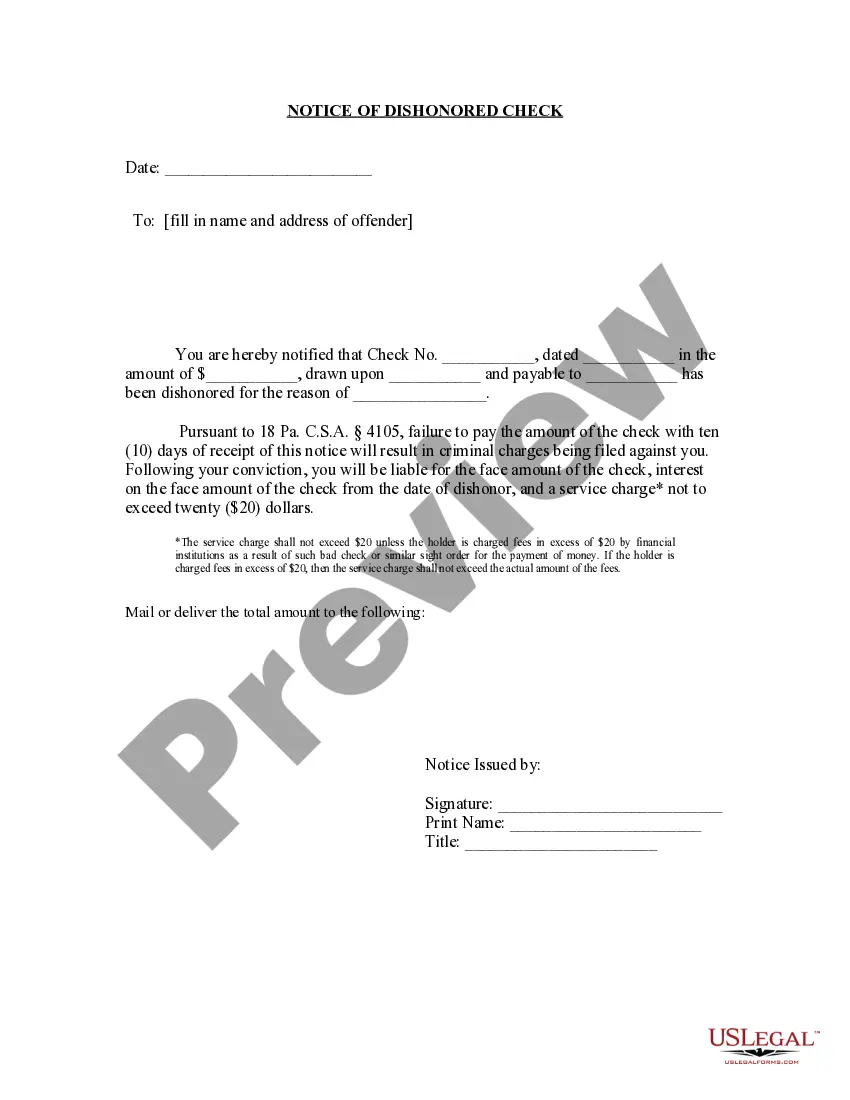

Allentown Pennsylvania Notice of Dishonored Check Civilvi— - Keywords: Bad Check, Bounced Check What is a Bad Check? A bad check refers to a check that a bank is unwilling or unable to honor because of insufficient funds in the account or a closed account. It is an unlawful act to issue a bad check knowingly to deceive or defraud the recipient. Understanding a Bounced Check A bounced check, also known as a dishonored check, occurs when the bank refuses to honor the payment due to insufficient funds. Bounced checks can create financial complications and legal consequences for both the issuer and the recipient. Different Types of Allentown Pennsylvania Notice of Dishonored Check — Civil 1. Initial Notice: Upon discovering a bounced check, the recipient or payee can send an initial notice to the issuer. This notice serves as a gentle reminder that the check was dishonored, providing them an opportunity to rectify the situation without further action. 2. Final Notice: If the issuer fails to resolve the issue or make payment within a specified timeframe after receiving the initial notice, a final notice may be issued. This notice emphasizes the urgency and potential consequences if the matter is not addressed promptly. 3. Legal Action Notice: When all attempts to resolve the matter fail, the payee may decide to pursue legal action against the issuer. A legal action notice is served, informing the issuer about the pending legal consequences, including potential civil charges, penalties, and other legal remedies. 4. Collection Agency Notice: In some cases, the payee may choose to engage a collection agency to handle the recovery of funds on their behalf. A collection agency notice is sent to inform the issuer that their debt has been assigned to a collections' agency, urging them to settle the matter to avoid further legal action. Consequences and Resolution: A recipient of a bad check may choose to pursue legal remedies to recover the funds owed. Civil charges may be filed against the issuer, which could lead to penalties, court fees, and potential damage to credit scores. To avoid such consequences, it is crucial for the issuer to promptly address the dishonored check by reimbursing the recipient and any associated costs. Disclaimer: This content is provided for informational purposes only and should not be considered legal advice. It is recommended to consult with a legal professional for specific guidance related to Allentown, Pennsylvania, notice of dishonored checks and the relevant civil proceedings.

