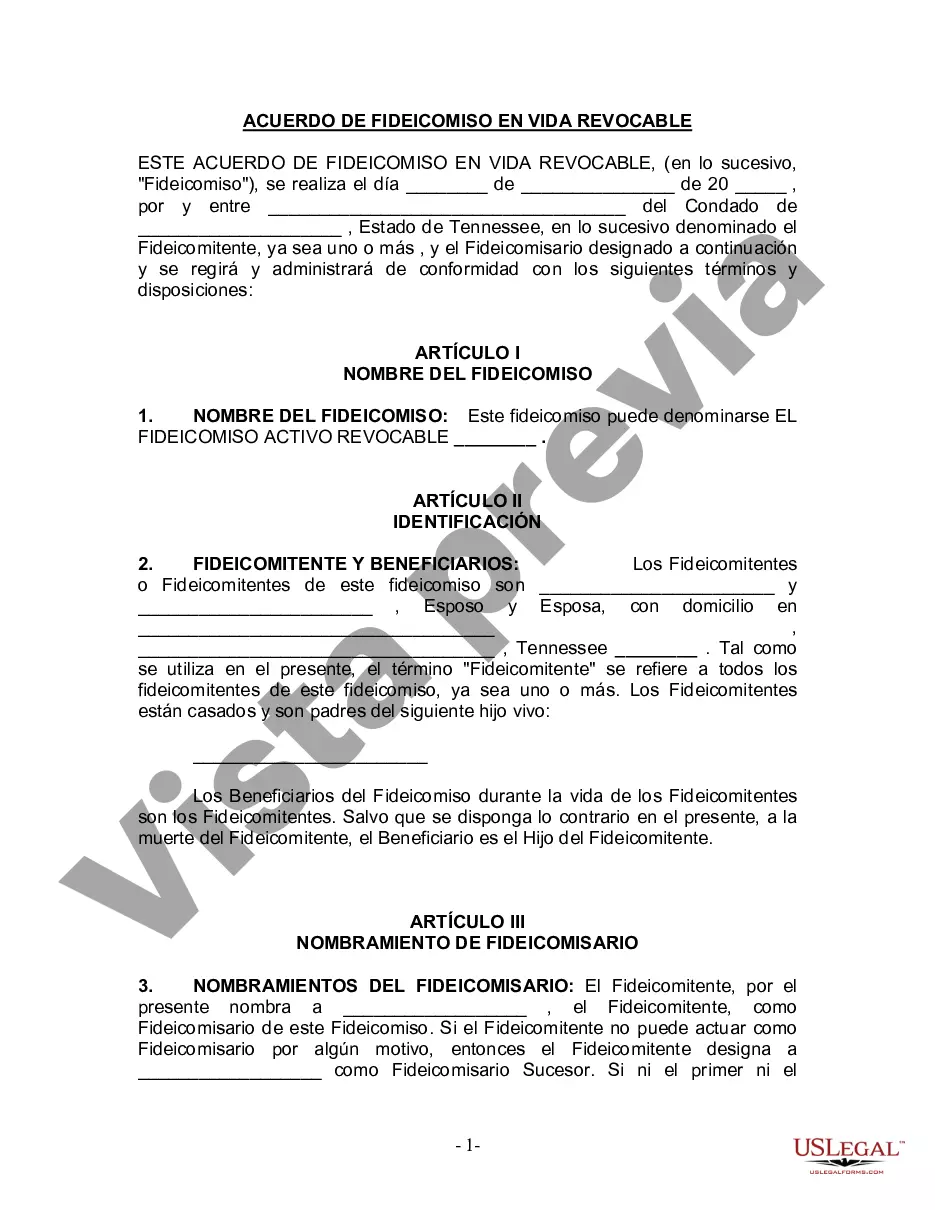

A Memphis Tennessee Living Trust for Husband and Wife with One Child is a legal document that allows married couples to plan and manage their assets during their lifetimes and dictate how their assets will be distributed after their passing. This trust is specifically designed for couples who have one biological or adopted child. Keywords: 1. Living Trust: This refers to a legal arrangement where the couple transfers ownership of their assets to a trust and designates a trustee to manage and distribute those assets. 2. Husband and Wife: This specifies that the trust is intended for married couples. 3. One Child: This indicates that the trust is meant for couples who have one biological or adopted child. 4. Distribution of Assets: This highlights that the trust provides instructions on how the couple's assets will be divided and distributed among their beneficiaries. 5. Estate Planning: This term refers to the process of organizing one's assets and affairs to ensure their efficient management and desired distribution upon death. Different types of Memphis Tennessee Living Trust for Husband and Wife with One Child may include: 1. Revocable Living Trust: This type of trust allows the couple to make changes or revoke the trust during their lifetimes. 