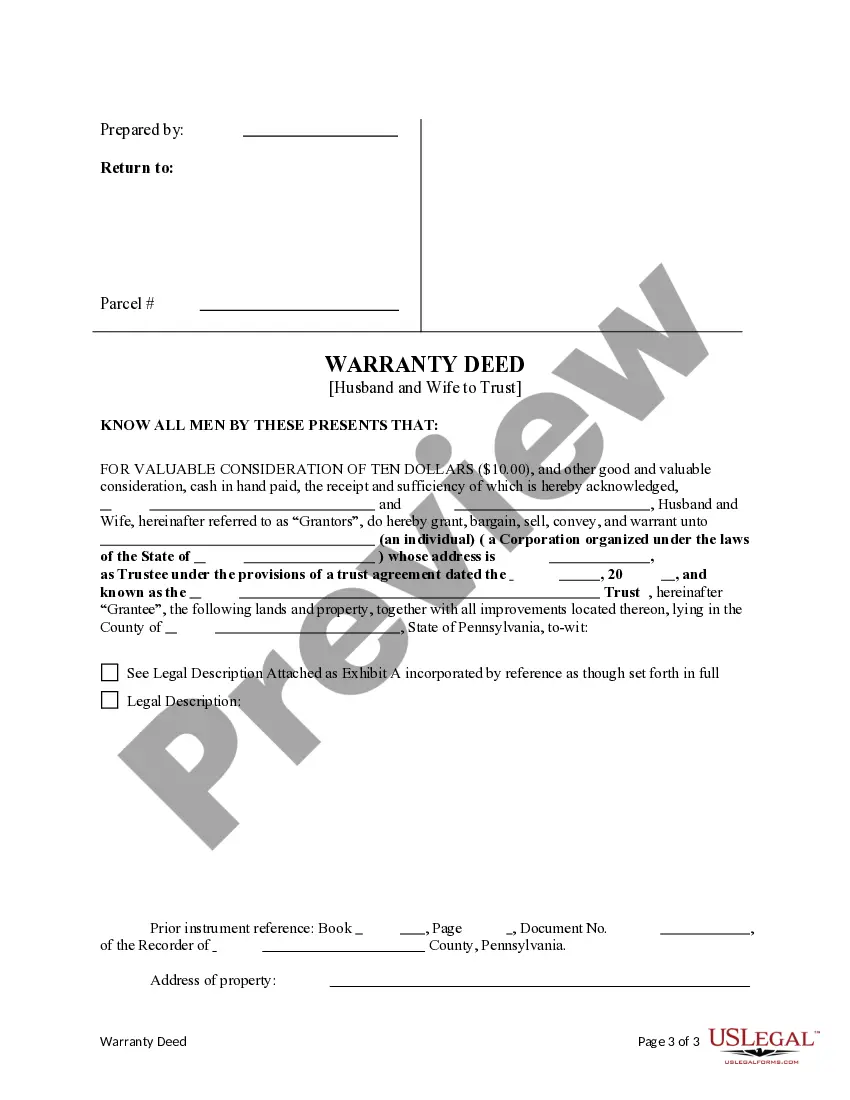

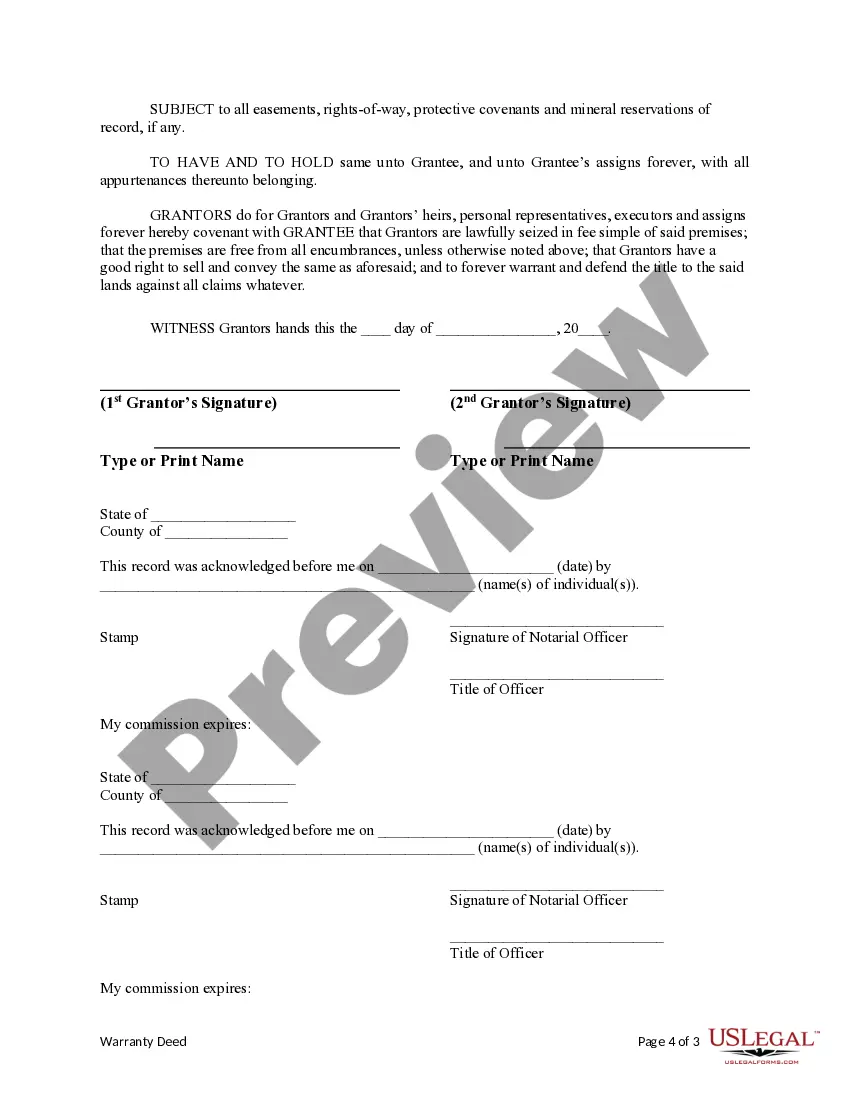

This form is a Warranty Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Pittsburgh Pennsylvania Husband and Wife to a Trust is a legal arrangement designed for couples looking to protect their assets and plan for the future. It offers various benefits for individuals residing in Pittsburgh, Pennsylvania, and can help streamline the estate planning process by ensuring a smooth transfer of assets. Here is a detailed description of what this arrangement entails, along with some key types of trusts commonly used by couples in Pittsburgh. Pittsburgh Pennsylvania Husband and Wife to a Trust, also known as a Joint Trust or Spousal Trust, is a type of revocable living trust that allows married couples to combine their assets into a single trust entity. By establishing this trust, couples can effectively manage, control, and pass on their assets to heirs or beneficiaries according to their wishes while minimizing potential estate taxes and probate costs. One of the primary advantages of Pittsburgh Pennsylvania Husband and Wife to a Trust is the flexibility it provides in managing assets during the couple's lifetime and after their passing. The trust is revocable, meaning the couple can modify or terminate it at any time as long as both spouses are still alive and in agreement. This allows them to make adjustments to the trust provisions, add or remove assets, or change beneficiaries as circumstances or wishes change over time. Additionally, placing assets into a joint trust simplifies the administration process by consolidating financial accounts, real estate, investments, and other valuable possessions under a single legal entity. This consolidation can result in smoother management, reduced administrative expenses, and easier asset transfer upon the death of one or both spouses. In Pittsburgh, Pennsylvania, there are different types of trusts that fall under the category of Husband and Wife to a Trust, considering specific circumstances and goals. Some common types include: 1. Revocable Living Trust: Also known as a Family Trust, this type of trust allows both spouses to retain control over their assets while providing a seamless transfer of the trust's assets to beneficiaries upon the death of the last surviving spouse. 