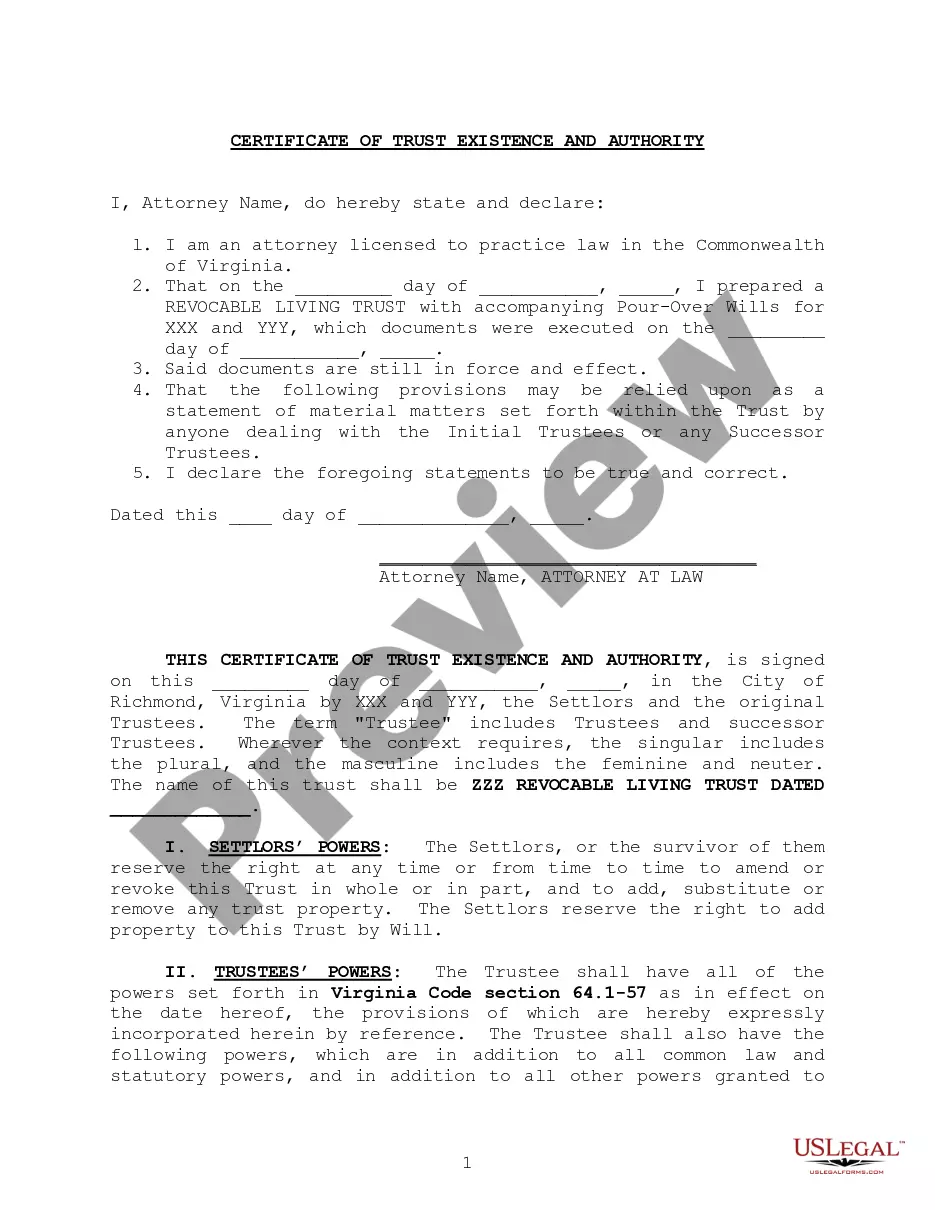

Allegheny Pennsylvania Limited Power of Attorney (LPO) is a legal document that grants specific powers to an appointed agent, allowing them to make decisions and take actions on behalf of the individual creating the power of attorney (the principal). This limited power of attorney is designed to address specific circumstances, typically for a limited time and purpose. There are several types of Allegheny Pennsylvania Limited Power of Attorney, each serving a different purpose and specifying different powers. Some common types include: 1. Financial Power of Attorney: This limited power of attorney grants the agent the authority to handle the principal's financial matters. It may include powers such as managing bank accounts, paying bills, collecting debts, managing investments, and filing tax returns. 2. Medical Power of Attorney: In this type of limited power of attorney, the agent is authorized to make medical decisions on behalf of the principal when they are unable to do so themselves. This includes granting the agent the ability to consent to medical treatments, access medical records, and make end-of-life decisions if necessary. 3. Real Estate Power of Attorney: With this limited power of attorney, the agent is given the authority to handle the principal's real estate matters. This includes buying or selling property, leasing or renting out properties, signing contracts, and managing real estate investments. 4. Legal Power of Attorney: This type of limited power of attorney empowers the agent to make legal decisions on behalf of the principal. It may include representing the principal in court, signing legal documents, filing lawsuits, and managing legal affairs. Sample Powers to Include in Allegheny Pennsylvania Limited Power of Attorney: 1. Banking and Financial Transactions: Authorizing the agent to access and manage the principal's bank accounts, make deposits and withdrawals, pay bills, and manage investments. 2. Real Estate Transactions: Granting the agent the power to buy, sell, lease, or mortgage properties on behalf of the principal. 3. Business Transactions: Allowing the agent to make decisions related to the principal's business interests, such as signing contracts, managing day-to-day operations, or executing agreements. 4. Health Care Decisions: Empowering the agent to make medical decisions, including consent for medical treatments, access to medical records, and decision-making in case of incapacity. 5. Tax Matters: Providing the agent with the authority to file tax returns, make tax-related decisions, and communicate with tax authorities on behalf of the principal. It is important to consult with a qualified attorney to create an Allegheny Pennsylvania Limited Power of Attorney tailored to your specific needs. The attorney will guide you through the process, ensuring all necessary powers are included, and ensuring compliance with applicable laws and regulations. Remember, the powers granted can be restricted or expanded as per your preferences and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Poder notarial limitado en el que se especifican poderes con ejemplos de poderes incluidos - Pennsylvania Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Allegheny Pennsylvania Poder Notarial Limitado En El Que Se Especifican Poderes Con Ejemplos De Poderes Incluidos?

