance of financial statements in connection with a prenuptial or premarital agreement is crucial. In this guide, we will delve into the various types of Allentown, Pennsylvania financial statements that can be utilized exclusively for prenuptial agreements. By familiarizing yourself with these statements and their key components, you can ensure transparency, peace of mind, and financial security in your relationship. Types of Allentown, Pennsylvania Financial Statements for Prenuptial Agreements: 1. Income Statements: An income statement provides a comprehensive overview of an individual's financial standing by showcasing their income, expenses, and net income. Creating income statements before entering a prenuptial agreement allows couples to define financial responsibilities and determine how any potential future income or losses will be allocated, should the marriage dissolve. Keywords: Allentown financial income statement, Pennsylvania prenuptial income statement, prenuptial agreement financial disclosure. 2. Asset and Property Statements: Asset and property statements outline the current value and ownership details of personal properties, real estate, investments, and any other significant assets. These statements are essential in prenuptial agreements to establish a clear understanding of each partner's financial worth and how these assets should be divided or retained in the event of a divorce or separation. Keywords: Allentown asset statement, Pennsylvania property statement, prenuptial agreement asset disclosure. 3. Debt Statements: Debt statements disclose any existing debts, liabilities, or loans incurred by either party prior to the marriage. It is crucial to include this information in a prenuptial agreement to determine how these debts will be handled, who will be responsible for them, and how they can impact the overall financial stability of the marriage. Keywords: Allentown debt statement, Pennsylvania premarital debt disclosure, prenuptial agreement debt documentation. 4. Bank Account and Investment Statements: Bank account and investment statements provide an overview of an individual's financial holdings, including savings accounts, checking accounts, certificates of deposit (CDs), mutual funds, stocks, bonds, or any other investment vehicles. These statements are necessary to establish each partner's separate financial interests, prevent commingling of assets, and define how these accounts and investments will be addressed in the prenuptial agreement. Keywords: Allentown bank statement, Pennsylvania investment statement, prenuptial agreement financial holdings. Conclusion: Understanding the different types of Allentown, Pennsylvania financial statements relevant to prenuptial agreements is essential for couples entering into marriage. By diligently disclosing and documenting their financial standing using income statements, asset and property statements, debt statements, and bank account and investment statements, couples can establish a strong financial foundation, manage expectations, and secure their individual and combined wealth. Seeking legal advice from a qualified attorney experienced in prenuptial agreements can further ensure that these financial statements are accurately prepared and reinforce the security of both partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allentown Pennsylvania Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement

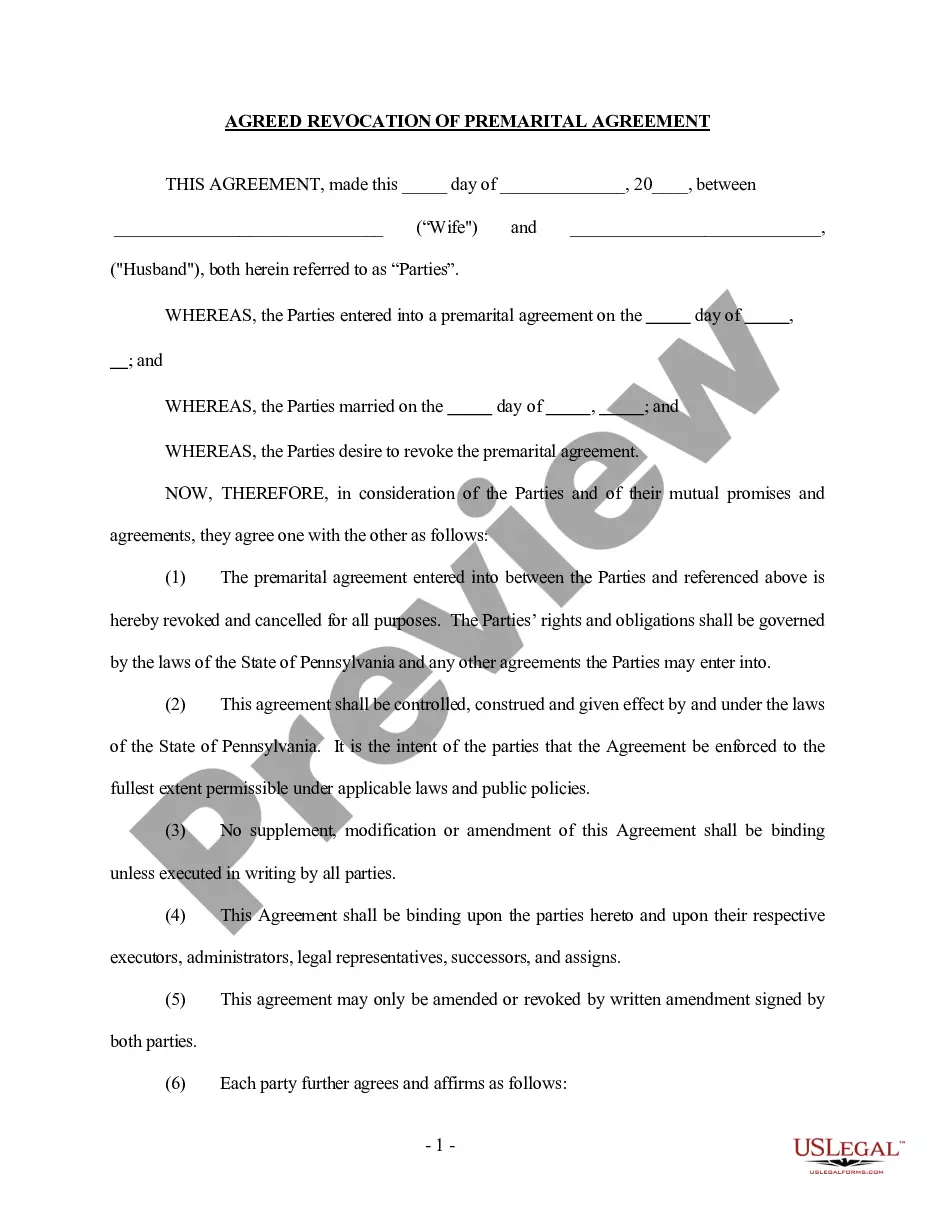

Description

How to fill out Allentown Pennsylvania Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Allentown Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Allentown Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Allentown Pennsylvania Financial Statements only in Connection with Prenuptial Premarital Agreement would work for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!