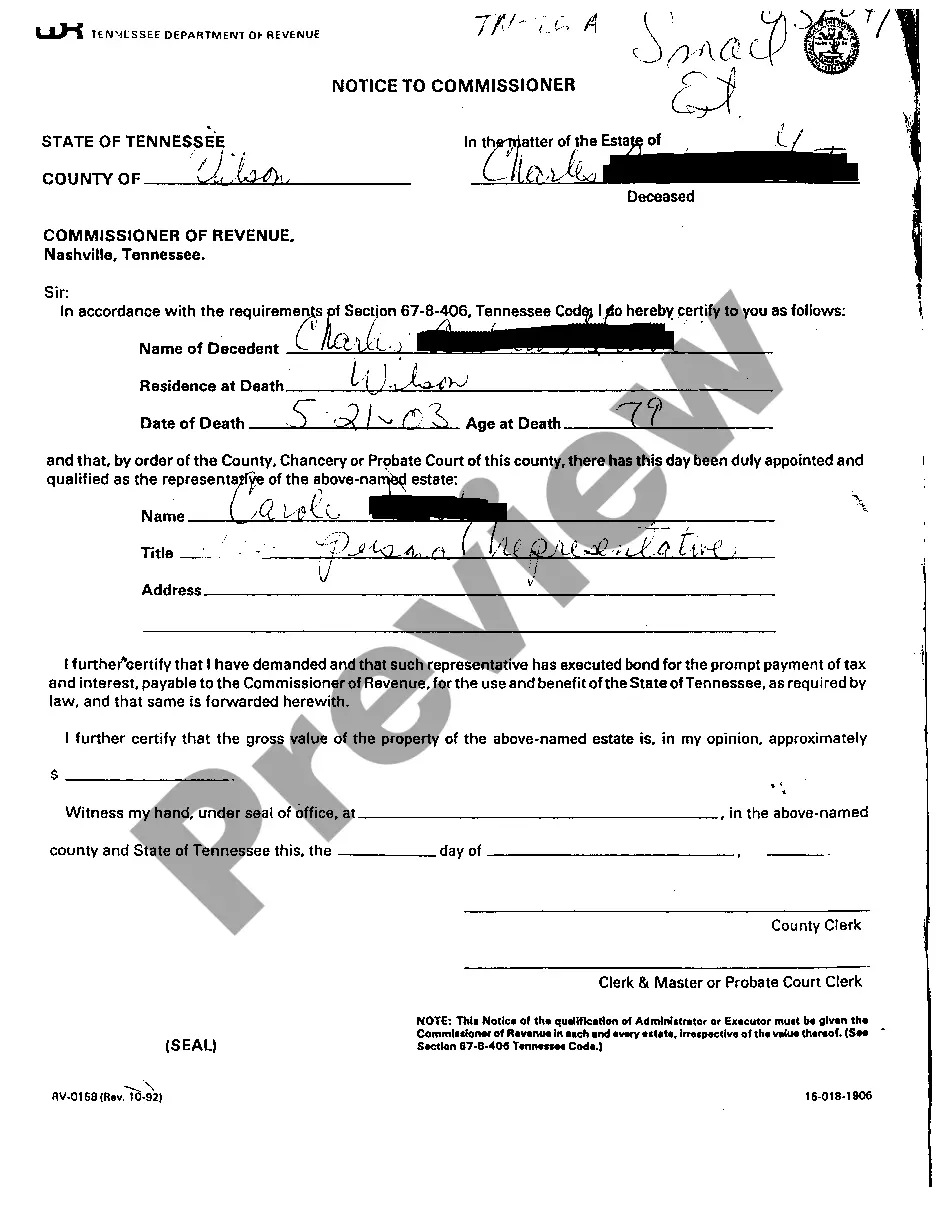

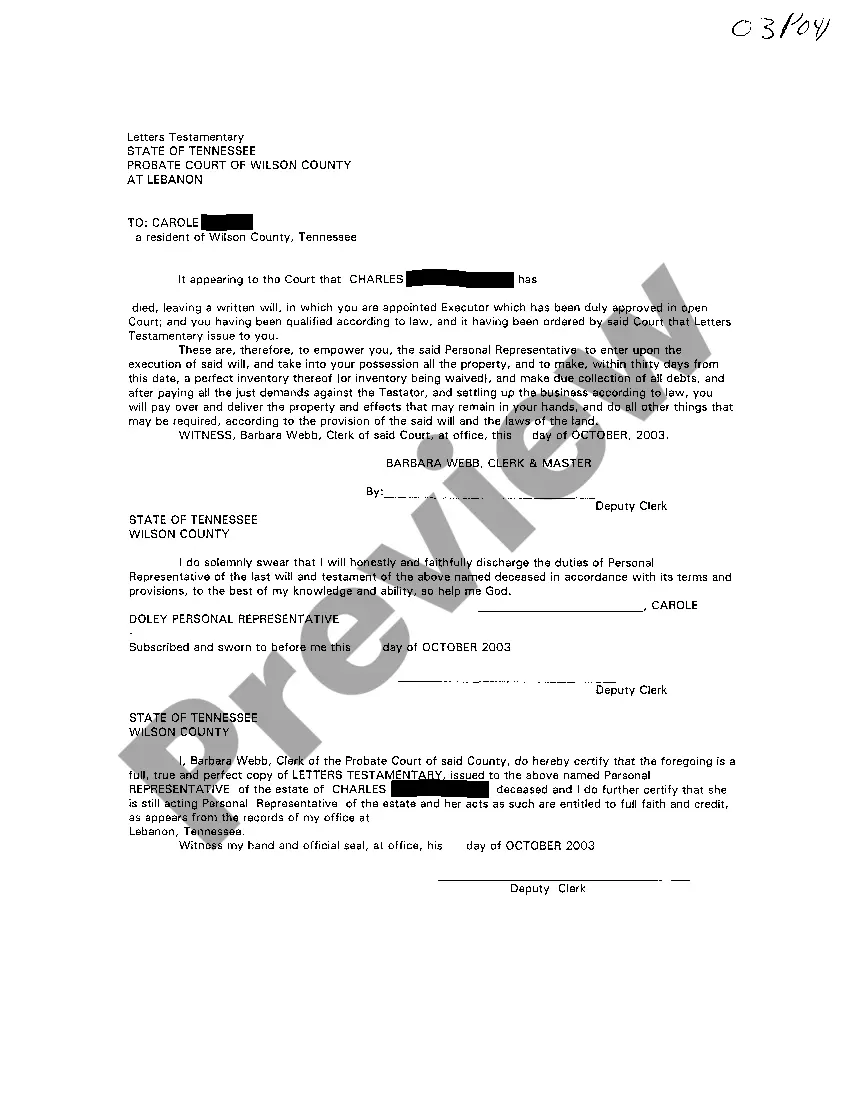

Title: Knoxville Tennessee Notice To Commissioner of Revenue That Will have Deceased is Being Probated Description: A Knoxville Tennessee Notice To Commissioner of Revenue That Will have Deceased is Being Probated serves as a formal legal document informing the Commissioner of Revenue regarding the initiation of the probate process for a deceased person's will. This notice plays a crucial role in ensuring proper taxation and transfer of assets. In Knoxville, Tennessee, there may be different types of notices depending on specific situations, which include: 1. Notice To Commissioner of Revenue for Probate of Original Will: This type of notice is used when the original will of a deceased individual is being probated in Knoxville, Tennessee. It alerts the Commissioner of Revenue about the probate process, ensuring the proper assessment and taxation of the deceased person's assets. 2. Notice To Commissioner of Revenue for Probate of Duplicate Will: If a duplicate copy of the deceased person's will is being probated instead of the original, this notice informs the Commissioner of Revenue in Knoxville, Tennessee, about the probate proceedings. It ensures that the assets' valuation, taxation, and distribution are accurately accounted for. 3. Notice To Commissioner of Revenue for Probate of Holographic Will: In cases where the deceased person's will is handwritten (holographic), this notice apprises the Commissioner of Revenue in Knoxville, Tennessee, about the probate process. It confirms the legitimacy of the holographic will, allowing for the appropriate taxation and distribution of assets to be carried out. 4. Notice To Commissioner of Revenue for Jointly Held Assets Probate: If the deceased person's assets were jointly held with another party, such as a spouse, this notice informs the Commissioner of Revenue in Knoxville, Tennessee, about the probate proceedings. It ensures proper valuation, taxation, and distribution of the jointly owned assets in line with applicable laws. Keywords: Knoxville Tennessee, notice, Commissioner of Revenue, probate, deceased person, will, legal document, taxation, assets, probate process, original will, duplicate will, holographic will, jointly held assets, probate proceedings.

