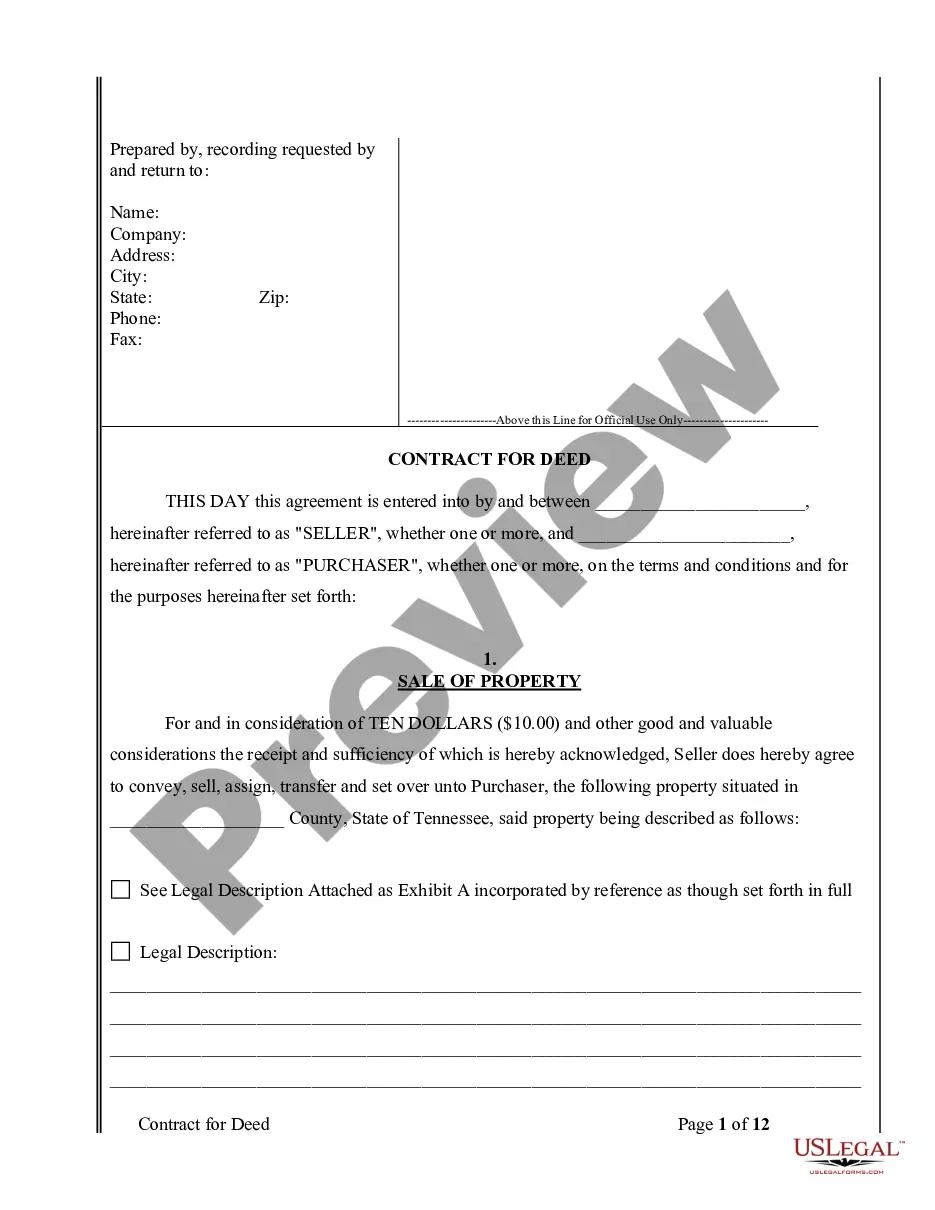

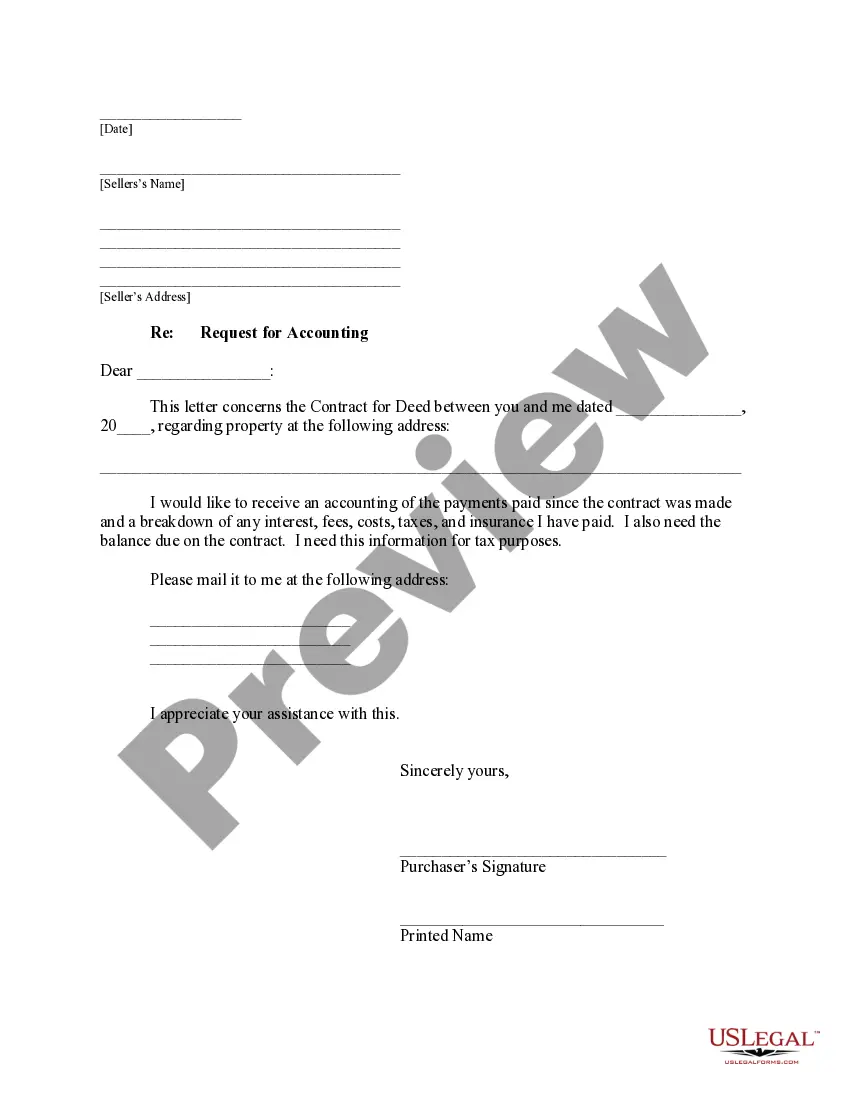

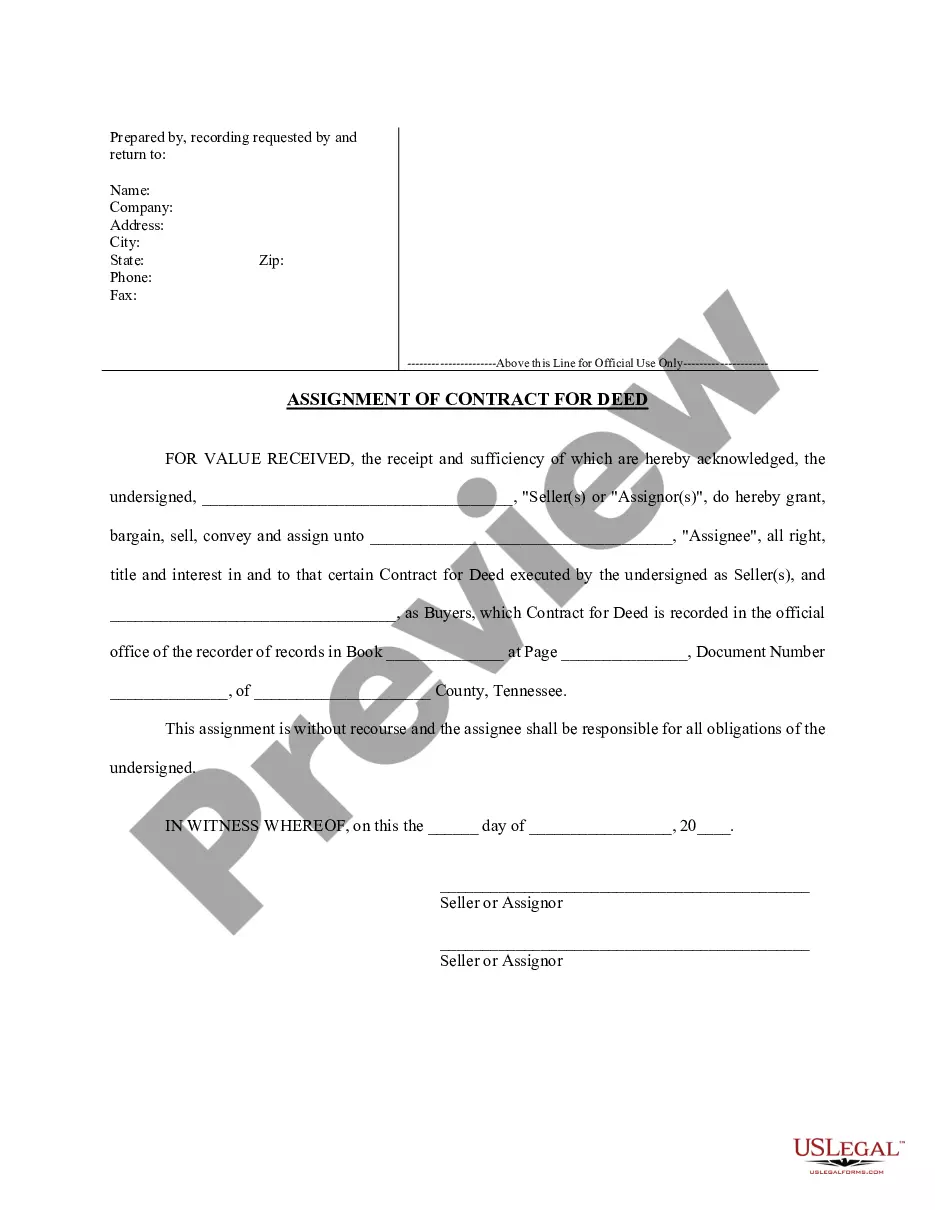

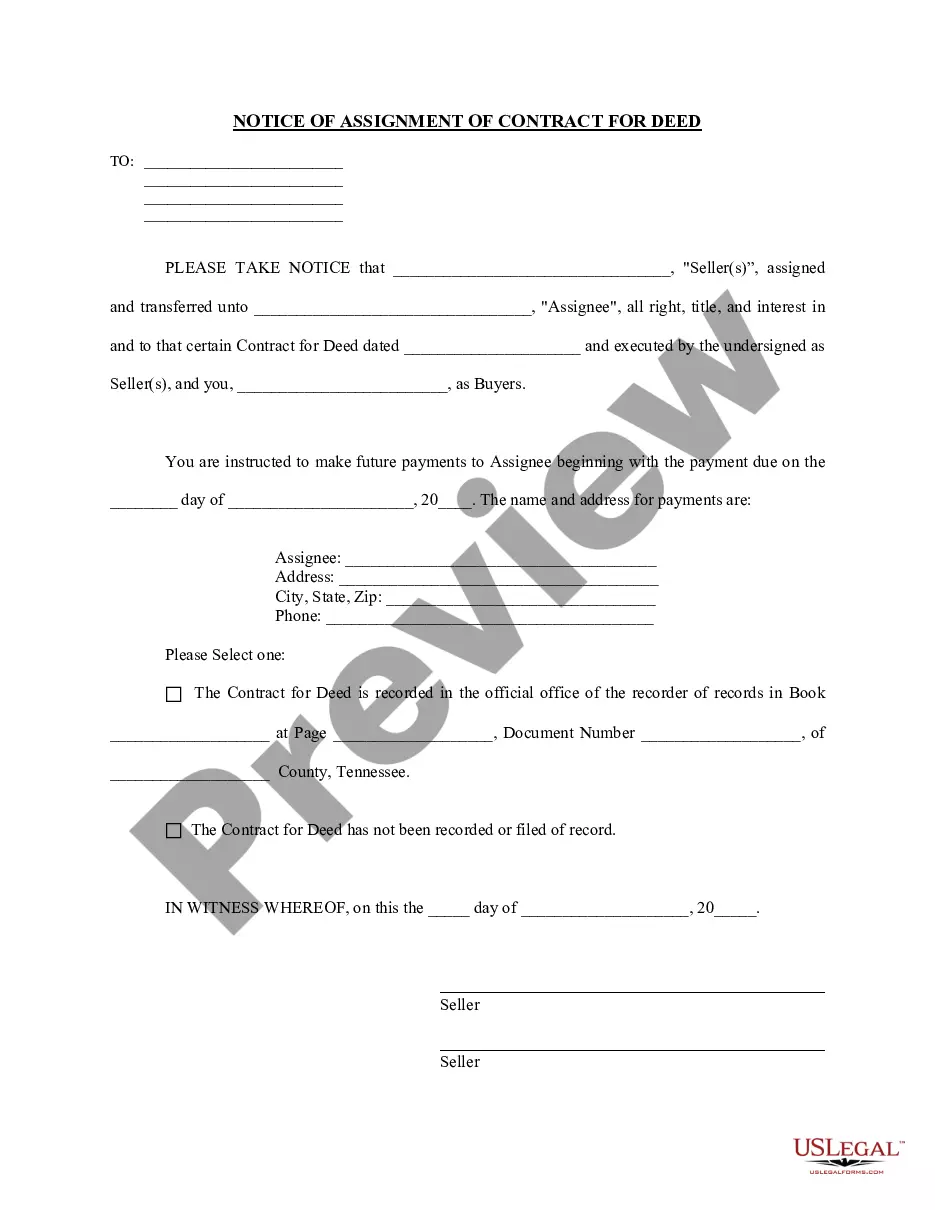

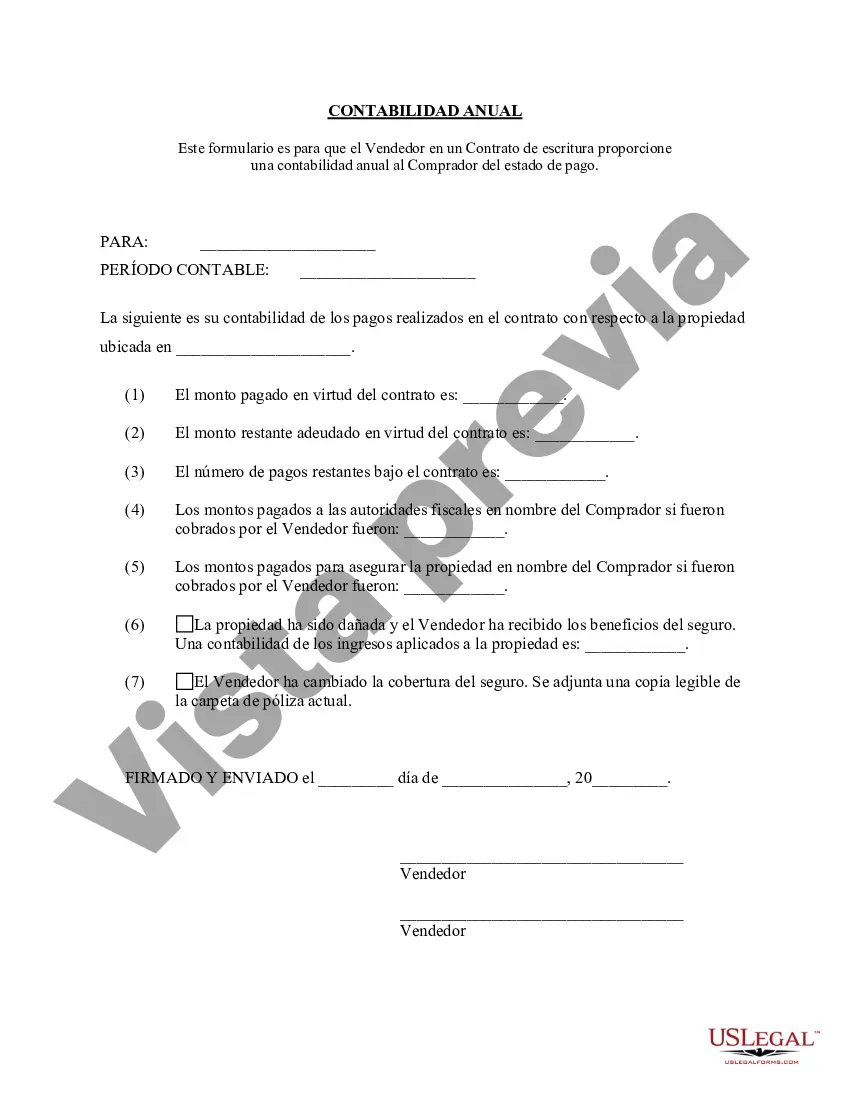

The Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement is a document that outlines the financial information and transactions between the seller and the buyer in a contract for deed agreement in Murfreesboro, Tennessee. This statement serves as a detailed report of income, expenses, and other financial aspects that pertain to the contract for deed arrangement. The purpose of the Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement is to ensure transparency between the seller and the buyer, providing a clear overview of the financial status of the contract. It plays a crucial role in maintaining trust and building a strong working relationship between both parties involved. Keywords: Murfreesboro Tennessee, contract