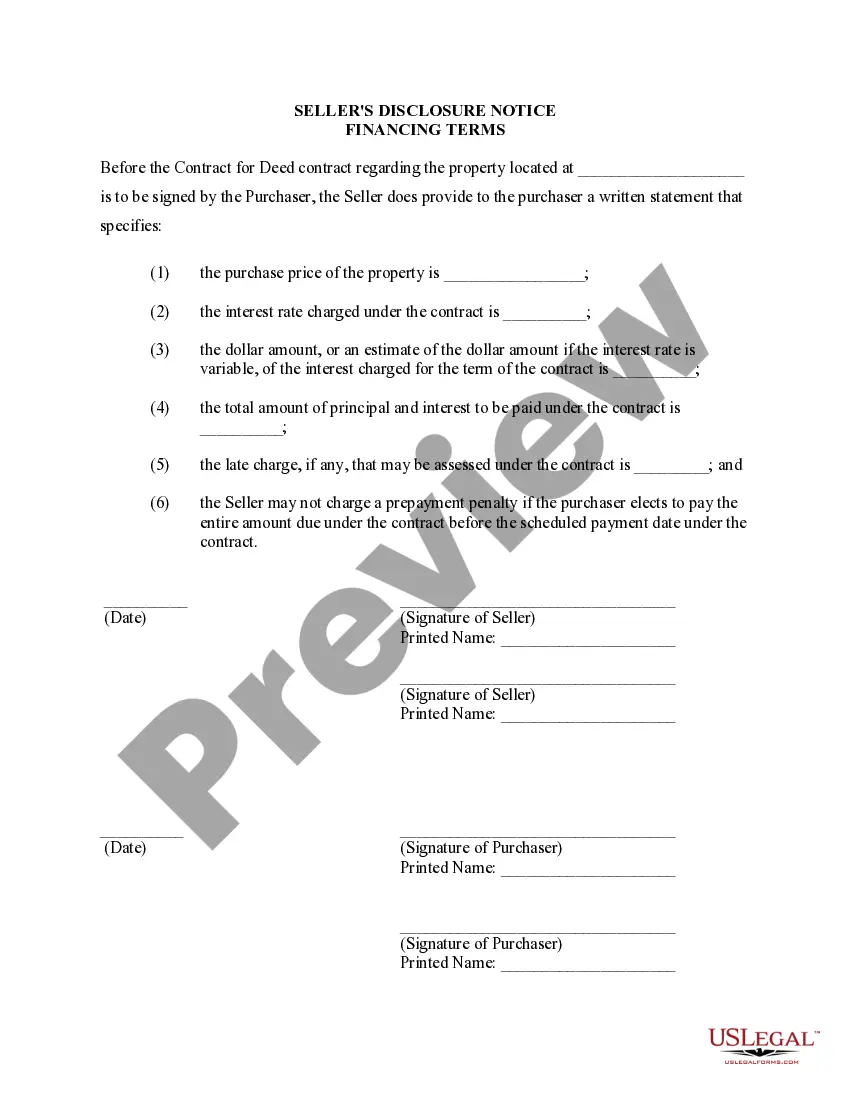

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financial aspects of purchasing a residential property through this specific type of agreement. This disclosure provides important information for both the seller and the buyer and helps ensure transparency and legal compliance throughout the agreement. Here are some types of Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Interest Rate and Loan Terms: This section of the disclosure specifies the interest rate applicable to the financing terms offered by the seller, along with any relevant details regarding the loan repayment period, such as the duration and frequency of payments. 2. Down Payment and Purchase Price: The disclosure will clearly state the required down payment amount, usually expressed as a percentage of the total purchase price. It will also include the agreed-upon price of the residential property being sold under the Land Contract. 3. Financing Fees and Costs: This section outlines any additional fees or costs associated with the financing arrangements, such as origination fees, document preparation fees, or attorney fees. These should be clearly disclosed to ensure that both parties understand the financial aspects involved in the transaction. 4. Late Payment Penalties: The disclosure will address the consequences of late or missed payments, including any penalties or additional interest charges that may apply. This ensures that the buyer is aware of the possible repercussions for failing to meet their obligations under the Land Contract. 5. Property Insurance and Taxes: The disclosure will outline the buyer's responsibility for maintaining property insurance coverage during the term of the agreement and provide details regarding the handling of property taxes, whether they will be paid by the seller or the buyer. 6. Default and Termination Provisions: This section will outline the circumstances under which the Land Contract may be terminated due to default or non-compliance with the agreed-upon terms and the potential remedies available to either party in case of such termination. It's important to note that while these are common elements found in a Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, the specific content and language may vary depending on the individual agreement and the preferences of the parties involved. It's advisable to consult with a real estate professional or attorney to ensure that the disclosure accurately reflects the terms of the Land Contract and complies with local laws and regulations.Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financial aspects of purchasing a residential property through this specific type of agreement. This disclosure provides important information for both the seller and the buyer and helps ensure transparency and legal compliance throughout the agreement. Here are some types of Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Interest Rate and Loan Terms: This section of the disclosure specifies the interest rate applicable to the financing terms offered by the seller, along with any relevant details regarding the loan repayment period, such as the duration and frequency of payments. 2. Down Payment and Purchase Price: The disclosure will clearly state the required down payment amount, usually expressed as a percentage of the total purchase price. It will also include the agreed-upon price of the residential property being sold under the Land Contract. 3. Financing Fees and Costs: This section outlines any additional fees or costs associated with the financing arrangements, such as origination fees, document preparation fees, or attorney fees. These should be clearly disclosed to ensure that both parties understand the financial aspects involved in the transaction. 4. Late Payment Penalties: The disclosure will address the consequences of late or missed payments, including any penalties or additional interest charges that may apply. This ensures that the buyer is aware of the possible repercussions for failing to meet their obligations under the Land Contract. 5. Property Insurance and Taxes: The disclosure will outline the buyer's responsibility for maintaining property insurance coverage during the term of the agreement and provide details regarding the handling of property taxes, whether they will be paid by the seller or the buyer. 6. Default and Termination Provisions: This section will outline the circumstances under which the Land Contract may be terminated due to default or non-compliance with the agreed-upon terms and the potential remedies available to either party in case of such termination. It's important to note that while these are common elements found in a Sioux Falls South Dakota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, the specific content and language may vary depending on the individual agreement and the preferences of the parties involved. It's advisable to consult with a real estate professional or attorney to ensure that the disclosure accurately reflects the terms of the Land Contract and complies with local laws and regulations.