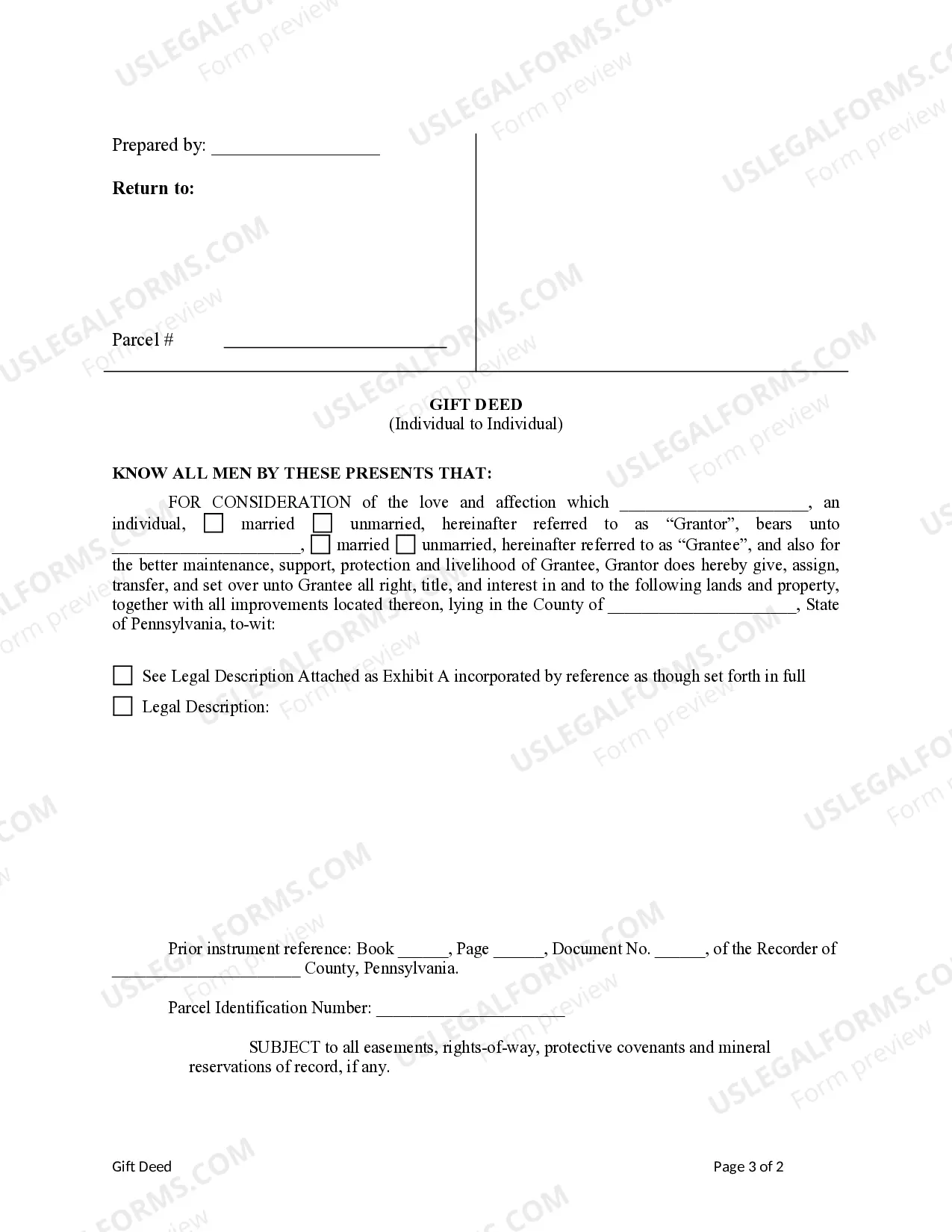

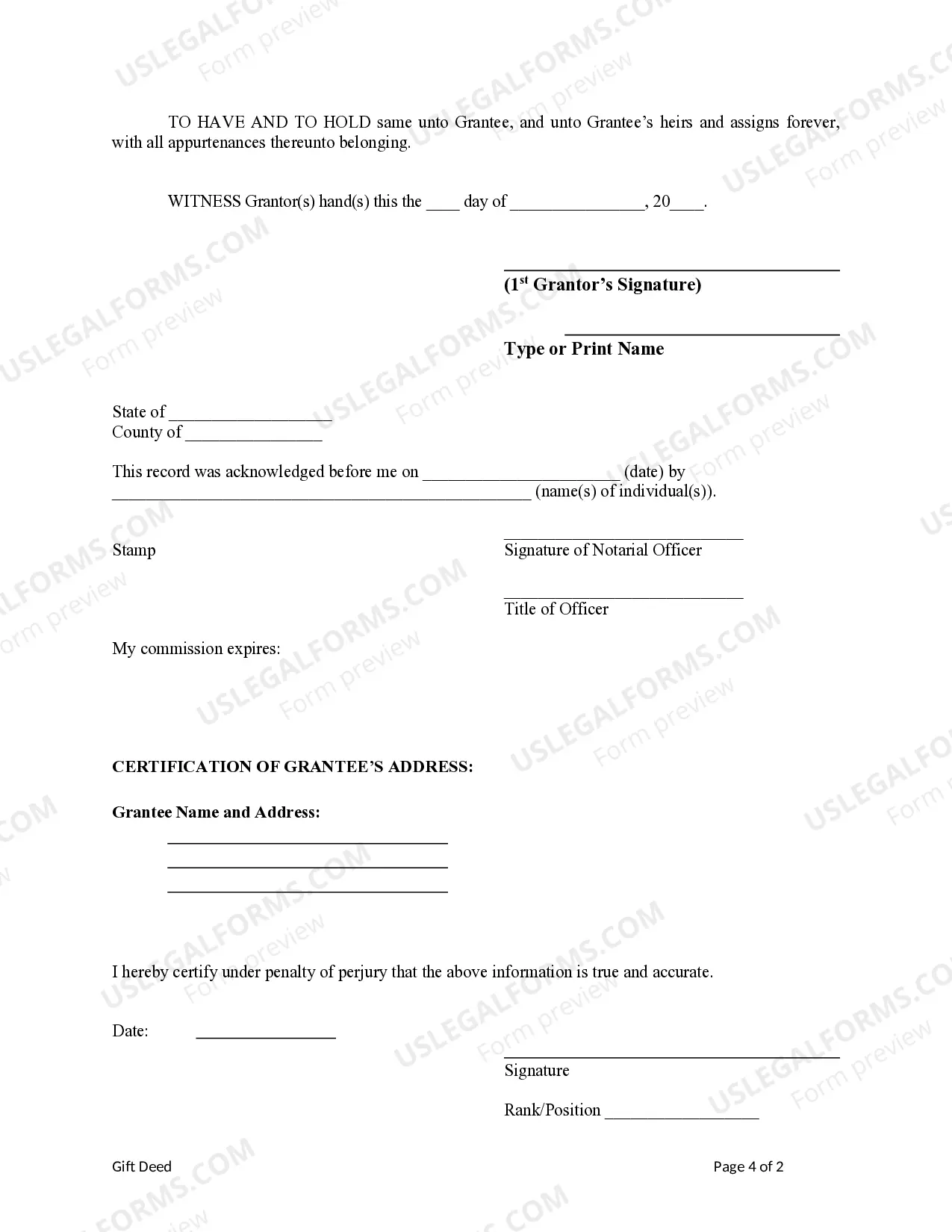

A Pittsburgh Pennsylvania Gift Deed for Individual to Individual is a legal document used to transfer ownership of a property or asset from one person to another without any monetary consideration involved. This type of deed is commonly used when an individual intends to gift a property, such as a house, land, or a valuable asset, to another person without receiving any payment in return. The Pittsburgh Pennsylvania Gift Deed for Individual to Individual is governed by the laws and regulations of the state, specifically those related to property transfers and taxation. It is important to consult with an attorney or a real estate professional familiar with the local laws before proceeding with the gift deed. The gift deed must include specific information to be considered valid, such as the names and addresses of both the donor (the person gifting the property) and the done (the recipient of the gift). The legal description of the property being gifted should also be included, which typically includes the parcel number, boundaries, and any other relevant details. In Pittsburgh, Pennsylvania, there are various types of gift deeds for individuals to individuals, depending on the nature of the gift and the specific circumstances: 1. Residential Property Gift Deed: This type of gift deed is used when an individual gifts a residential property, such as a house or a condominium unit, to another person. 2. Vacant Land Gift Deed: When an individual wishes to gift a vacant land or a lot without any structures or improvements, this type of gift deed is used. 3. Marketable Title Gift Deed: In some cases, the donor may choose to gift a property with a marketable title, meaning it has a clear ownership history and is free from any liens or encumbrances. 