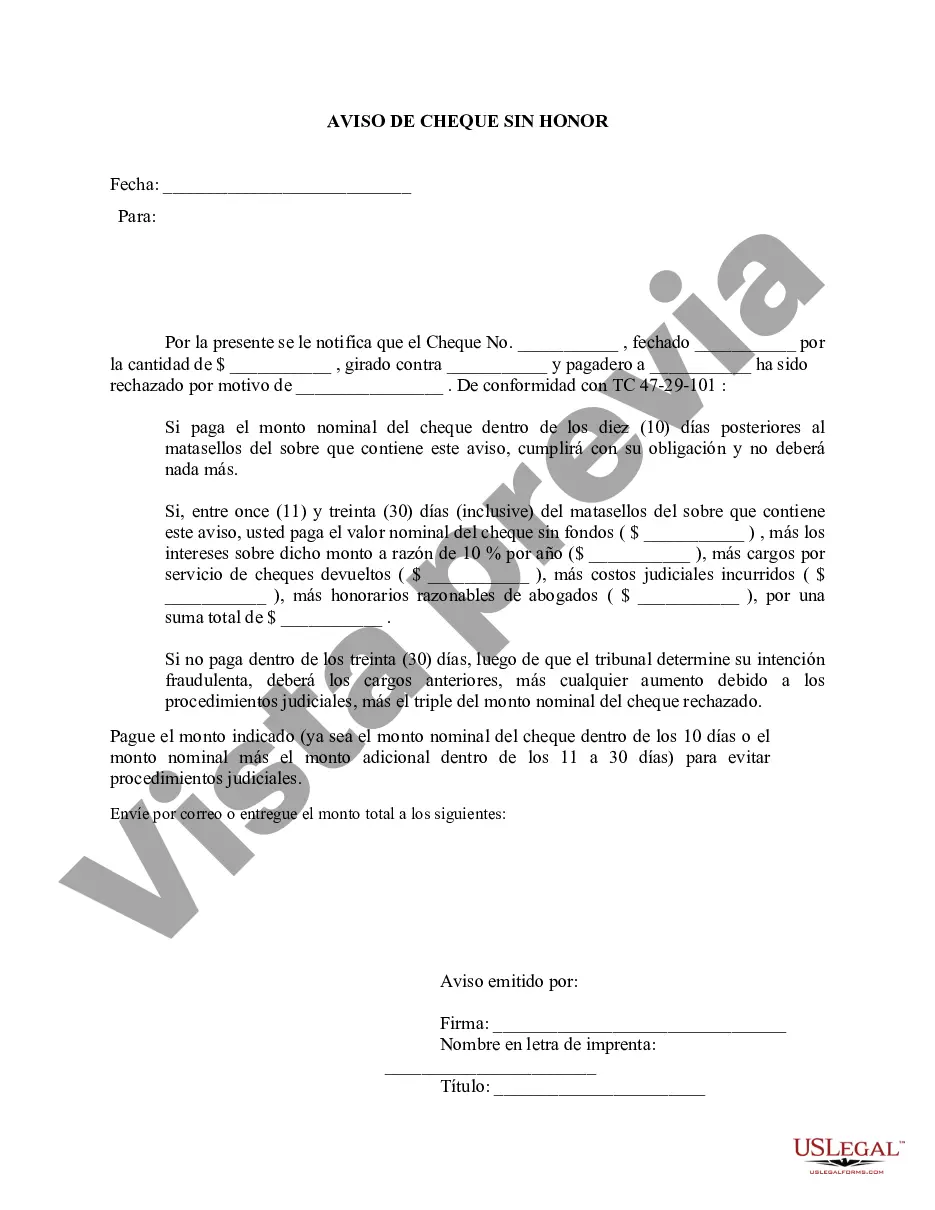

Title: Understanding the Nashville Tennessee Notice of Dishonored Check — Civil Introduction: In Nashville, Tennessee, businesses and individuals who receive a bounced check or a bad check have the opportunity to recover the owed amount through a legal process. The Nashville Tennessee Notice of Dishonored Check — Civil is an official document provided to inform individuals who have written a check that has been dishonored by a financial institution. This detailed description aims to help you understand the process, implications, and legal actions associated with this notice. Types of Dishonored Checks: 1. Bad Check: Also known as an insufficient fund check, a bad check refers to a check that the issuer writes without enough funds in the checking account. When the recipient attempts to deposit or cash the check, it bounces due to insufficient funds. 2. Non-Sufficient Funds (NSF) Check: An NSF check occurs when the account holder does not have adequate funds to cover the specified amount at the time of check presentment. Consequently, the financial institution will decline the payment as the account lacks sufficient funds. 3. Stop Payment Check: A stop payment check is a request made by the check issuer to their bank, attempting to prevent the recipient from cashing the check. However, if the recipient attempts to deposit or cash the check after a stop payment request has been placed, it will be dishonored. Process and Legal Actions: 1. Receipt of Notice: Upon receiving a dishonored check, the recipient, commonly referred to as the payee, will typically receive a Notice of Dishonored Check — Civil from the financial institution. This notice informs the payee that their check has been dishonored due to insufficient funds or other reasons. 2. Statutory Penalties: Tennessee law allows the payee to seek statutory penalties for a dishonored check. The payee can file a civil action against the check issuer to recover the face value of the check, additional service fees, and any statutory damages allowed by law. Statutory penalties are meant to compensate the payee for damages resulting from the dishonored check. 3. Notice Requirements: The payee must provide written notice to the check issuer, outlining the details of the dishonored check, including the check date, amount, and the bank that dishonored it. This notice aims to inform the issuer of the dishonored check and request payment within a specified timeframe. 4. Response and Resolution: Upon receiving the notice, the check issuer may choose to dispute the dishonored check or settle the matter by paying the owed amount and any associated fees within the specified timeframe. Failure to respond or settle the issue may result in legal consequences. Conclusion: Receiving a Nashville Tennessee Notice of Dishonored Check — Civil can be frustrating, but understanding the process and legal actions involved can help both parties navigate through the situation. It is crucial for check issuers to be aware of the potential consequences of writing a bad check, while payees should know their rights and available legal remedies to recover the owed amount.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nashville Tennessee Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Nashville Tennessee Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Nashville Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Nashville Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Nashville Tennessee Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!