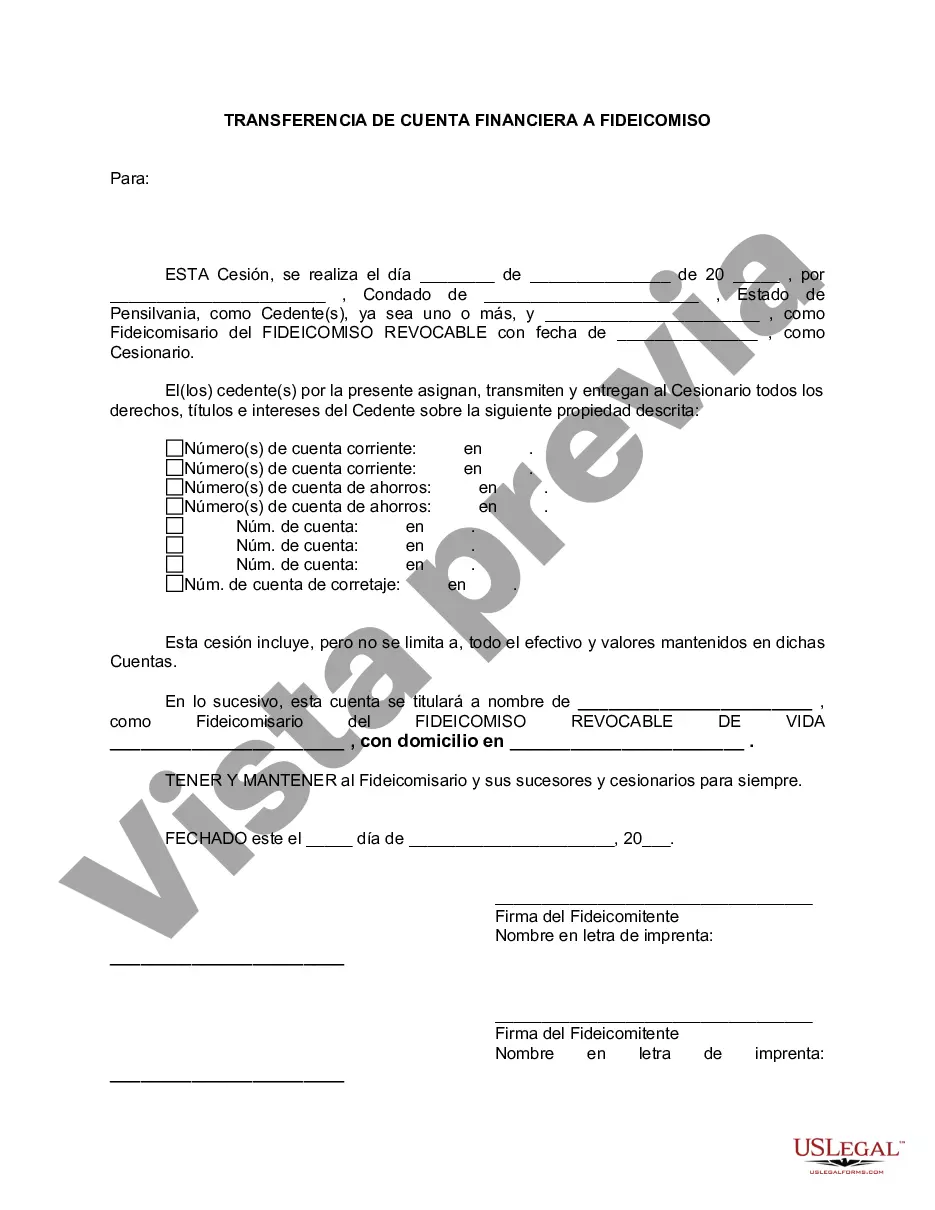

Allegheny Pennsylvania Financial Account Transfer to Living Trust is a process where individuals can transfer their financial accounts to a living trust, allowing them to maintain control over their assets during their lifetime and ensure a smooth transfer of these accounts after their passing. This legal document offers numerous benefits, including probate avoidance, privacy protection, and seamless asset distribution. To initiate an Allegheny Pennsylvania Financial Account Transfer to Living Trust, individuals need to follow specific steps. Firstly, they must establish a living trust and carefully outline its terms and conditions. This includes naming a trustee who will be responsible for managing the trust and distributing assets according to the granter's wishes. Next, individuals need to identify the financial accounts they wish to transfer into the trust. These can include bank accounts, investment accounts, retirement accounts, stocks, bonds, and other assets of financial value. By transferring ownership and control of these accounts to the living trust, individuals ensure that these assets are integrated into the trust's structure and governed by its rules. When transferring financial accounts to a living trust in Allegheny Pennsylvania, it's essential to update the account ownership details with the financial institutions where these accounts are held. This involves completing the requisite paperwork, such as account transfer forms and designating the living trust as the primary account holder. Different types of Allegheny Pennsylvania Financial Account Transfers to Living Trusts may include: 1. Bank Account Transfer to Living Trust: This involves transferring personal checking or savings accounts, certificates of deposit, money market accounts, or any other type of account held with a bank into the living trust. 2. Investment Account Transfer to Living Trust: Individuals can transfer investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, ETFs, and other securities, into the living trust. 3. Retirement Account Transfer to Living Trust: This type of transfer applies to qualified retirement accounts, such as 401(k)s, IRAs, Roth IRAs, or pension plans. By naming the living trust as the beneficiary, individuals can ensure the assets are seamlessly transferred to the trust upon their passing. 4. Real Estate Account Transfer to Living Trust: While real estate is not traditionally classified as a financial account, individuals can transfer ownership of properties they own, including residential homes, rental properties, commercial buildings, or land, into the living trust. By executing an Allegheny Pennsylvania Financial Account Transfer to Living Trust, individuals can protect their financial assets, streamline the estate planning process, and ensure their wishes are upheld. It is advisable to consult with an experienced estate planning attorney or a financial advisor to navigate the legal requirements and implications of such transfers effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Transferencia de cuenta financiera a fideicomiso en vida - Pennsylvania Financial Account Transfer to Living Trust

Description

How to fill out Allegheny Pennsylvania Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Allegheny Pennsylvania Financial Account Transfer to Living Trust becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Allegheny Pennsylvania Financial Account Transfer to Living Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Allegheny Pennsylvania Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

El fideicomiso financiero es un instrumento que le permite al inversor participar de un proyecto o de un cobro futuro determinado a traves de una colocacion de deuda o una participacion de capital.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Para que exista el contrato de Fideicomiso basta con que esten estas dos partes; es decir, el Fideicomitente y el Fiduciario, y que los fines sean licitos y determinados. El (Los) Fideicomisario(s) son las personas fisicas o morales que reciben el o los provechos que el fideicomiso implica.

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Los fideicomisos patrimoniales no cuentan como un testamento, la diferencia se da en que un fideicomiso permite que las propiedades se distribuyan a los beneficiarios sin tener que pasar por el proceso testamentario, adicionalmente, los fideicomisos son documentos mas privados.