Murfreesboro Tennessee Prenuptial Premarital Agreement without Financial Statements: A Comprehensive Guide Introduction: A prenuptial premarital agreement is a legal document that outlines the rights and responsibilities of each spouse in the event of a divorce or separation. It is designed to protect both parties' interests and assets, providing clarity and certainty in case the marriage ends. In Murfreesboro, Tennessee, couples have the option of creating a prenuptial premarital agreement without including financial statements, which simplifies the process. In this article, we will delve into the specifics of this type of agreement to help you understand its purpose, benefits, and different variations. Understanding the Purpose: The primary purpose of a prenuptial premarital agreement without financial statements in Murfreesboro, Tennessee, is to establish a fair division of assets and liabilities without disclosing specific financial details. Instead of providing exhaustive statements on income, expenses, and net worth, this type of agreement focuses on defining how the couple's assets will be divided if the marriage ends. It safeguards individual properties and minimizes potential conflicts during divorce proceedings by setting clear guidelines in advance. Benefits of a Prenuptial Premarital Agreement without Financial Statements: 1. Protecting Separate Property: By clearly identifying separate assets, such as premarital properties, investments, and family heirlooms, partners can ensure that they will remain in their possession, regardless of property acquired during the marriage. This is particularly significant for parties who have accumulated substantial wealth or own businesses before marriage. 2. Defining Property Division: This agreement allows couples to determine how their property and debts will be divided, should the marriage end in divorce. By setting the terms beforehand, it helps avoid lengthy disputes and expensive legal battles over asset distribution, providing peace of mind to both parties. 3. Limiting Spousal Support: In some cases, a prenuptial premarital agreement without financial statements can outline predetermined alimony or spousal support terms in case of a divorce. By addressing financial support in advance, it ensures that both partners understand their fair share and reduces the potential for lengthy court battles over post-divorce support. Different Types of Prenuptial Premarital Agreements without Financial Statements in Murfreesboro, Tennessee: 1. Standard Prenuptial Agreement: This is the most common type of prenuptial agreement, which typically covers various aspects such as property division, debt allocation, spousal support, and legal rights. However, financial statements are omitted, focusing solely on the terms and conditions without disclosing detailed financial information. 2. Prenuptial Agreement with a Sunset Clause: This type of prenuptial agreement includes a provision called the "sunset clause," which specifies the agreed-upon terms will only be valid for a certain period. After that period, the agreement expires, allowing the couple to reconsider its terms. This can be useful if financial circumstances drastically change over time. Conclusion: In Murfreesboro, Tennessee, a prenuptial premarital agreement without financial statements offers couples a simplified approach to protect their assets and interests in case of divorce or separation. By focusing on clear guidelines for asset division, instead of disclosing financial details, both parties can enter into marriage with a sense of security and confidence. These agreements provide opportunities for open communication, ensure fairness, and minimize potential conflicts. Whether a standard prenuptial agreement or one with a sunset clause, couples can tailor their agreement to meet their unique needs and goals.

