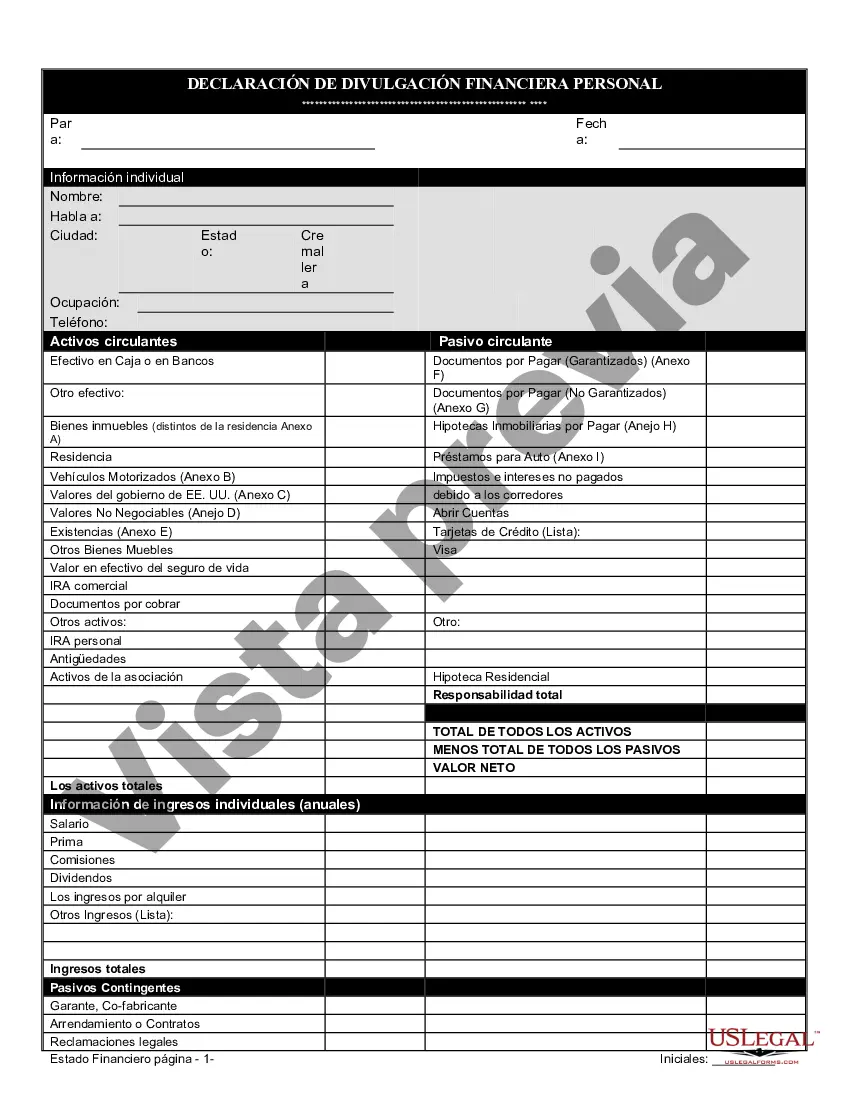

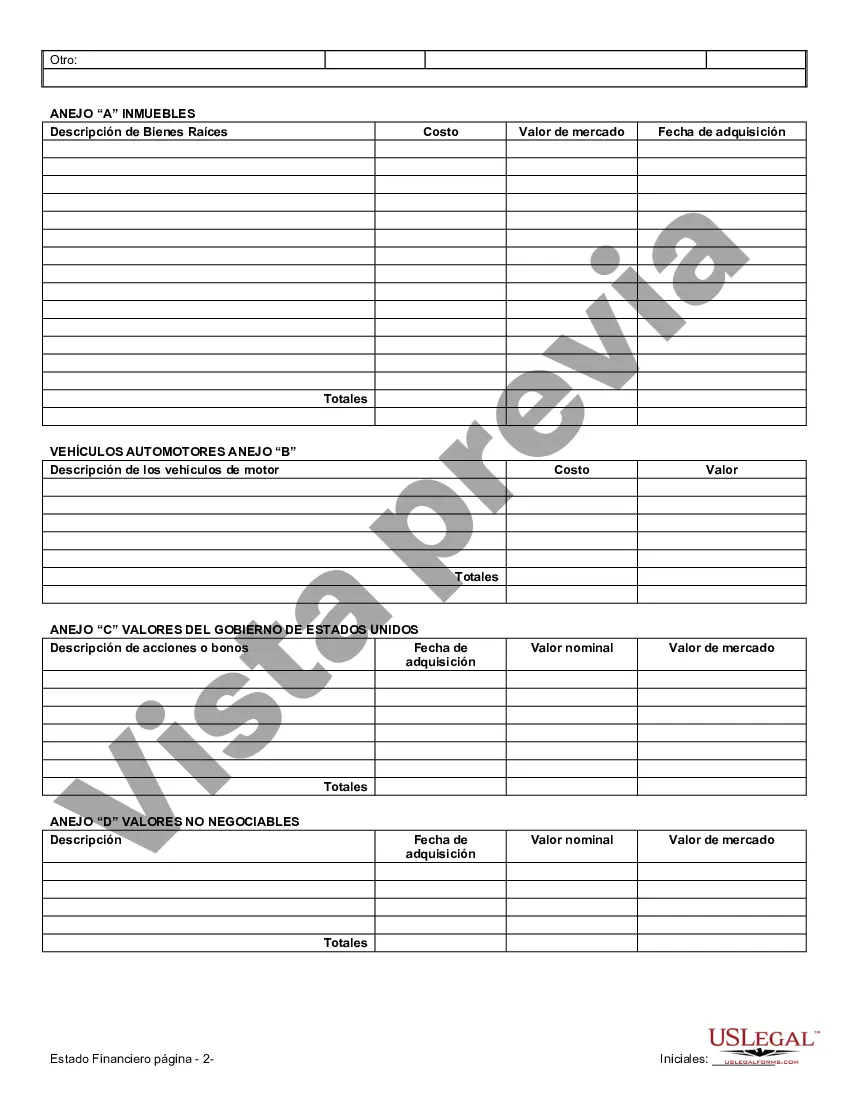

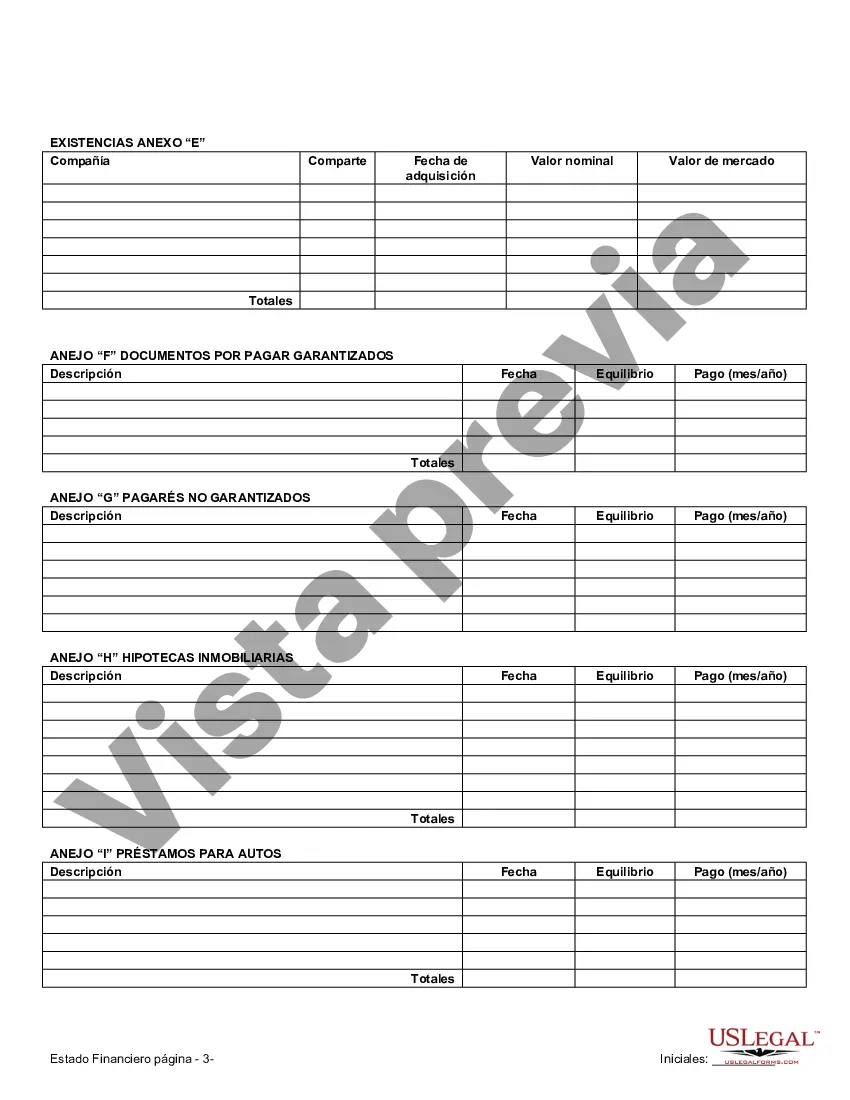

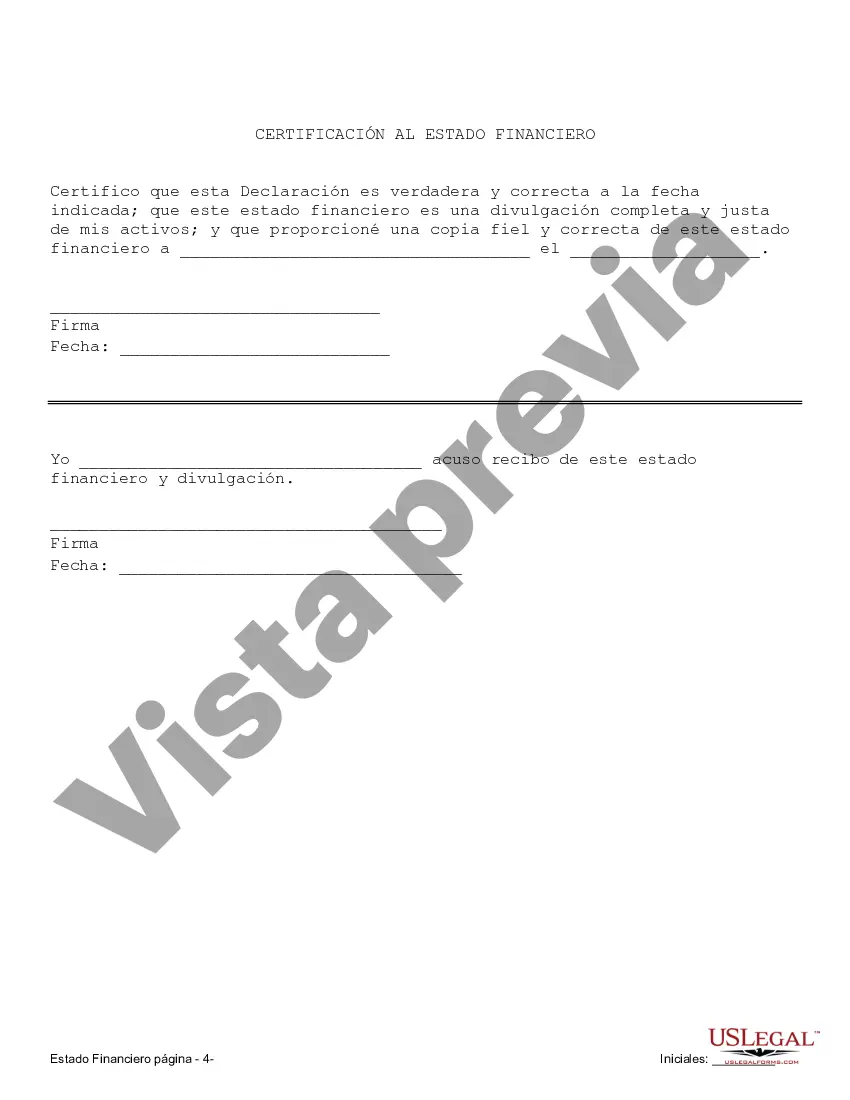

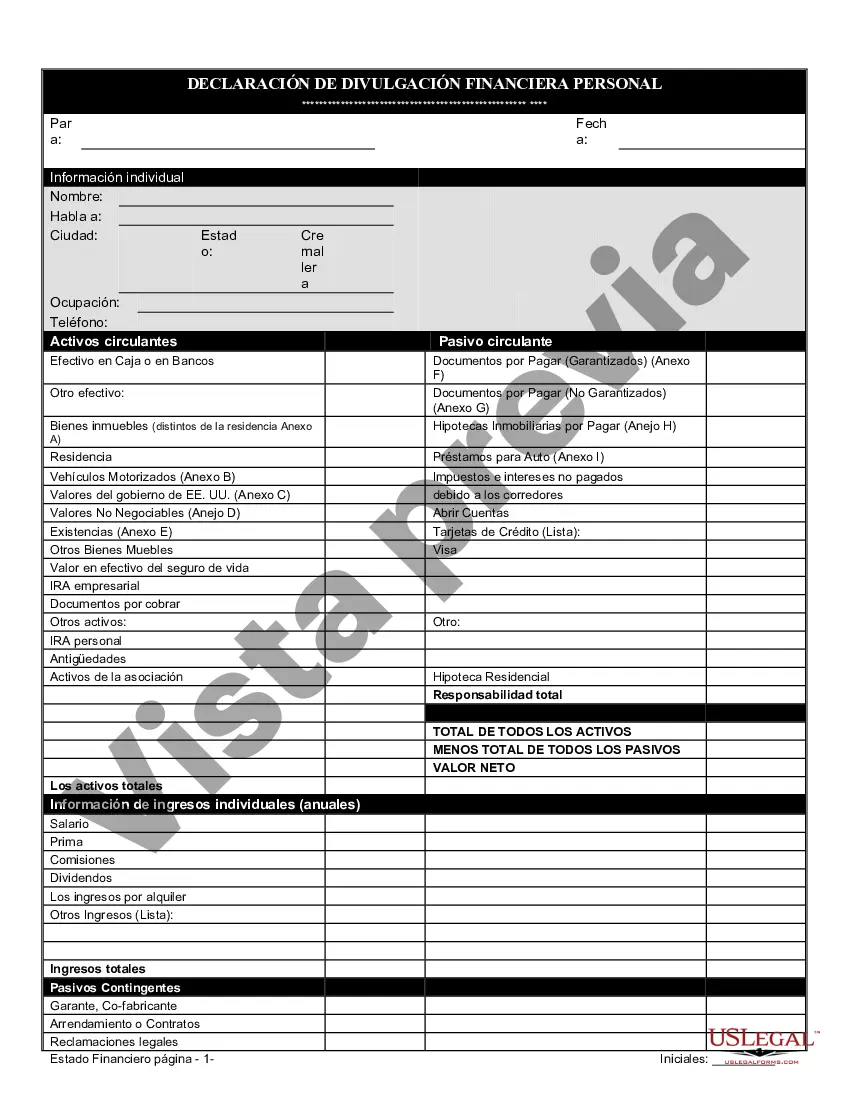

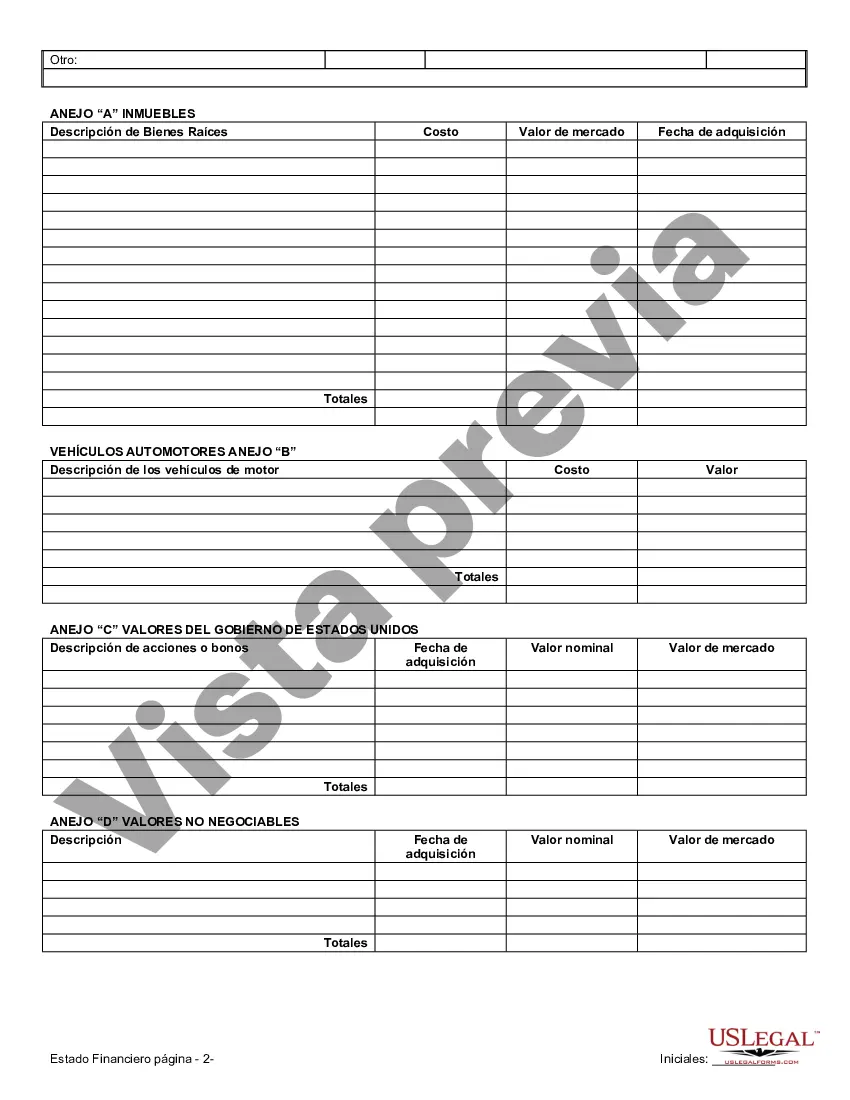

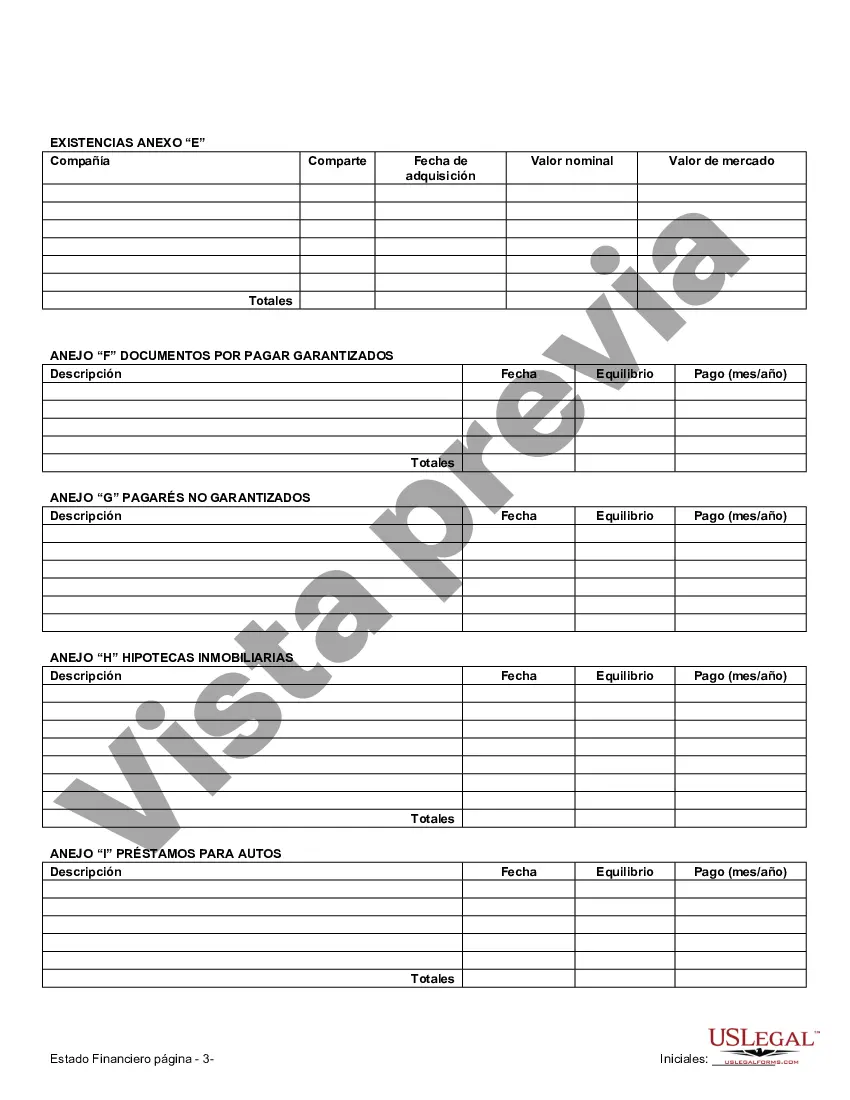

When it comes to prenuptial or premarital agreements in Knoxville, Tennessee, financial statements play a crucial role. Financial statements are documents that provide a comprehensive overview of an individual or couple's financial situation, including assets, liabilities, incomes, and expenses. These statements are essential elements in drafting a fair and equitable prenuptial agreement. In Knoxville, Tennessee, there are three main types of financial statements often used in connection with prenuptial or premarital agreements: 