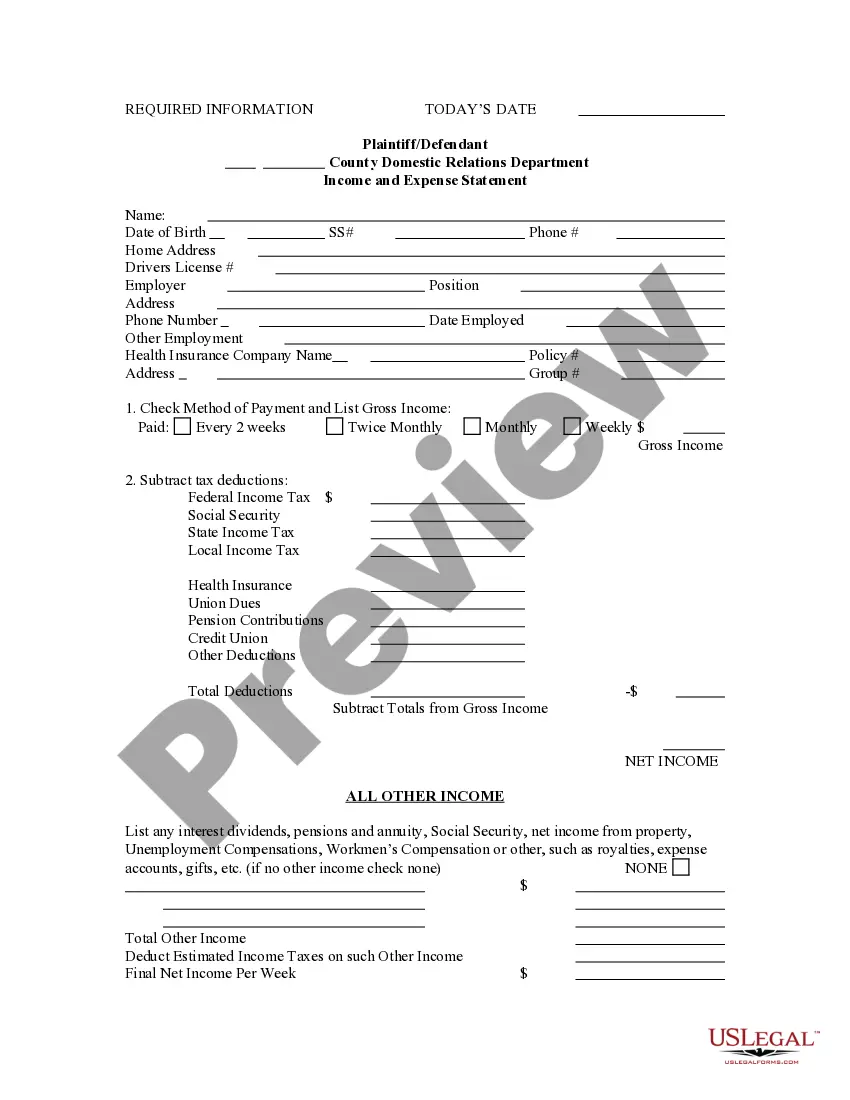

This is an Income and Expense Statement, to be used in causes of action where children are involved. This form provides the Court with basic information regarding employment, health insurance and the income and expenses of the parties.

The Philadelphia Pennsylvania Income and Expense Statement is a financial document that provides a detailed breakdown of an individual or entity's income and expenses in the state of Pennsylvania, specifically in the city of Philadelphia. This statement helps analyze the financial health and profitability of businesses, individuals, or organizations operating in Philadelphia. By comparing income sources and expense categories, one can gain valuable insights into their financial standing, make informed decisions, and plan for future growth. The Philadelphia Pennsylvania Income and Expense Statement is a vital tool for various entities, including self-employed individuals, small businesses, corporations, and nonprofit organizations. It helps them summarize and organize their financial activities within the city, ensuring compliance with local tax laws and regulations. There are different types of Philadelphia Pennsylvania Income and Expense Statements that cater to specific entities and their unique financial circumstances. Here are a few variations: 1. Personal Income and Expense Statement: This type of statement is designed for individuals and households residing in Philadelphia. It captures sources of income, such as salaries, investments, rental income, and freelance earnings, along with various expenses, including housing costs, transportation, utilities, healthcare, and entertainment expenses. 2. Business Income and Expense Statement: Targeted towards small businesses, startups, and corporations operating in Philadelphia, this statement accounts for revenue generated from sales, services, or other business activities. It outlines various expense categories, including employee salaries, rent, utilities, marketing costs, inventory purchases, and insurance premiums. 3. Nonprofit Income and Expense Statement: Nonprofit organizations in Philadelphia have their own unique income and expense statement. This statement classifies revenue streams like grants, donations, sponsorships, and program fees. Expenses encompass administrative costs, program expenses, fundraising activities, and any investments made in the organization's mission. Regardless of the specific type, the Philadelphia Pennsylvania Income and Expense Statement plays a crucial role in tracking financial performance, identifying trends, and facilitating proper tax reporting. It enables individuals and businesses in Philadelphia to make informed financial decisions and optimize their operations for sustained growth.The Philadelphia Pennsylvania Income and Expense Statement is a financial document that provides a detailed breakdown of an individual or entity's income and expenses in the state of Pennsylvania, specifically in the city of Philadelphia. This statement helps analyze the financial health and profitability of businesses, individuals, or organizations operating in Philadelphia. By comparing income sources and expense categories, one can gain valuable insights into their financial standing, make informed decisions, and plan for future growth. The Philadelphia Pennsylvania Income and Expense Statement is a vital tool for various entities, including self-employed individuals, small businesses, corporations, and nonprofit organizations. It helps them summarize and organize their financial activities within the city, ensuring compliance with local tax laws and regulations. There are different types of Philadelphia Pennsylvania Income and Expense Statements that cater to specific entities and their unique financial circumstances. Here are a few variations: 1. Personal Income and Expense Statement: This type of statement is designed for individuals and households residing in Philadelphia. It captures sources of income, such as salaries, investments, rental income, and freelance earnings, along with various expenses, including housing costs, transportation, utilities, healthcare, and entertainment expenses. 2. Business Income and Expense Statement: Targeted towards small businesses, startups, and corporations operating in Philadelphia, this statement accounts for revenue generated from sales, services, or other business activities. It outlines various expense categories, including employee salaries, rent, utilities, marketing costs, inventory purchases, and insurance premiums. 3. Nonprofit Income and Expense Statement: Nonprofit organizations in Philadelphia have their own unique income and expense statement. This statement classifies revenue streams like grants, donations, sponsorships, and program fees. Expenses encompass administrative costs, program expenses, fundraising activities, and any investments made in the organization's mission. Regardless of the specific type, the Philadelphia Pennsylvania Income and Expense Statement plays a crucial role in tracking financial performance, identifying trends, and facilitating proper tax reporting. It enables individuals and businesses in Philadelphia to make informed financial decisions and optimize their operations for sustained growth.