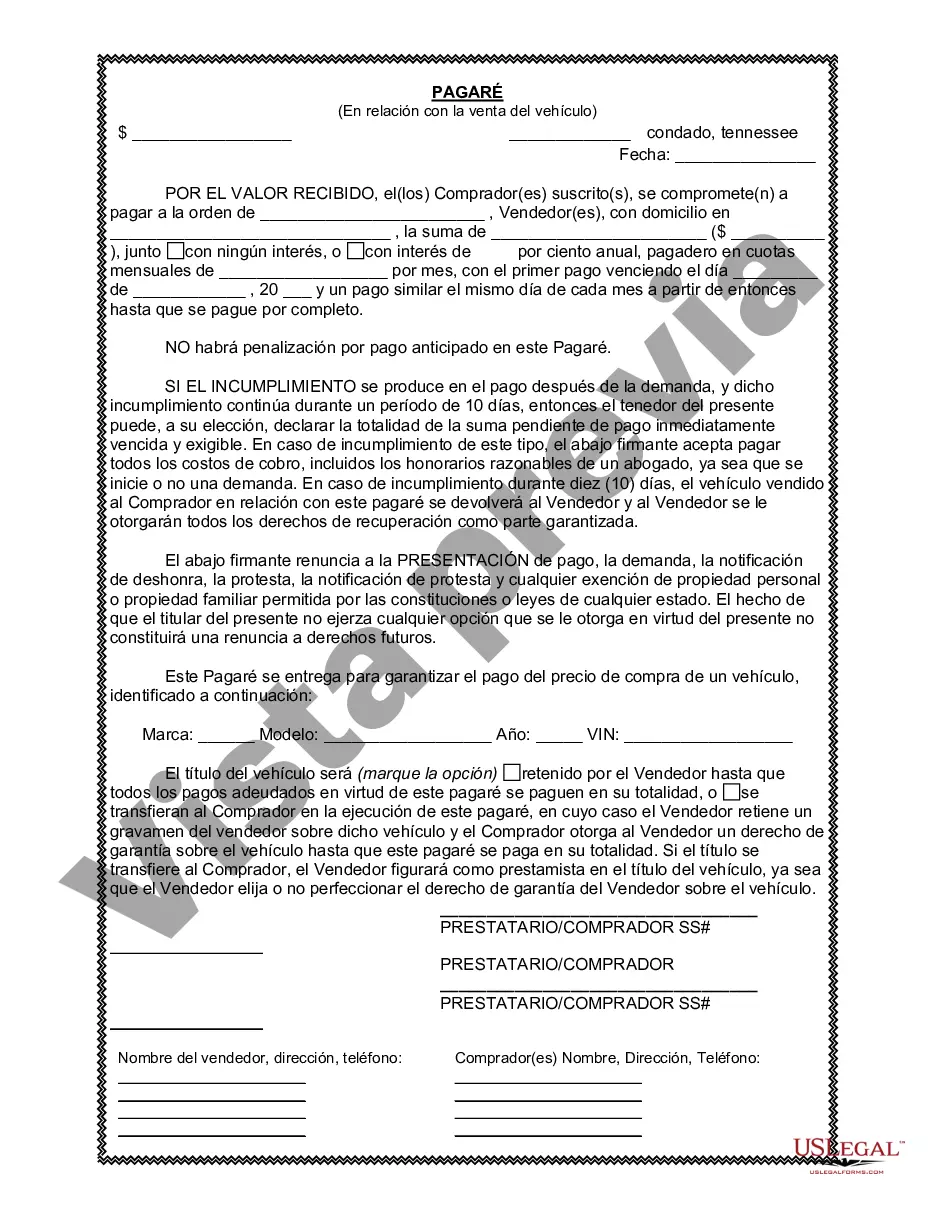

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Murfreesboro Tennessee promissory note in connection with the sale of a vehicle or automobile is a legally binding agreement between a buyer and a seller, outlining the terms and conditions of the sale and financing arrangement. This document serves as evidence of the loan made by the seller to the buyer, granting the buyer possession of the vehicle while requiring them to make regular payments until the debt is fully repaid. Keywords: Murfreesboro Tennessee, promissory note, sale of vehicle, sale of automobile, financing arrangement, legally binding agreement, terms and conditions, loan, possession, regular payments, fully repaid. Types of Murfreesboro Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Simple Promissory Note: This is a basic promissory note that outlines the amount borrowed, repayment terms, interest rate (if applicable), and consequences of default. It is suitable for straightforward vehicle sales without complex financing arrangements. 2. Installment Agreement Promissory Note: This type of promissory note specifies the loan amount, repayment terms, interest rate (if applicable), and an agreed-upon schedule of installment payments. It is commonly used when the purchase price of the vehicle is paid off in several smaller payments over an agreed period. 3. Balloon Payment Promissory Note: In cases where the buyer cannot afford large monthly payments, a balloon payment promissory note may be used. This note requires the buyer to make smaller monthly installments with a substantial "balloon" payment due at the end of the loan term. 4. Secured Promissory Note: A secured promissory note includes terms that grant the seller a security interest in the vehicle being sold. This enables the seller to repossess the vehicle if the buyer defaults on the loan repayment, providing some protection for the seller. 5. Chattel Mortgage Promissory Note: A chattel mortgage promissory note is used when the buyer finances the purchase of a vehicle using the vehicle itself as collateral. This note includes provisions that give the seller the right to repossess and sell the vehicle if the buyer fails to fulfill the repayment obligations. It is essential to consult legal professionals or financial advisors when drafting or signing any promissory note to ensure compliance with Murfreesboro Tennessee laws and to protect the interests of both the buyer and the seller involved in the sale of a vehicle or automobile.A Murfreesboro Tennessee promissory note in connection with the sale of a vehicle or automobile is a legally binding agreement between a buyer and a seller, outlining the terms and conditions of the sale and financing arrangement. This document serves as evidence of the loan made by the seller to the buyer, granting the buyer possession of the vehicle while requiring them to make regular payments until the debt is fully repaid. Keywords: Murfreesboro Tennessee, promissory note, sale of vehicle, sale of automobile, financing arrangement, legally binding agreement, terms and conditions, loan, possession, regular payments, fully repaid. Types of Murfreesboro Tennessee Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Simple Promissory Note: This is a basic promissory note that outlines the amount borrowed, repayment terms, interest rate (if applicable), and consequences of default. It is suitable for straightforward vehicle sales without complex financing arrangements. 2. Installment Agreement Promissory Note: This type of promissory note specifies the loan amount, repayment terms, interest rate (if applicable), and an agreed-upon schedule of installment payments. It is commonly used when the purchase price of the vehicle is paid off in several smaller payments over an agreed period. 3. Balloon Payment Promissory Note: In cases where the buyer cannot afford large monthly payments, a balloon payment promissory note may be used. This note requires the buyer to make smaller monthly installments with a substantial "balloon" payment due at the end of the loan term. 4. Secured Promissory Note: A secured promissory note includes terms that grant the seller a security interest in the vehicle being sold. This enables the seller to repossess the vehicle if the buyer defaults on the loan repayment, providing some protection for the seller. 5. Chattel Mortgage Promissory Note: A chattel mortgage promissory note is used when the buyer finances the purchase of a vehicle using the vehicle itself as collateral. This note includes provisions that give the seller the right to repossess and sell the vehicle if the buyer fails to fulfill the repayment obligations. It is essential to consult legal professionals or financial advisors when drafting or signing any promissory note to ensure compliance with Murfreesboro Tennessee laws and to protect the interests of both the buyer and the seller involved in the sale of a vehicle or automobile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.