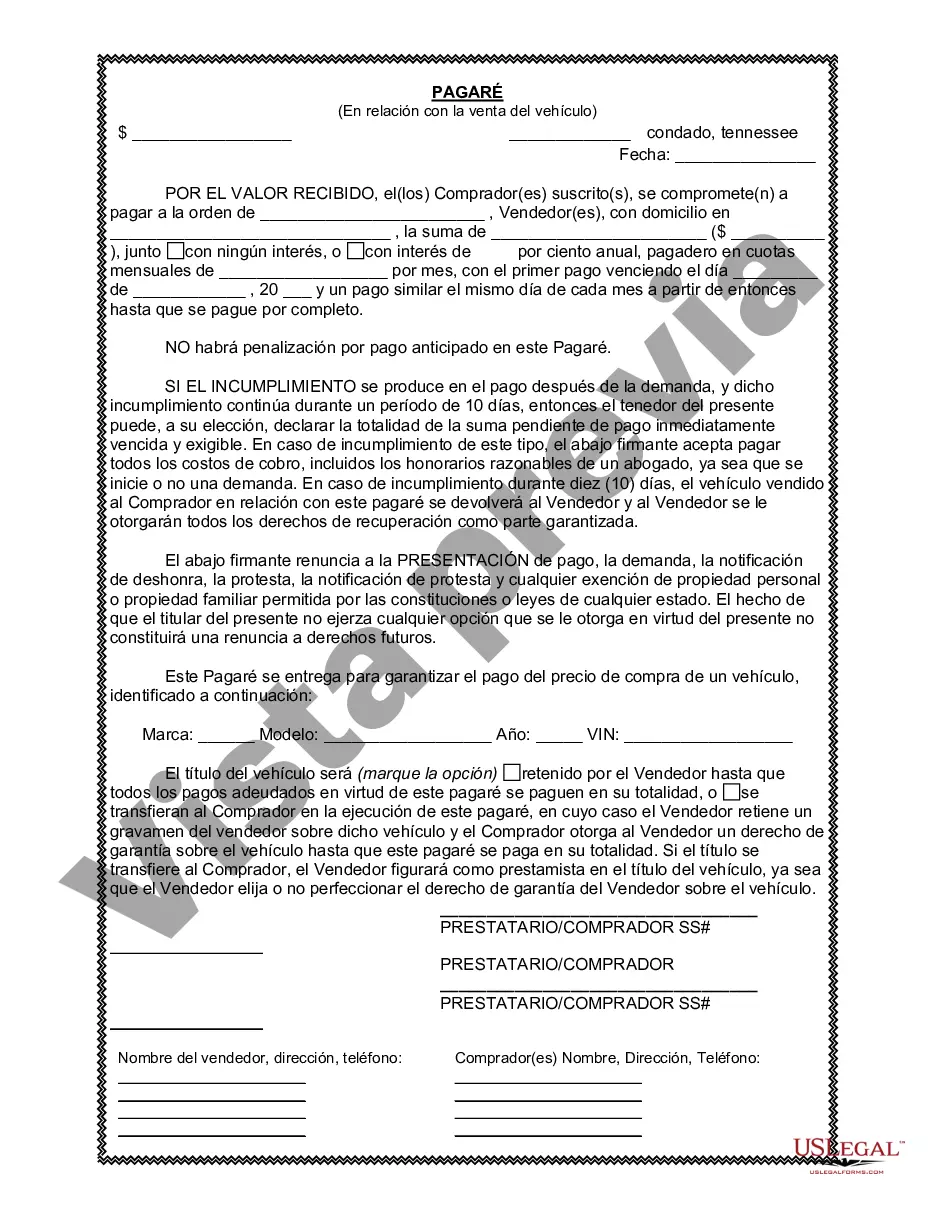

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

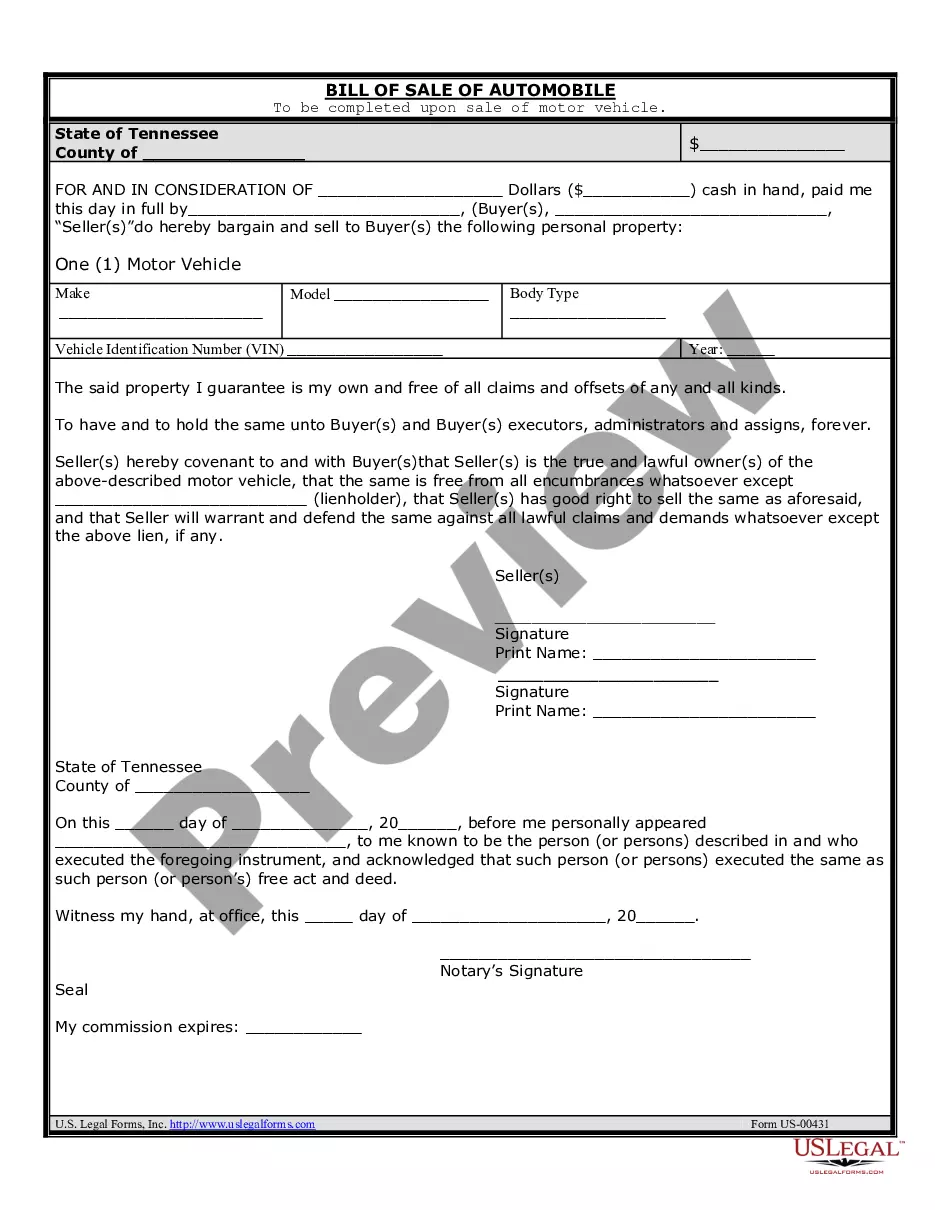

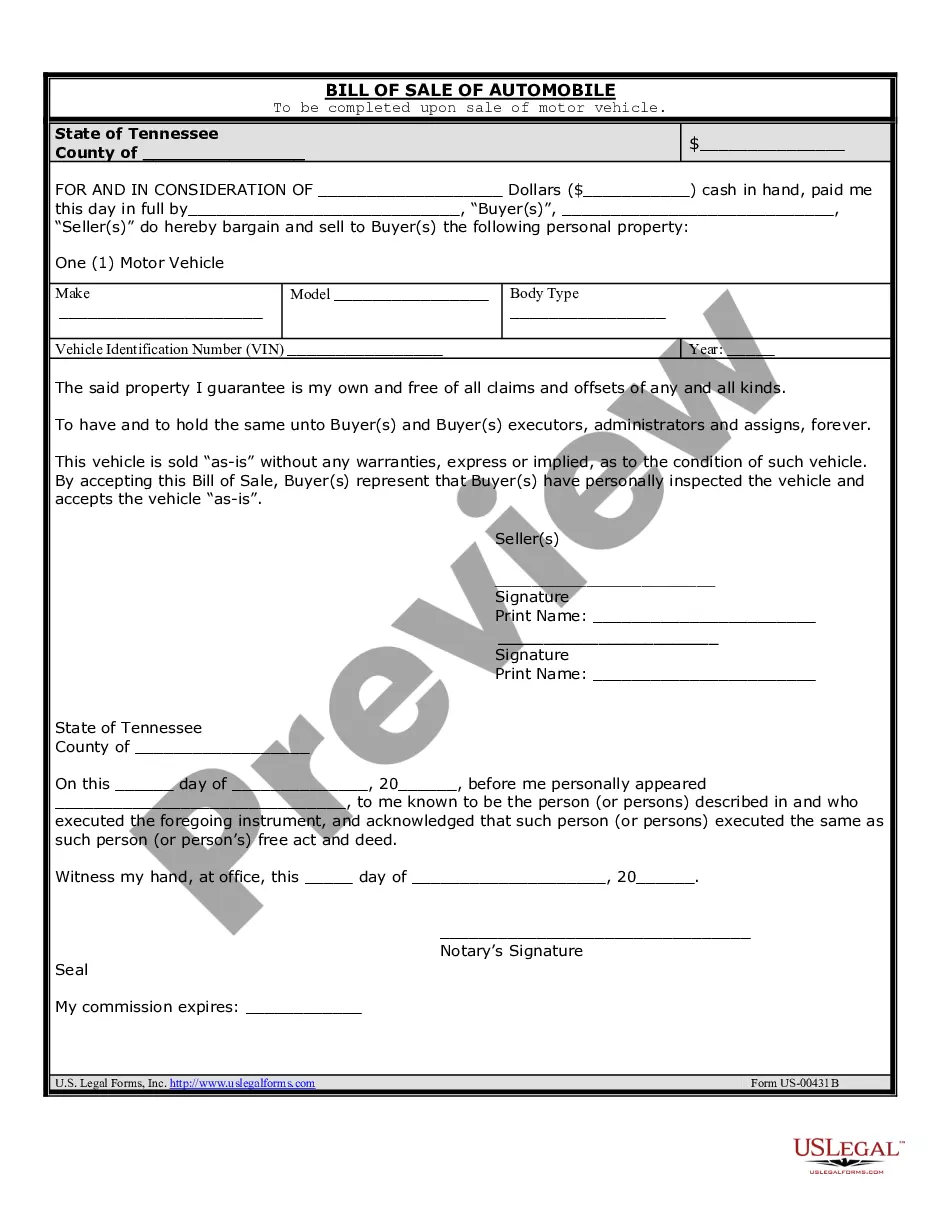

A Memphis Tennessee Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms of a loan agreement between the buyer and seller. This promissory note is specific to the state of Tennessee and is used when financing a vehicle purchase. The promissory note serves as evidence of the loan and includes essential details such as the names and contact information of both parties involved, the vehicle's make, model, and VIN number, the agreed purchase price, and the terms of repayment. It also includes provisions regarding interest rates, late payment penalties, and any additional fees or charges associated with the loan. The purpose of this promissory note is to document the arrangement between the buyer and seller in a sale where the buyer agrees to pay the purchase price in installments instead of paying the full amount upfront. By signing this note, both parties acknowledge their rights and responsibilities, ensuring the smooth execution of the transaction. Different types of Memphis Tennessee Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Simple Promissory Note: This type of note outlines the basic terms of the loan, such as the amount borrowed, the repayment schedule, and any applicable interest rates. It is often used for straightforward transactions without extensive additional terms or conditions. 2. Secured Promissory Note: Here, the seller has the right to repossess the vehicle if the buyer fails to make the agreed-upon payments. This type of note provides an extra layer of protection for the seller by allowing them to reclaim the vehicle in case of default. 