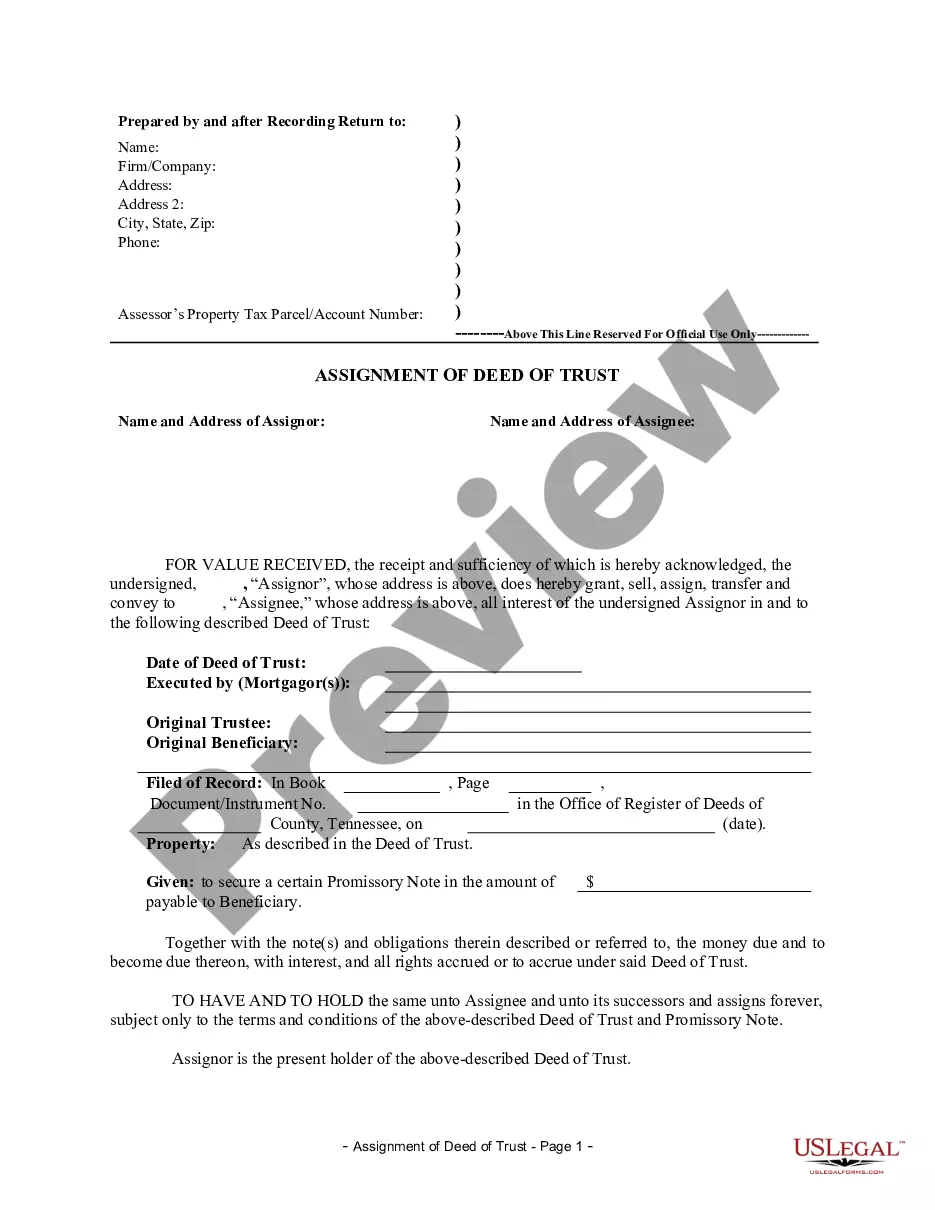

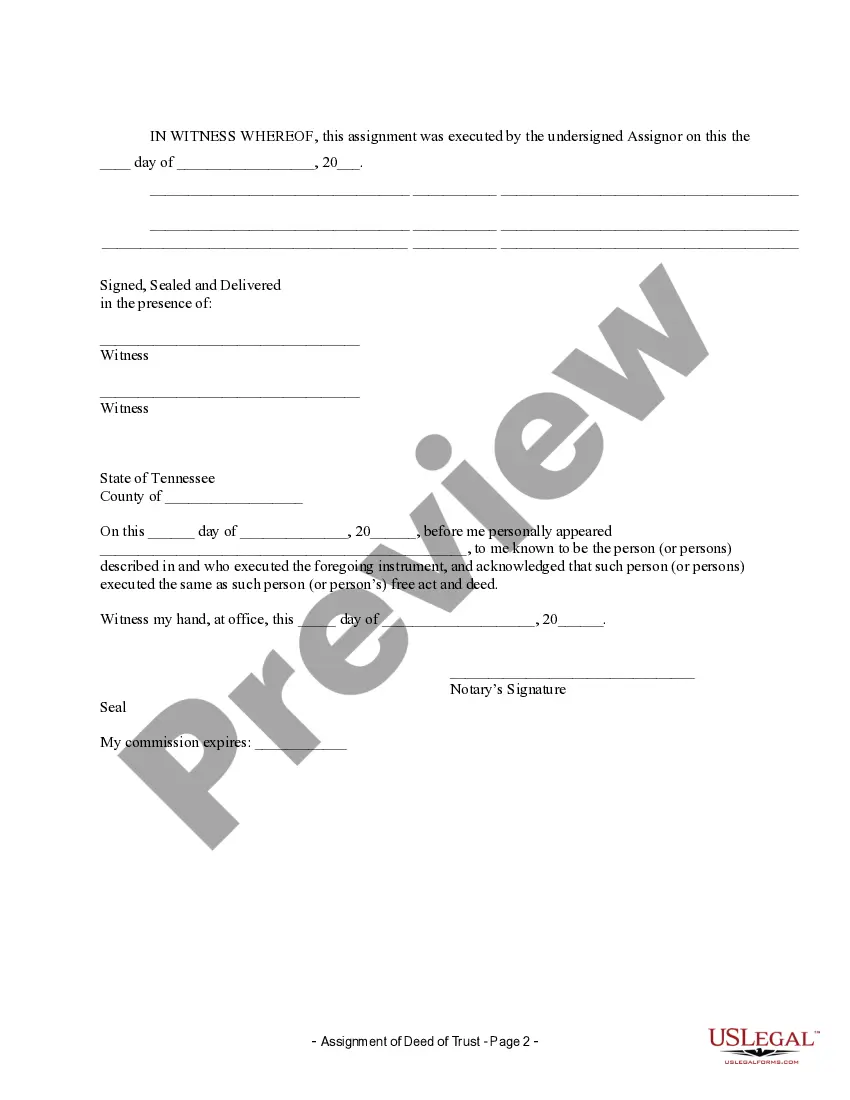

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

The assignment of deed of trust by an individual mortgage holder in Chattanooga, Tennessee is a legal document that involves the transfer of rights and responsibilities related to a mortgage loan. This assignment allows the mortgage holder to transfer their interest in the property to another party, while the original loan terms remain intact. Keywords: Chattanooga Tennessee, Assignment of Deed of Trust, Individual Mortgage Holder, mortgage loan, transfer of rights, transfer of responsibilities, property ownership. There are several types of Chattanooga Tennessee Assignment of Deed of Trust by an Individual Mortgage Holder: 1. Voluntary Assignment — This occurs when the individual mortgage holder willingly transfers their interest in the property to another party. It could be due to various reasons such as financial restructuring, estate planning, or the sale of the property. 2. Involuntary Assignment — This type of assignment may be initiated by external factors, such as foreclosure or bankruptcy. In such cases, the individual mortgage holder may be forced to transfer their interest in the property to satisfy outstanding debts. 3. Assumption of Mortgage — In some instances, the individual mortgage holder may choose to assign the deed of trust to allow another party to assume the mortgage loan. This is often seen during property transfers or when the original mortgage holder wants to transfer the loan responsibility to someone else. 4. Partial Assignment — Instead of transferring the entire mortgage, an individual mortgage holder may choose to assign only a portion of their interest in the property. This could be done to provide collateral for a separate loan or to involve multiple parties in the property ownership. 5. Investment Assignment — In situations where an individual mortgage holder seeks to diversify their investments, they can assign their mortgage interest to another investor. This enables them to earn passive income from the mortgage payments without being directly involved in property management. Regardless of the type, a Chattanooga Tennessee Assignment of Deed of Trust by an Individual Mortgage Holder requires careful documentation and legal procedures to ensure the smooth transfer of property ownership while preserving the rights and obligations established by the original mortgage agreement. It is crucial to consult with a legal professional or a qualified real