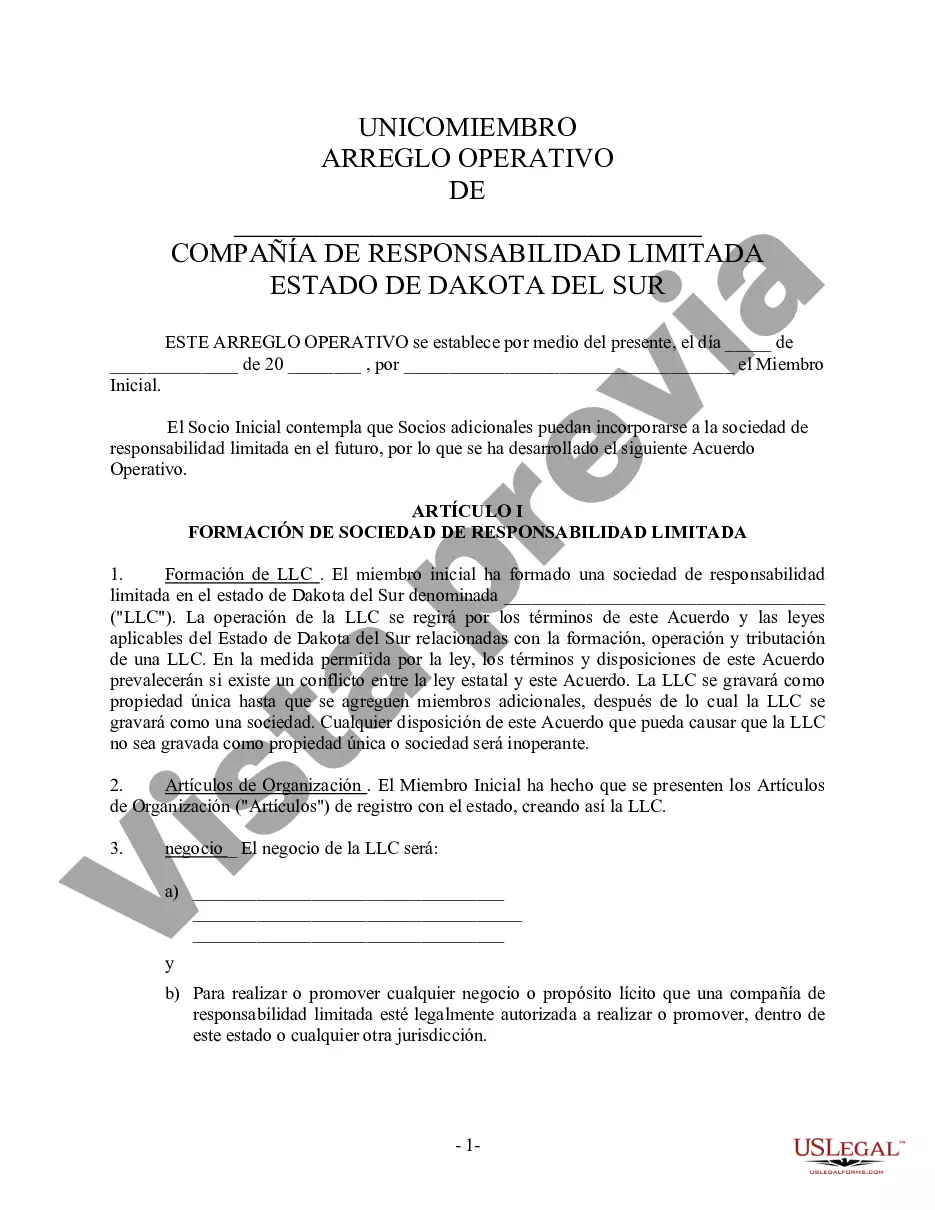

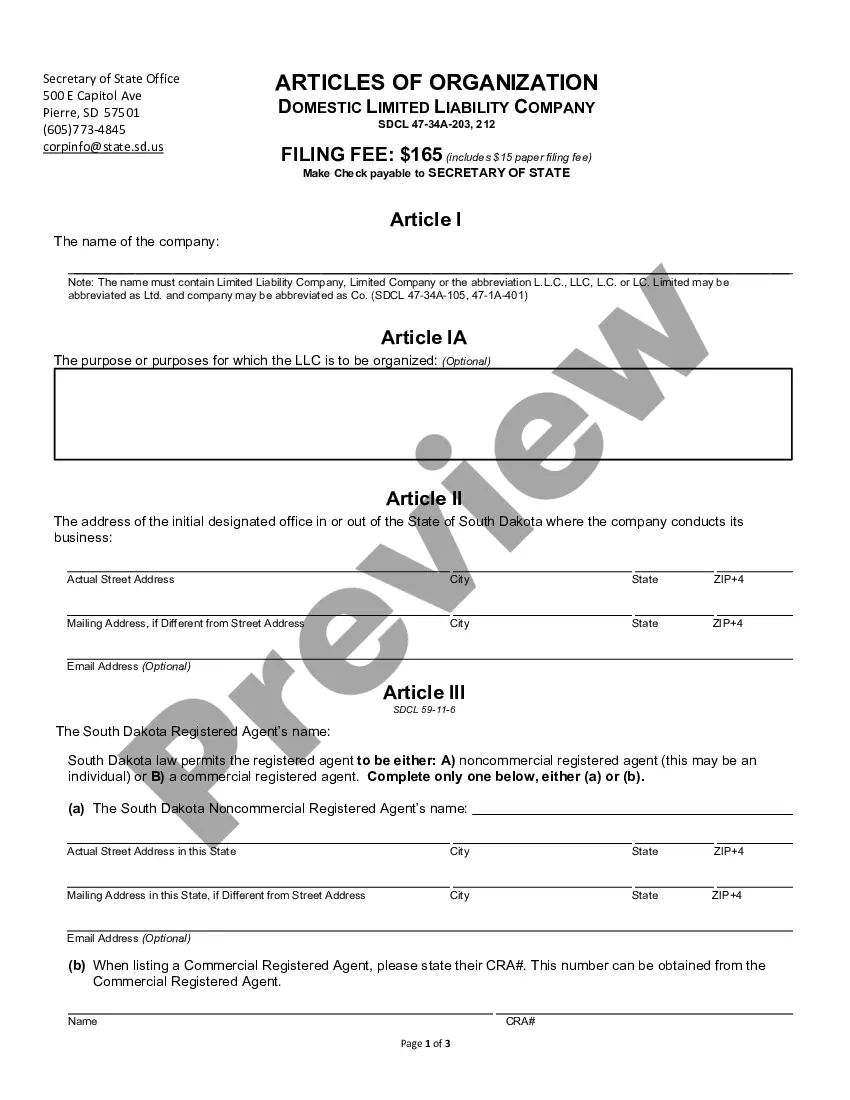

The Sioux Falls South Dakota Single Member Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the structure, rules, and regulations for a single member LLC in Sioux Falls, South Dakota. It serves as a crucial contract between the owner of the LLC, known as the "member," and the company itself. This agreement is formulated to establish the rights, responsibilities, and obligations of the single member within the LLC. It covers various aspects of the business, including management, decision-making, profit distribution, and dissolution procedures. The agreement ensures clarity, mitigates potential conflicts, and safeguards the interests of all parties involved. Key elements covered in the Sioux Falls South Dakota Single Member LLC Operating Agreement include: 1. Formation: This section outlines the process of forming the single-member LLC, including details like the name of the company, business purpose, registered agent, and duration, if applicable. 2. Member Contributions: It specifies the capital, assets, or property contributed by the single member to start or operate the LLC. This can include cash, equipment, intellectual property, or any other resources necessary for the business. 3. Management and Decision-Making: This section defines how the LLC will be managed and who will have authority over its operations. It may state that the single member has full control or appoint a manager to handle day-to-day affairs. Additionally, it outlines voting rights, decision-making procedures, and the level of involvement of the member in the company's activities. 4. Allocation of Profits and Losses: The agreement establishes how the profits and losses will be divided among the single member and the LLC. This can be based on capital contributions, ownership percentages, or any other agreed-upon method. 