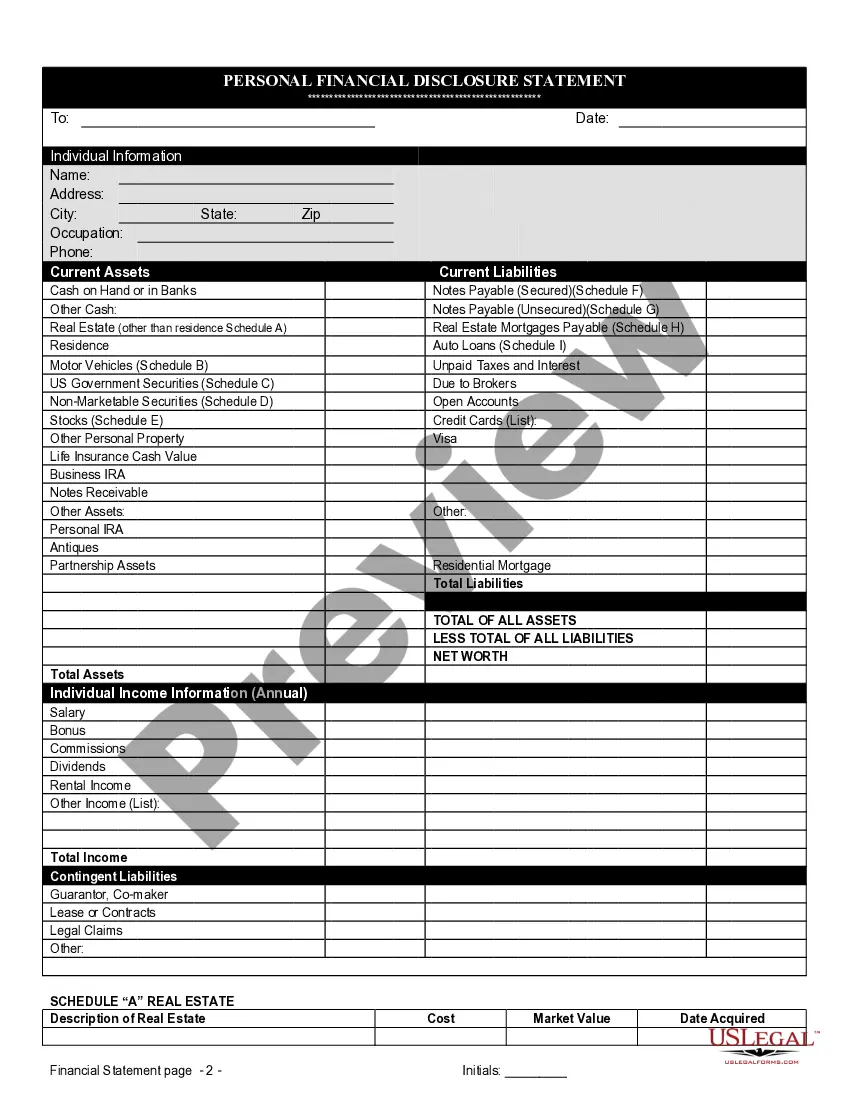

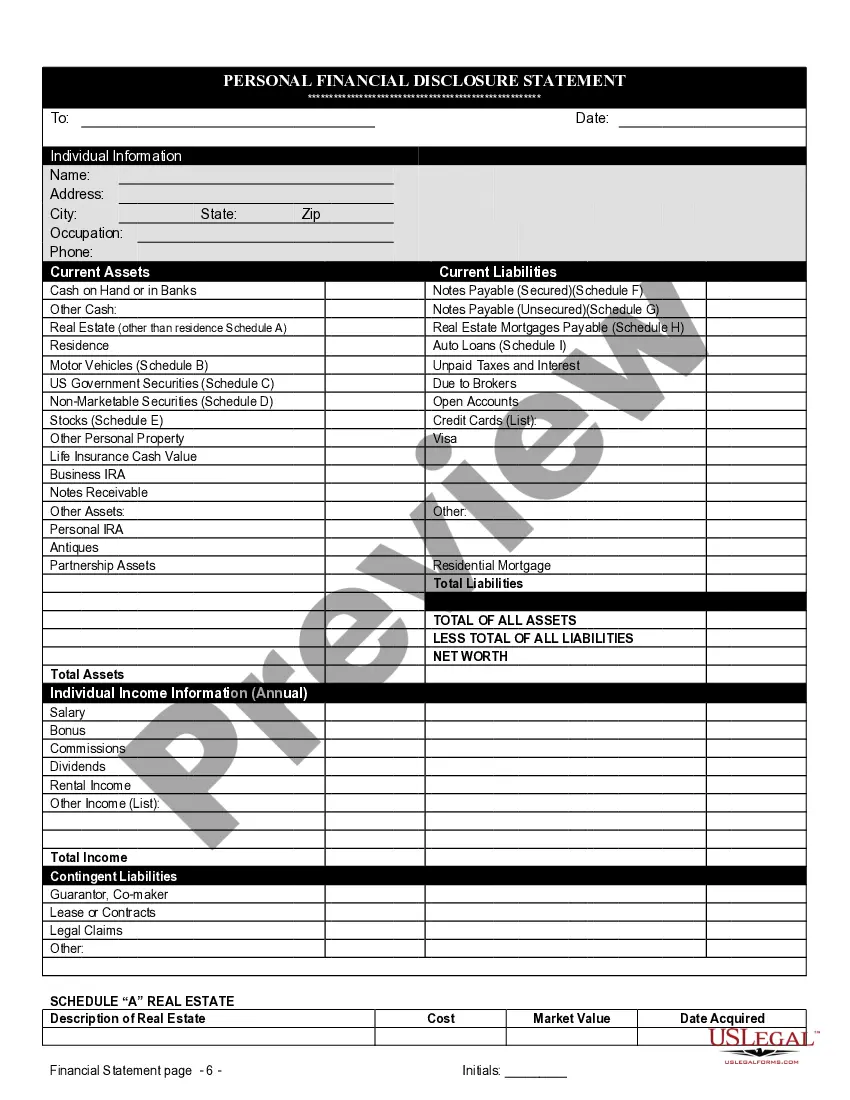

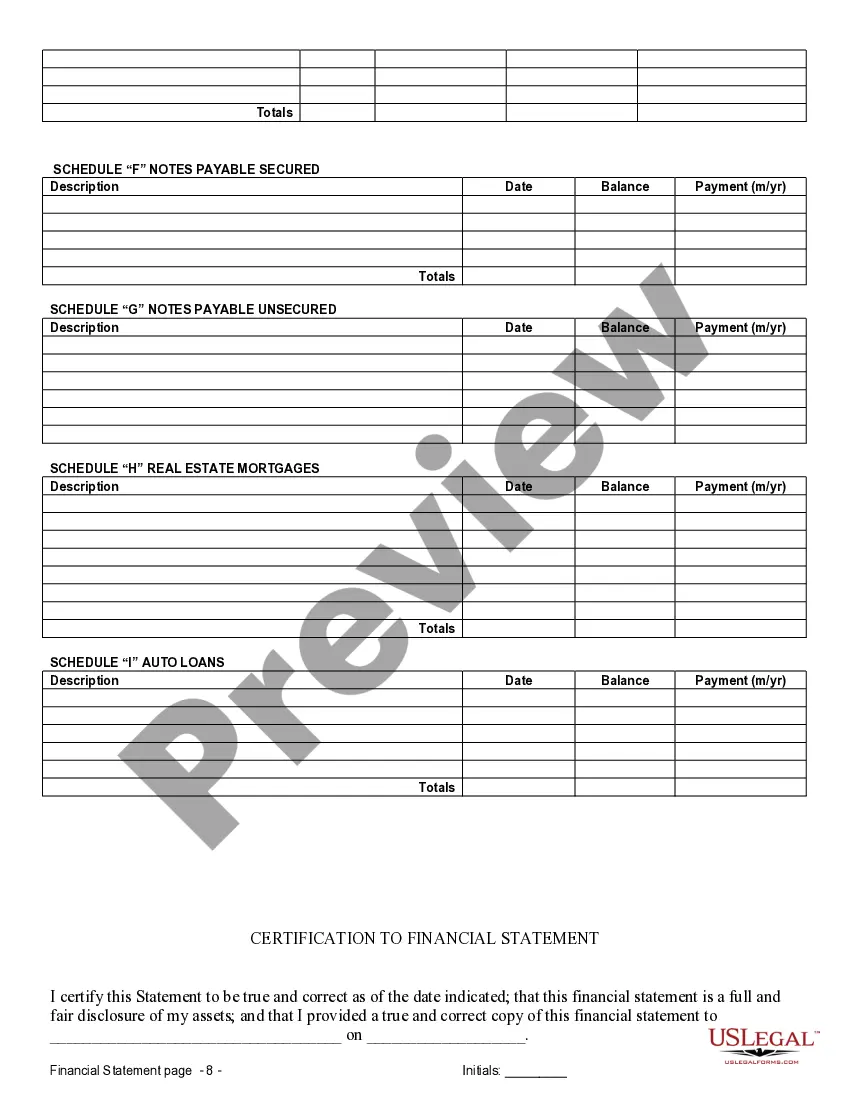

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Tennessee Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are appropriately sorted by area of application and jurisdiction, making the search for the Chattanooga Tennessee Financial Statements exclusively related to Prenuptial Premarital Agreement as straightforward as pie.

Maintaining documents organized and compliant with legal standards is of utmost significance. Leverage the US Legal Forms library to consistently have vital document templates accessible for any requirements right at your fingertips!

- Examine the Preview mode and form overview.

- Ensure you’ve selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Look for an alternative template if necessary.

- If you spot any discrepancies, utilize the Search tab above to find the accurate one.

- If it meets your needs, proceed to the next phase.

Form popularity

FAQ

Tennessee does not recognize common law marriages formed after January 1, 2017. However, if a couple established a common law marriage before this date, it may still be legally recognized. When discussing Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement, it is crucial to understand that prenuptial agreements can clarify financial matters for couples, regardless of their marital status. You can benefit from using our platform to draft a tailored prenuptial agreement that meets your specific needs.