1. Personal Financial Statements: Personal financial statements are individual records that outline a person's financial standing. These statements typically include details about personal assets, such as property, investments, bank accounts, and valuables. They also list any debts, loans, or liabilities, such as mortgages, credit card debts, or student loans. Personal financial statements provide a comprehensive snapshot of an individual's financial health and can help determine how assets will be distributed in case of divorce or separation. 2. Business Financial Statements: In cases where one or both parties to a prenuptial agreement own a business, business financial statements become crucial. These statements provide an overview of the business's financial position, including income, expenses, assets, and liabilities. Business financial statements help determine the value of the business and its potential impact on the prenuptial agreement. They are often used to safeguard the interests of both parties and ensure that the business is handled fairly in case of divorce. 3. Joint Financial Statements: Joint financial statements are documents that provide a comprehensive picture of a couple's financial situation combined. These statements include details about shared assets, jointly-owned properties, investments, bank accounts, and other accounts held jointly. They also list any shared debts or liabilities. Joint financial statements are particularly important when drafting a prenuptial agreement as they help define how shared assets and liabilities will be distributed in case of a separation or divorce. When preparing financial statements for a prenuptial or premarital agreement in Knoxville, Tennessee, it is crucial to ensure accuracy, transparency, and full disclosure. These statements should be prepared in consultation with a legal professional who specializes in family law or a financial advisor experienced in prenuptial agreements to ensure compliance with local laws and regulations. Prenuptial agreements that incorporate detailed and accurate financial statements provide clarity and protection for both parties involved. By openly discussing and disclosing financial information, couples in Knoxville, Tennessee, can enter into a marriage with a clear understanding of the financial landscape, potential risks, and agreed-upon solutions in the event of a divorce or separation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Knoxville Tennessee Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Knoxville Tennessee Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are searching for a relevant form, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can get a large number of templates for company and personal purposes by types and regions, or key phrases. With the high-quality search feature, getting the latest Knoxville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement is as easy as 1-2-3. Moreover, the relevance of each and every record is proved by a group of skilled attorneys that on a regular basis review the templates on our website and revise them based on the most recent state and county demands.

If you already know about our platform and have an account, all you should do to get the Knoxville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the sample you require. Read its explanation and make use of the Preview function (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to discover the proper file.

- Confirm your decision. Click the Buy now button. Following that, select the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the file format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the obtained Knoxville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each and every template you save in your profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, you can return and save it once more at any time.

Make use of the US Legal Forms professional library to gain access to the Knoxville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement you were looking for and a large number of other professional and state-specific samples in a single place!