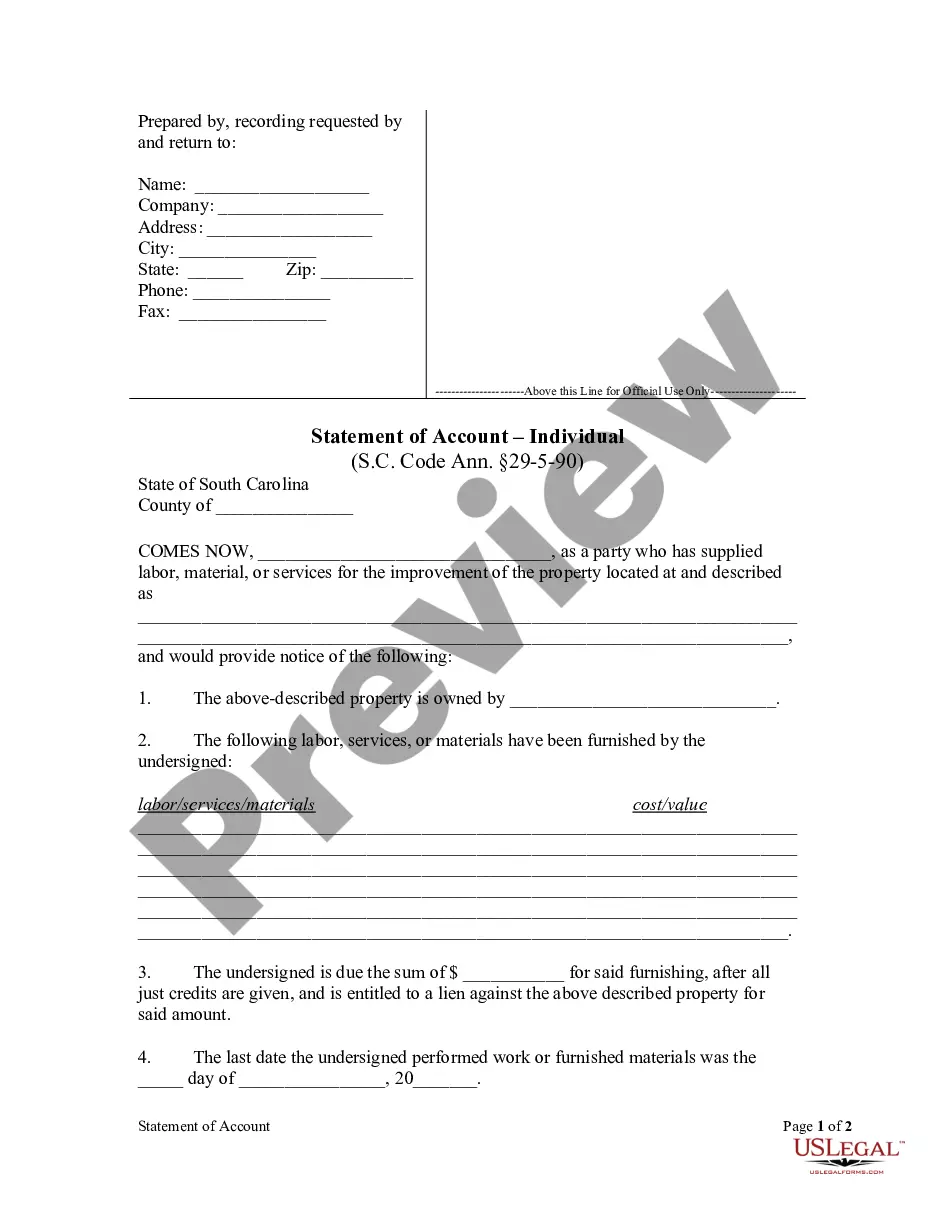

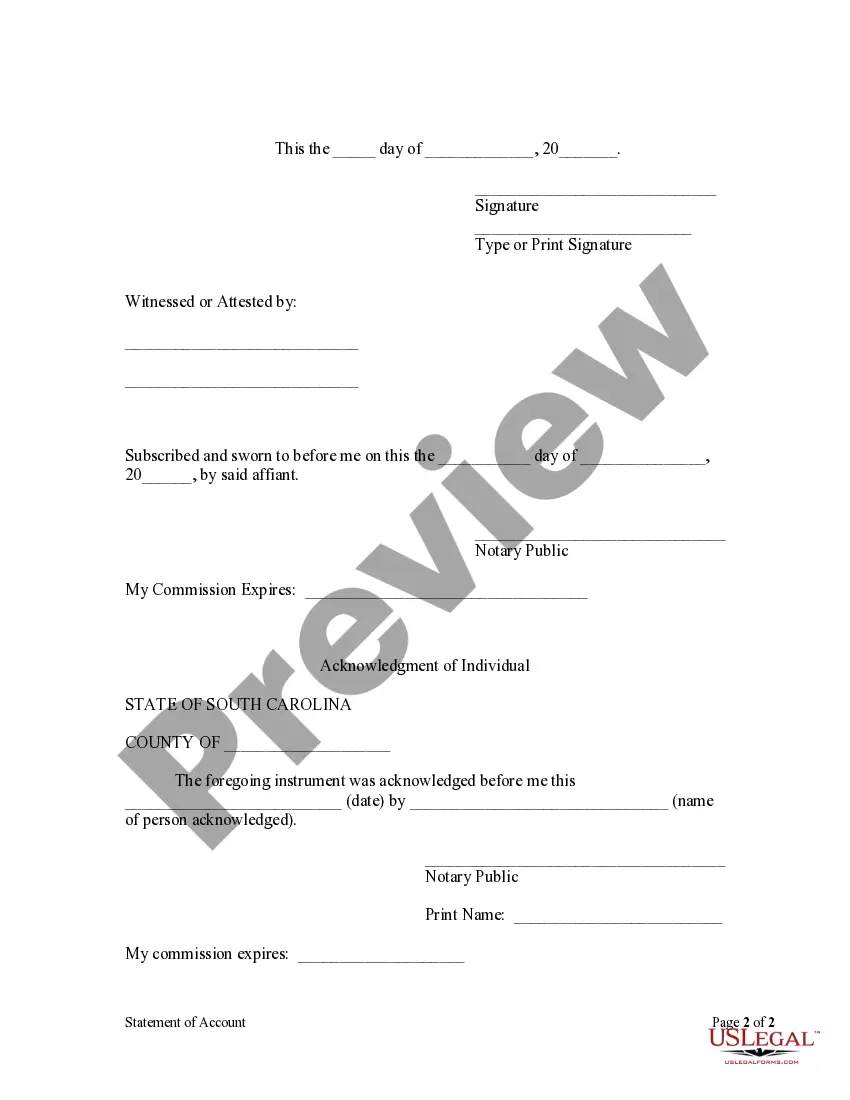

A lien shall be dissolved unless the person desiring to avail himself thereof, within ninety days after he ceases to labor on or furnish labor or materials for such building or structure, serves upon the owner or, in the event the owner cannot be found, upon the person in possession and files in the office of the register of deeds or the clerk of court of the county in which the building or structure is situated a statement of a just and true account of the amount due him, with all just credits given, together with a description of the property intended to be covered by the lien sufficiently accurate for identification, with the name of the owner of the property, if known, which certificate shall be subscribed and sworn to by the person claiming the lien or by someone in his behalf and shall be recorded in a book kept for the purpose by the register or clerk who shall be entitled to the same fees therefor as for recording mortgages of equal length.

The North Charleston South Carolina Statement of Account — Individual is a document that provides a comprehensive summary of an individual's financial transactions and balances. It serves as an essential tool for individuals to keep track of their financial activities and ensure accuracy in their accounts. The statement of account typically includes various important details such as the individual's name, address, account number, and the reporting period covered by the statement. It presents a detailed list of all financial transactions made within the specified period, including deposits, withdrawals, purchases, payments, and any applicable fees or charges. Additionally, the statement of account may also feature the individual's current balance, outstanding balance, and the available credit or funds. It provides a clear picture of the individual's financial standing and helps in managing personal finances effectively. There may be different types of North Charleston South Carolina Statement of Account — Individual, each catering to a specific financial institution or service provider. Some commonly seen variations include: 1. North Charleston South Carolina Bank Statement of Account — Individual: This type of statement is issued by banks and includes detailed information about the individual's bank transactions, such as deposits, withdrawals, transfers, and interest earned. 2. North Charleston South Carolina Credit Card Statement of Account — Individual: This statement is typically provided by credit card companies and outlines the individual's credit card activities, including purchases, payments, cash advances, and any applicable fees or interest charges. 