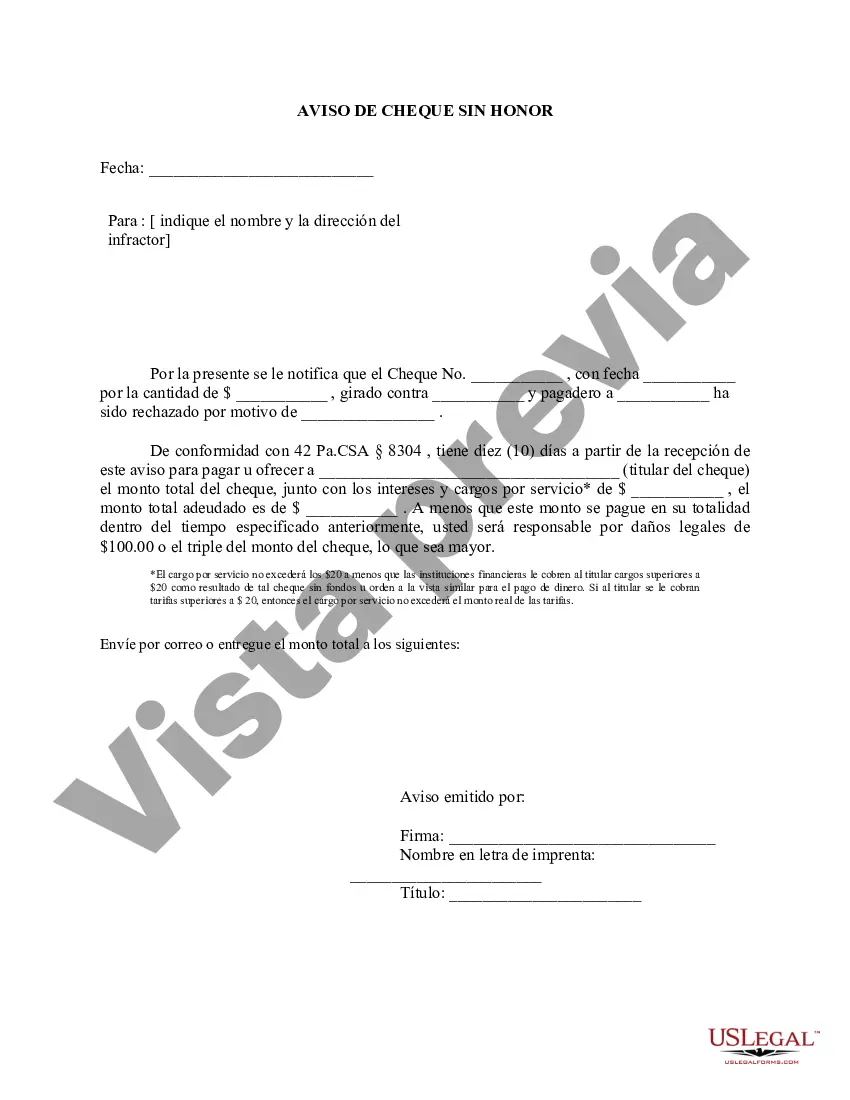

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allentown Pennsylvania Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Allentown Pennsylvania Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Allentown Pennsylvania Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is proper for you, you can select the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!