estate agent to navigate the complexities involved in such assignments.The assignment of deed of trust by an individual mortgage holder in Chattanooga, Tennessee is a legal document that involves the transfer of rights and responsibilities related to a mortgage loan. This assignment allows the mortgage holder to transfer their interest in the property to another party, while the original loan terms remain intact. Keywords: Chattanooga Tennessee, Assignment of Deed of Trust, Individual Mortgage Holder, mortgage loan, transfer of rights, transfer of responsibilities, property ownership. There are several types of Chattanooga Tennessee Assignment of Deed of Trust by an Individual Mortgage Holder: 1. Voluntary Assignment — This occurs when the individual mortgage holder willingly transfers their interest in the property to another party. It could be due to various reasons such as financial restructuring, estate planning, or the sale of the property. 2. Involuntary Assignment — This type of assignment may be initiated by external factors, such as foreclosure or bankruptcy. In such cases, the individual mortgage holder may be forced to transfer their interest in the property to satisfy outstanding debts. 3. Assumption of Mortgage — In some instances, the individual mortgage holder may choose to assign the deed of trust to allow another party to assume the mortgage loan. This is often seen during property transfers or when the original mortgage holder wants to transfer the loan responsibility to someone else. 4. Partial Assignment — Instead of transferring the entire mortgage, an individual mortgage holder may choose to assign only a portion of their interest in the property. This could be done to provide collateral for a separate loan or to involve multiple parties in the property ownership. 5. Investment Assignment — In situations where an individual mortgage holder seeks to diversify their investments, they can assign their mortgage interest to another investor. This enables them to earn passive income from the mortgage payments without being directly involved in property management. Regardless of the type, a Chattanooga Tennessee Assignment of Deed of Trust by an Individual Mortgage Holder requires careful documentation and legal procedures to ensure the smooth transfer of property ownership while preserving the rights and obligations established by the original mortgage agreement. It is crucial to consult with a legal professional or a qualified real estate agent to navigate the complexities involved in such assignments.