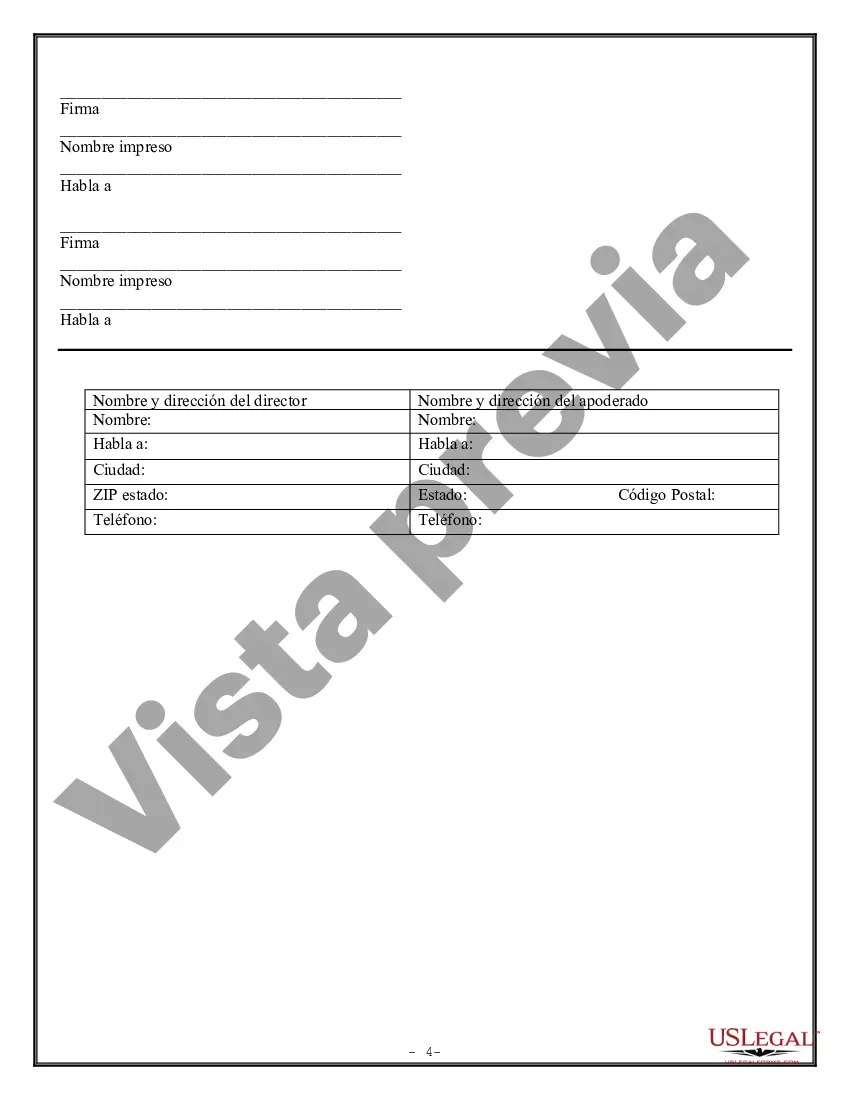

Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers allows individuals or entities in Philadelphia, Pennsylvania, to grant someone else the authority to act on their behalf for specific stock transactions and corporate matters. This legal document is tailored to provide a limited scope of powers, ensuring that the attorney-in-fact has only the authority explicitly stated in the agreement. The following are some important details regarding the Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers, along with names of different types that may exist. 1. Purpose: This limited power of attorney is designed to grant an agent, also known as an attorney-in-fact, the right to make stock transactions and corporate decisions on behalf of the principal, who may be an individual or an entity such as a corporation or partnership. 2. Specific Powers: The document explicitly identifies the specific powers that the principal wishes to confer upon the attorney-in-fact. This may include buying or selling stocks, bonds, or other securities, managing investment portfolios, voting on stocks in corporate meetings, entering into shareholder or partnership agreements, or executing corporate contracts. 3. Scope and Limitations: The limited power of attorney ensures that the authority granted is restricted to the specified stock transactions and corporate powers. It serves as a protective measure against any potential misuse of authority by the attorney-in-fact, as they cannot apply these powers beyond the agreed-upon limits. 4. Attorney-in-Fact: The attorney-in-fact, also referred to as the agent, is the individual selected by the principal to carry out the authorized actions. It is crucial to choose a trusted and capable person with a deep understanding of stock transactions and corporate affairs. 5. Principal: The principal is the person granting the limited power of attorney. They retain ultimate control over the decision-making process and have the ability to revoke or amend the power of attorney if desired. 6. Execution and Witness Requirement: The Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers must be executed in accordance with Pennsylvania state laws. This typically involves the principal's signature, notarization, and the signatures of two disinterested witnesses. 7. Types of Limited Power of Attorney: While the Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers generally refers to a specific scope of authority, it may need to be tailored to meet individual requirements. This could result in various types, such as Limited Power of Attorney for Stock Transactions Only, Limited Power of Attorney for Corporate Voting Rights, or Limited Power of Attorney for Partnership Agreements. Understanding the Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers is crucial for both those granting and those receiving the authority. It enables individuals or entities to effectively manage their stock holdings and corporate affairs with peace of mind, ensuring that the chosen agent acts in their best interests within the defined limits of the power of attorney.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Poder Notarial Limitado para Transacciones de Acciones y Poderes Corporativos - Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Philadelphia Pennsylvania Poder Notarial Limitado Para Transacciones De Acciones Y Poderes Corporativos?

