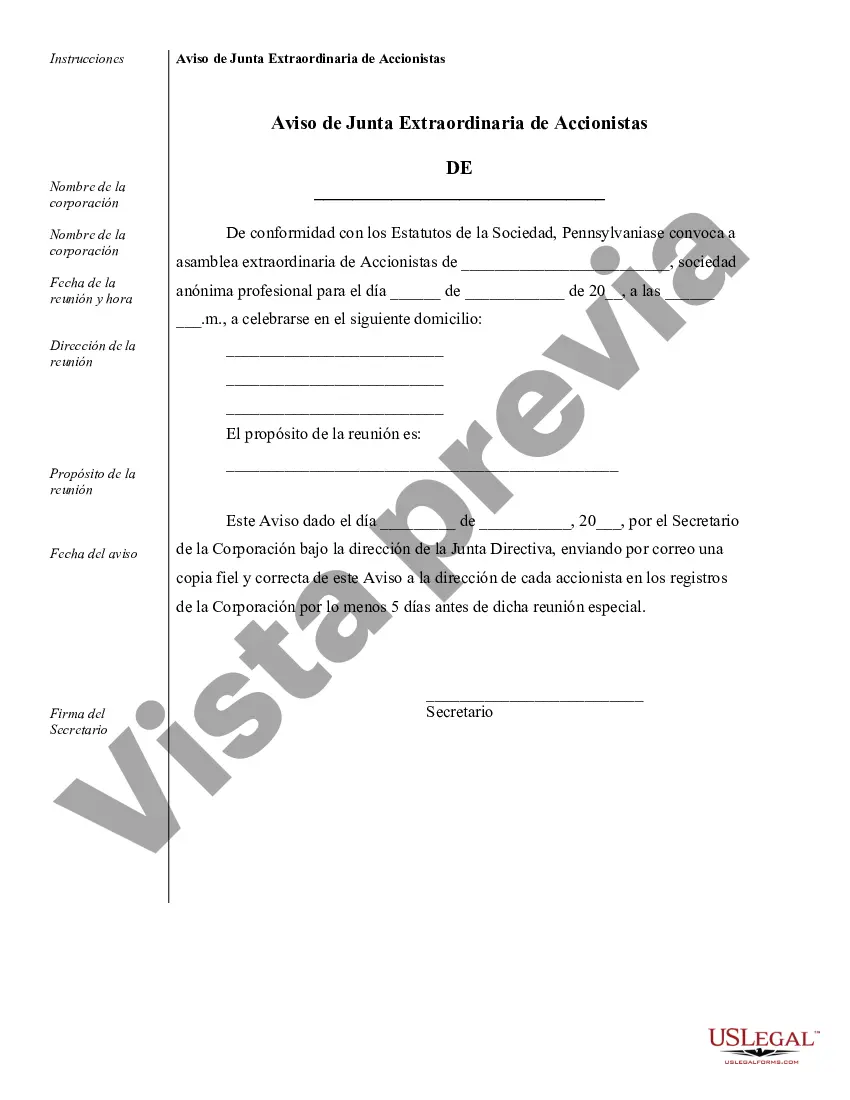

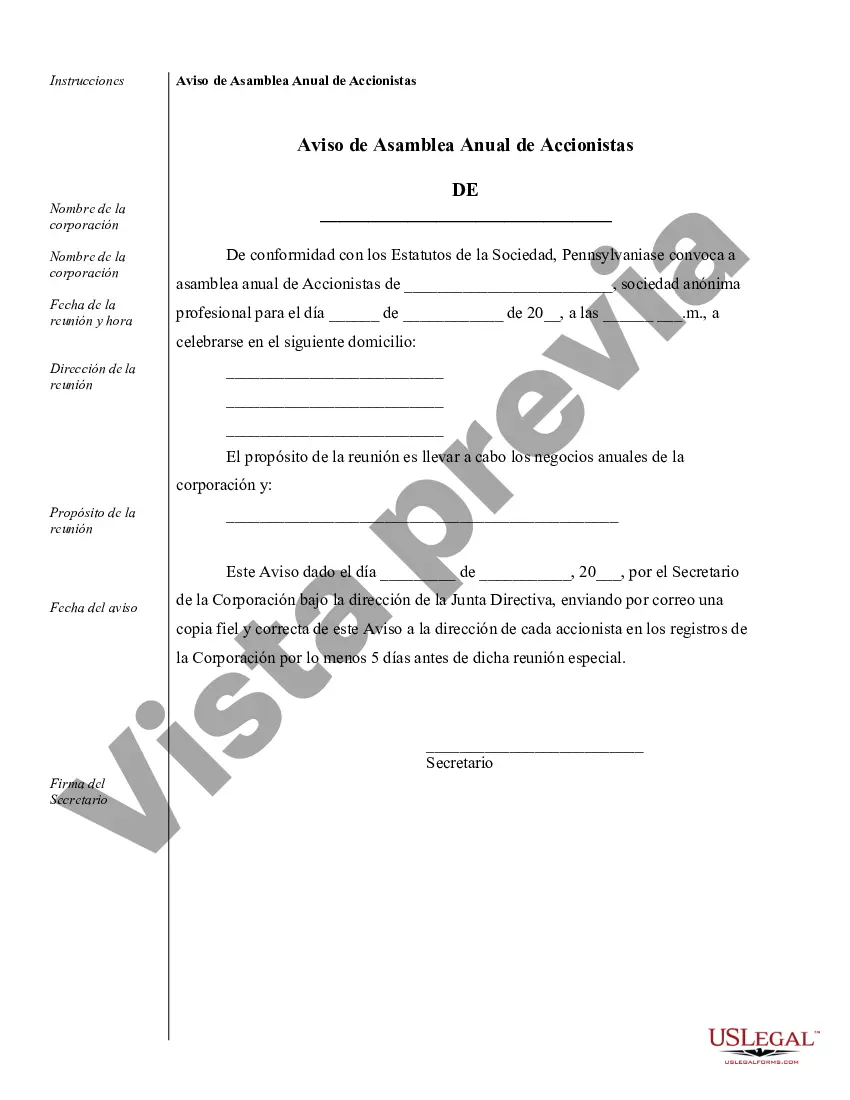

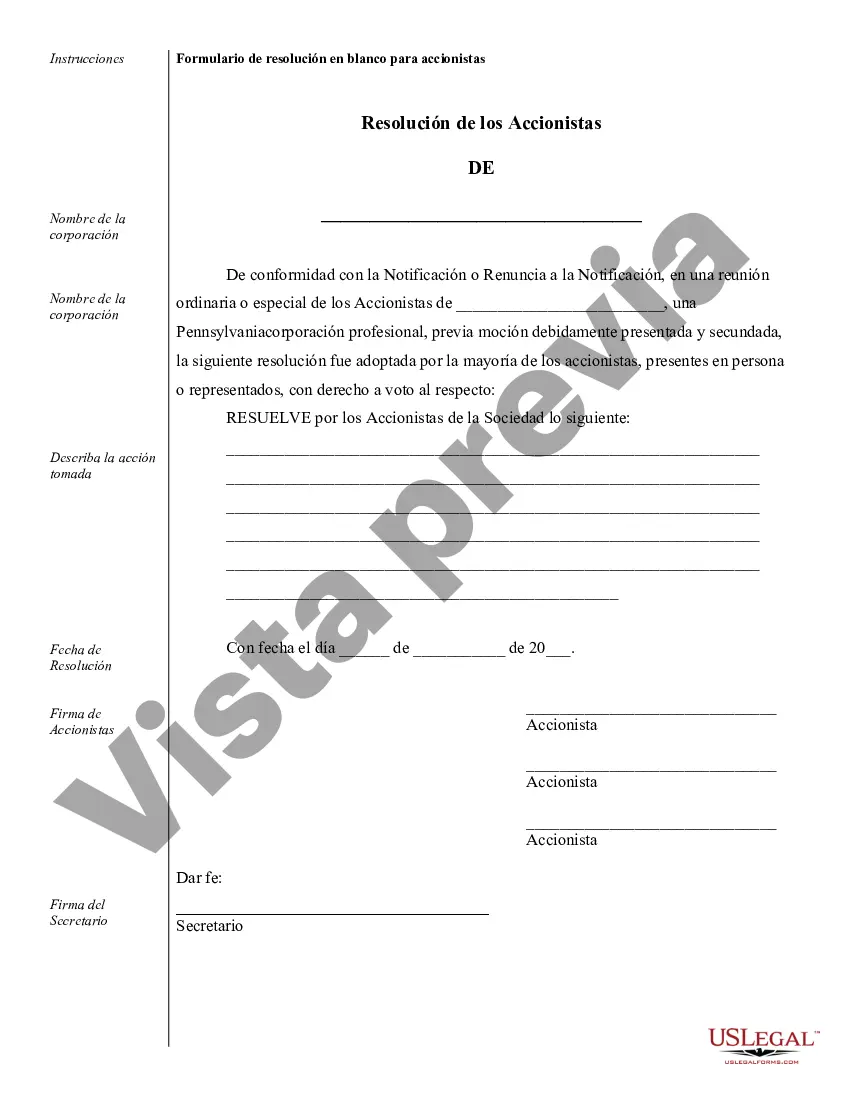

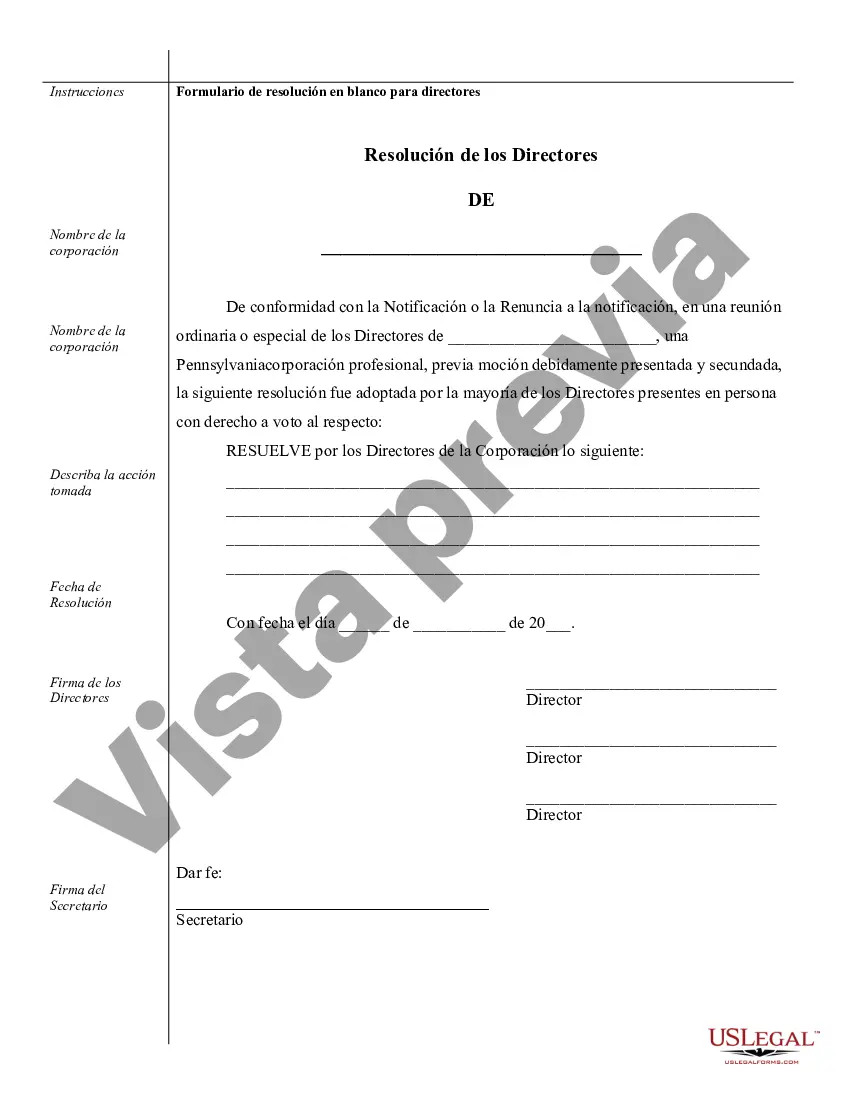

Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation serve as crucial documentation that ensures the legal compliance, transparency, and smooth operation of such businesses. These records contain comprehensive information about a professional corporation's structure, governance, and financial activities, which are essential for maintaining corporate integrity and abiding by Pennsylvania state laws. One type of Allegheny Sample Corporate Record that are often included is the Articles of Incorporation. This document outlines the corporation's basic information, such as its name, purpose, registered office address, registered agent, and details about its authorized shares. Articles of Incorporation provide the foundation for the corporation's existence and separate it as a legal entity from its shareholders. Another important record is the Bylaws of the professional corporation. Bylaws serve as the internal rule book, outlining the procedures for electing directors and officers, conducting meetings, making corporate decisions, and