2. Irrevocable Living Trust: In this case, the trust cannot be modified or terminated without the consent of the beneficiaries or a court order. 3. Testamentary Trust: This trust is created as part of a Last Will and Testament and takes effect upon the couple's death. It allows the couple to appoint a trustee and provide instructions for asset distribution. 4. Special Needs Trust: This is a specialized trust designed to provide for the financial needs of a disabled or special needs' child while preserving their eligibility for government benefits. 5. Charitable Remainder Trust: This trust allows the couple to make a charitable donation while retaining an income stream from the donated assets for themselves or their child. When creating a Memphis Tennessee Living Trust for Husband and Wife with One Child, couples should consult with an experienced estate planning attorney who can provide personalized advice and guidance based on their specific circumstances and objectives. It is crucial to ensure the trust is legally valid and aligns with relevant state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Memphis Tennessee Fideicomiso en vida para esposo y esposa con un hijo - Tennessee Living Trust for Husband and Wife with One Child

Description

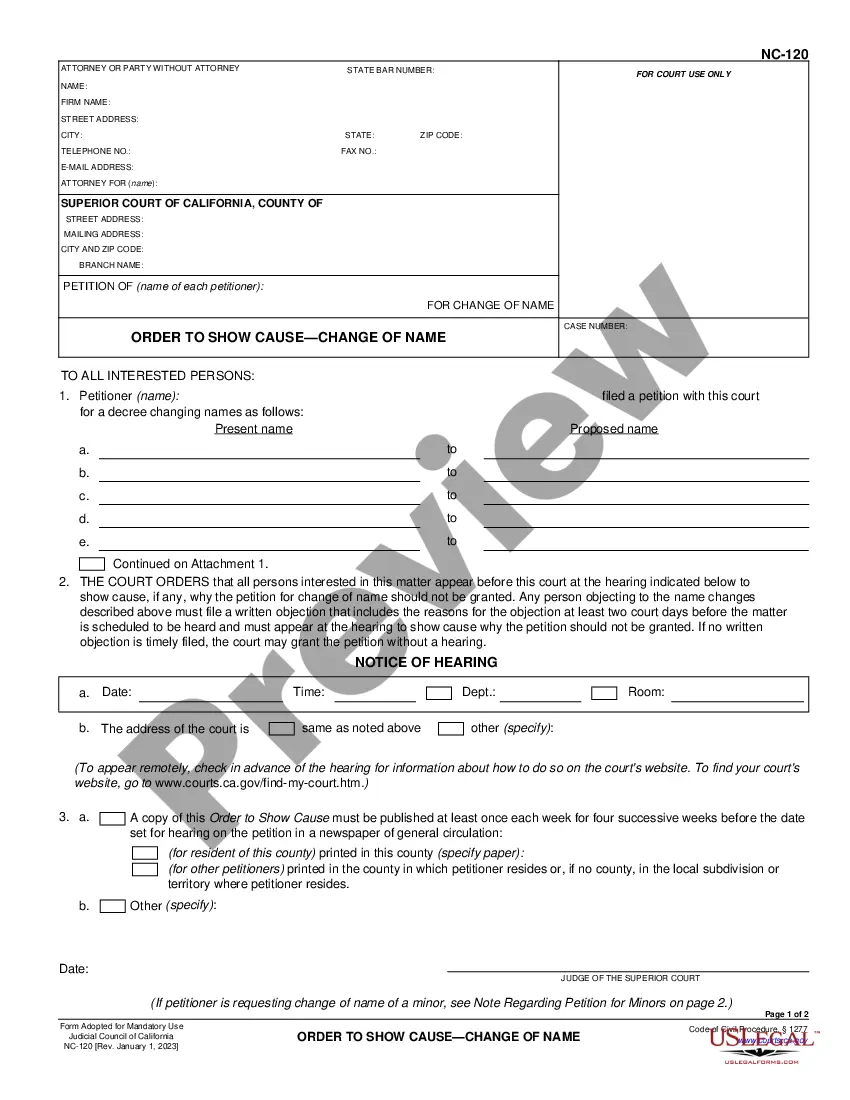

How to fill out Memphis Tennessee Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