Knoxville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Description

How to fill out Knoxville Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

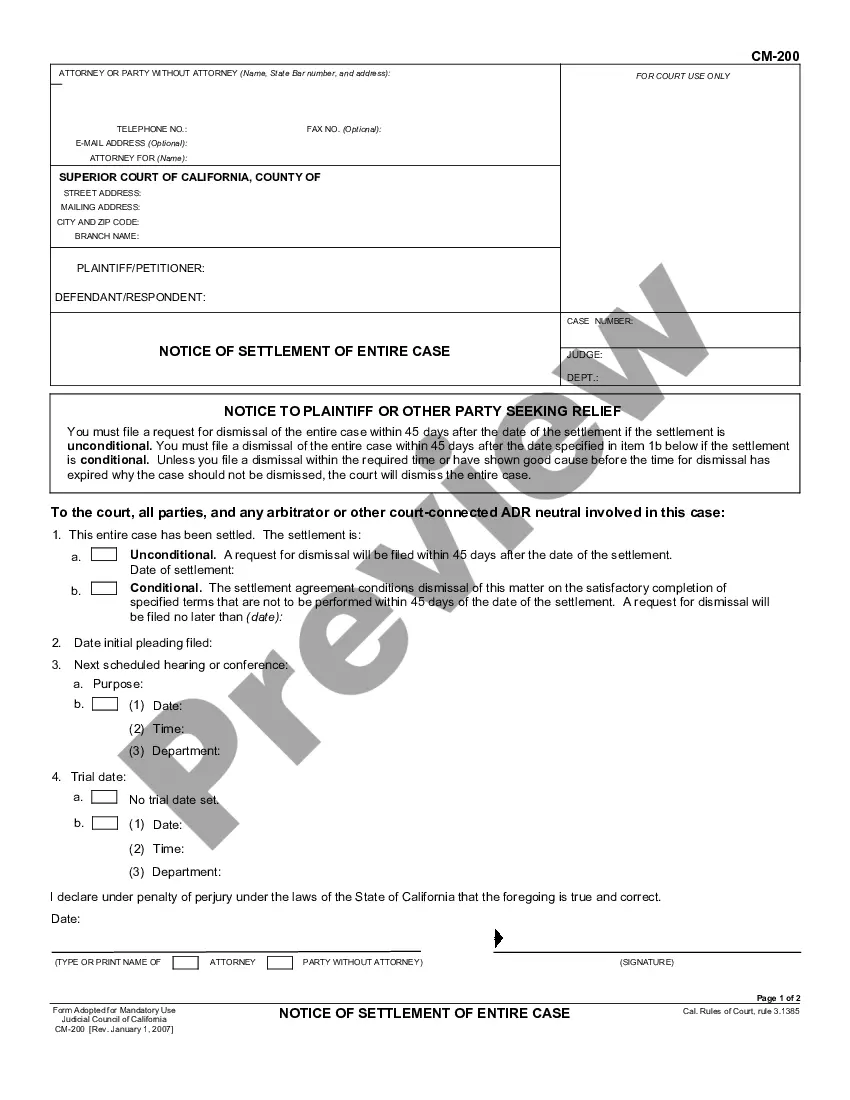

US Legal Forms is an online collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Knoxville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Knoxville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Knoxville Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!