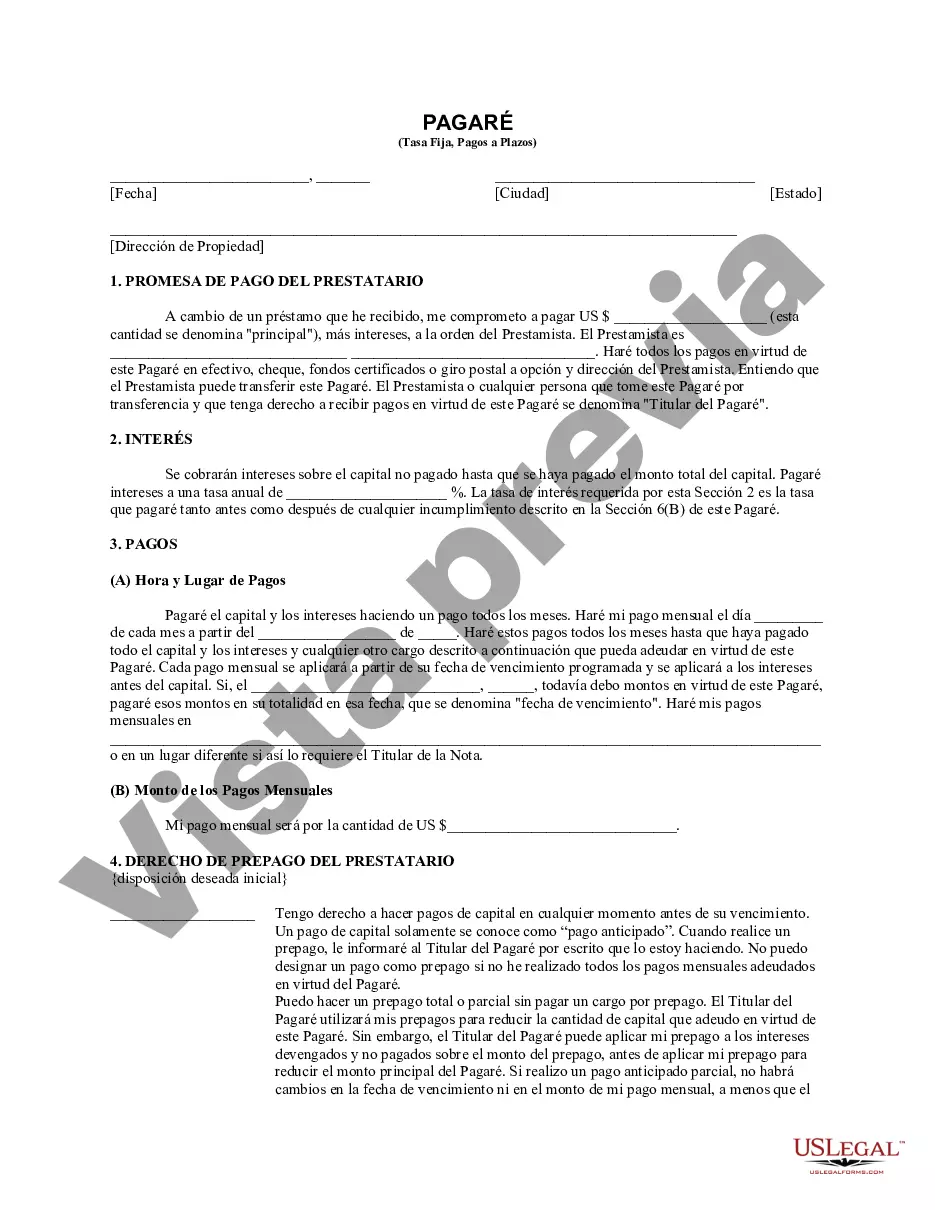

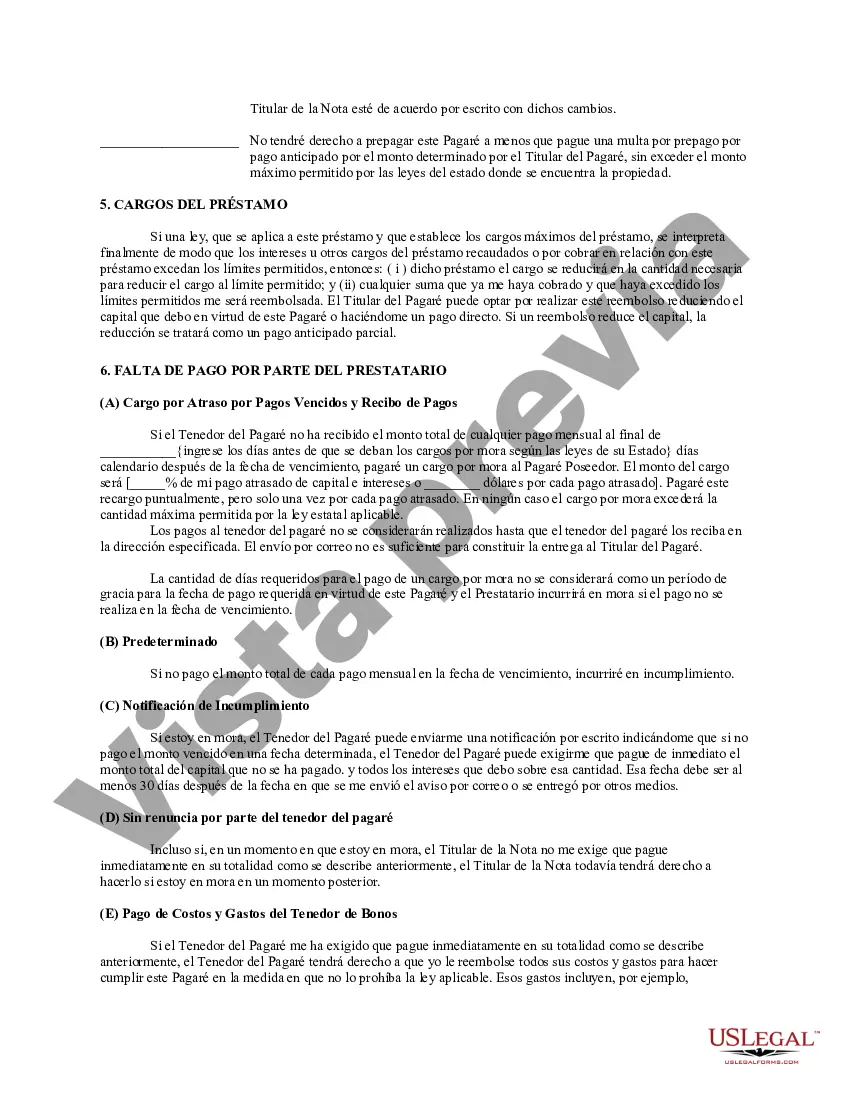

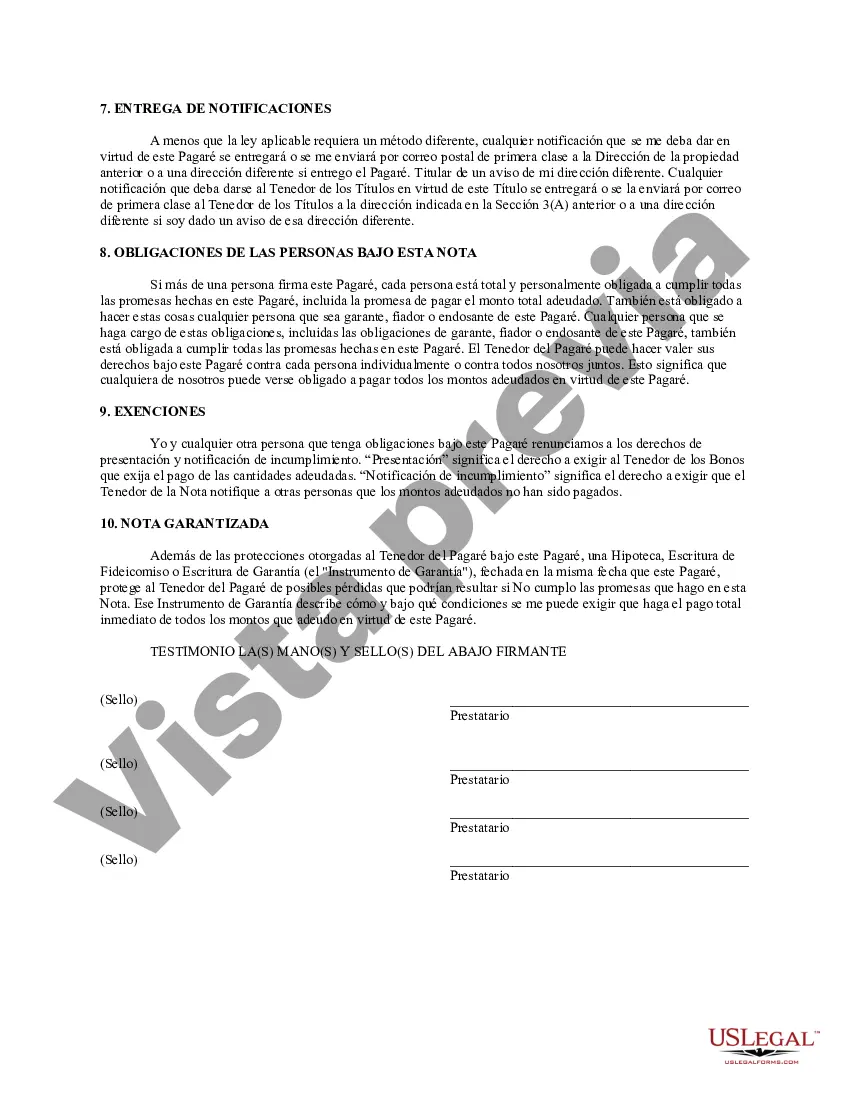

A Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This type of promissory note is specifically used for real estate transactions in Pittsburgh, Pennsylvania, where the borrower pledges their residential property as collateral to secure the loan. Key Components: 1. Amount and Interest Rate: The promissory note will clearly state the principal amount of the loan, which refers to the initial sum borrowed. Additionally, it will outline the fixed interest rate that the borrower agrees to pay throughout the repayment term. 2. Repayment Terms: The note will specify the installment period (monthly, quarterly, etc.) in which the borrower will make the payments. It will also highlight the due dates and the duration of the loan, usually expressed in months or years. 3. Security Agreement: The Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate requires the borrower to use their residential property as collateral. The property serves as security, providing the lender with the right to foreclose and sell the property if the borrower defaults on their loan obligations. 