5. Distribution of Assets: In the event of dissolution, bankruptcy, or sale of the LLC, this section outlines how the assets and liabilities will be distributed. It provides guidelines for distributing the remaining funds to the single member or any other designated recipients. While the Sioux Falls South Dakota Single Member LLC Operating Agreement serves as a template for single-member LCS, variations can exist depending on specific circumstances or business needs. Some different types of Sioux Falls South Dakota Single Member LLC Operating Agreements include: 1. Member-Managed vs. Manager-Managed Operating Agreement: This type of distinction determines whether the single member will handle day-to-day operations personally (member-managed) or appoint a manager to oversee the LLC's activities (manager-managed). 2. Member Contributions Agreement: In addition to the general operating agreement, this agreement details specific member contributions, such as capital investments, intellectual property licensing, or real estate transfer. 3. Voting and Decision-Making Agreement: To add clarity to decision-making processes, this agreement may provide specific guidelines on voting rights, quorum requirements, and dispute resolution mechanisms. 4. Tax Allocations Agreement: If the single member desires a particular method of tax allocation, a separate agreement can be drafted to address this aspect, ensuring compliance with federal and state tax regulations. Overall, the Sioux Falls South Dakota Single Member LLC Operating Agreement serves as a vital document for any single-member LLC in Sioux Falls, South Dakota, offering a structured framework for their daily operations, contractual obligations, and potential disputes. It is recommended that aspiring entrepreneurs and business owners consult with legal professionals to draft a customized operating agreement suitable for their specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sioux Falls South Dakota Acuerdo Operativo LLC de Sociedad de Responsabilidad Limitada de Miembro Único - South Dakota Single Member Limited Liability Company LLC Operating Agreement

Description

How to fill out Sioux Falls South Dakota Acuerdo Operativo LLC De Sociedad De Responsabilidad Limitada De Miembro Único?

