Title: North Charleston South Carolina Living Trust for Individuals Who are Single, Divorced, or Widow/Widower with No Children Introduction: In North Charleston, South Carolina, individuals who are single, divorced, or widowed and do not have children may opt for a Living Trust to ensure their assets are managed and distributed according to their wishes. A living trust offers several benefits, including avoiding probate and maintaining privacy. Let's explore the different types of living trusts available to suit the needs of individuals in these unique circumstances. 1. Revocable Living Trust: A revocable living trust is a common choice for individuals who are single, divorced, or widowed with no children. It allows the person, known as the granter, to maintain control over their assets during their lifetime. They have the freedom to modify or revoke the trust as circumstances change. Upon their passing, the assets in the trust will be distributed to the designated beneficiaries without the need for probate. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked once it is created. This type of trust provides added protection to the granter's assets, shields them from creditors, and reduces potential estate tax liability. The granter may also appoint a reliable trustee to manage the trust and ensure its proper distribution after their passing. 3. Special Needs Trust: For individuals without children who have disabled dependents or loved ones with special needs, a special needs trust can be established within a living trust. This type of trust allows the granter to provide financially for their disabled dependents without affecting their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI). 4. Charitable Remainder Trust: A charitable remainder trust is an option for individuals who are passionate about philanthropy. It allows the granter to transfer assets into a trust, retaining a stream of income during their lifetime. Upon their passing, the remaining trust assets are directed to charitable organizations of their choice. This type of trust offers potential tax benefits for the granter and supports causes they care about. 5. Pour-Over Will Trust: A pour-over will trust can be used in conjunction with a living trust to ensure any assets not transferred to the trust during the granter's lifetime are distributed according to their wishes. This trust acts as a safety net, catching any overlooked assets and transferring them into the living trust, ensuring consistent management and distribution. Conclusion: North Charleston, South Carolina offers several types of living trusts to accommodate the unique needs of individuals who are single, divorced, or widowed with no children. Choosing the appropriate living trust involves considering personal circumstances, asset distribution preferences, and the desire for asset control during one's lifetime. Seeking qualified legal counsel is essential to ensure the creation of a comprehensive living trust that aligns with an individual's wishes and safeguards their assets effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Charleston South Carolina Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

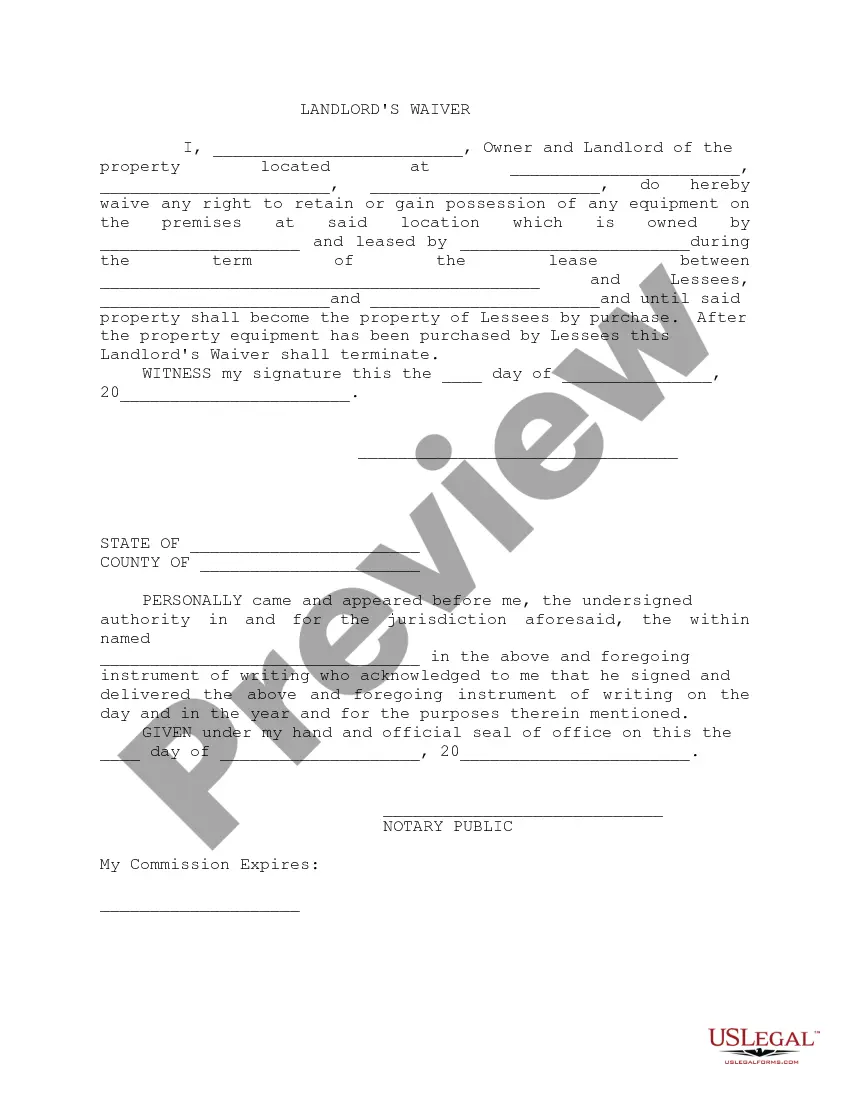

Description

How to fill out North Charleston South Carolina Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

If you are looking for a relevant form template, it’s difficult to choose a more convenient place than the US Legal Forms website – probably the most comprehensive online libraries. Here you can get a large number of form samples for company and individual purposes by types and regions, or key phrases. With the high-quality search function, finding the most up-to-date North Charleston South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is as easy as 1-2-3. Additionally, the relevance of each and every file is proved by a team of expert lawyers that regularly review the templates on our platform and revise them in accordance with the latest state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the North Charleston South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the form you need. Read its description and make use of the Preview function (if available) to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the needed document.

- Affirm your choice. Click the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the acquired North Charleston South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children.

Every form you add to your profile does not have an expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to get an extra duplicate for modifying or printing, feel free to come back and download it once more whenever you want.

Make use of the US Legal Forms extensive collection to get access to the North Charleston South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children you were seeking and a large number of other professional and state-specific samples in a single place!