Philadelphia Pennsylvania Formulario de última voluntad legal para una viuda o viudo sin hijos - Pennsylvania Last Will for a Widow or Widower with no Children

Description

How to fill out Pennsylvania Formulario De última Voluntad Legal Para Una Viuda O Viudo Sin Hijos?

If you are looking for a legitimate form template, it’s challenging to find a superior platform compared to the US Legal Forms website – likely the most extensive libraries available online.

Here you can obtain a vast array of templates for business and personal needs categorized by type and region, or through specific keywords.

With the enhanced search functionality, locating the most recent Philadelphia Pennsylvania Legal Last Will Form for a Widow or Widower without Children is as straightforward as 1-2-3.

Confirm your choice. Click the Buy now button. Then, choose the desired subscription plan and provide information to register an account.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the accuracy of each document is verified by a team of qualified attorneys who routinely assess the templates on our site and update them according to the latest state and local regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Philadelphia Pennsylvania Legal Last Will Form for a Widow or Widower without Children is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions listed below.

- Ensure you have located the form you need. Review its description and utilize the Preview option (if available) to examine its content.

- If it doesn’t meet your requirements, use the Search option located at the top of the screen to find the suitable document.

Form popularity

FAQ

-Debe estar escrito todo el y firmado por el testador, con expresion del ano, mes y dia en que se otorgue. Podemos incluir tachones y enmiendas, ahora bien deberemos salvarlas bajo la firma del testador. Por lo tanto no parece complicado, lo podremos realizar utilizando, lapiz y papel y firmarlo.

CUMPLA LAS SIGUIENTES REGLAS: Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

COMO REDACTAR UN TESTAMENTO Decide lo que deberia incluir tu testamento. Haz una lista de tus bienes. Decide quien debe recibir cada cosa. Divide tu patrimonio restante. Contrata un abogado. Usa un servicio de escritura de testamentos online. Escribe el testamento tu mismo. Finaliza tu testamento.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

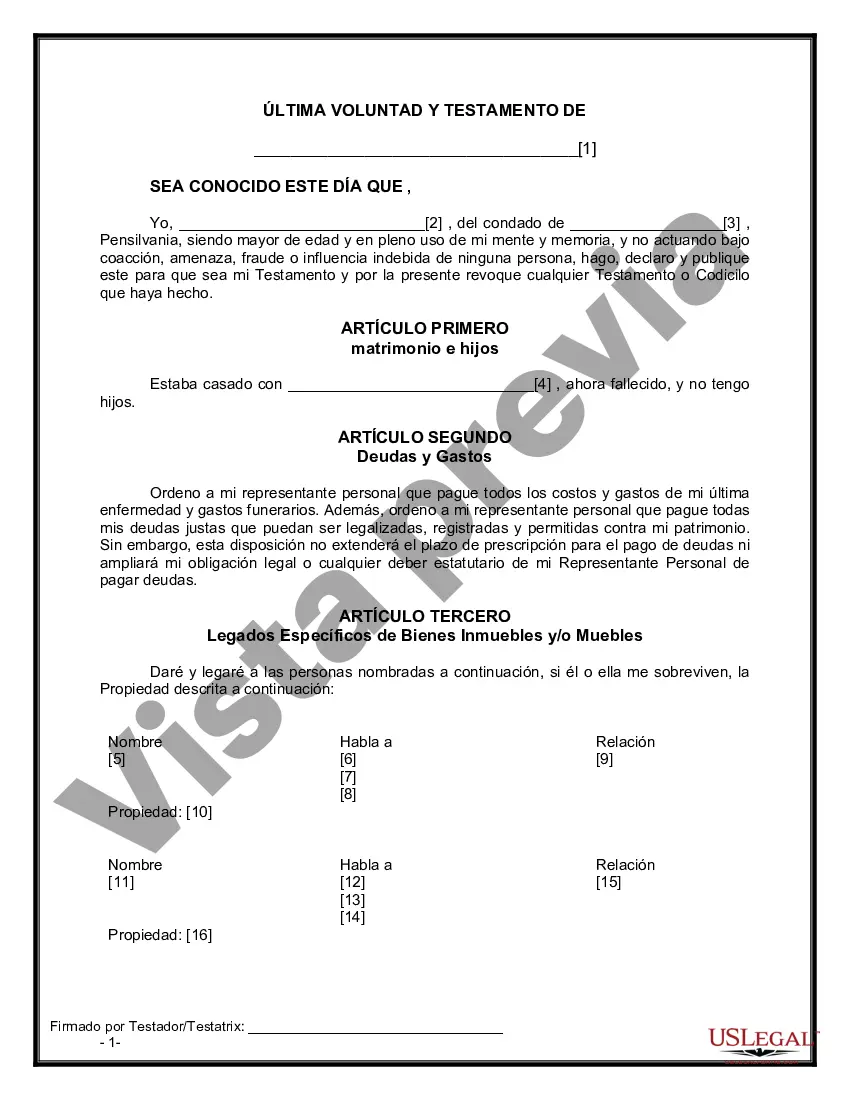

El testamento es un acto, o instrumento legal, mediante el cual una persona decide el destino de sus bienes y su patrimonio al momento de su fallecimiento. El testamento es un acto unilateral, formal y solemne, donde una persona expresa su voluntad respecto a como se dispondra de sus bienes tras su muerte.

COMO REDACTAR UN TESTAMENTO Decide lo que deberia incluir tu testamento. Haz una lista de tus bienes. Decide quien debe recibir cada cosa. Divide tu patrimonio restante. Contrata un abogado. Usa un servicio de escritura de testamentos online. Escribe el testamento tu mismo. Finaliza tu testamento.

¿ Que requisitos debe cumplir? El testador debe tener como minimo 18 anos de edad. El testador debe tener buena salud mental. Al redactarlo, debe escribir su nombre y apellidos como aparecen en su acta de nacimiento. El testamento debe precisar quien sera el albacea.

COMO REDACTAR UN TESTAMENTO Decide lo que deberia incluir tu testamento. Haz una lista de tus bienes. Decide quien debe recibir cada cosa. Divide tu patrimonio restante. Contrata un abogado. Usa un servicio de escritura de testamentos online. Escribe el testamento tu mismo. Finaliza tu testamento.

Para un testamento generico, que se realiza sobre todos los bienes y se instituye a una persona como heredera, el costo minimo es de $28.000 y maximo de $100.000. Es importante registrarlo ya que al momento de una sucesion, el juez buscara saber si la persona fallecida indico que hacer con sus bienes despues de muerto.

En el testamento debe constar el nombre, edad, domicilio y nacionalidad del testador, detalle de sus matrimonios y de todos sus hijos, la declaracion de hallarse en pleno uso de sus facultades y el nombre y domicilio de los testigos. El documento debe firmarse por el testador, el notario y los testigos.