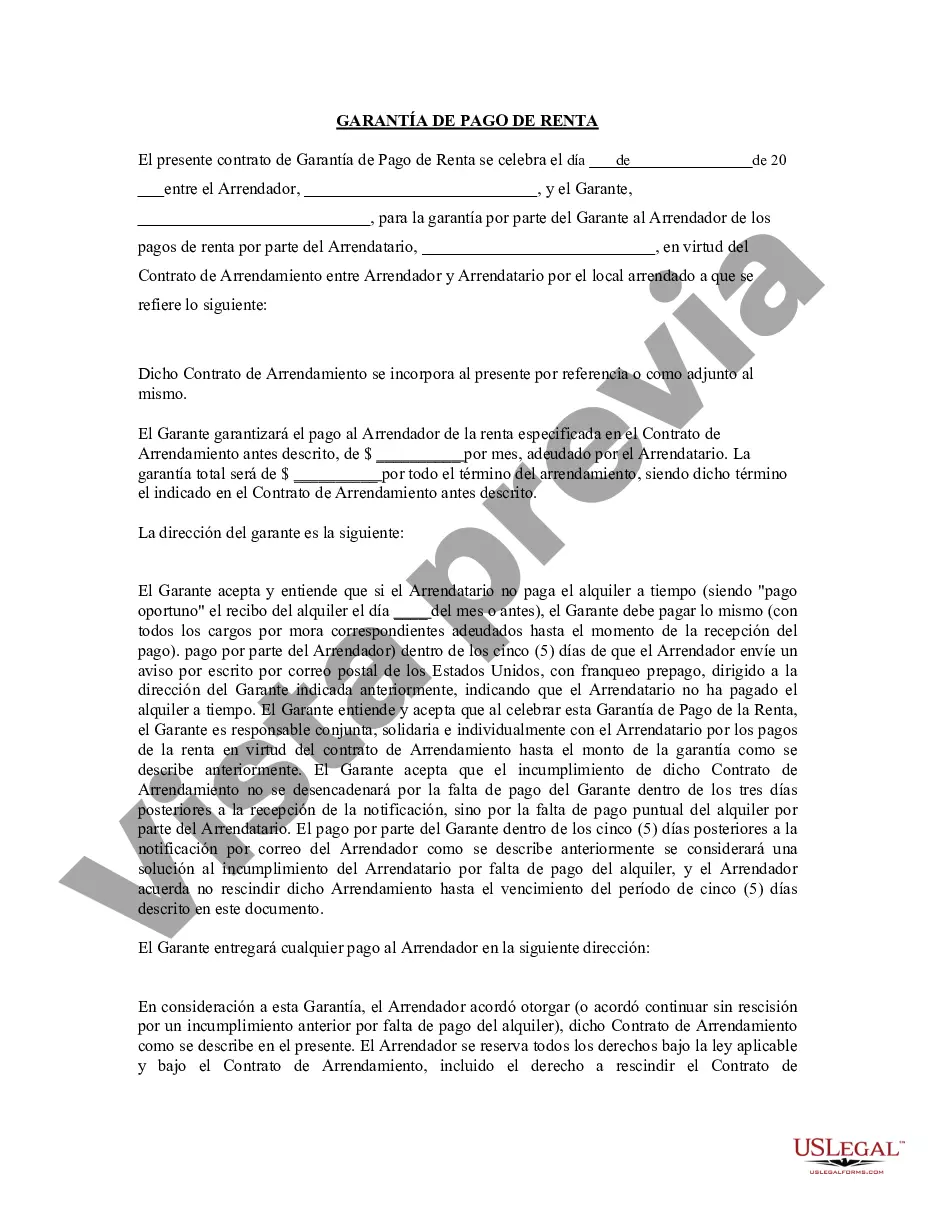

The Memphis Tennessee Guaranty or Guarantee of Payment of Rent is a legal agreement that provides security and assurance to landlords regarding the timely payment of rent by their tenants. It is a contractual arrangement in which a third party, known as the guarantor, pledges to cover any rental payment defaults made by the tenant. This ensures that landlords receive consistent rental income and minimizes their financial risks. Keywords: Memphis Tennessee, Guaranty, Guarantee, Payment, Rent, Legal agreement, Security, Assurance, Landlords, Tenants, Third party, Rental payment defaults, Rental income, Financial risks. There are various types of Memphis Tennessee Guaranty or Guarantee of Payment of Rent, based on the nature and scope of the guarantor's liability. Some common types include: 1. Full Guaranty: This is the most comprehensive type of guaranty, where the guarantor assumes full responsibility for all rental payment obligations of the tenant. In case of tenant default, the landlord can seek full payment from the guarantor, who is obligated to cover the entire rent amount. 2. Limited Guaranty: In a limited guaranty, the guarantor's liability is restricted to a specific time period or a predetermined maximum amount. For example, the guarantor may only be responsible for rent defaults occurring during the first year of the lease or up to a specified monetary limit. 3. Conditional Guaranty: A conditional guaranty imposes certain conditions or triggers under which the guarantor's liability is activated. For instance, the guarantor may only be obligated to cover rental payment defaults if the tenant fails to meet certain financial criteria or breaches specific lease terms. 4. Unconditional Guaranty: In contrast to a conditional guaranty, an unconditional guaranty does not involve any predefined conditions or limitations. The guarantor is unconditionally liable for all rental payment defaults, irrespective of any other circumstances. 5. Joint and Several guaranties: A joint and several guaranties is applicable when multiple guarantors are involved. Under this arrangement, each guarantor can be held individually responsible for the full amount of the tenant's rent defaults. This grants flexibility to the landlord to pursue specific guarantors or all of them collectively for reimbursement. 6. Corporate Guaranty: In certain cases, a corporation may act as the guarantor. A corporate guaranty provides the landlord with the assurance that the corporation will cover any rental payment defaults made by its officers or employees acting as tenants. These different types of Memphis Tennessee Guaranty or Guarantee of Payment of Rent allow landlords to select the most suitable arrangement based on their specific requirements and risk tolerance. It is essential for both landlords and tenants to clearly understand the terms and conditions outlined in the guaranty agreement to ensure a transparent and mutually beneficial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Memphis Tennessee Garantía o Garantía de Pago de Renta - Tennessee Guaranty or Guarantee of Payment of Rent

Description

How to fill out Memphis Tennessee Garantía O Garantía De Pago De Renta?

If you are searching for a relevant form template, it’s difficult to choose a more convenient service than the US Legal Forms site – probably the most considerable libraries on the web. Here you can find thousands of document samples for company and individual purposes by categories and states, or key phrases. Using our advanced search feature, finding the latest Memphis Tennessee Guaranty or Guarantee of Payment of Rent is as elementary as 1-2-3. Furthermore, the relevance of each document is proved by a group of skilled lawyers that regularly check the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Memphis Tennessee Guaranty or Guarantee of Payment of Rent is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the form you need. Read its explanation and use the Preview function to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the proper file.

- Affirm your choice. Select the Buy now option. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the obtained Memphis Tennessee Guaranty or Guarantee of Payment of Rent.

Every single template you add to your user profile has no expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to receive an extra duplicate for enhancing or creating a hard copy, feel free to come back and download it once again at any time.

Take advantage of the US Legal Forms extensive library to gain access to the Memphis Tennessee Guaranty or Guarantee of Payment of Rent you were looking for and thousands of other professional and state-specific samples in a single place!