2. Marital Deduction Trust (A/B Trust): This trust strategy aims to maximize the utilization of each spouse's federal estate tax exemption. Upon the death of the first spouse, the trust splits into two separate trusts: the Marital Trust, which provides income and use of assets to the surviving spouse, and the Bypass Trust (also known as the Family Trust), which preserves assets and passes them to the heirs free of federal estate taxes. 3. Qualified Terminable Interest Property Trust (TIP Trust): This trust structure is specifically designed to provide ongoing financial support and protection for a surviving spouse. It allows the assets to qualify for the marital deduction while granting the first spouse to die control over the ultimate distribution of the assets. 4. Charitable Remainder Trust (CRT): If a couple has charitable intentions, establishing a CRT can provide them with income during their lifetime while donating the remaining trust assets to a charitable organization upon their death. This type of trust offers potential tax advantages and a way to support causes close to the couple's heart. It's important to consult with an experienced estate planning attorney in Pittsburgh, Pennsylvania to determine the most suitable type of Husband and Wife to a Trust based on individual circumstances, needs, and goals. With proper planning and guidance, couples residing in Pittsburgh can secure their assets, simplify the transfer of wealth, and ensure their financial legacy continues for generations to come.Pittsburgh Pennsylvania Husband and Wife to a Trust is a legal arrangement designed for couples looking to protect their assets and plan for the future. It offers various benefits for individuals residing in Pittsburgh, Pennsylvania, and can help streamline the estate planning process by ensuring a smooth transfer of assets. Here is a detailed description of what this arrangement entails, along with some key types of trusts commonly used by couples in Pittsburgh. Pittsburgh Pennsylvania Husband and Wife to a Trust, also known as a Joint Trust or Spousal Trust, is a type of revocable living trust that allows married couples to combine their assets into a single trust entity. By establishing this trust, couples can effectively manage, control, and pass on their assets to heirs or beneficiaries according to their wishes while minimizing potential estate taxes and probate costs. One of the primary advantages of Pittsburgh Pennsylvania Husband and Wife to a Trust is the flexibility it provides in managing assets during the couple's lifetime and after their passing. The trust is revocable, meaning the couple can modify or terminate it at any time as long as both spouses