Title: Nashville Tennessee Order to Close Without Detailed Accounting: An In-depth Overview Introduction: In Nashville, Tennessee, an "Order to Close Without Detailed Accounting" refers to a legal directive that allows for the closure of a business or organization without requiring a comprehensive financial report or detailed accounting records. This article explores the various aspects and implications of this order, shedding light on its types, impact, and potential reasons for issuance. Types of Nashville Tennessee Order to Close Without Detailed Accounting: 1. Emergency Closure Order: An emergency closure order may be imposed by local authorities or governing bodies to swiftly shut down a business without demanding an exhaustive financial assessment. Primarily enacted in situations of immediate public health and safety risks, this order aims to prioritize public welfare over the need for detailed accounting. 2. Temporary Closure Order: A temporary closure order permits a business to be shut down temporarily without necessitating a precise financial breakdown. It is often employed during extraordinary circumstances such as natural disasters, unexpected building damages, or unforeseen events that require the business to suspend operations quickly. 3. Voluntary Closure Order: In certain situations, businesses may voluntarily opt to close without providing detailed accounting. This decision might be a result of the business owner's personal circumstances, financial hardships, or strategic considerations. The order allows for closure without placing undue burden on the business to furnish exhaustive financial records. Impact and Implications: — Timely Response and Safety: The Nashville Tennessee Order to Close Without Detailed Accounting provides an efficient mechanism to respond promptly to emergencies or unforeseen circumstances, safeguarding public health and safety, which often take precedence over financial transparency. — Reduced Administrative Burden: By waiving the requirement for comprehensive accounting records, this order relieves businesses of the added burden of preparing detailed financial reports, enabling faster closure procedures and minimizing disruption. — Potential Challenges: While the order expedites the closure process, it may limit opportunities for a thorough investigation into businesses' financial status, potentially impeding efforts to trace assets, ensure appropriate debt repayments, or uncover fraudulent activities. Reasons for Issuance: 1. Public Health and Safety Concerns: The order is typically issued when businesses pose a risk to public health or safety, primarily during health crises, natural disasters, or incidents that necessitate an immediate shutdown for public protection. 2. Urgent Circumstances: Unexpected situations such as building collapses, severe infrastructure damages, or unforeseen events might demand rapid closure without the time-consuming requirement of detailed accounting. 3. Strategic Business Decisions: Business owners may voluntarily decide to close their establishments due to financial hardships, personal reasons, or changes in the market environment. The order allows for a swifter closure without the added burden of accounting documentation. Conclusion: The Nashville Tennessee Order to Close Without Detailed Accounting serves as a legal mechanism to promptly shutter businesses in various exceptional circumstances. While contributing to public safety and reducing administrative burden, it is important to recognize potential challenges, such as limited financial investigation opportunities. By understanding the types and implications of this order, businesses and the local community can better comprehend and adapt to the requirements for closure in Nashville, Tennessee.

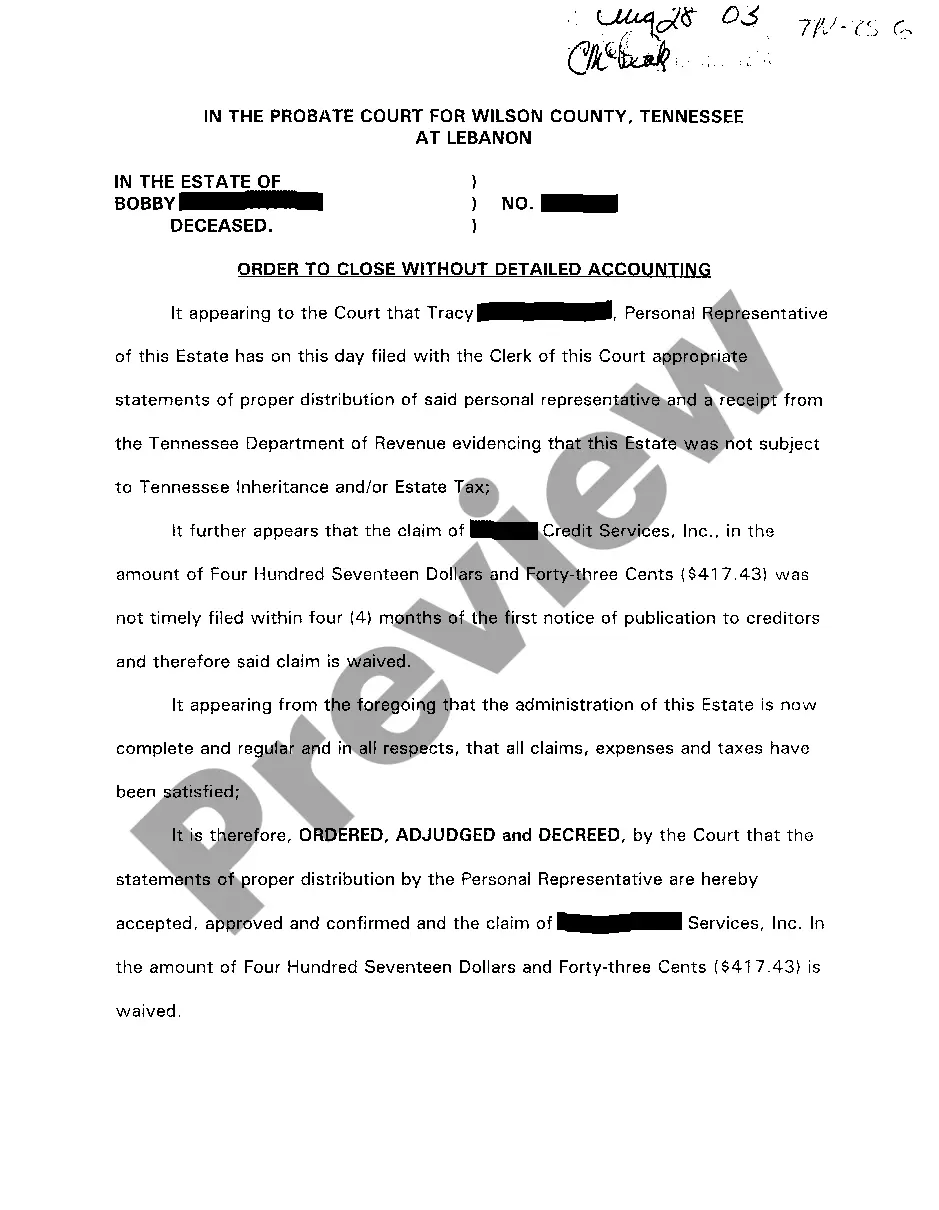

Nashville Tennessee Order To Close Without Detailed Accounting

Description

How to fill out Nashville Tennessee Order To Close Without Detailed Accounting?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, usually, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Nashville Tennessee Order To Close Without Detailed Accounting or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Nashville Tennessee Order To Close Without Detailed Accounting complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Nashville Tennessee Order To Close Without Detailed Accounting is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!