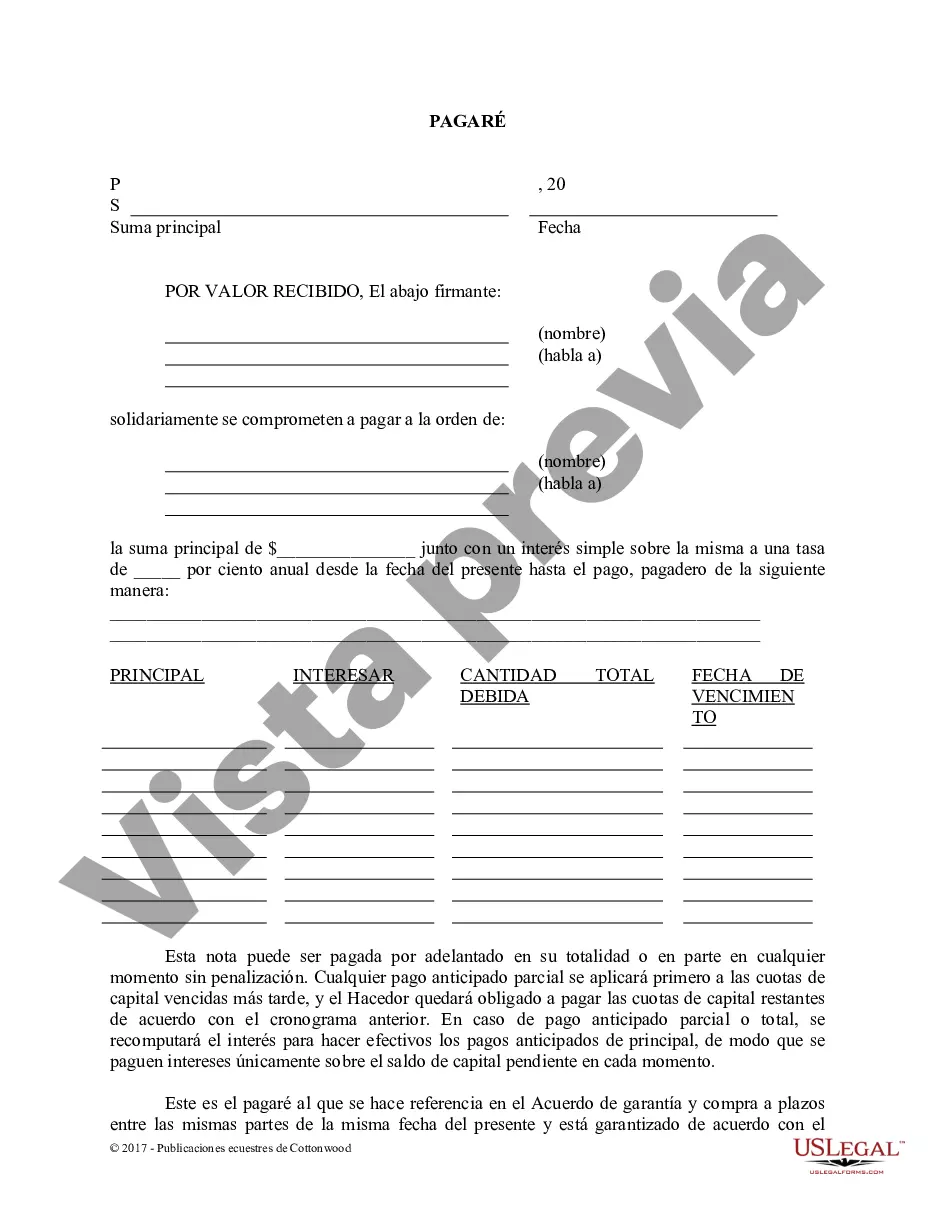

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Sioux Falls South Dakota Promissory Note — Horse Equine Forms are legally binding documents used in the horse industry to outline the terms and conditions of a loan between a lender and a borrower. These forms ensure that all parties involved are aware of their rights and responsibilities in the transaction. The Sioux Falls South Dakota Promissory Note — Horse Equine Forms serve as a written agreement that establishes the loan amount, interest rate, repayment schedule, and any additional terms agreed upon by the parties. This document provides protection to both the lender and the borrower, as it clearly outlines the expectations and obligations of each party. There are several types of Sioux Falls South Dakota Promissory Note — Horse Equine Forms available, catering to specific situations and preferences. Let's explore a few common variations: 1. Simple Promissory Note: This form outlines the basic terms of the loan, including the loan amount, interest rate, repayment schedule, and any applicable penalties for late payments. 2. Secured Promissory Note: This form includes additional provisions specifying collateral offered by the borrower to secure the loan. In case of default, the lender can legally seize and sell the designated asset to recover their investment. 3. Installment Promissory Note: This form breaks down the loan repayment into periodic installments, allowing the borrower to pay back the loan over a predetermined time frame. It includes details such as installment amount, due dates, and any interest accrued. 4. Revolving Promissory Note: This form establishes a revolving line of credit, enabling the borrower to borrow and repay funds multiple times within a set limit. It outlines the conditions for borrowing, repayment terms, and any fees associated with the revolving credit facility. 5. Demand Promissory Note: This type of promissory note allows the lender to demand repayment of the loan at any time. It provides flexibility for the lender but may require immediate repayment from the borrower upon demand. Sioux Falls South Dakota Promissory Note — Horse Equine Forms are essential for individuals and businesses engaged in the horse industry, whether for purchasing or selling horses, financing equipment or facilities, or any other horse-related transaction. These forms ensure that both parties have a clear understanding of their financial obligations and help prevent disputes or misunderstandings in the future.Sioux Falls South Dakota Promissory Note — Horse Equine Forms are legally binding documents used in the horse industry to outline the terms and conditions of a loan between a lender and a borrower. These forms ensure that all parties involved are aware of their rights and responsibilities in the transaction. The Sioux Falls South Dakota Promissory Note — Horse Equine Forms serve as a written agreement that establishes the loan amount, interest rate, repayment schedule, and any additional terms agreed upon by the parties. This document provides protection to both the lender and the borrower, as it clearly outlines the expectations and obligations of each party. There are several types of Sioux Falls South Dakota Promissory Note — Horse Equine Forms available, catering to specific situations and preferences. Let's explore a few common variations: 1. Simple Promissory Note: This form outlines the basic terms of the loan, including the loan amount, interest rate, repayment schedule, and any applicable penalties for late payments. 2. Secured Promissory Note: This form includes additional provisions specifying collateral offered by the borrower to secure the loan. In case of default, the lender can legally seize and sell the designated asset to recover their investment. 3. Installment Promissory Note: This form breaks down the loan repayment into periodic installments, allowing the borrower to pay back the loan over a predetermined time frame. It includes details such as installment amount, due dates, and any interest accrued. 4. Revolving Promissory Note: This form establishes a revolving line of credit, enabling the borrower to borrow and repay funds multiple times within a set limit. It outlines the conditions for borrowing, repayment terms, and any fees associated with the revolving credit facility. 5. Demand Promissory Note: This type of promissory note allows the lender to demand repayment of the loan at any time. It provides flexibility for the lender but may require immediate repayment from the borrower upon demand. Sioux Falls South Dakota Promissory Note — Horse Equine Forms are essential for individuals and businesses engaged in the horse industry, whether for purchasing or selling horses, financing equipment or facilities, or any other horse-related transaction. These forms ensure that both parties have a clear understanding of their financial obligations and help prevent disputes or misunderstandings in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.