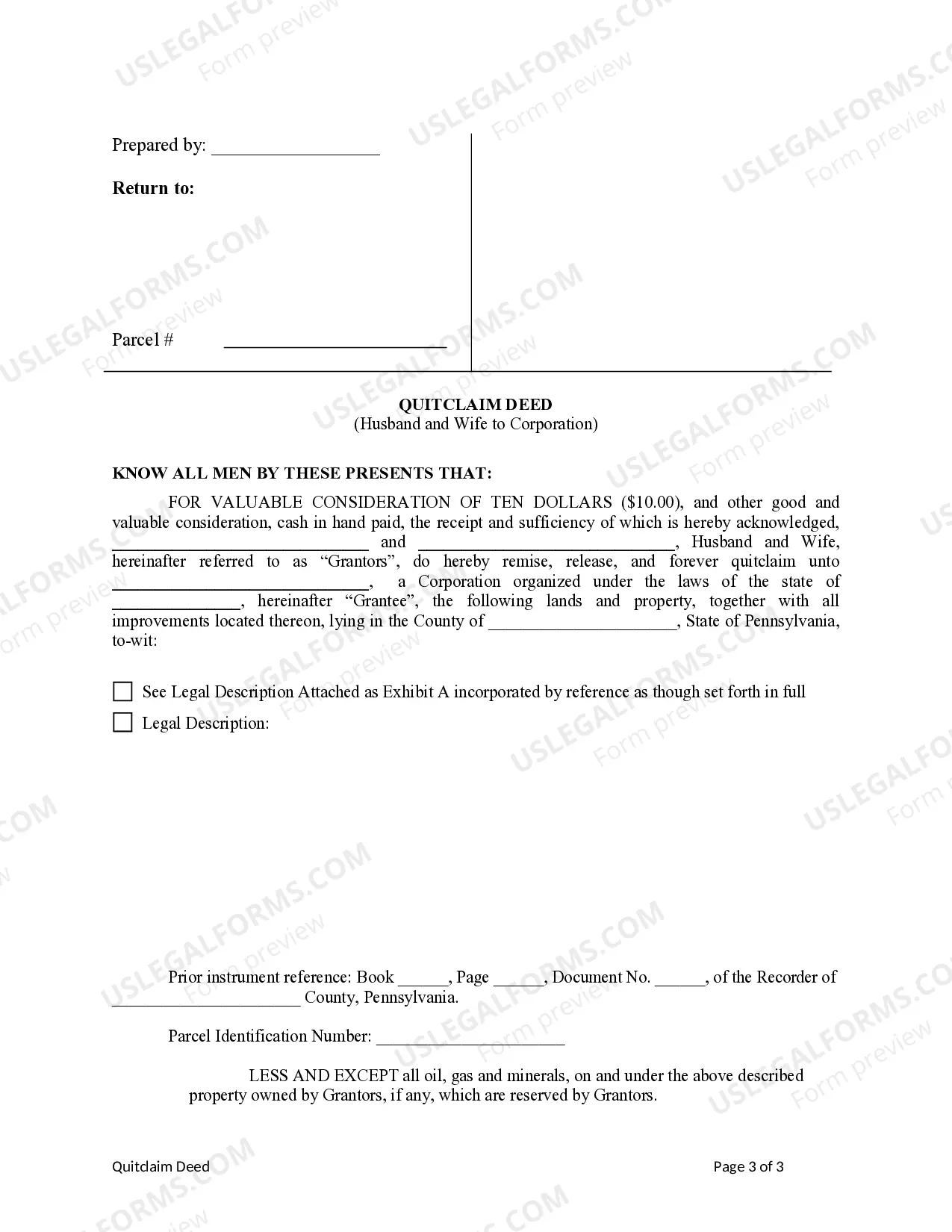

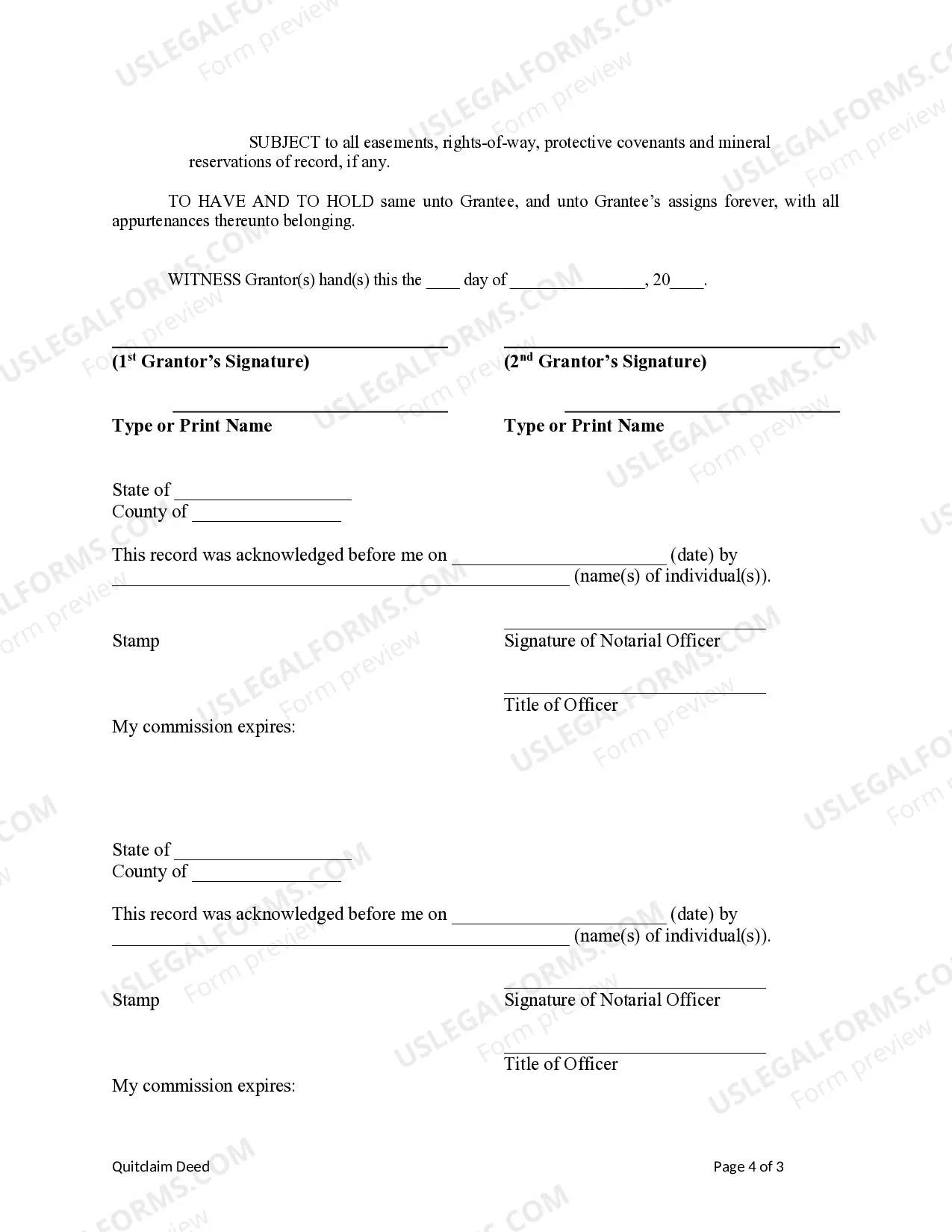

Philadelphia, Pennsylvania Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation using a quitclaim deed. This type of deed is commonly used when a property is being transferred between parties who have an existing relationship, such as a husband and wife transferring ownership to their corporation. The Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation involves the transfer of real estate assets. It is important to note that this deed only conveys the interest or rights that the husband and wife have in the property, without providing any guarantee of ownership or clear title. It is essential for both parties to understand that any unknown claims, liens, or encumbrances on the property will not be resolved or transferred with this type of deed. There are different types of Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation, tailored to specific situations or requirements. Some variations include: 1. Standard Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation: This is a straightforward deed that transfers the property from the married couple to the corporation without any specific conditions or restrictions. 2. Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation with Restrictive Clauses: This type of deed may include specific provisions or restrictions, such as limitations on the use of the property, future sale restrictions, or any other specified conditions agreed upon by the parties involved. 3. Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation with Financial Considerations: In some cases, there may be financial considerations involved in the transfer, such as debt settlements, financial obligations, or the assumption of mortgage agreements. This type of deed would include specific clauses addressing these considerations. 4. Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: This deed may be used for estate planning purposes, where the married couple wishes to transfer ownership to their corporation to facilitate estate management, tax planning, or asset protection. It is essential to consult with a qualified attorney or legal professional to ensure the appropriate deed type is utilized and to ensure compliance with all relevant laws and regulations in Philadelphia, Pennsylvania. The specific requirements and processes for executing a Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation may vary, so seeking professional advice is advised to ensure a smooth and legally binding transfer of ownership.

Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Philadelphia Pennsylvania Quitclaim Deed From Husband And Wife To Corporation?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no law background to draft such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation in minutes using our reliable platform. In case you are presently an existing customer, you can go on and log in to your account to get the appropriate form.

However, if you are new to our library, make sure to follow these steps prior to obtaining the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation:

- Ensure the form you have chosen is suitable for your area considering that the rules of one state or area do not work for another state or area.

- Review the document and go through a quick outline (if provided) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start again and look for the suitable form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to Corporation as soon as the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.