3. Balloon Promissory Note: In this note, the buyer agrees to make small monthly payments with a large final payment (a balloon payment) at the end of the loan term. This arrangement is suitable for buyers who expect a lump sum payment, such as a tax refund or bonus, at the end of the loan period. 4. Acceleration Promissory Note: This type of note allows the seller to demand immediate payment of the remaining balance if the buyer defaults on any of the scheduled payments. It gives the seller the right to accelerate the loan's due date and take appropriate legal action to recover the outstanding debt. These various types of promissory notes provide flexibility and customization options for buyers and sellers within the Memphis, Tennessee area. It is crucial for all parties involved to carefully review and understand the terms of the promissory note before signing, seeking legal advice if necessary, to ensure a fair and legally binding agreement in the vehicle sale transaction.A Memphis Tennessee Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms of a loan agreement between the buyer and seller. This promissory note is specific to the state of Tennessee and is used when financing a vehicle purchase. The promissory note serves as evidence of the loan and includes essential details such as the names and contact information of both parties involved, the vehicle's make, model, and VIN number, the agreed purchase price, and the terms of repayment. It also includes provisions regarding interest rates, late payment penalties, and any additional fees or charges associated with the loan. The purpose of this promissory note is to document the arrangement between the buyer and seller in a sale where the buyer agrees to pay the purchase price in installments instead of paying the full amount upfront. By