A Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when a married couple wishes to transfer a property they jointly own into their LLC business entity. The Quitclaim Deed serves as evidence of the transfer of ownership rights, with the couple as granters (sellers) and the LLC as the grantee (buyer). It is essential to ensure that the Quitclaim Deed accurately outlines the property details, granters' names, and the LLC's legal name and address. By using a Quitclaim Deed, the couple is making no guarantees or warranties about the property's status or title, and they are simply transferring their ownership interests to the LLC. It is important that the couple understands the implications and consequences of this type of transfer, as it may impact their individual rights and liabilities concerning the property. There are different variations of the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC, each having specific applications based on the unique circumstances of the property transfer. Some common types include: 1. Standard Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC: This is the general form used for transferring ownership without any specific conditions or additional provisions. 2. Philadelphia Pennsylvania Quitclaim Deed with Special Stipulations from Husband and Wife to LLC: This type of deed may include special conditions or specific provisions that both parties agree upon before the transfer, such as the LLC assuming outstanding mortgages or liens. 3. Philadelphia Pennsylvania Quitclaim Deed with Joint Tenancy Conversion from Husband and Wife to LLC: If the couple originally owned the property as joint tenants, this deed variation facilitates the conversion of ownership to the LLC. It may involve additional steps and requirements compared to a standard Quitclaim Deed. 4. Philadelphia Pennsylvania Quitclaim Deed with Tenancy by the Entirety Conversion from Husband and Wife to LLC: Similar to the previous type, this deed converts ownership from tenancy by the entirety to the LLC. However, this applies specifically to married couples residing in Pennsylvania. It is essential for the parties involved to consult with legal professionals, such as real estate attorneys or title companies, to ensure the appropriate Quitclaim Deed type is selected and to address any specific legal requirements or implications associated with the property transfer or LLC formation.

Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC

State:

Pennsylvania

County:

Philadelphia

Control #:

PA-09-77

Format:

Word;