A prenup can provide some level of protection, but it varies based on the wording and the laws in your area. Typically, a cheating clause will determine how assets are divided if infidelity occurs. It’s vital to understand how your agreement reflects on your specific situation. US Legal forms can help ensure that your Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement accurately represent your intentions and secure your interests.

Indeed, you can incorporate a cheating clause within your prenuptial agreement. This clause specifies the actions that may lead to repercussions in the event of infidelity. Having clarity on this matter can promote a sense of security and trust in the relationship. For a smooth creation of such documents, US Legal forms offers user-friendly templates for Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement.

A prenup does not have to be a deal breaker, but it can be a significant topic of discussion. Many couples view it as a practical approach to protecting their assets and clarifying financial responsibilities. Open communication about the reasons for considering a prenup fosters understanding and collaboration. Utilizing US Legal forms for drafting ensures that your Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement are handled appropriately.

It is possible to include a weight clause in your prenuptial agreement, which may detail expectations regarding health and fitness. Such clauses can create an understanding of mutual accountability within the marriage. However, enforceability may vary, so consulting a legal expert is wise. For assistance in crafting such specific agreements, US Legal forms can help streamline the process for Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement.

Yes, you can include a cheating clause in your prenuptial agreement. This clause can outline the consequences if one partner engages in infidelity. It plays a significant role in addressing expectations and responsibilities in the relationship. If you need assistance creating such clauses, consider using US Legal forms to generate documents tailored for Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement.

A prenup in Tennessee remains valid as long as both parties do not alter or revoke the agreement. It ensures that the terms set forth regarding asset division are honored. For comprehensive clarity, including Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement can add weight to your agreement's longevity and effectiveness.

Prenups do not automatically expire in Tennessee; they remain effective until you decide to revoke or modify them through a written agreement. It is important to review your prenup periodically to ensure it still reflects your situation. Incorporating Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement can help in making informed revisions as needed.

Yes, prenups generally hold up in court in Tennessee if they are properly executed and meet legal standards. Courts typically enforce agreements that are fair and entered into voluntarily. To substantiate your agreement, including Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement can further solidify its legitimacy.

Signing a prenup is not necessarily a red flag; in fact, it often signals a responsible approach to financial management in a relationship. Many couples find that having clear financial expectations helps foster trust and communication. Utilizing Chattanooga Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement can also demonstrate financial transparency.