Contracts for the payment of money, commonly referred to as bills and notes, are governed by the ordinary law of contracts. However, where bills and notes have the quality of being negotiable, they may also be subject to special legislation, embodied in the Uniform Commercial Code, governing such instruments.

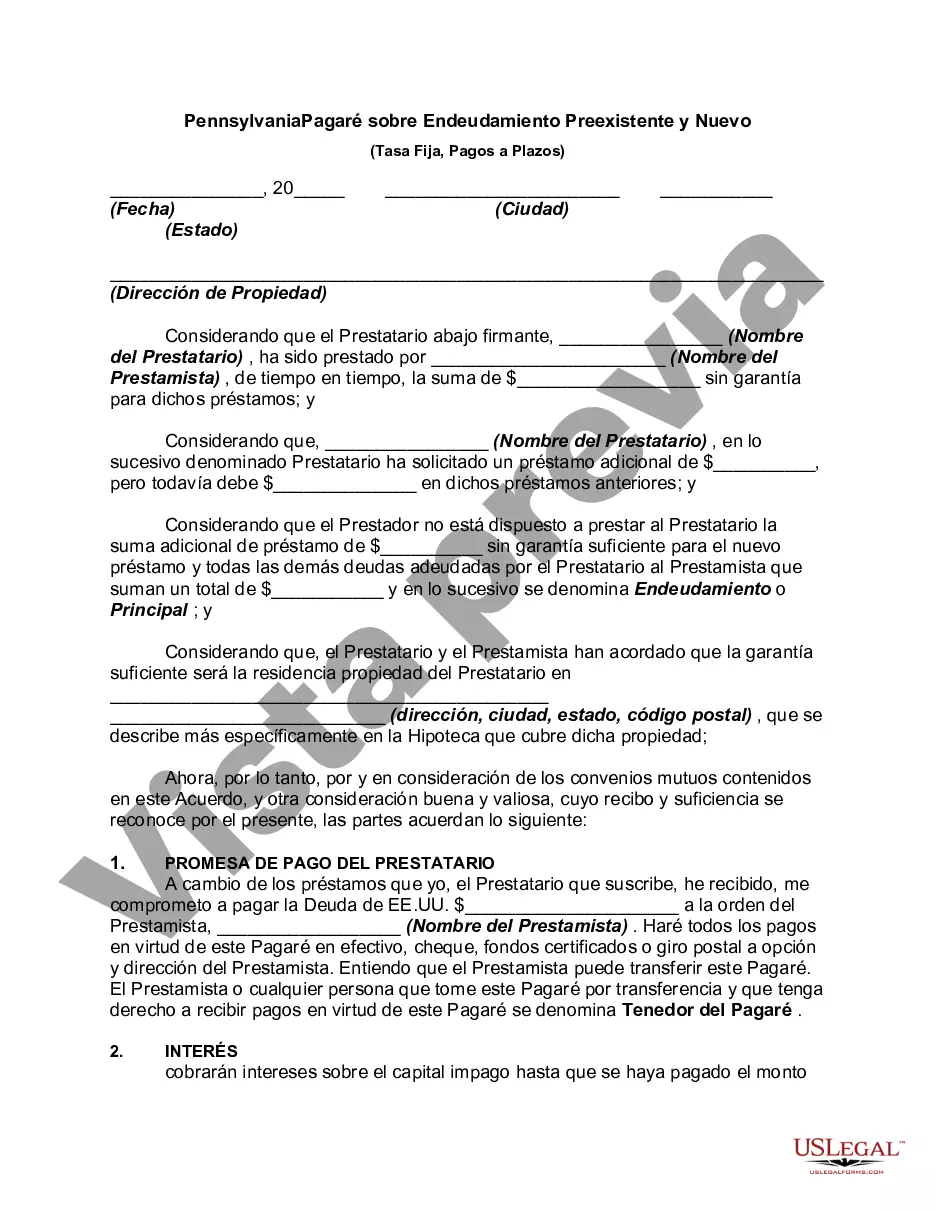

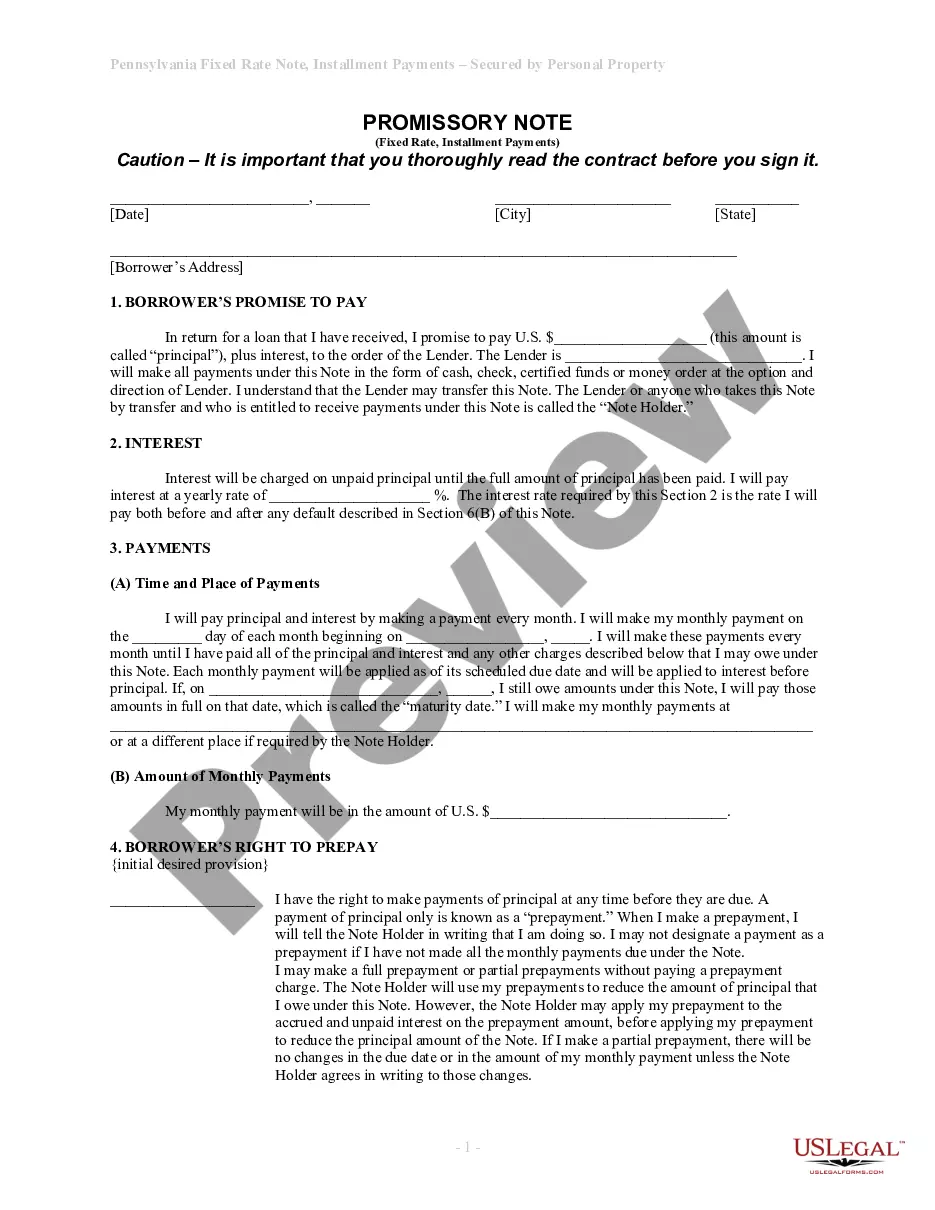

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allentown Pennsylvania Pagaré de Pensilvania sobre endeudamiento nuevo y preexistente - Pennsylvania Promissory Note on Pre-Existing and New Indebtedness

Description

How to fill out Pennsylvania Pagaré De Pensilvania Sobre Endeudamiento Nuevo Y Preexistente?

Are you seeking a trustworthy and budget-friendly provider of legal documents to obtain the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts.

US Legal Forms is your ideal selection.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of papers to facilitate your separation or divorce through the legal system, we have everything you need.

Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates we grant access to are not generic and are structured based on the specifications of different states and regions.

If the template does not suit your legal situation, restart your search.

Now you can create your account. Then select the subscription plan and proceed to payment. After completing the payment, download the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts in any available format. You can return to the site when necessary and redownload the document without any additional charges.

- To download the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it.

- Keep in mind that you can retrieve your previously acquired form templates at any time from the My documents section.

- Is this your first visit to our site? No problem. You can set up an account with quick simplicity, but prior to that, ensure you do the following.

- Verify if the Allentown Pennsylvania Promissory Note on Pre-Existing and New Debts aligns with the regulations of your state and locality.

- Review the form’s specifics (if available) to ascertain who and what the form is designed for.