for deed, seller's annual accounting statement, financial information, transactions, income, expenses, financial aspects, transparency, overview, trust, working relationship. Different types of the Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement may include: 1. Income Statement: This type of statement presents the seller's annual income derived from the contract for deed agreement. It includes details of payments received from the buyer, such as principal, interest, and other relevant income sources. 2. Expense Statement: This statement outlines the seller's annual expenses related to the contract for deed. It covers costs such as insurance, property taxes, maintenance, repairs, and any other expenses directly associated with the property subject to the contract for deed. 3. Balance Sheet: The balance sheet provides a snapshot of the seller's financial position at the end of the accounting period. It includes assets (e.g., the property under the contract for deed) and liabilities (e.g., outstanding mortgage or other debts), giving a comprehensive overview of the seller's net worth. 4. Cash Flow Statement: This statement tracks the cash inflows and outflows related to the contract for deed transactions. It evaluates the seller's ability to generate cash and manage it effectively, ensuring a sound financial position. 5. Profit and Loss Statement: Also known as an income statement, this statement records the seller's revenues, costs, and expenses over a specific period. It provides an in-depth analysis of the financial performance of the contract for deed, depicting the net profit or loss generated. It is essential for both the seller and the buyer to thoroughly review and understand the Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement to ensure accurate financial records and a smooth continuation of the contract for deed agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Murfreesboro Tennessee Contrato de Escrituración Estado Contable Anual del Vendedor - Tennessee Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Murfreesboro Tennessee Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are looking for a relevant form template, it’s extremely hard to find a better platform than the US Legal Forms website – probably the most comprehensive online libraries. Here you can find a huge number of form samples for business and individual purposes by types and regions, or keywords. With the high-quality search feature, discovering the most recent Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement is as elementary as 1-2-3. Moreover, the relevance of every document is confirmed by a group of professional lawyers that regularly check the templates on our platform and update them according to the most recent state and county requirements.

If you already know about our platform and have an account, all you need to get the Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have found the sample you require. Check its information and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate record.

- Affirm your selection. Choose the Buy now option. Next, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and download it to your system.

- Make adjustments. Fill out, modify, print, and sign the received Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement.

Each template you save in your profile does not have an expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an additional version for editing or creating a hard copy, you can return and save it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Murfreesboro Tennessee Contract for Deed Seller's Annual Accounting Statement you were looking for and a huge number of other professional and state-specific samples on a single website!