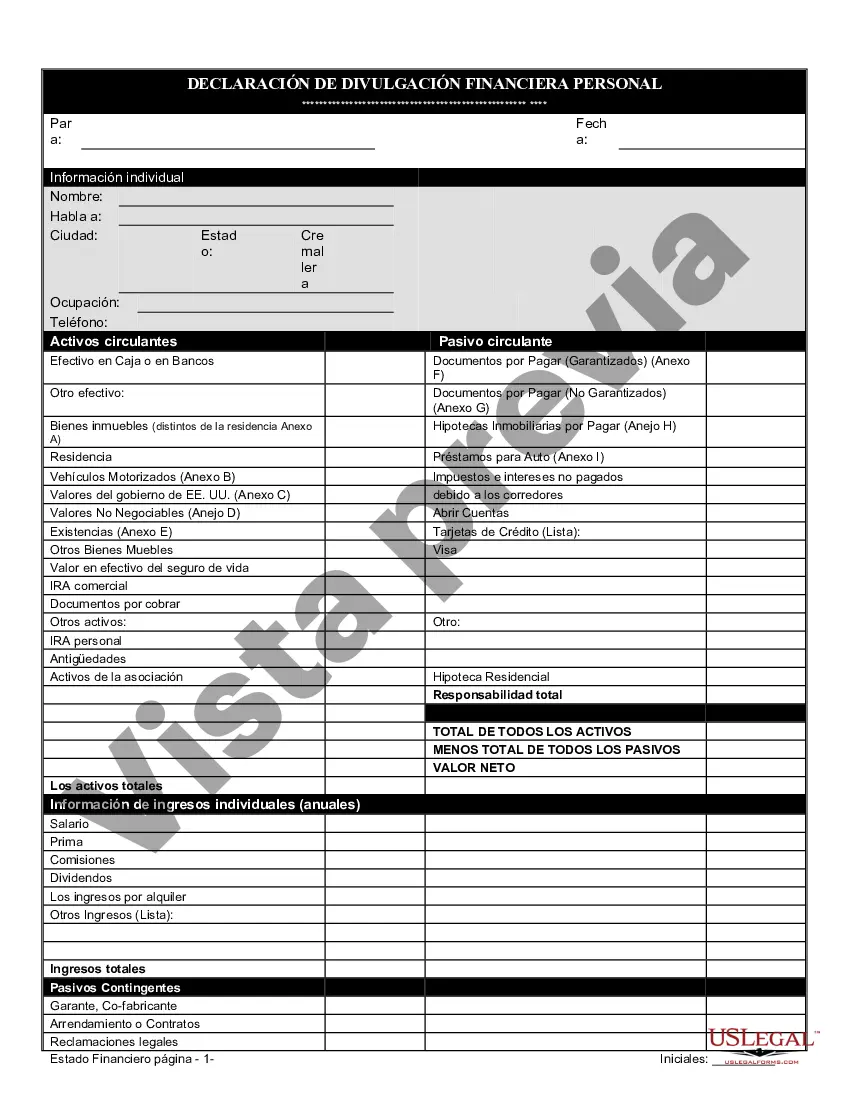

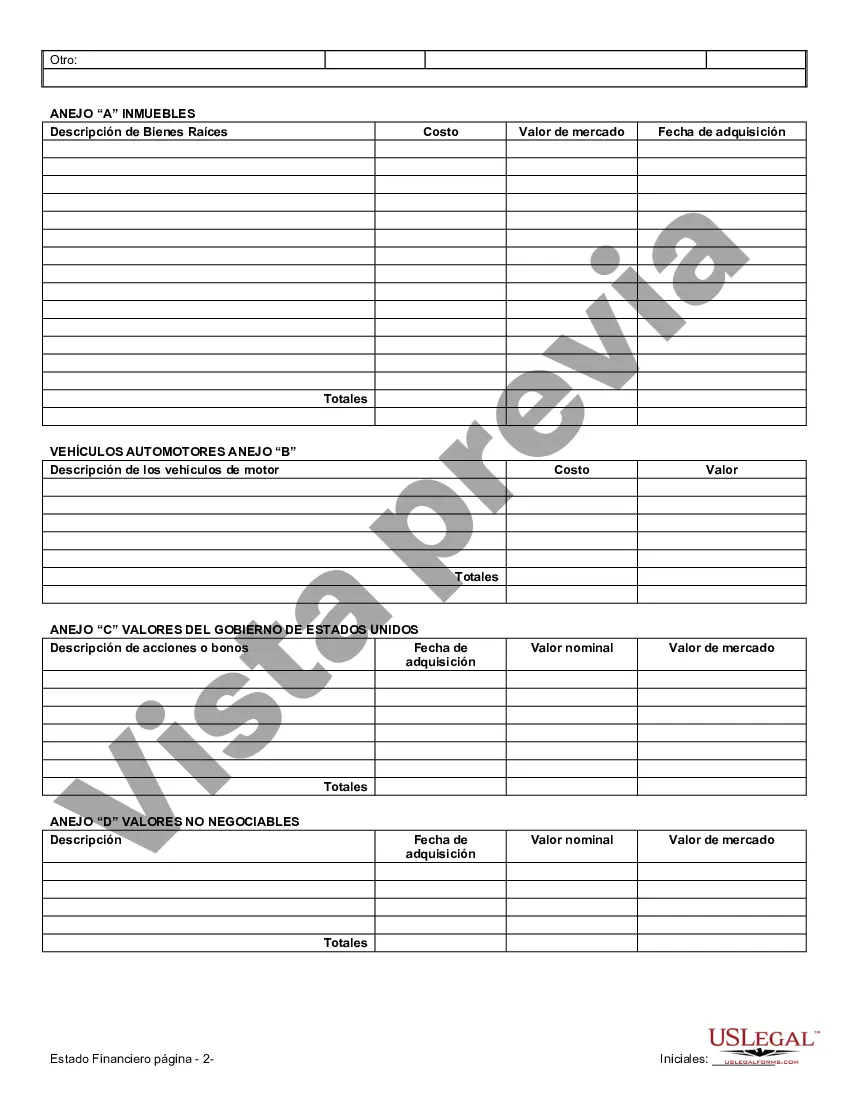

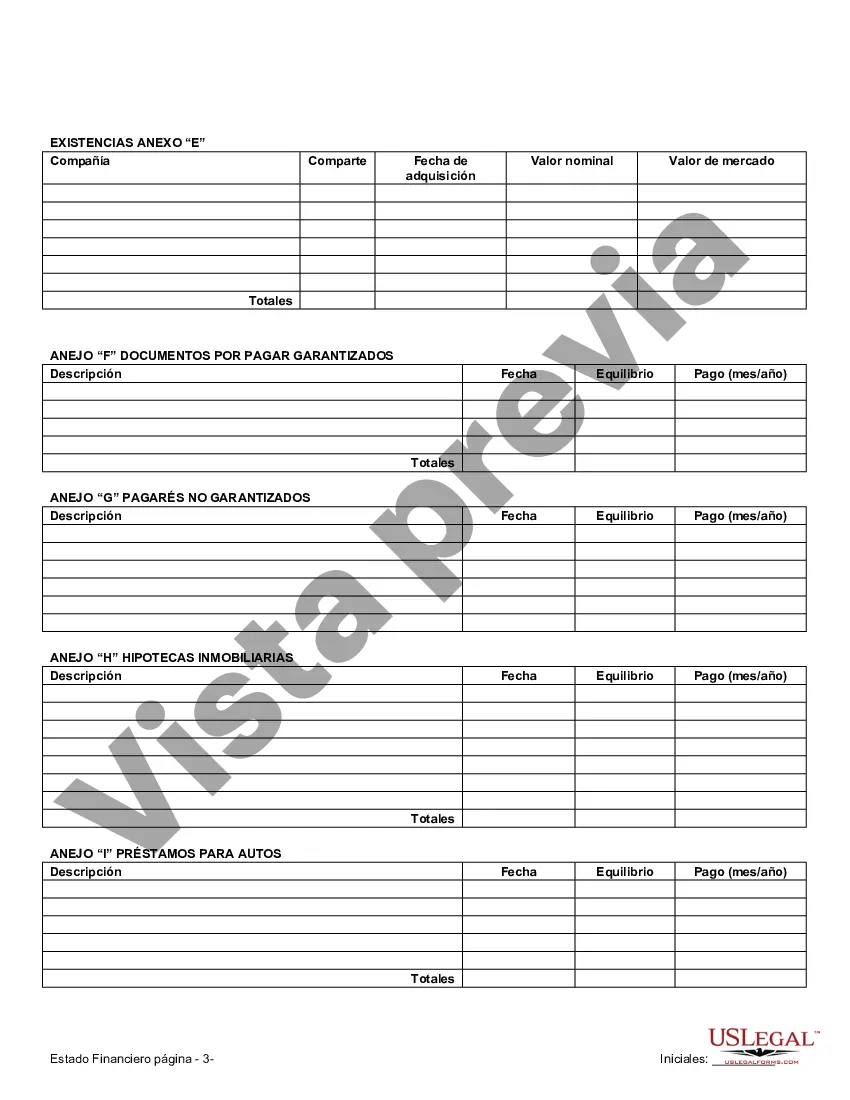

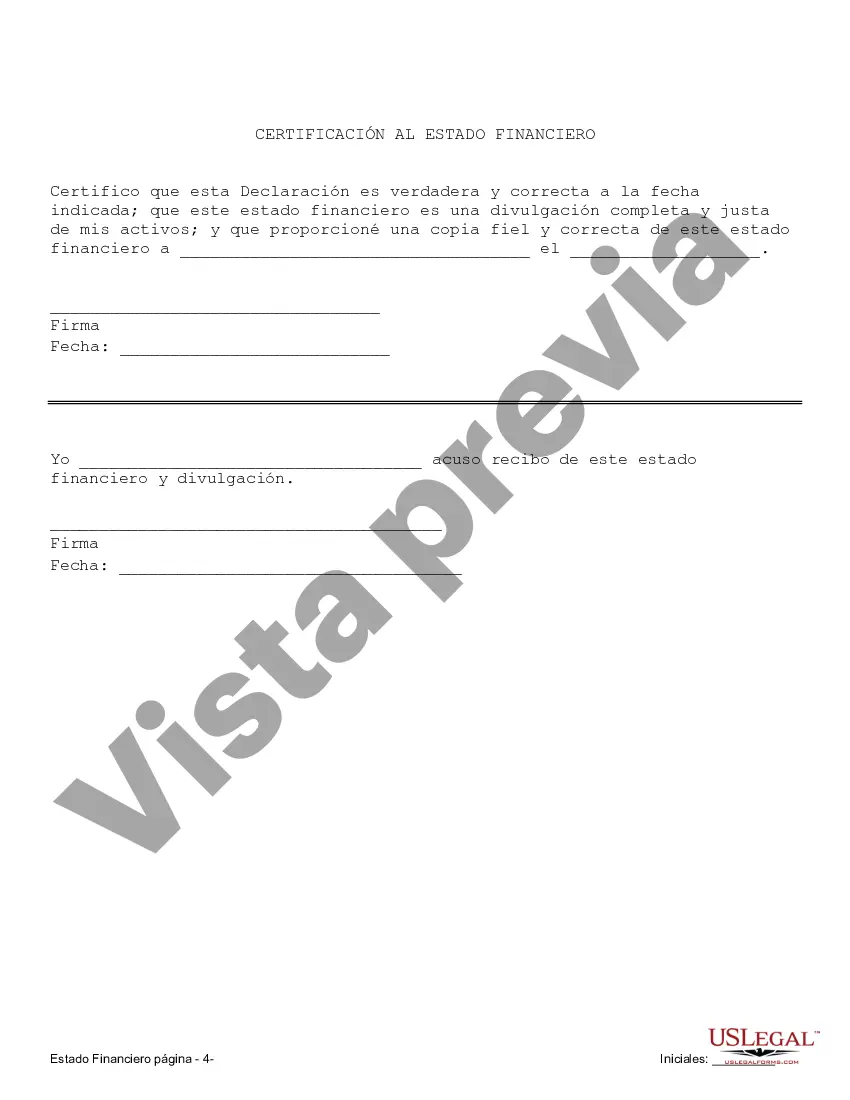

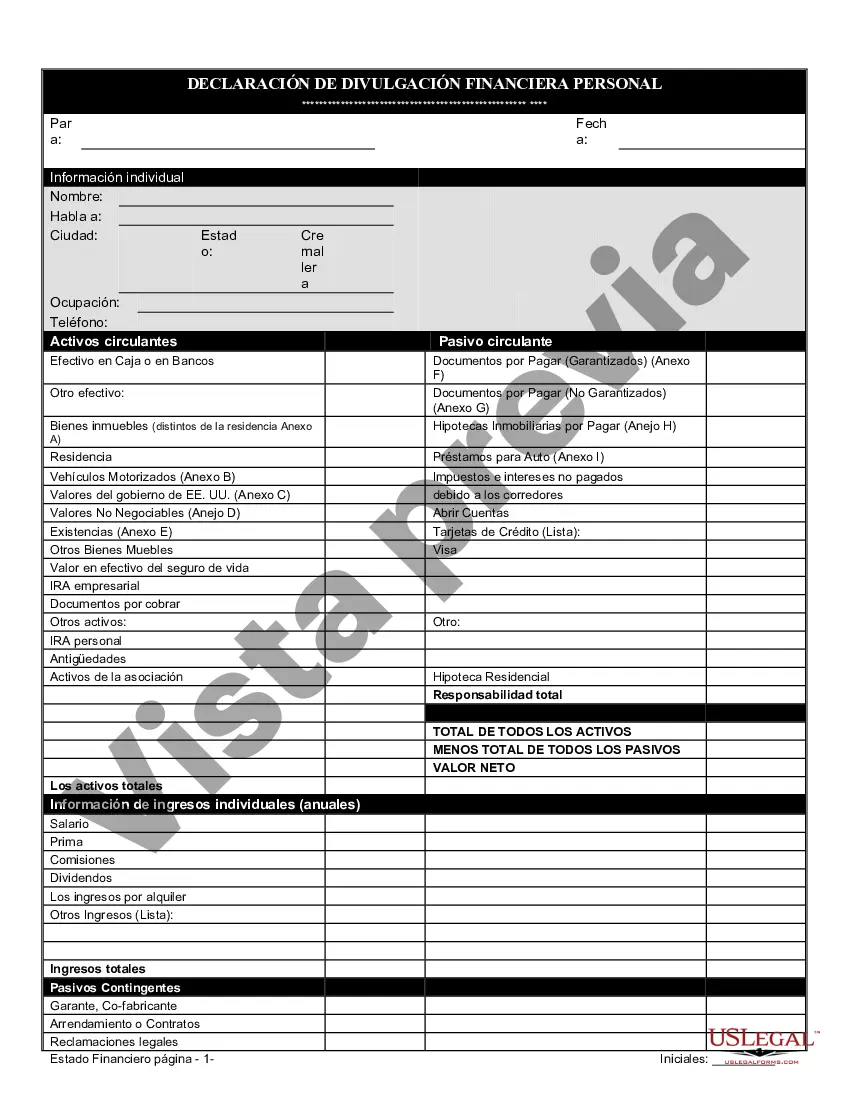

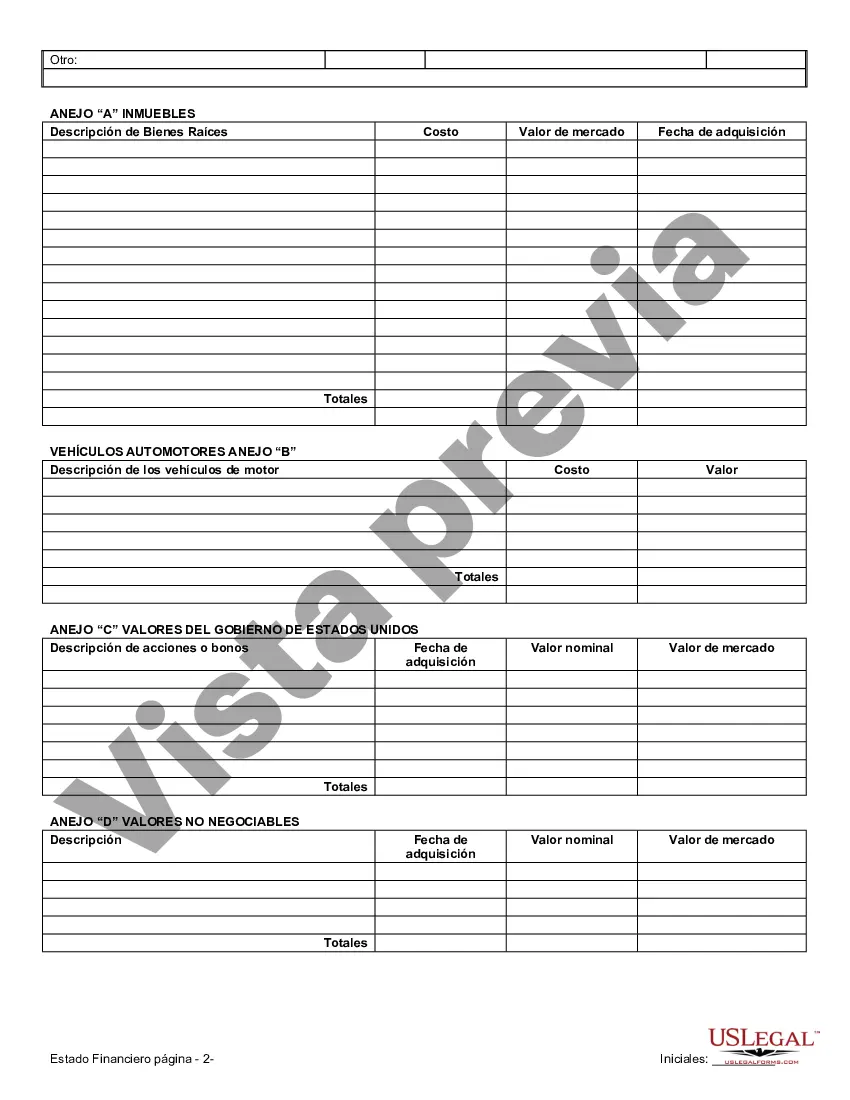

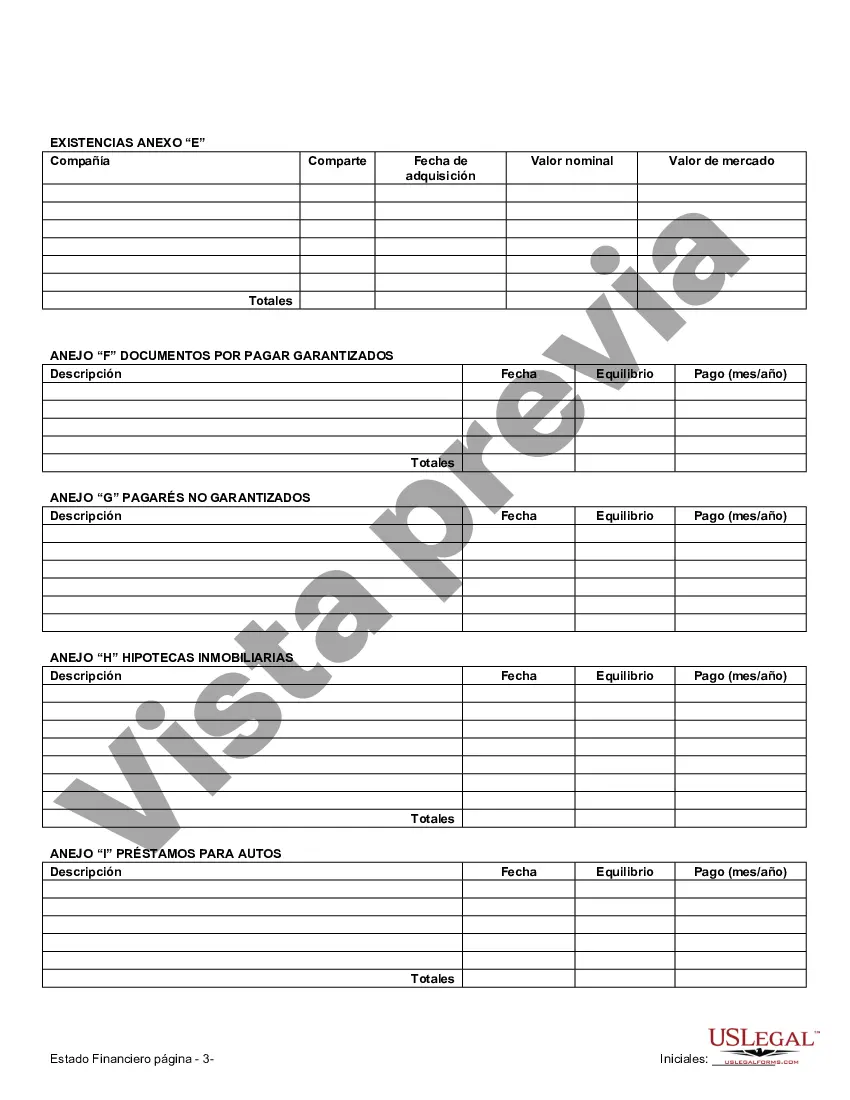

Nashville Tennessee Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Nashville, Tennessee, financial statements play a crucial role in prenuptial and premarital agreements. This detailed description will provide you with a comprehensive understanding of what Nashville financial statements entail, their significance in the context of prenuptial agreements, and explore various types of financial statements