3. North Charleston South Carolina Utility Statement of Account — Individual: Utility companies such as electricity, water, or gas providers may issue this statement to summarize an individual's utility usage, billing details, and any outstanding payments owed. 4. North Charleston South Carolina Investment Statement of Account — Individual: Investment firms or financial advisors may issue this statement to clients, providing a comprehensive overview of their investment holdings, transactions, gains/losses, dividends, and portfolio performance. In summary, the North Charleston South Carolina Statement of Account — Individual is a vital financial document that provides an individual with an accurate record of their financial activities. By reviewing this statement regularly, individuals can ensure their accounts are in order, identify any discrepancies, and make informed decisions about their personal finances.The North Charleston South Carolina Statement of Account — Individual is a document that provides a comprehensive summary of an individual's financial transactions and balances. It serves as an essential tool for individuals to keep track of their financial activities and ensure accuracy in their accounts. The statement of account typically includes various important details such as the individual's name, address, account number, and the reporting period covered by the statement. It presents a detailed list of all financial transactions made within the specified period, including deposits, withdrawals, purchases, payments, and any applicable fees or charges. Additionally, the statement of account may also feature the individual's current balance, outstanding balance, and the available credit or funds. It provides a clear picture of the individual's financial standing and helps in managing personal finances effectively. There may be different types of North Charleston South Carolina Statement of Account — Individual, each catering to a specific financial institution or service provider. Some commonly seen variations include: 1. North Charleston South Carolina Bank Statement of Account — Individual: This type of statement is issued by banks and includes detailed information about the individual's bank transactions, such as deposits, withdrawals, transfers, and interest earned. 2. North Charleston South Carolina Credit Card Statement of Account — Individual: This statement is typically provided by credit card companies and outlines the individual's credit card activities, including purchases, payments, cash advances, and any applicable fees or interest charges. 3. North Charleston South Carolina Utility Statement of Account — Individual: Utility companies such as electricity, water, or gas providers may issue this statement to summarize an individual's utility usage, billing details, and any outstanding payments owed. 4. North Charleston South Carolina Investment Statement of Account — Individual: Investment firms or financial advisors may issue this statement to clients, providing a comprehensive overview of their investment holdings, transactions, gains/losses, dividends, and portfolio performance. In summary, the North Charleston South Carolina Statement of Account — Individual is a vital financial document that provides an individual with an accurate record of their financial activities. By reviewing this statement regularly, individuals can ensure their accounts are in order, identify any discrepancies, and make informed decisions about their personal finances.