Benefit from the US Legal Forms and have immediate access to any form template you want. Our beneficial website with a huge number of document templates makes it simple to find and get almost any document sample you need. You can download, fill, and certify the Allegheny Pennsylvania Limited Power of Attorney where you Specify Powers with Sample Powers Included in just a matter of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our library is a wonderful strategy to increase the safety of your document filing. Our experienced attorneys on a regular basis review all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Allegheny Pennsylvania Limited Power of Attorney where you Specify Powers with Sample Powers Included? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you view. In addition, you can find all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you require. Make certain that it is the form you were looking for: verify its title and description, and use the Preview function when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Choose the format to get the Allegheny Pennsylvania Limited Power of Attorney where you Specify Powers with Sample Powers Included and change and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Allegheny Pennsylvania Limited Power of Attorney where you Specify Powers with Sample Powers Included.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!

Form popularity

FAQ

Proporcionar los datos generales del mandante o poderdante: nombre (s); apellidos paterno y materno; fecha y lugar de nacimiento; nacionalidad: estado civil y, en caso de ser casado, presentar copia del comprobante de matrimonio y determinar bajo que regimen patrimonial (sociedad conyugal o separacion de bienes);

Un poder notarial es un documento a traves del cual usted autoriza a una persona de su confianza para que, en su nombre y representacion, realice diversos tramites administrativos y legales en Mexico; tales como comprar, vender, escriturar o administrar propiedades; retirar dinero y manejar cuentas bancarias, registro

Lo que se necesita para hacer un poder notarial es acudir a una Notaria, presentar el DNI y/o pasaporte, y pagar el coste del poder. Posteriormente firmas con el visto bueno de un notario para designar a otra persona como tu representante legal para actuar en tu nombre en actos juridicos, empresariales u otros.

Un poder notarial es un documento legal que otorga a una persona (conocida como agente) amplios poderes para administrar los asuntos de otra persona (conocida como mandante) en su nombre.

Consulta los poderes notariales aceptados en la presentacion de tramites fiscales Poder general para pleitos y cobranzas. Poder general para actos de administracion. Poder general para ejercer actos de dominio. Poderes especiales.

¿Que es un documento de Poder Notarial Duradero? Un documento de Poder Notarial Duradero permite que usted seleccione a una amistad o pariente en quien confia para que le ayude con sus finanzas y/o sus decisiones sobre el cuidado de su salud.

Indice 2.1 Poder legitimo. 2.2 Poder de referencia. 2.3 Poder experto. 2.4 Poder de recompensa. 2.5 Poder coercitivo.

Los poderes notariales especificos limitan a tu apoderado a manejar solo ciertas tareas, como pagar las cuentas o vender una vivienda, y por lo general lo hacen de manera temporal.

¿Como se otorga un poder duradero? Debe otorgarse mediante escritura publica ante un abogado o abogada notaria. Este es un acto que se debe realizar de forma libre y voluntaria, sin ser forzada o amenazada por otra persona.

Para el otorgamiento de un Testamento Publico Abierto, el interesado debe acudir ante el Consul General a manifestar su voluntad.... CONCEPTOPRECIOPoderes Generales o Especiales por Persona Fisica$ 154.00Poderes Generales o Especiales por Persona Moral$ 230.008 more rows ?