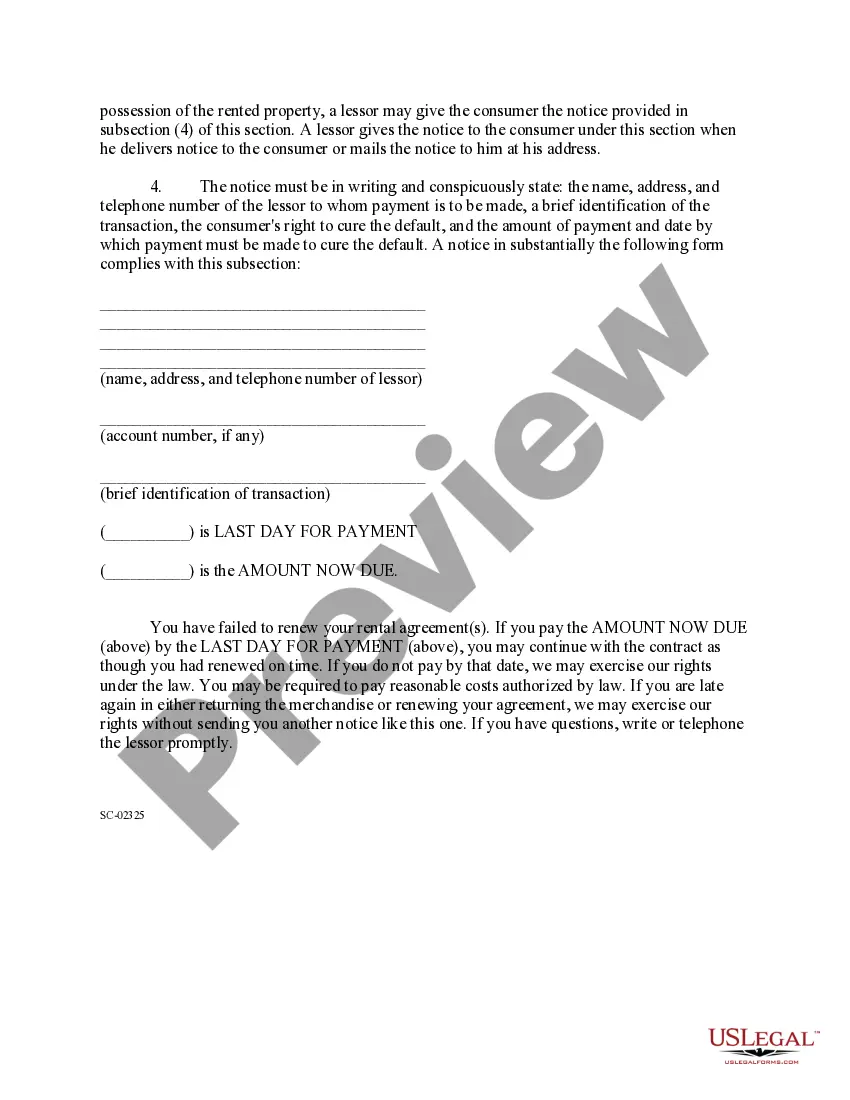

North Charleston South Carolina Notice of Consumer's Right to Cure Default

Description

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

Acquiring certified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It is a digital collection of over 85,000 legal templates catering to both personal and professional requirements as well as various real situations.

All the files are accurately categorized by application area and jurisdiction, making the search for the North Charleston South Carolina Notice of Consumer's Right to Cure Default as straightforward and simple as pie.

Maintaining documentation organized and compliant with legal standards holds significant importance. Take advantage of the US Legal Forms library to consistently have vital document templates for any requirements readily available!

- Examine the Preview mode and document description.

- Ensure you have chosen the correct one that aligns with your needs and completely adheres to your local jurisdiction standards.

- Look for another template, if required.

- Should you identify any discrepancy, utilize the Search tab above to locate the appropriate one.

- If it meets your criteria, proceed to the subsequent step.

Form popularity

FAQ

Under South Carolina law (S.C. Code § 15-3-530), the statute of limitations for most types of consumer and business debt is three (3) years. As an article from the U.S. Federal Trade Commission (FTC) explains, the statute of limitations typically begins ?ticking? once a debtor fails to make payments on the debt.

In South Carolina, creditors and debt collectors can only come after you for medical and credit card debt for three years. They can pursue you for mortgage debt for twenty years and state tax debt for ten years.

No, you cannot go to jail for not making your loan payments! Creditors may try to make you believe that this is possible, but South Carolina does not have ?debtor's prison.?

This statute, commonly referred to as South Carolina's statute of repose, also provides that a certificate of occupancy is proof of substantial completion of a project, unless the parties otherwise agree, in writing.

In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Borrowers' Rights In South Carolina, borrowers have a right of redemption to redeem their vehicles. Lenders must send borrowers with a written ?Right to Redeem? notice after the repossession. The notice must outline the lender's intentions to sell or auction the repossessed vehicle.

A magistrate's judgment is valid for three years, whereas a circuit court judgment is valid for ten years. Therefore, the filing of a magistrate's judgment in circuit court extends the life of the judgment to that of the circuit court's. Judgments in South Carolina may not be renewed.

Judgments in South Carolina may not be renewed. The South Carolina Supreme Court has concluded that a judgment is ?utterly extinguished after the expiration of ten years from the date of entry.? Hardee v. Lynch, 212 S.C.

South Carolina, like at least thirty-one other states, has a ?right to cure? statute applicable to residential construction defect claims. The South Carolina Notice and Opportunity to Cure Construction Dwelling Defects Act, S.C. Code Ann.

Generally, the 1st month you are late on your car payment, the lender can start the repossession process. There is usually a section in your payment agreement or contract that says the lender can take the property back if you fall behind in your payments.