other important governance matters. These rules ensure that the professional corporation operates in a consistent and predictable manner, safeguarding the interests of all stakeholders. Financial records are also a crucial component of Allegheny Sample Corporate Records. These may include annual financial statements such as balance sheets, income statements, and cash flow statements. Such records provide transparency into the corporation's financial health, profitability, and liquidity. These financial records are vital for tax filings, audits, and maintaining the corporation's reputation with stakeholders, including clients, investors, and regulatory bodies. Meeting minutes are another important component of Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation. They document the discussions, decisions, and actions taken during board of directors' meetings and shareholders' meetings. Meeting minutes ensure transparency and accountability within the corporation, providing a historical record of the corporation's decision-making processes. Additionally, depending on the nature of the professional corporation, there may be additional records required. For example, professional corporations in certain fields, such as medicine, law, or engineering, might need to maintain records specific to their industry's regulations and licensing requirements. In conclusion, Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation consist of various documents such as Articles of Incorporation, Bylaws, financial records, and meeting minutes. These records are crucial for corporate governance, legal compliance, financial transparency, and successful business operations. By maintaining these records accurately and diligently, professional corporations can demonstrate their professional ethics, fulfill their legal obligations, and build trust among stakeholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Ejemplos de registros corporativos para una corporación profesional de Pensilvania - Sample Corporate Records for a Pennsylvania Professional Corporation

Description

How to fill out Pennsylvania Ejemplos De Registros Corporativos Para Una Corporación Profesional De Pensilvania?

Are you in search of a dependable and budget-friendly legal documentation provider to purchase the Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation? US Legal Forms is the ideal selection.

Whether you require a straightforward arrangement to establish rules for living with your partner or a collection of documents to facilitate your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use. Every template we provide is not generic and is tailored based on the specifications of distinct states and counties.

To obtain the document, you must Log In to your account, locate the necessary form, and click the Download button located beside it. Please be aware that you can download your previously acquired document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can easily set up an account, but before doing so, ensure that you.

Now you can create your account. Then select the subscription plan and move forward with the payment. Once the payment is completed, you can download the Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation in any available format. You can revisit the website at any time and re-download the form at no cost.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to squandering your precious time searching for legal documents online.

- Verify if the Allegheny Sample Corporate Records for a Pennsylvania Professional Corporation aligns with the regulations of your state and locality.