used in this legal process. Financial statements hold immense importance in prenuptial or premarital agreements as they allow couples to disclose their assets, liabilities, income, and expenses. These statements help establish transparency, promote fairness, and protect the interests of both parties involved. When preparing for a prenuptial agreement in Nashville, accurate and thorough financial statements are essential to ensure a successful and legally-binding agreement. Different types of financial statements may be included in a prenuptial or premarital agreement, varying based on individual circumstances. The key types include: 1. Personal Financial Statements: These statements outline an individual's financial standing, including details about their assets (such as real estate, investment portfolios, cash, or personal property) and liabilities (such as mortgages, loans, or credit card debts). This provides a clear snapshot of an individual's overall financial situation. 2. Business Financial Statements: If either party owns a business, business financial statements should be included. These statements detail the company's financial health, including revenues, expenses, assets, liabilities, and any potential disputes or outstanding litigation. Clear visibility into the business's financial state helps determine how marital property may be treated in case of a divorce. 3. Tax Returns and Tax-Related Financial Statements: Tax returns are crucial financial documents that provide an overview of an individual's income, deductions, and other relevant information. When preparing a prenuptial agreement in Nashville, providing copies of recent tax returns is essential for understanding an individual's financial situation and full disclosure of their financial obligations. 4. Retirement Account Statements: Detailed statements from retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, or pension plans, should be included. These statements show the current value of the accounts, contributions made during the marriage, and any other pertinent information. 5. Bank Statements and Investment Account Statements: Providing bank statements and investment account statements helps verify an individual's income, savings, investments, and any debts related to these accounts. These statements ensure transparency, allowing both parties to make informed decisions regarding the division of assets and liabilities in a prenuptial agreement. 6. Pay Stubs and Employment Contracts: Including recent pay stubs and employment contracts ensures accurate disclosure of an individual's income, bonuses, benefits, and future earning potential. This information helps determine potential alimony or support obligations in the event of a divorce. When drafting a prenuptial or premarital agreement in Nashville, Tennessee, it is crucial to consult with a qualified attorney specializing in family law and ensure the accuracy and completeness of the financial statements provided. By doing so, couples can create a fair and legally binding agreement that protects their respective assets and interests in the event of a divorce.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nashville Tennessee Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Nashville Tennessee Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Nashville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Nashville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Nashville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!