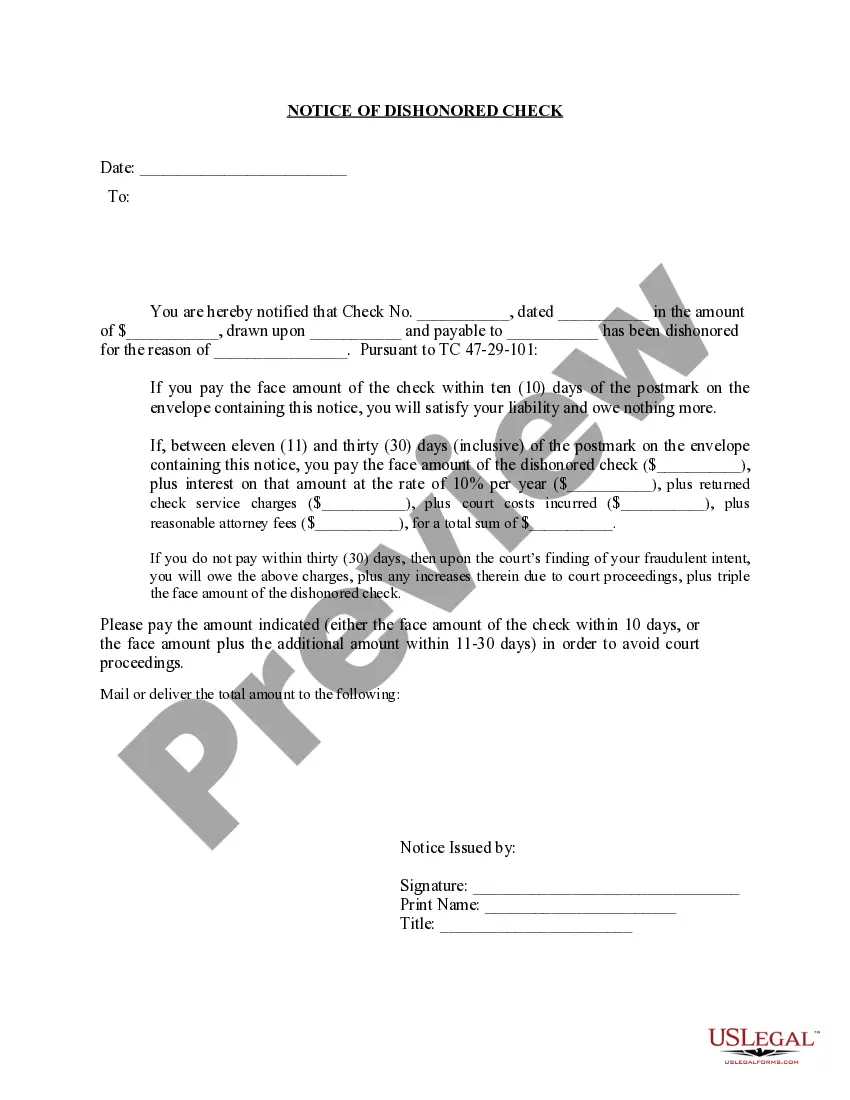

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Clarksville Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Tennessee Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Do you require a reliable and cost-effective legal forms supplier for the Clarksville Tennessee Notice of Dishonored Check - Civil - Keywords: insufficient funds, bounced check? US Legal Forms is your ideal choice.

Whether you seek a basic agreement to establish guidelines for living with your partner or need a collection of documents to facilitate your divorce process through the court, we have you covered. Our site provides over 85,000 current legal document templates for personal and commercial use. All templates we provide are not generic and are tailored to the regulations of specific states and regions.

To acquire the form, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously obtained document templates at any time within the My documents tab.

Is this your first time visiting our platform? No worries. You can create an account with great ease, but before doing that, ensure to follow these steps.

Now you can establish your account. Next, choose the subscription plan and proceed to the payment. After the payment is completed, download the Clarksville Tennessee Notice of Dishonored Check - Civil - Keywords: insufficient funds, bounced check in any format that is available. You can revisit the website whenever necessary and redownload the form at no additional cost.

Finding current legal documents has never been simpler. Give US Legal Forms a chance today, and say goodbye to wasting your precious time deciphering legal paperwork online for good.

- Verify that the Clarksville Tennessee Notice of Dishonored Check - Civil - Keywords: insufficient funds, bounced check complies with the laws of your state and locality.

- Examine the form’s specifics (if applicable) to ascertain its suitability for your needs.

- Repeat the search if the form does not meet your legal situation.

Form popularity

FAQ

A check may be returned or dishonored if the funds are not available at the time of processing. Other circumstances include account errors or the check being stale, which means it is dated too far in the past. It's always wise to keep track of your account balance to prevent potential bounced checks. If you face such an issue, consider seeking help through services like UsLegalForms.

Checks get returned primarily due to insufficient funds in the payer's account. Other factors include closed accounts or discrepancies in the information provided on the check. If a check bounces, it’s crucial to resolve the issue quickly to avoid penalties. Engaging with platforms like UsLegalForms can provide resources to address returned checks effectively.

A check can be dishonored for several reasons, ranging from insufficient funds to a closed account. Other common causes include a signature mismatch or issues with the check itself, such as missing important information. Understanding these causes can help you prevent a bounced check situation. When facing a Clarksville Tennessee Notice of Dishonored Check, knowing the reasons behind dishonoring can guide your next steps.

Yes, you can get a warrant for a bad check in Tennessee, especially if it is determined to be a willful violation. If the check writer fails to make good on the check after receiving a notice, legal action may follow. In cases of severe fraud or repeated offenses, civil actions may escalate to criminal charges. Being proactive about resolving a bounced check is essential to avoid such outcomes.

In Tennessee, issuing a bad check is considered a criminal offense. Under state law, if you write a check without sufficient funds in your account, you may face legal penalties. The law provides that repeated offenses can lead to more serious consequences, including fines and possible jail time. Understanding the implications of a Clarksville Tennessee Notice of Dishonored Check is important for both individuals and businesses.

To avoid a bounced check, create a system for tracking your income and expenses closely. Regularly reconcile your bank statements to catch any discrepancies early. Additionally, set up alerts with your bank for low balances, helping you stay informed. By following these practices, you can steer clear of the complications that come with a Clarksville Tennessee Notice of Dishonored Check.

Bounced checks are checks that cannot be processed due to insufficient funds in the issuer's bank account. This incident typically results in penalties and fees for the person who wrote the check. Such occurrences may also lead to legal implications, especially in cases involving a Clarksville Tennessee Notice of Dishonored Check. Understanding this can help you manage your finances better.

You can prevent issuing a bad check by ensuring that you have sufficient funds before writing one. Double-check your account balance and consider linking your account to a savings or overdraft protection plan. Utilizing platforms like USLegalForms can also help you understand proper check-writing procedures, avoiding bad checks and legal issues related to a Clarksville Tennessee Notice of Dishonored Check.

To avoid bouncing checks, always keep track of your bank account balance. Regularly update your ledger to reflect any pending transactions. Utilizing budgeting tools or apps can help you monitor your funds effectively. By staying aware of your financial situation, you can prevent the scope of a Clarksville Tennessee Notice of Dishonored Check.

Writing a bounced check is unintentional, usually resulting from insufficient funds in the account. To prevent this, always ensure you have enough balance before issuing a check. If a check does bounce, it is critical to communicate immediately with the recipient, offering to rectify the situation as soon as possible to maintain trust and business relationships.