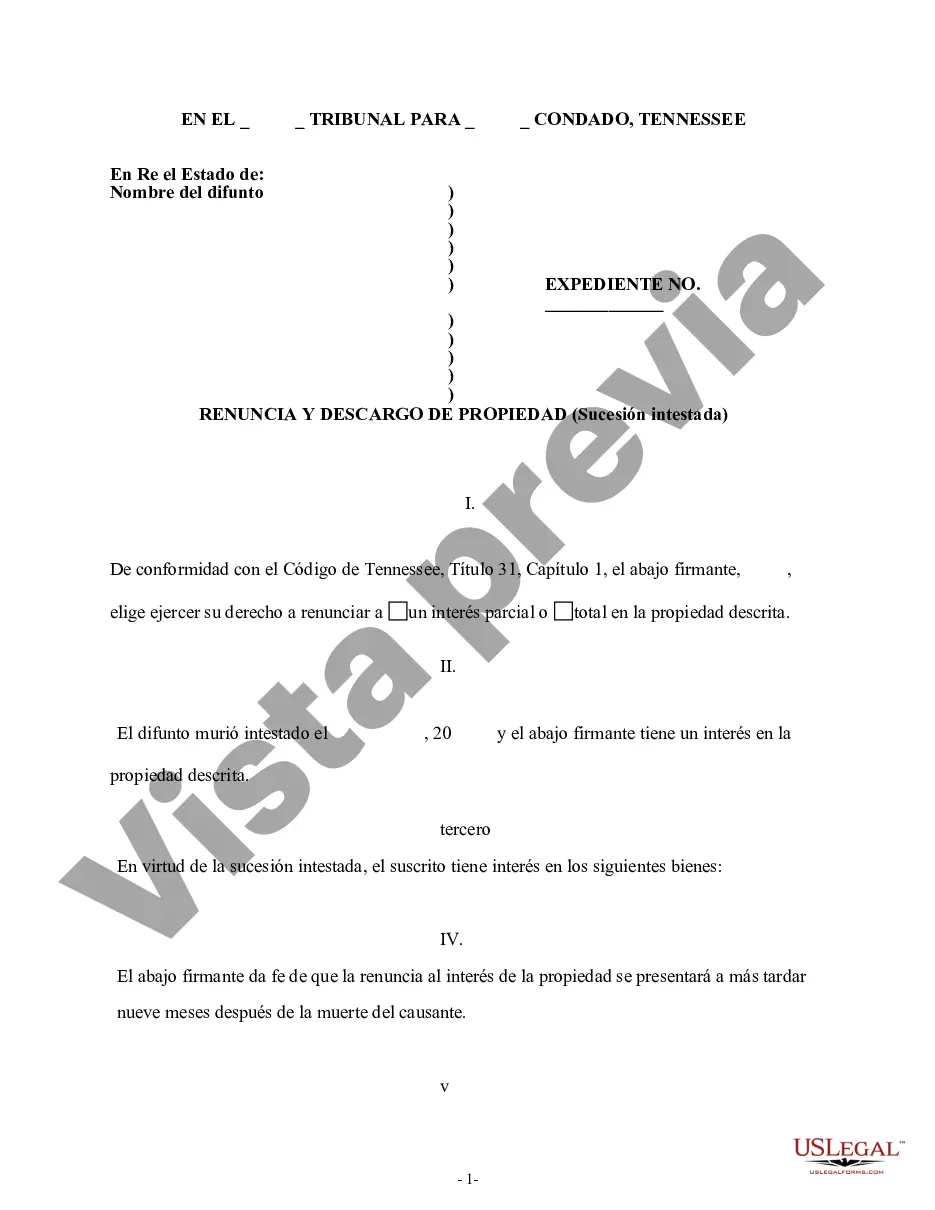

Chattanooga Tennessee Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal process in which an individual refuses to accept an inheritance or property that is obtained through the intestate succession laws of Tennessee. In the event that someone passes away without leaving behind a valid will or any other estate planning documents, the state's intestate succession laws determine how their property will be distributed among their heirs. A renunciation is a formal declaration made by an individual who has been designated as a beneficiary of an estate or property, stating their refusal to accept the inheritance. This renunciation effectively disclaims their right to the assets involved, allowing the property to pass on to the next eligible beneficiary in line. This process is often initiated when the beneficiary has personal reasons for not wanting to accept the property, such as a desire to avoid potential debts, tax liabilities, or other legal responsibilities associated with the inherited assets. In Chattanooga, Tennessee, there are two primary types of renunciation and disclaimer of property received by intestate succession: 1. Partial Renunciation: This type of renunciation allows a beneficiary to disclaim only a portion of the inherited property. By renouncing a partial interest in the assets, the beneficiary can choose to accept a smaller share or completely forego certain specific items or portions of the estate. This partial renunciation offers flexibility in adjusting the distribution of assets among the other beneficiaries involved. 2. Full Renunciation: As the name suggests, a full renunciation involves the complete refusal to accept any part of the property received through intestate succession. The renouncing beneficiary forfeits their right to any share in the estate, passing it entirely to the next eligible beneficiary in line according to Tennessee law. This type of renunciation is common when the beneficiary believes that accepting the inheritance would be disadvantageous or against their interests. By utilizing the renunciation and disclaimer process, beneficiaries in Chattanooga, Tennessee, have the opportunity to modify the distribution of property received through intestate succession. This legal mechanism ensures that assets are distributed according to the preferences and intentions of the individual who renounces their claim, while maintaining the integrity of the state's intestate succession laws. It is crucial to consult with an experienced attorney to navigate the specific requirements and implications of the renunciation process to ensure compliance with Tennessee state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chattanooga Tennessee Renuncia y Deslinde de Bienes recibidos por Sucesión Intestada - Tennessee Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Chattanooga Tennessee Renuncia Y Deslinde De Bienes Recibidos Por Sucesión Intestada?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Chattanooga Tennessee Renunciation And Disclaimer of Property received by Intestate Succession? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Chattanooga Tennessee Renunciation And Disclaimer of Property received by Intestate Succession conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search if the form isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Chattanooga Tennessee Renunciation And Disclaimer of Property received by Intestate Succession in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal paperwork online once and for all.