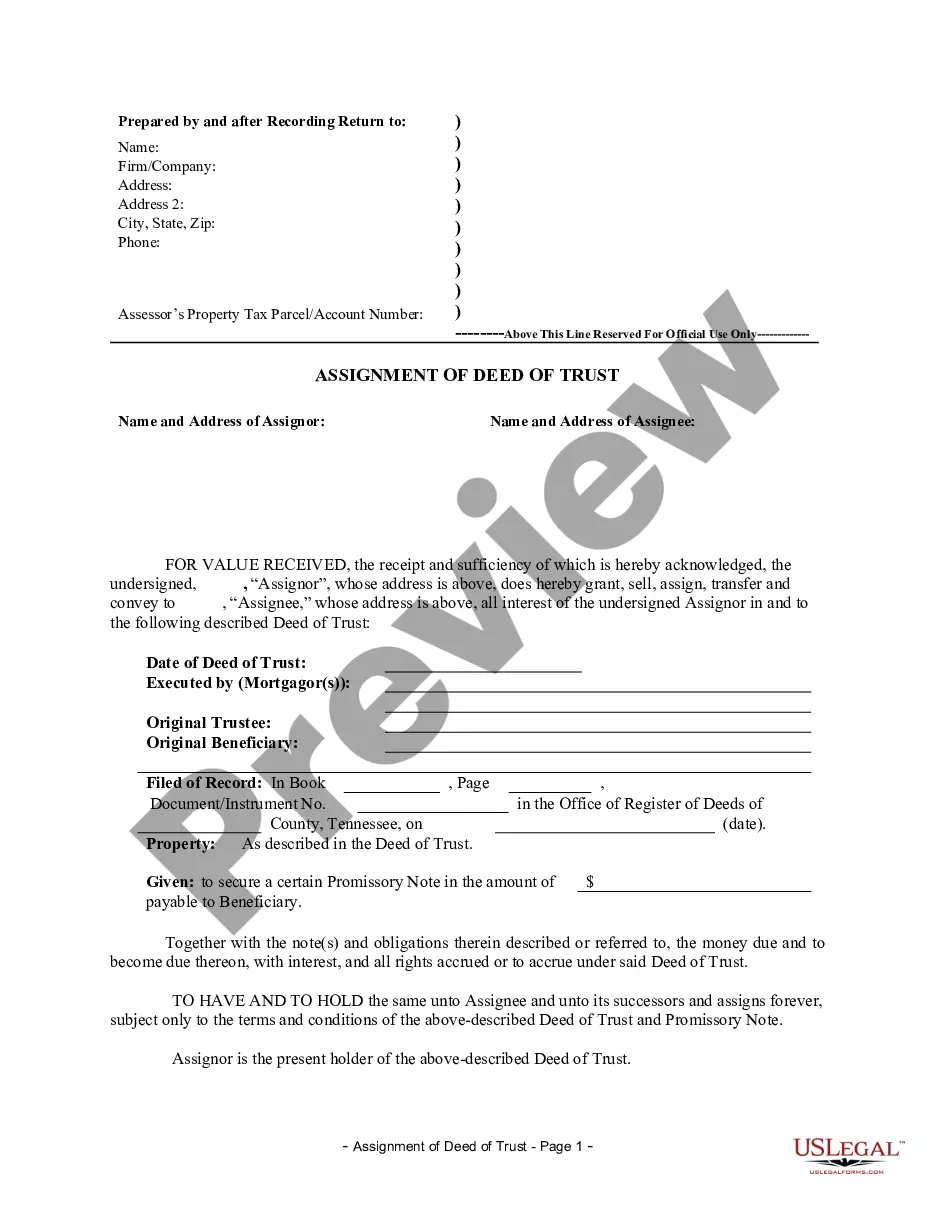

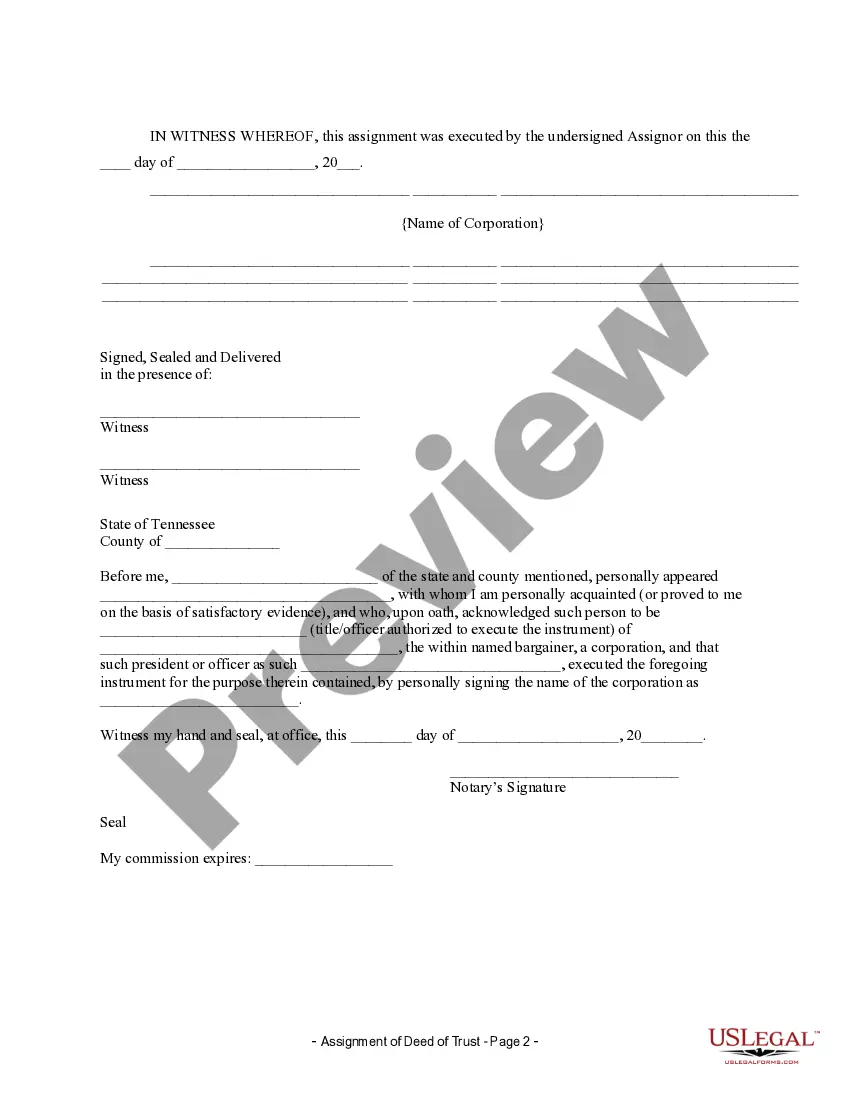

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Tennessee Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you’ve previously utilized our service, Log In to your account and store the Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to quickly locate and store any template for your personal or professional use!

- Verify you’ve found an appropriate document. Browse through the description and use the Preview option, if available, to ascertain if it aligns with your needs. If it doesn't meet your criteria, utilize the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder. Select the file format for your document and save it to your device.

- Finalize your sample. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Tennessee recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. Each serves a specific purpose in property transfers and ownership rights. Understanding these types can help you navigate the complexities of real estate transactions, especially regarding a Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder.

In Tennessee, recording a deed involves filing the document with the local county register's office. You need to present the original deed along with any required fees for recording. Recording is vital for establishing the legal ownership of the property, particularly when handling a Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, to ensure that your rights are protected.

To transfer a deed in Tennessee, you must first prepare the deed document, specifying the property and the parties involved. After ensuring that the deed is signed and notarized, you can submit it for recording at the local county register's office. This process is crucial, especially when dealing with a Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, as proper documentation protects both the buyers and sellers.

To fill out a quit claim deed in Tennessee, begin by obtaining the correct form, which includes sections for the grantor's and grantee's names, the property description, and any relevant legal details. Ensure that you accurately provide all necessary information, including the county in which the property is located. It is advisable to have the form notarized for it to be legally binding. Additionally, using resources like US Legal Forms can simplify the process and ensure you comply with local laws.