4. Partial Interest Gift Deed: Instead of gifting the entire property, an individual may choose to gift a percentage of their ownership interest in a property. This type of gift deed outlines the specific percentage being transferred. Once the gift deed is prepared and signed by both parties, it must be notarized and recorded at the local County Recorder's Office to make it publicly accessible and enforceable. It is crucial to note that gifting a property has potential tax implications for both the donor and the done. Thus, it is wise to consult with a tax professional or an attorney to understand the tax implications and any applicable exemptions or limits. In summary, a Pittsburgh Pennsylvania Gift Deed for Individual to Individual is a legal document used to transfer ownership of a property or asset as a gift. Different types of gift deeds include residential property gift deeds, vacant land gift deeds, marketable title gift deeds, and partial interest gift deeds. Consulting with legal professionals is highly recommended navigating the legal complexities and tax implications related to gift deeds in Pittsburgh, Pennsylvania.

Pittsburgh Pennsylvania Gift Deed for Individual to Individual

Description

How to fill out Pittsburgh Pennsylvania Gift Deed For Individual To Individual?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Pittsburgh Pennsylvania Gift Deed for Individual to Individual? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Pittsburgh Pennsylvania Gift Deed for Individual to Individual conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the document is good for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Pittsburgh Pennsylvania Gift Deed for Individual to Individual in any available file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.