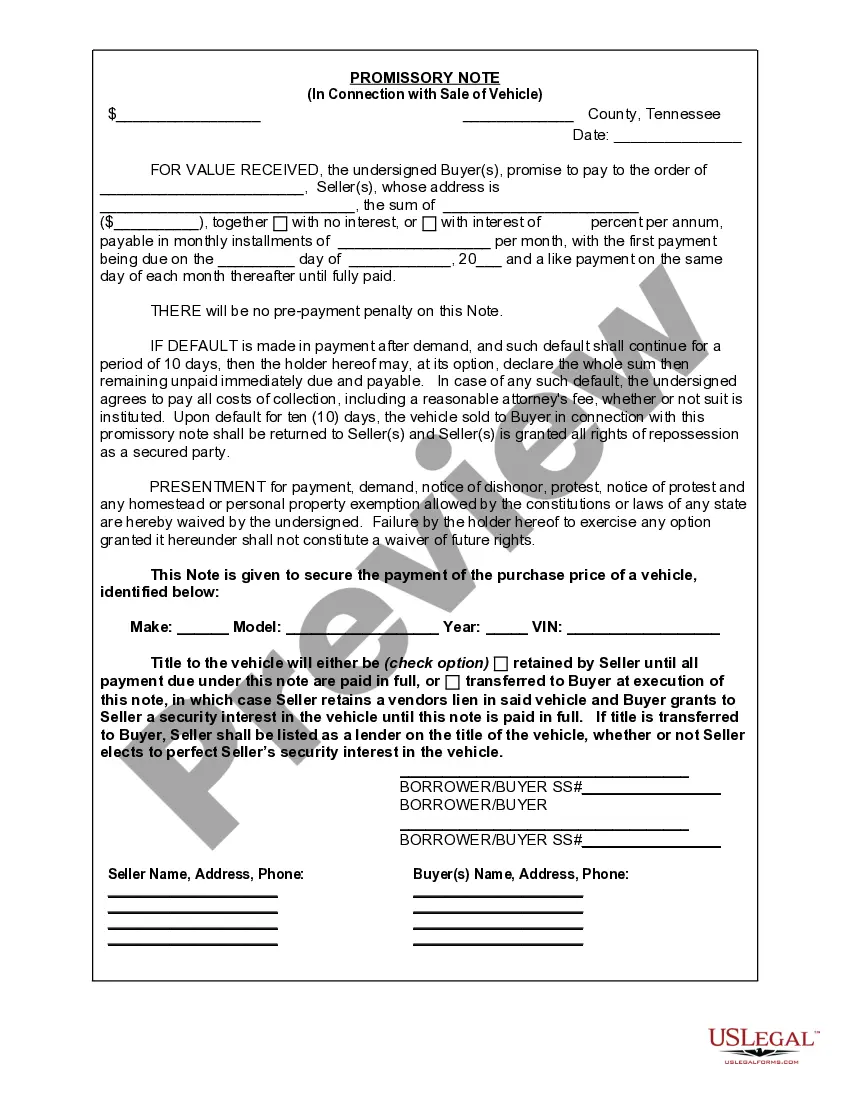

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Tennessee Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Regardless of social or occupational rank, completing legal paperwork is an unfortunate requirement in the modern world.

Often, it is nearly impossible for someone lacking any legal training to create this type of documents from the ground up, mainly due to the complex language and legal subtleties they involve.

This is where US Legal Forms comes into play.

Verify that the template you have selected is tailored to your location, as the laws of one state or county are not applicable to another.

Review the document and check a brief description (if present) of the scenarios the form can serve. If the one you selected does not fulfill your needs, you can restart and search for the required form.

- Our platform offers an extensive collection of over 85,000 ready-to-use documents that are specific to your state, accommodating nearly any legal scenario.

- US Legal Forms is also an excellent tool for associates or legal advisors seeking to enhance their efficiency with our DIY papers.

- Regardless of whether you require the Clarksville Tennessee Promissory Note concerning Vehicle or Automobile Sale or any other document that will be legally recognized in your area, US Legal Forms puts everything within reach.

- Here’s how you can obtain the Clarksville Tennessee Promissory Note concerning Vehicle or Automobile Sale in just a few minutes using our reliable platform.

- If you are already a member, you may simply Log In to your account to acquire the necessary form.

- If you are unfamiliar with our library, be sure to take the following steps before obtaining the Clarksville Tennessee Promissory Note regarding Vehicle or Automobile Sale.

Form popularity

FAQ

To get a promissory note for a car, you can create one using a template or consult a legal service. Platforms like uslegalforms provide customizable templates to ensure you include all critical details. This makes obtaining a valid Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile straightforward and accessible.

A promissory note for the sale of a motor vehicle is a legal document outlining the borrower's promise to repay a specified amount to the seller over a defined period. It includes details like payment terms, interest rates, and vehicle information. This type of note serves as a vital tool in securing financing and ensuring clarity in transactions involving a Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile.

Yes, promissory notes can hold up in court, provided they are properly executed and contain all necessary terms. Courts often enforce clear agreements that outline the obligations of both parties. By ensuring your Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile is well-drafted, you significantly improve its enforceability.

In Tennessee, a promissory note does not typically require notarization to be legally binding; however, it can add an extra layer of authenticity. Notarizing the document can help prevent disputes about the signatures or terms. Therefore, while it is not mandatory, considering notarization for your Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile could enhance its validity.

You can obtain your promissory note by either creating one yourself or using a reliable template from a legal document provider. Ensure the note includes all necessary details to protect both parties. Platforms like uslegalforms offer user-friendly options to create a valid Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile quickly and efficiently.

To fill out a promissory note, start by clearly stating the name of the borrower and lender, along with their contact information. Next, include the amount being borrowed, the interest rate, and the repayment schedule. It’s also important to specify any terms or conditions regarding default or late payments. For a Clarksville Tennessee promissory note in connection with the sale of a vehicle or automobile, ensure all details are accurate to protect both parties.

In general, an assignment of promissory notes does not need to be notarized to be valid. However, notarization can provide an extra layer of security and can be required by certain lenders or institutions. It is wise to check local laws to ensure compliance. For your needs related to a Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile, consider consulting US Legal Forms for guidance and templates that include all necessary legal requirements.

Yes, a handwritten promissory note can be legal in many states, including Tennessee. However, it is essential to ensure that all necessary information is included, such as the names of the parties and the payment terms. A well-drafted handwritten note can still provide legal protection, but using a formal template can provide a clearer structure. US Legal Forms offers templates specifically for a Clarksville Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile, making the process easier.