are still alive and in agreement. This allows them to make adjustments to the trust provisions, add or remove assets, or change beneficiaries as circumstances or wishes change over time. Additionally, placing assets into a joint trust simplifies the administration process by consolidating financial accounts, real estate, investments, and other valuable possessions under a single legal entity. This consolidation can result in smoother management, reduced administrative expenses, and easier asset transfer upon the death of one or both spouses. In Pittsburgh, Pennsylvania, there are different types of trusts that fall under the category of Husband and Wife to a Trust, considering specific circumstances and goals. Some common types include: 1. Revocable Living Trust: Also known as a Family Trust, this type of trust allows both spouses to retain control over their assets while providing a seamless transfer of the trust's assets to beneficiaries upon the death of the last surviving spouse. 2. Marital Deduction Trust (A/B Trust): This trust strategy aims to maximize the utilization of each spouse's federal estate tax exemption. Upon the death of the first spouse, the trust splits into two separate trusts: the Marital Trust, which provides income and use of assets to the surviving spouse, and the Bypass Trust (also known as the Family Trust), which preserves assets and passes them to the heirs free of federal estate taxes. 3. Qualified Terminable Interest Property Trust (TIP Trust): This trust structure is specifically designed to provide ongoing financial support and protection for a surviving spouse. It allows the assets to qualify for the marital deduction while granting the first spouse to die control over the ultimate distribution of the assets. 4. Charitable Remainder Trust (CRT): If a couple has charitable intentions, establishing a CRT can provide them with income during their lifetime while donating the remaining trust assets to a charitable organization upon their death. This type of trust offers potential tax advantages and a way to support causes close to the couple's heart. It's important to consult with an experienced estate planning attorney in Pittsburgh, Pennsylvania to determine the most suitable type of Husband and Wife to a Trust based on individual circumstances, needs, and goals. With proper planning and guidance, couples residing in Pittsburgh can secure their assets, simplify the transfer of wealth, and ensure their financial legacy continues for generations to come.