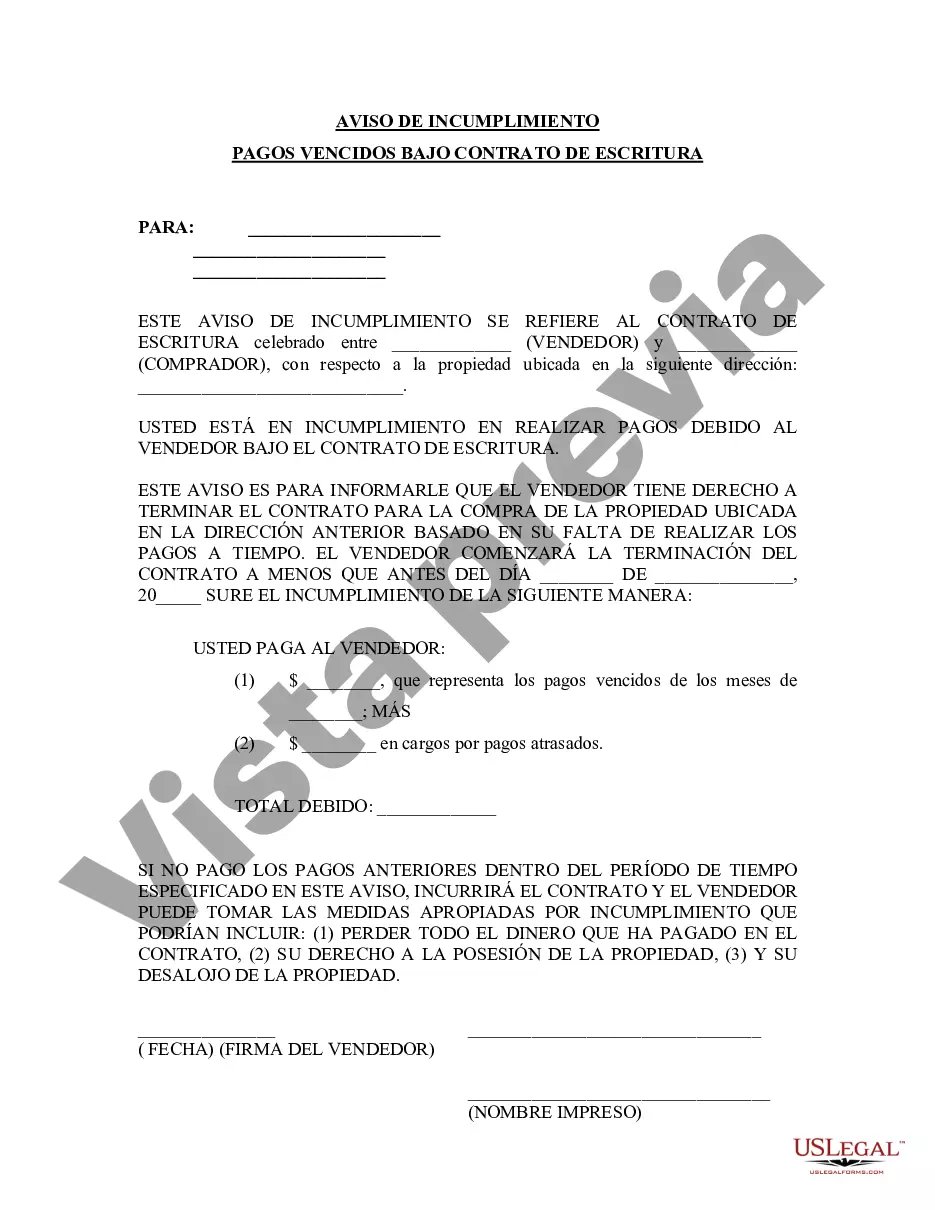

A Murfreesboro Tennessee Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document issued to a party who has failed to make timely payments on a Contract for Deed agreement in Murfreesboro, Tennessee. This notice serves as a formal warning of the default and outlines the consequences that may follow if the past due payments are not rectified. Keywords: Murfreesboro Tennessee, Notice of Default, Past Due Payments, Contract for Deed There are three types of Murfreesboro Tennessee Notices of Default for Past Due Payments in connection with Contract for Deed, namely: 1. Murfreesboro Tennessee Notice of Default — Preliminary: This notice is issued in the initial stages when the borrower has missed a payment or multiple payments on their Contract for Deed agreement. It serves as a warning that the borrower is in default and outlines the amount owed, the due date, and the grace period (if any) to rectify the payment default. 2. Murfreesboro Tennessee Notice of Default — Intent to Foreclose: This notice is sent after the borrower has failed to make the required payments even after the preliminary notice. It states the intention of the lender to foreclose on the property if the past due payments are not made within a specified timeframe. The notice outlines the consequences of foreclosure and the borrower's options to avoid foreclosure, such as paying the past due amount or coming to a repayment agreement with the lender. 3. Murfreesboro Tennessee Notice of Default — Final Notice: This notice is issued when the borrower fails to cure the default or reach a repayment agreement with the lender within the timeframe specified in the intent to foreclose notice. It declares the final notice of default and informs the borrower that the property will be foreclosed upon, giving a final opportunity to resolve the default and prevent foreclosure. It is important for borrowers in Murfreesboro, Tennessee who receive a Notice of Default for Past Due Payments in connection with Contract for Deed to take immediate action to address the delinquency. Contacting the lender, negotiating repayment plans, or seeking legal advice can help navigate through the process and potentially avoid foreclosure proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Murfreesboro Tennessee Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Tennessee Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Murfreesboro Tennessee Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

Are you looking for a reliable and inexpensive legal forms provider to get the Murfreesboro Tennessee Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Murfreesboro Tennessee Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search if the form isn’t good for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Murfreesboro Tennessee Notice of Default for Past Due Payments in connection with Contract for Deed in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online once and for all.