Tennessee operates under a deed system, as it uses deeds to convey real property ownership. Owners use deeds like warranty deeds and quitclaim deeds to transfer titles between parties. This approach provides a clear record of ownership transfer, which is crucial for real estate transactions. Familiarity with the Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder can provide additional insight into managing property titles effectively in this deed state.

Yes, in Tennessee, you must register a deed to make it valid and enforceable against third parties. Once you execute the deed, you should file it with the local county register's office. Registration protects your ownership rights and ensures other parties are aware of the property's title status. Utilizing uslegalforms can simplify the process of handling the Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder and ensure compliance with registration requirements.

To add someone to a deed in Tennessee, you typically need to prepare a new deed that includes the name of that individual. This involves drafting a quitclaim deed or warranty deed to transfer a portion of ownership. After correctly preparing the new document, it must be signed and notarized before submitting it to the local registry. For assistance, the uslegalforms platform provides resources on how to manage the Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder effectively.

In Tennessee, certain conditions must be met for a deed to be valid. This includes the names of the parties involved, a clear description of the property, and signatures of the grantor and witness. Additionally, the deed must be executed according to state laws, ensuring it is legally enforceable. When dealing with the Chattanooga Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, it's vital to adhere to these conditions to protect your interests.

In Tennessee, a deed can be prepared by attorneys, licensed title companies, or individuals with knowledge of local real estate law. It’s essential to ensure that all legal requirements are met to avoid complications. For those seeking assistance with documents like a Chattanooga Tennessee assignment of deed of trust by corporate mortgage holder, platforms like uslegalforms can provide the necessary resources and templates.

A corporate assignment involves a corporation taking over rights or interests in a legal agreement, such as a deed of trust. This is common in real estate transactions, where corporate entities need to manage assets. In Chattanooga, Tennessee, a corporate assignment of deed of trust by corporate mortgage holder can streamline the process of asset management.