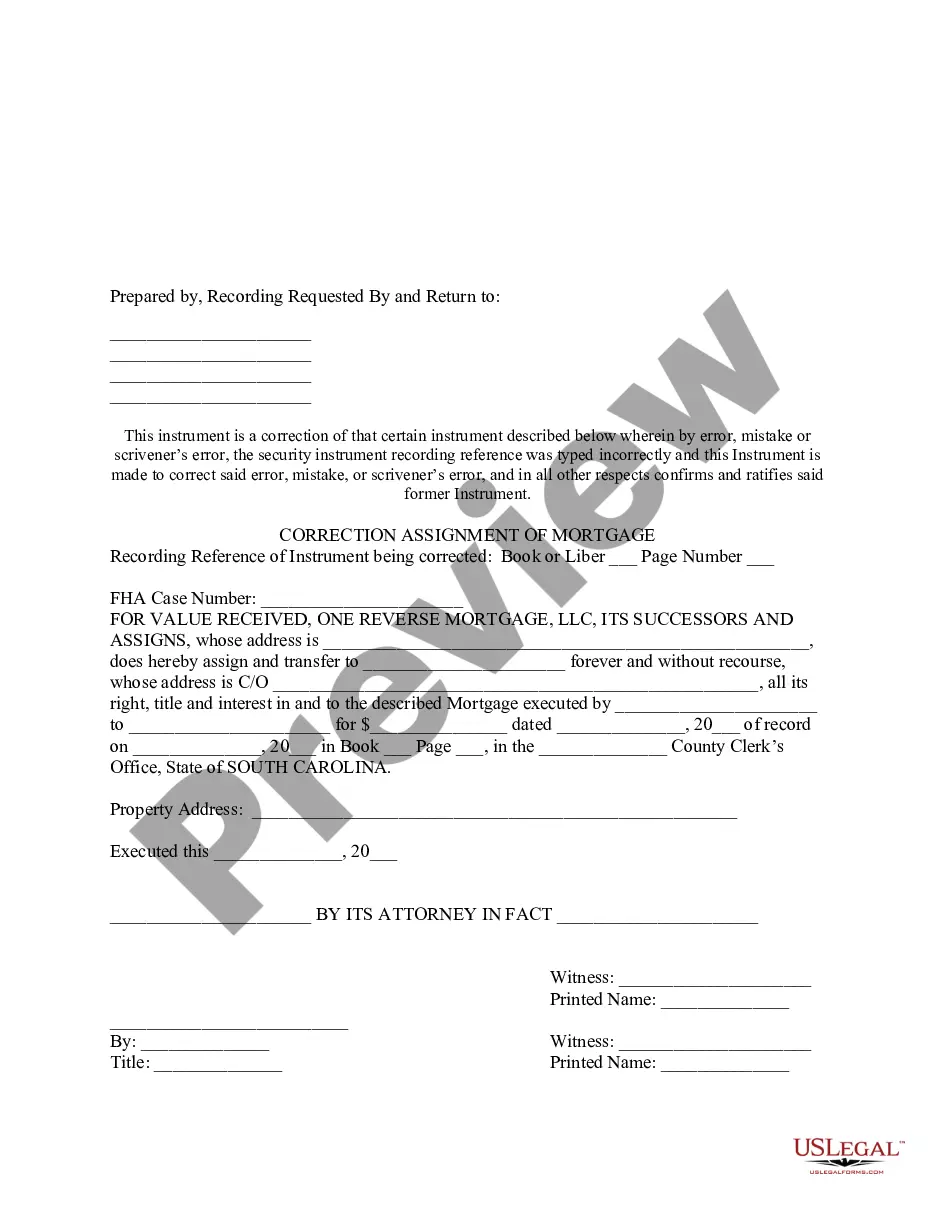

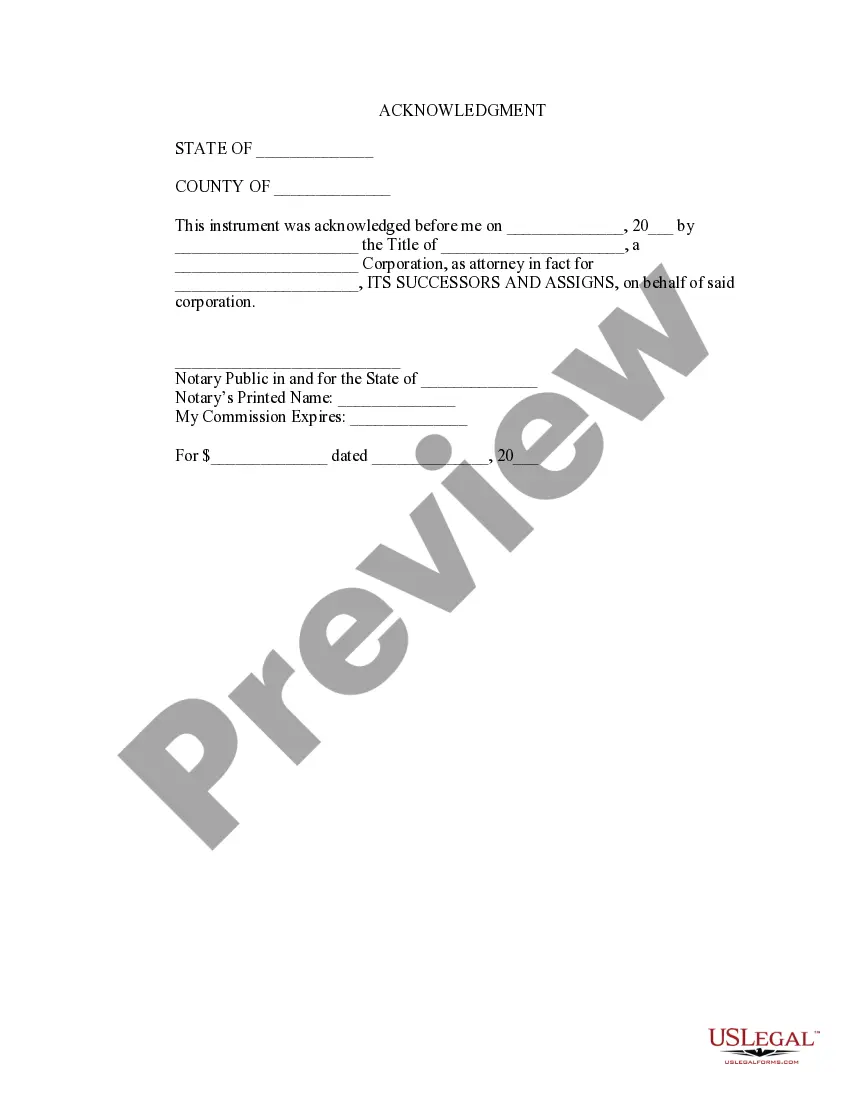

The North Charleston South Carolina Correction Assignment of Mortgage is a legal document used in real estate transactions to rectify errors or omissions in a previously recorded assignment of mortgage. This corrective measure is essential to ensure the accuracy and enforceability of the mortgage assignment. A mortgage assignment is a transfer of the mortgage from one party to another, typically arising when a property is sold or when a loan is transferred between lenders. However, errors in this process may occur due to clerical mistakes, wrong identification of parties involved, or inaccurate legal descriptions of the property. The North Charleston South Carolina Correction Assignment of Mortgage provides a solution when errors or omissions are discovered after the original assignment is recorded. The document is filed with the appropriate county office to correct any inaccuracies and validate the proper transfer of the mortgage. Keywords: North Charleston South Carolina, Correction Assignment of Mortgage, real estate transactions, rectify errors, omissions, previously recorded, mortgage assignment, corrective measure, accuracy, enforceability, transfer of mortgage, clerical mistakes, wrong identification, legal descriptions, property, solution, filed, county office, proper transfer. Types of Correction Assignment of Mortgage in North Charleston South Carolina: 1. Corrective Assignment: This type of correction assignment is used when there is a minor error or omission in the original assignment of mortgage. It aims to rectify the mistake without altering the fundamental terms or intent of the document. 