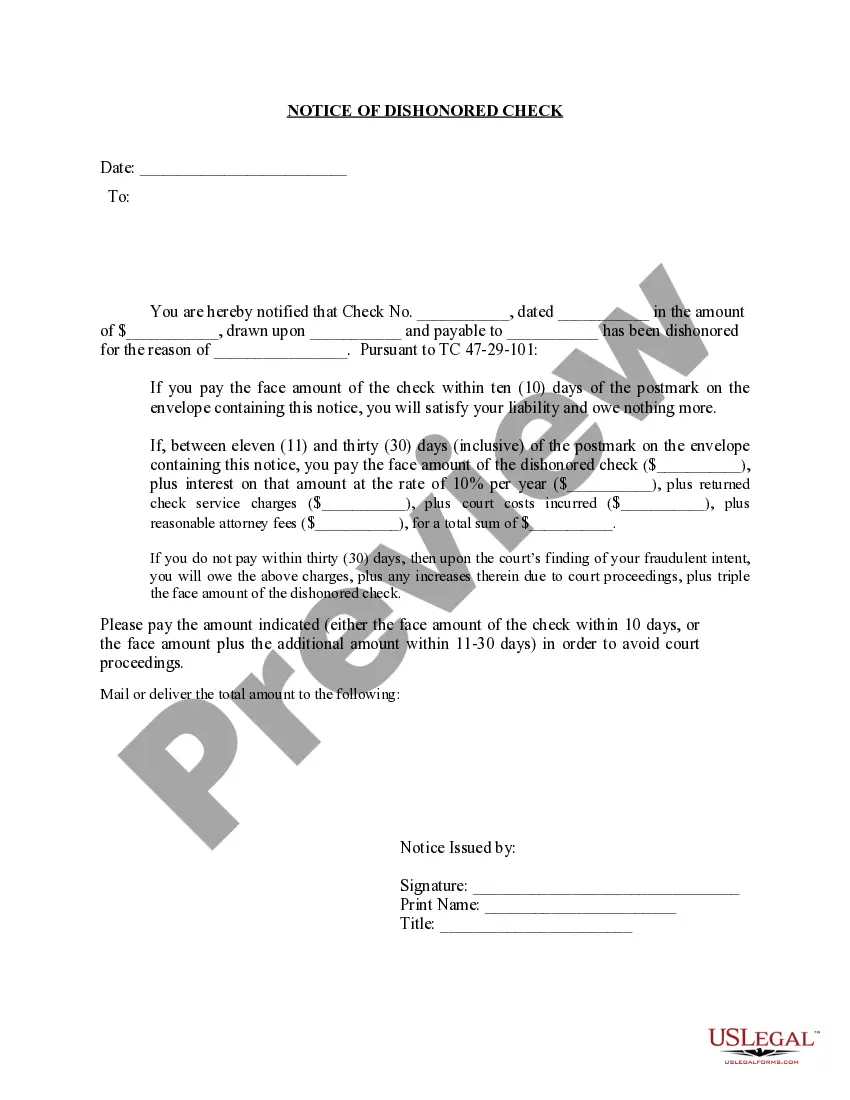

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

The Memphis Tennessee Notice of Dishonored Check — Civil is an official legal document used for notifying an individual or business entity that a check they issued has been returned unpaid by the bank for insufficient funds in the account. This notice serves as a way to inform the check writer about the consequences of issuing a bad or bounced check and the actions that may be taken against them if the matter is not resolved. Keywords related to this notice include "bad check" and "bounced check," which are commonly used to describe a check that has been rejected by the bank due to lack of funds in the account. These keywords help highlight the nature of the document and the legal implications associated with issuing such checks. The Memphis Tennessee Notice of Dishonored Check — Civil can be further categorized based on different types of bad or bounced checks, each representing a specific situation or violation. Some possible classifications include: 1. Insufficient Funds Check: This refers to a check given by an individual or business with an insufficient amount of money in their bank account to cover the check's value. It indicates that the account balance was not high enough to honor the payment. 2. Closed Account Check: This type of check is issued from an account that has been closed by the account holder. When the bank receives such a check, it automatically bounces due to the absence of an active account. 3. Forgery Check: This category encompasses checks that are issued by someone other than the legitimate account holder. It could involve identity theft or any fraudulent activity where a person intentionally writes a check on someone else's behalf. 4. Stop Payment Check: A stop payment check is one in which the account holder informs their bank to stop or cancel the payment before it is processed. These checks cannot be honored as per the instructions provided by the account holder. 5. Post-Dated Check: A post-dated check refers to a check that is written by the issuer for a later date than the current date. If the recipient attempts to cash or deposit this check before the specified date, it will likely be returned as a dishonored check. It is important for the notice to clearly state the type of dishonored check in order to provide the recipient with specific information regarding the violation committed. This enables the recipient to understand the exact reason for the dishonor and to take appropriate action to rectify the situation, such as paying the amount owed or rectifying any errors that may have occurred.