If you are searching for a relevant form template, it’s difficult to choose a better platform than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can get a huge number of templates for organization and individual purposes by types and states, or keywords. Using our advanced search feature, finding the most up-to-date Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers is as elementary as 1-2-3. Furthermore, the relevance of each and every file is verified by a team of expert lawyers that on a regular basis check the templates on our platform and revise them according to the latest state and county demands.

If you already know about our system and have a registered account, all you need to receive the Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the form you need. Check its explanation and utilize the Preview feature (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the appropriate record.

- Affirm your selection. Select the Buy now button. Next, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the file format and download it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers.

Each template you add to your user profile does not have an expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to have an additional copy for modifying or printing, you can return and save it once again anytime.

Make use of the US Legal Forms professional library to gain access to the Philadelphia Pennsylvania Limited Power of Attorney for Stock Transactions and Corporate Powers you were looking for and a huge number of other professional and state-specific templates on a single platform!

Form popularity

FAQ

Si te preguntas como hacer un poder notarial online, lamentablemente ello no es posible como tal en nuestro actual ordenamiento juridico, puesto que es requisito indispensable que el notario compruebe fisicamente la personalidad del poderdante; sin embargo, ello no quiere decir que no sea posible firmar un poder ?

-El poder simple tiene una vigencia de tres meses. -El poder notarial fuera de registro tiene una vigencia de un ano. -El poder por escritura publica no tiene una vigencia establecida, salvo que el poderdante lo estipule en el documento.

La carta poder debe contener nombre completo y domicilio del otorgante y de quien recibe el poder; para el caso de los testigos, solo nombre y firma. 3. -La carta poder se presentara en original y copia, no se aceptan escaneadas, fotocopiadas o en celular.

Requisitos Concurrir el interesado con su carne de identidad y aportar las generales del apoderado, asi como explicar exhaustivamente las facultades. No es necesaria la concurrencia del apoderado. Sellos del timbre por el valor correspondiente. (Ver Costos).

Todo poder se otorga ante Notario de Fe Publica y debe ser autorizado personalmente por el CONFERENTE-MANDANTE. El poder puede ser faccionado mediante instructiva elaborada por un Abogado o labrarse directamente a peticion verbal del conferente-mandante.

En el lugar que dice Por la presente hay que escribir otorgo o cedo, en mayusculas o minusculas. Luego dice al Sr. Y ahi se debe escribir el nombre de la persona que recibe el poder. Para que a. La siguiente linea que vamos a llenar es amplia, pero aqui solo debemos escribir la palabra mi.

Lo que se necesita para hacer un poder notarial es acudir a una Notaria, presentar el DNI y/o pasaporte, y pagar el coste del poder. Posteriormente firmas con el visto bueno de un notario para designar a otra persona como tu representante legal para actuar en tu nombre en actos juridicos, empresariales u otros.

Podrias obtenerlo en uno o dos dias. En cualquiera de los dos casos, es posible que tengas que reservar una o dos tardes para reunir informacion y decidir por ti mismo lo que quieres que diga el poder notarial. Recuerde que el documento que otorga el poder debe ser claro y comprensible.

La carta poder debe contener nombre completo y domicilio del otorgante y de quien recibe el poder; para el caso de los testigos, solo nombre y firma. 3. -La carta poder se presentara en original y copia, no se aceptan escaneadas, fotocopiadas o en celular.

Requisitos Concurrir el interesado con su carne de identidad y aportar las generales del apoderado, asi como explicar exhaustivamente las facultades. No es necesaria la concurrencia del apoderado. Sellos del timbre por el valor correspondiente. (Ver Costos).

Interesting Questions

More info

England & Wales. British Parliament. (i) The general provisions governing the powers, duties, and liabilities of company directors. The general provisions governing the powers, duties, and liabilities of company directors. Vesta: “a tax on non-business income by virtue of subsection 1a×1) of the Income Tax Act 2001” Vesting is the act of holding a stock position in a corporation on an arm's length basis, so that there is no gain or loss for tax purposes. Generally, the holding period of stock can be less than 5 years. If a vesting provision is offered for a short-term or non-vesting period of up to 9 years, a grant is treated as being acquired on the date of grant, and a corresponding tax-free or tax-linked allowance is allowed. In such cases, a shareholder does not need to meet the longer vesting requirement of the relevant income tax legislation.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.