2. Amended Assignment: An amended assignment is necessary when significant changes need to be made to the original assignment of mortgage. This could include correcting the names of the parties involved, updating legal descriptions, or modifying other critical information. 3. Quitclaim Assignment: In some cases, where the original assignment of mortgage cannot be corrected or amended, a quitclaim assignment might be used. This involves the release of all interest in the mortgage by the assigning party, ensuring a clean transfer to the new assignee. 4. Supplemental Assignment: A supplemental assignment is required when additional details or amendments need to be included in the original assignment of mortgage. This can occur when additional parties become involved in the mortgage or when new terms are added to the agreement. 5. Corrective Reassignment: If errors are discovered in a previously corrected assignment of mortgage, a corrective reassignment may be necessary. This type of correction assignment corrects any mistakes made in previous correction filings, ensuring the accuracy of the overall transaction. It is important to consult with legal professionals or real estate experts in North Charleston, South Carolina, to ensure compliance with local laws and regulations when dealing with any Correction Assignment of Mortgage.

North Charleston South Carolina Correction Assignment of Mortgage

Description

How to fill out North Charleston South Carolina Correction Assignment Of Mortgage?

Do you need a reliable and inexpensive legal forms supplier to buy the North Charleston South Carolina Correction Assignment of Mortgage? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the North Charleston South Carolina Correction Assignment of Mortgage conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the North Charleston South Carolina Correction Assignment of Mortgage in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal papers online for good.