4. Default Consequences: This section of the note outlines the actions that the lender can take in the event of default. It may include late payment fees, additional interest charges, or the initiation of foreclosure proceedings. 5. Signatures and Notarization: The promissory note must be signed by both the borrower and the lender to indicate their agreement and consent to the terms outlined. The signatures are often notarized to validate the authenticity of the document. Types of Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Residential Purchase Loan: This type of promissory note is used when a borrower seeks financing to purchase a residential property in Pittsburgh, Pennsylvania. The loan amount is typically equivalent to the purchase price of the property, and the property itself serves as collateral. 2. Home Equity Loan: In this case, the borrower already owns a residential property in Pittsburgh and wishes to tap into the equity they have built. The promissory note secures the loan against the property's value, allowing the borrower to access funds for various purposes while still residing in the home. 3. Mortgage Refinance Loan: When a borrower refinances their existing mortgage on their Pittsburgh residential property, a new promissory note is often created. This note secures the refinanced loan amount against the property and replaces the original note, aligning with the new terms and conditions of the loan. In conclusion, a Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document used in real estate transactions to establish the terms of a loan secured by a residential property in Pittsburgh. It protects both the borrower and the lender by clearly outlining the loan amount, interest rate, repayment schedule, and consequences of default. The various types include residential purchase loans, home equity loans, and mortgage refinance loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pittsburgh Pennsylvania Pagaré de tasa fija a plazos de Pensilvania garantizado por bienes raíces residenciales - Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Pittsburgh Pennsylvania Pagaré De Tasa Fija A Plazos De Pensilvania Garantizado Por Bienes Raíces Residenciales?

Do you need a reliable and inexpensive legal forms provider to get the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Pittsburgh Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate in any provided file format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.