- Review the form’s description (if available) to determine who and what the form is intended for.

- Start the search anew if the form is unsuitable for your legal circumstances.

Form popularity

FAQ

Toma nota de lo siguiente: Obtenga una cuenta bancaria comercial de la empresa. Presentar permisos y licencias comerciales de Pensilvania. Obtenga responsabilidad por negocios y seguro de responsabilidad profesional con cobertura para empleados. Presentar un Informe anual de Pensilvania LLC o informe bienal.

La definicion de Pittsburgh en el diccionario es un puerto en SW Pennsylvania, en la confluencia de los rios Allegheny y Monongahela, que forman el rio Ohio: se establecio alrededor de Fort Pitt en 1758; se desarrollo rapidamente con el descubrimiento de depositos de hierro y uno de los yacimientos de carbon mas ricos

Atracciones principales en Pittsburgh Phipps Conservatory and Botanical Gardens. 3.298. Lugares historicos 2022 Jardines.Mount Washington. 3.021. Barrios 2022 Montanas.PNC Park. 6.084. Campos y estadios.Duquesne Incline. 4.275.Strip District. 2.989.Bicycle Heaven. 918.Carnegie Museum of Natural History. 1.661.Heinz Field. 2.161.

Pittsburgh es una ciudad de los Estados Unidos, sede del condado de Allegheny en el estado de Pensilvania. Con una poblacion de 302 971 habitantes en el limite urbano y mas de 2 370 930 personas en el area metropolitana, se trata de la segunda ciudad mas poblada de Pensilvania y la vigesimo septima mas grande del pais.

Su capital es Harrisburg y su ciudad mas poblada, Filadelfia, famosa por ser el lugar donde se elaboro la Declaracion de Independencia y la Constitucion.

Comprobante de domicilio fiscal. Identificacion oficial con fotografia. Acta de nacimiento en copia certificada....Recuerda que 30 dias despues de tu registro deberas presentarte de nuevo en el modulo del SAT para obtener tu Firma Electronica (FIEL) presentando: Identificacion oficial. CURP. Comprobante de domicilio.

Disfruta del beisbol con los Pittsburgh Pirates.Toma el brunch en Pamela's Diner.Visita el Museo de Andy Warhol.Phipps Conservatory & Botanical Gardens.Pasea por Schenley Park.Sube al historico Funicular de Duquesne. Satisfaz tu apetito en Strip District.Degusta cerveza artesana en una iglesia.

¿Como doy de alta mi empresa ante el SAT? Acuse de preinscripcion al RFC. Comprobante de domicilio fiscal. Identificacion oficial con fotografia. Acta de nacimiento en copia certificada. Si eres extranjero debes presentar tu forma migratoria multiple (FMM), carta de naturalizacion o documento migratorio vigente.

¿Como crear una empresa en Mexico? Recibir autorizacion de la Secretaria de Economia para usar el nombre.Elaborar el acta constitutiva de la empresa con ayuda de un notario.Hacer el aviso de uso de denominacion.Inscribirse en el Registro Publico de Comercio.Inscribirse en el Registro Federal de Contribuyentes.

Pittsburgh es una ciudad de los Estados Unidos, sede del condado de Allegheny en Pensilvania. Se encuentra en la parte suroeste de Pensilvania y se ha desarrollado alrededor del lugar donde los rios Allegheny y Monongahela se unen para formar el rio Ohio.

Interesting Questions

More info

If you have ever registered or are about to register a corporation in Pennsylvania, the state may sue you for failure to comply with certain statutes in the state that affect corporations, including, but not limited to, the Pennsylvania Business Corporation Law, the Delaware State Corporation Law, the District of Columbia Act, or any other law of this state. Contact attorney John Degrading at: If you have an existing registration, you must change it as soon as you become aware of the violation. If no current corporation is involved, contact the Division of Corporations in Harrisburg at to start the process.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.