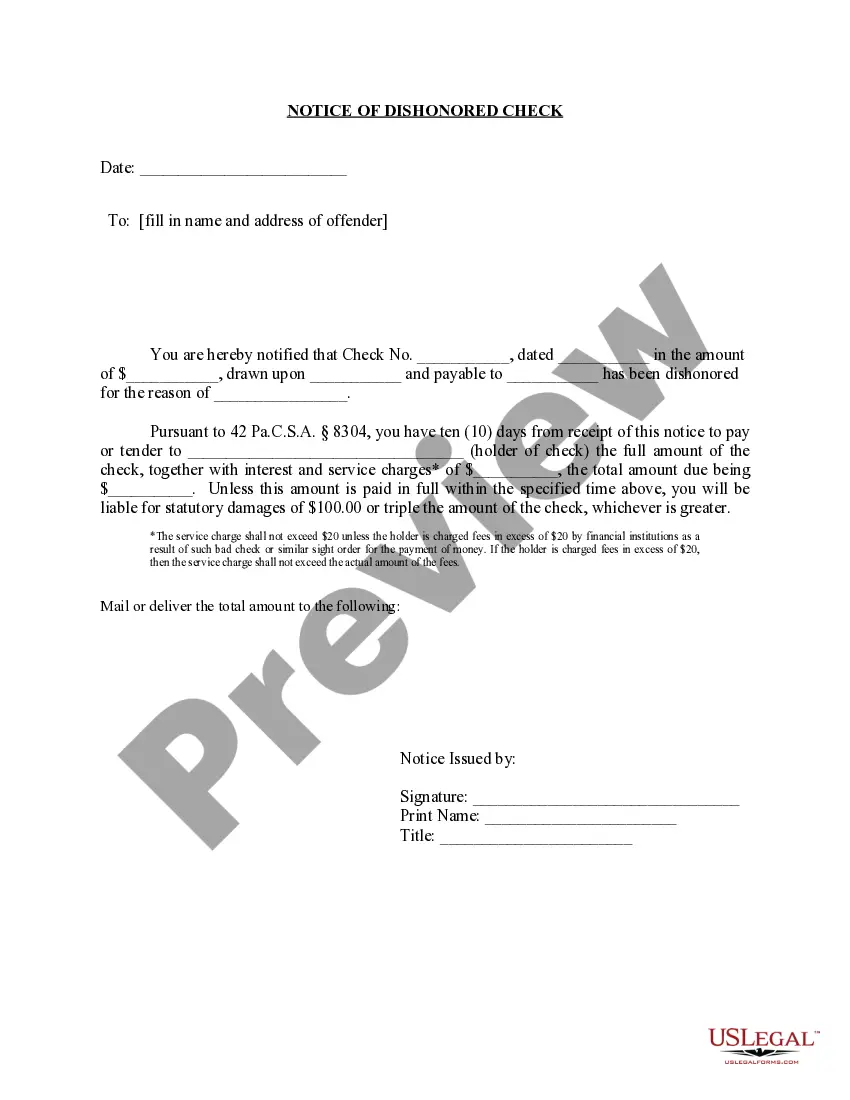

Allentown Pennsylvania Notice of Dishonored Check — Criminal Keywords: bad check, bounced check A bad check or a bounced check refers to a check that is returned by a bank due to insufficient funds or other reasons. In Allentown, Pennsylvania, the issuance of a bad check is considered a criminal offense. Upon the discovery of a bad check, the payee or recipient can initiate legal action by sending a Notice of Dishonored Check. Different types of Allentown Pennsylvania Notice of Dishonored Check — Criminal may include: 1. Notice of Dishonored Check — NSF (Non-Sufficient Funds): This type of notice is sent when the bank returns the check due to insufficient funds in the drawer's account. The payee will inform the drawer about the returned check and request immediate restitution. 2. Notice of Dishonored Check — Account Closed: When the bank returns the check because the drawer's account has been closed, this type of notice is issued. It notifies the drawer about the closed account and demands repayment or a replacement check. 3. Notice of Dishonored Check — Forgery: If the payee believes that the check was forged or altered, they can send a notice stating the suspicion of forgery. This notice urges the drawer to rectify the situation promptly or face potential legal consequences. 4. Notice of Dishonored Check — Stop Payment: In cases where the drawer intentionally places a stop payment order on a valid check, the payee issues this type of notice. It notifies the drawer about the stop payment order and emphasizes the importance of resolving the matter to avoid criminal charges. Regardless of the type of notice issued, Allentown, Pennsylvania, considers writing bad checks a serious offense. The recipient of a bad check can choose to pursue legal action, which may result in criminal charges, penalties, fines, and even imprisonment for the drawer. Additionally, the drawer may also be responsible for the costs associated with the bad check, such as bank fees and legal expenses. It is vital for individuals in Allentown to understand their legal obligations when issuing checks and to ensure sufficient funds are available in their accounts to honor the transactions. Proper financial management and responsible check writing practices can help avoid the issuance of bad checks, protect personal credibility, and maintain a good reputation within the community.