If you are looking for a relevant form, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a huge number of form samples for business and personal purposes by categories and states, or keywords. With our advanced search option, getting the latest Sioux Falls South Dakota Single Member Limited Liability Company LLC Operating Agreement is as elementary as 1-2-3. Moreover, the relevance of each and every record is confirmed by a group of professional lawyers that regularly review the templates on our platform and update them in accordance with the newest state and county laws.

If you already know about our platform and have an account, all you should do to get the Sioux Falls South Dakota Single Member Limited Liability Company LLC Operating Agreement is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

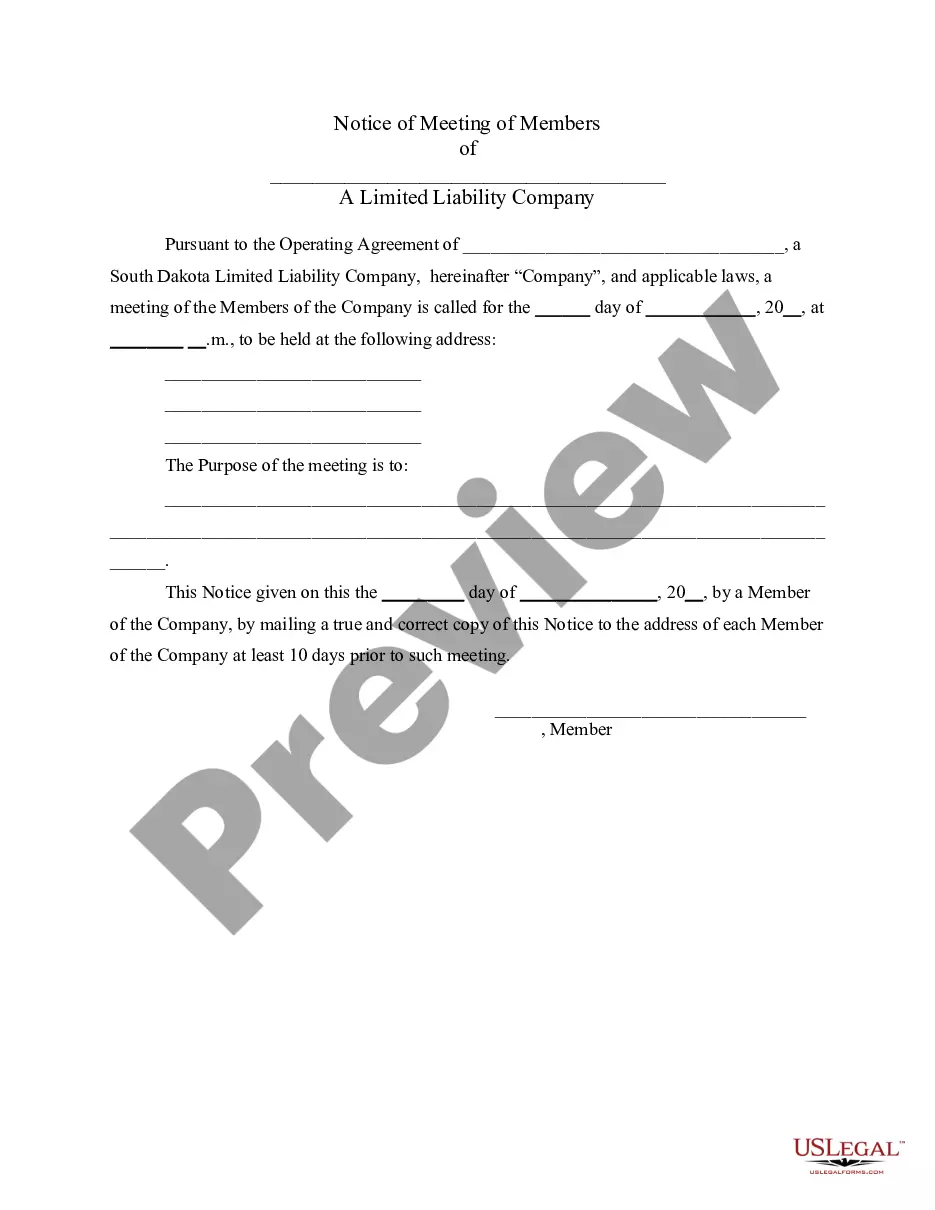

- Make sure you have chosen the sample you require. Read its description and use the Preview feature to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the proper record.

- Confirm your choice. Choose the Buy now button. Following that, pick your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the format and save it on your device.

- Make modifications. Fill out, revise, print, and sign the obtained Sioux Falls South Dakota Single Member Limited Liability Company LLC Operating Agreement.

Each form you add to your account has no expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to receive an additional duplicate for enhancing or creating a hard copy, you can come back and save it once again anytime.

Make use of the US Legal Forms professional library to gain access to the Sioux Falls South Dakota Single Member Limited Liability Company LLC Operating Agreement you were looking for and a huge number of other professional and state-specific templates on a single website!