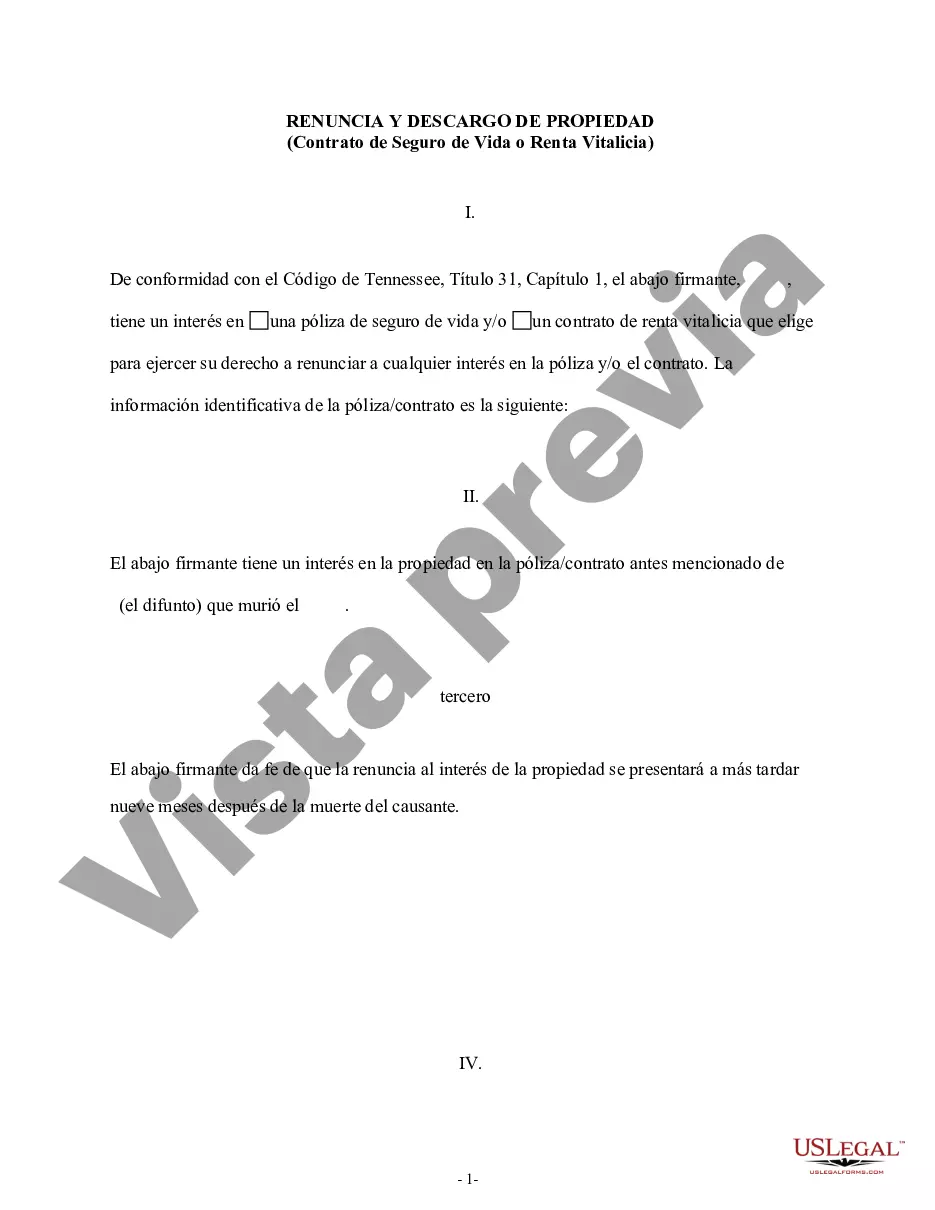

Nashville Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract In Nashville, Tennessee, the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process by which an individual disclaims or renounces their right to property received from a life insurance or annuity contract. By renouncing or disclaiming the property, the individual effectively declines to accept any interest or benefits associated with the policy or contract. This process is governed by the Tennessee laws and regulations and can be initiated by an individual who is named as the beneficiary in a life insurance or annuity contract but wishes to refuse any rights or interests in the insurance proceeds or annuity benefits. It is important to note that the renunciation or disclaimer must be completed within a certain timeframe and in compliance with the specific requirements outlined by the state. The Nashville Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provide individuals with the option to decline the property for various reasons, including: 1. Estate Planning: Individuals may strategically disclaim the property if they want to avoid taxable income or reduce their overall estate value for tax or financial planning purposes. 2. Ineligible for Benefits: If the beneficiary is ineligible to receive the insurance proceeds or annuity benefits due to legal restrictions, their renunciation or disclaimer allows the property to pass to an alternate beneficiary or contingent recipient. 3. Debt Protection: Individuals facing financial difficulties, bankruptcy, or significant debt may choose to disclaim the property to protect it from creditors' claims. It is essential to understand that there are different types of Renunciation and Disclaimer of Property from Life Insurance or Annuity Contracts available in Nashville, Tennessee. These include: 1. Partial Renunciation: In certain cases, a beneficiary may wish to disclaim only a portion of the property received from the life insurance policy or annuity contract. This partial renunciation allows the individual to retain some benefits while relinquishing others. 2. Contingent Renunciation: A contingent beneficiary, who becomes entitled to the property only if the primary beneficiary renounces it, can also renounce their rights to the property. This ensures a smooth transfer of benefits to the next designated contingent recipient. 3. Conditional Renunciation: In circumstances where certain conditions or events must occur before the property can be transferred, an individual may conditionally disclaim their interests. Once the conditions are met, the disclaimed property passes to the designated alternate beneficiary. The Nashville Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract process is complex and requires adherence to legal requirements and state-specific guidelines. It is advisable to seek professional legal advice or consult an attorney to ensure compliance with the necessary procedures and to understand the potential consequences of renouncing or disclaiming property from a life insurance or annuity contract in Nashville.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nashville Tennessee Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - Tennessee Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Nashville Tennessee Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

Take advantage of the US Legal Forms and get immediate access to any form sample you require. Our useful platform with a large number of document templates makes it easy to find and get virtually any document sample you want. You can download, complete, and sign the Nashville Tennessee Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract in a matter of minutes instead of browsing the web for several hours looking for a proper template.

Using our catalog is a superb strategy to raise the safety of your document submissions. Our professional lawyers regularly check all the records to ensure that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you get the Nashville Tennessee Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Find the template you need. Ensure that it is the template you were hoping to find: verify its name and description, and make use of the Preview function if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the document. Choose the format to obtain the Nashville Tennessee Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy form libraries on the web. We are always happy to assist you in virtually any legal case, even if it is just downloading the Nashville Tennessee Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Feel free to make the most of our platform and make your document experience as straightforward as possible!