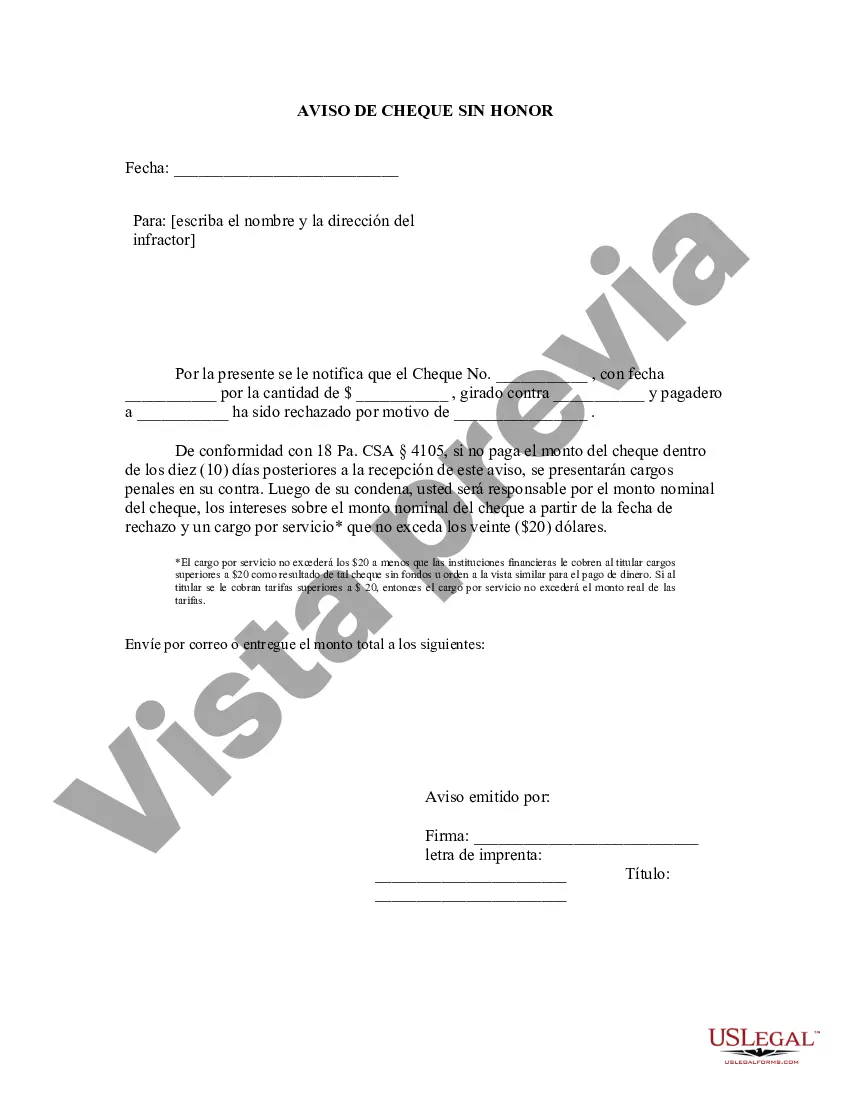

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allentown Pennsylvania Aviso de cheque sin fondos - Penal - Palabras clave: cheque sin fondos, cheque sin fondos - Pennsylvania Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

How to fill out Allentown Pennsylvania Aviso De Cheque Sin Fondos - Penal - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Take advantage of the US Legal Forms and have instant access to any form template you require. Our beneficial platform with a large number of document templates makes it simple to find and obtain almost any document sample you require. It is possible to export, complete, and certify the Allentown Pennsylvania Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check in a matter of minutes instead of surfing the Net for many hours trying to find a proper template.

Using our catalog is a great way to increase the safety of your form filing. Our experienced legal professionals regularly check all the records to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you get the Allentown Pennsylvania Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. In addition, you can find all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Find the template you require. Make sure that it is the form you were looking for: check its name and description, and use the Preview function if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Indicate the format to obtain the Allentown Pennsylvania Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check and modify and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy form libraries on the internet. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Allentown Pennsylvania Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check.

Feel free to take advantage of our service and make your document experience as convenient as possible!