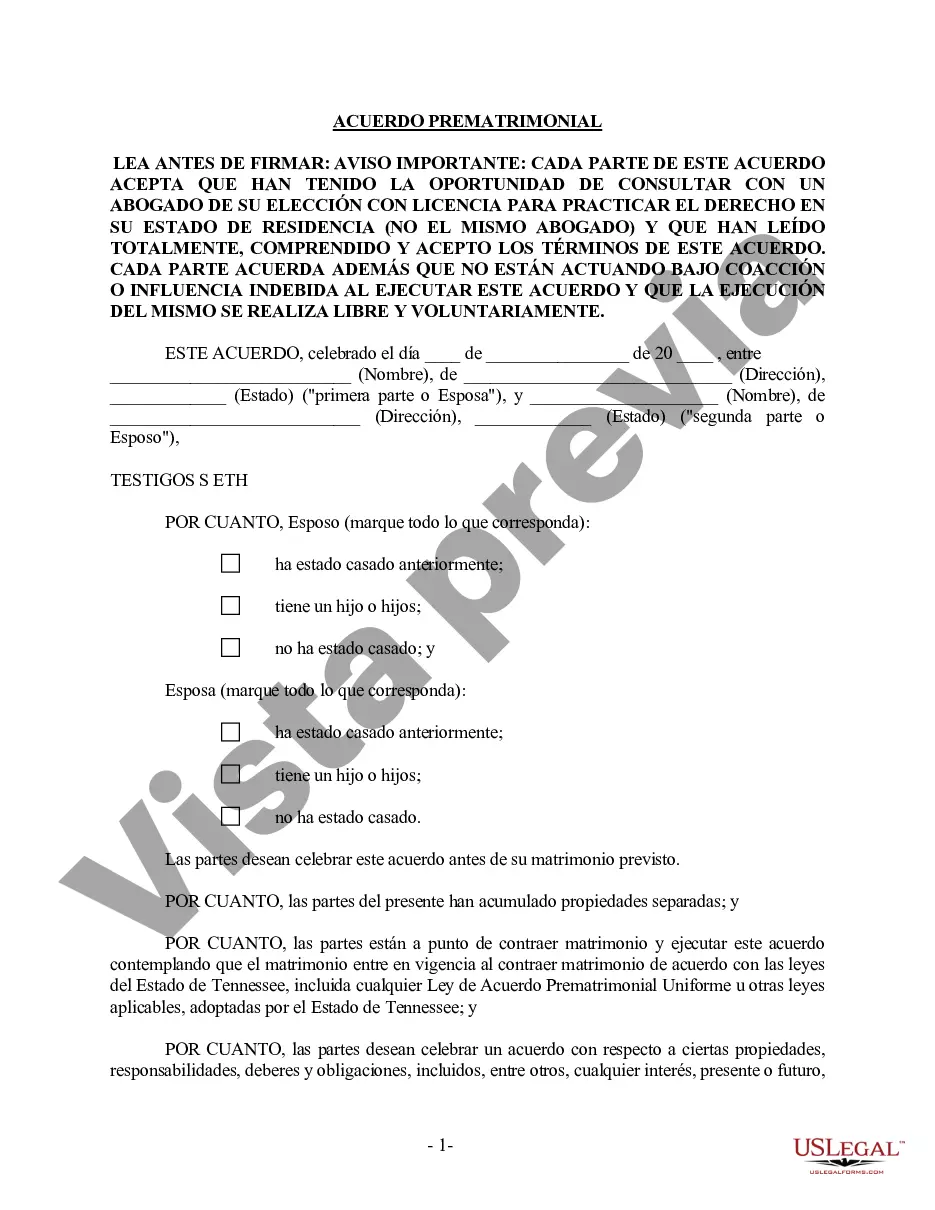

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Murfreesboro Acuerdo prematrimonial prenupcial de Tennessee sin estados financieros - Tennessee Prenuptial Premarital Agreement without Financial Statements

Description

How to fill out Murfreesboro Acuerdo Prematrimonial Prenupcial De Tennessee Sin Estados Financieros?

If you are looking for a valid form, it’s difficult to find a better service than the US Legal Forms website – one of the most comprehensive libraries on the web. Here you can get a large number of templates for business and individual purposes by types and regions, or key phrases. Using our advanced search function, getting the most up-to-date Murfreesboro Tennessee Prenuptial Premarital Agreement without Financial Statements is as easy as 1-2-3. Moreover, the relevance of each and every record is proved by a group of professional lawyers that regularly check the templates on our website and revise them according to the latest state and county demands.

If you already know about our platform and have an account, all you should do to receive the Murfreesboro Tennessee Prenuptial Premarital Agreement without Financial Statements is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the form you want. Read its information and use the Preview function to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to find the needed record.

- Confirm your choice. Select the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Get the template. Indicate the format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Murfreesboro Tennessee Prenuptial Premarital Agreement without Financial Statements.

Each and every template you save in your user profile does not have an expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to receive an additional copy for editing or creating a hard copy, you may return and export it again at any moment.

Take advantage of the US Legal Forms extensive catalogue to get access to the Murfreesboro Tennessee Prenuptial Premarital Agreement without Financial Statements you were looking for and a large number of other professional and state-specific templates on one website!