Rich Text

Instant download

Description

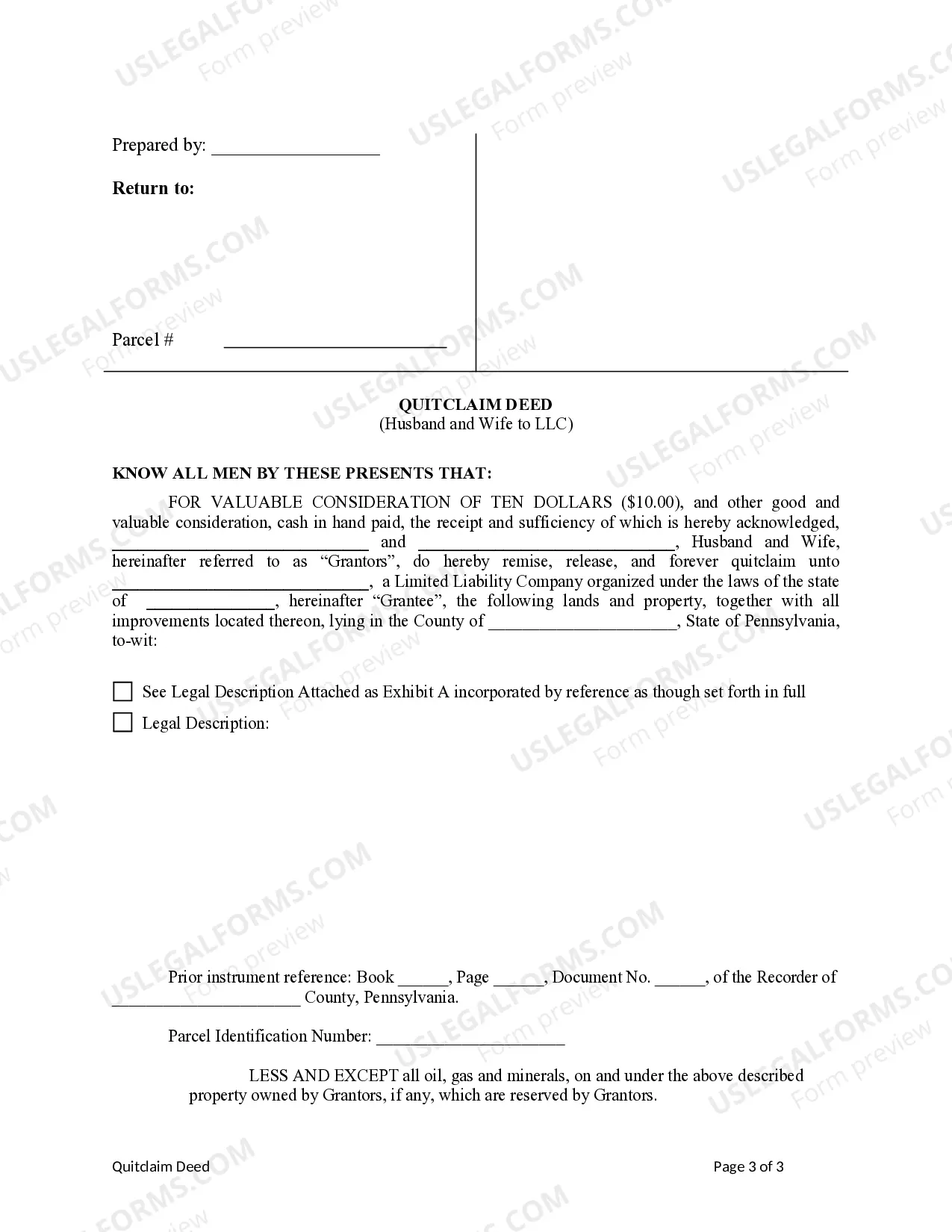

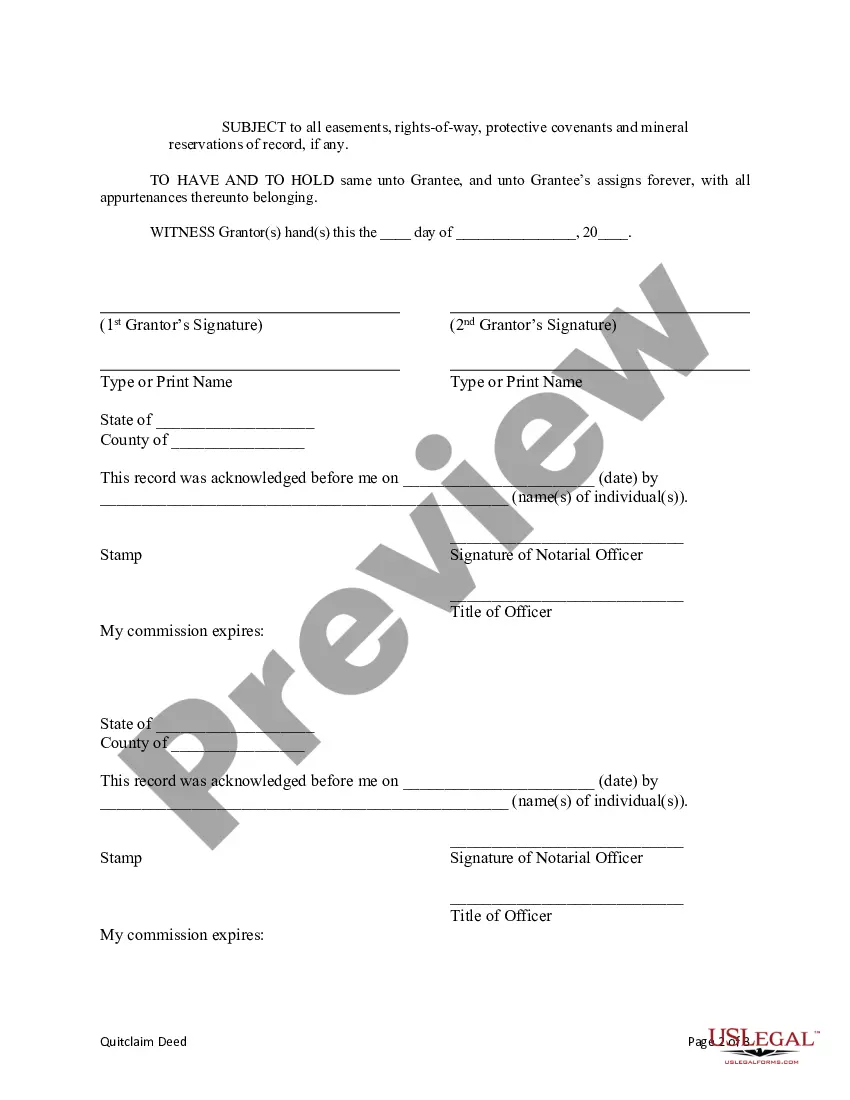

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when a married couple wishes to transfer a property they jointly own into their LLC business entity. The Quitclaim Deed serves as evidence of the transfer of ownership rights, with the couple as granters (sellers) and the LLC as the grantee (buyer). It is essential to ensure that the Quitclaim Deed accurately outlines the property details, granters' names, and the LLC's legal name and address. By using a Quitclaim Deed, the couple is making no guarantees or warranties about the property's status or title, and they are simply transferring their ownership interests to the LLC. It is important that the couple understands the implications and consequences of this type of transfer, as it may impact their individual rights and liabilities concerning the property. There are different variations of the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC, each having specific applications based on the unique circumstances of the property transfer. Some common types include: 1. Standard Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC: This is the general form used for transferring ownership without any specific conditions or additional provisions. 2. Philadelphia Pennsylvania Quitclaim Deed with Special Stipulations from Husband and Wife to LLC: This type of deed may include special conditions or specific provisions that both parties agree upon before the transfer, such as the LLC assuming outstanding mortgages or liens. 3. Philadelphia Pennsylvania Quitclaim Deed with Joint Tenancy Conversion from Husband and Wife to LLC: If the couple originally owned the property as joint tenants, this deed variation facilitates the conversion of ownership to the LLC. It may involve additional steps and requirements compared to a standard Quitclaim Deed. 4. Philadelphia Pennsylvania Quitclaim Deed with Tenancy by the Entirety Conversion from Husband and Wife to LLC: Similar to the previous type, this deed converts ownership from tenancy by the entirety to the LLC. However, this applies specifically to married couples residing in Pennsylvania. It is essential for the parties involved to consult with legal professionals, such as real estate attorneys or title companies, to ensure the appropriate Quitclaim Deed type is selected and to address any specific legal requirements or implications associated with the property transfer or LLC formation.

Free preview

How to fill out Philadelphia Pennsylvania Quitclaim Deed From Husband And Wife To LLC?

If you’ve already utilized our service before, log in to your account and save the Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Philadelphia Pennsylvania Quitclaim Deed from Husband and Wife to LLC. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!