signing this note, both parties acknowledge their rights and responsibilities, ensuring the smooth execution of the transaction. Different types of Memphis Tennessee Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Simple Promissory Note: This type of note outlines the basic terms of the loan, such as the amount borrowed, the repayment schedule, and any applicable interest rates. It is often used for straightforward transactions without extensive additional terms or conditions. 2. Secured Promissory Note: Here, the seller has the right to repossess the vehicle if the buyer fails to make the agreed-upon payments. This type of note provides an extra layer of protection for the seller by allowing them to reclaim the vehicle in case of default. 3. Balloon Promissory Note: In this note, the buyer agrees to make small monthly payments with a large final payment (a balloon payment) at the end of the loan term. This arrangement is suitable for buyers who expect a lump sum payment, such as a tax refund or bonus, at the end of the loan period. 4. Acceleration Promissory Note: This type of note allows the seller to demand immediate payment of the remaining balance if the buyer defaults on any of the scheduled payments. It gives the seller the right to accelerate the loan's due date and take appropriate legal action to recover the outstanding debt. These various types of promissory notes provide flexibility and customization options for buyers and sellers within the Memphis, Tennessee area. It is crucial for all parties involved to carefully review and understand the terms of the promissory note before signing, seeking legal advice if necessary, to ensure a fair and legally binding agreement in the vehicle sale transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.