Benefit from the US Legal Forms and have immediate access to any form sample you require. Our useful platform with a huge number of document templates makes it easy to find and get virtually any document sample you need. It is possible to save, fill, and certify the Memphis Tennessee Living Trust for Husband and Wife with One Child in just a matter of minutes instead of surfing the Net for several hours searching for a proper template.

Utilizing our catalog is a wonderful way to improve the safety of your document submissions. Our professional lawyers on a regular basis check all the records to ensure that the templates are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Memphis Tennessee Living Trust for Husband and Wife with One Child? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

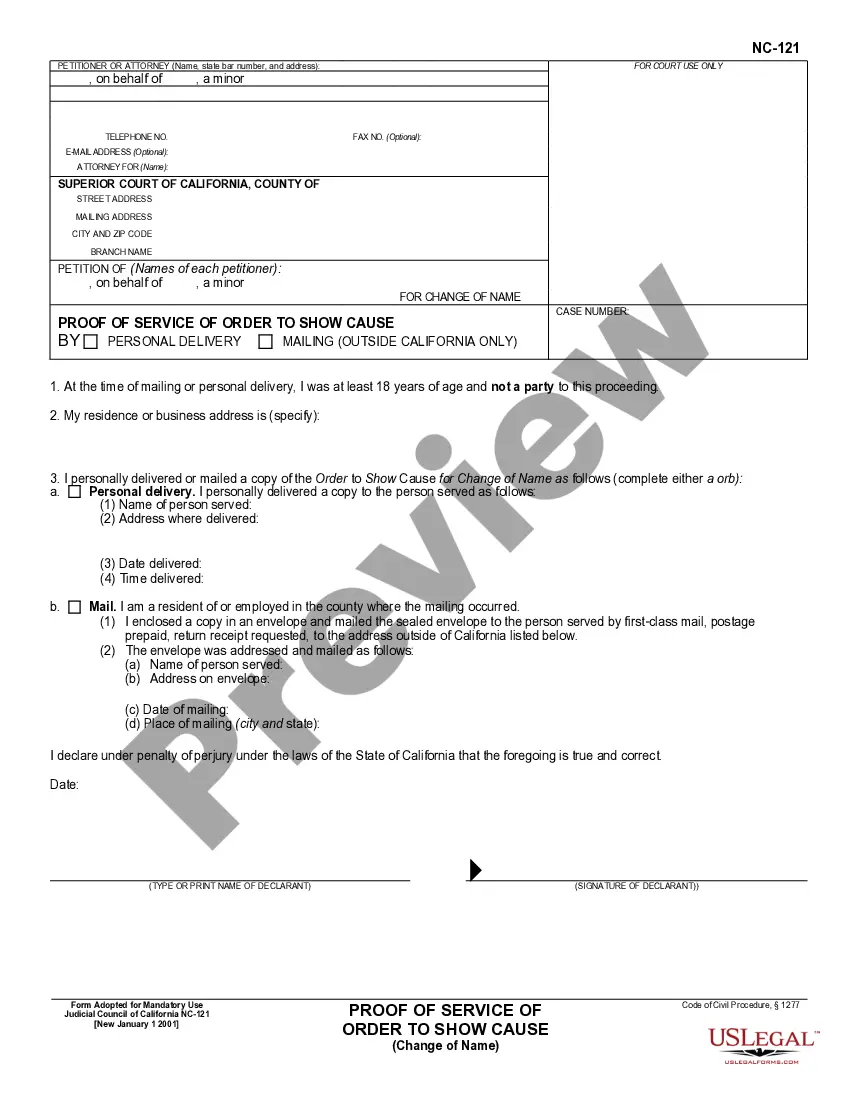

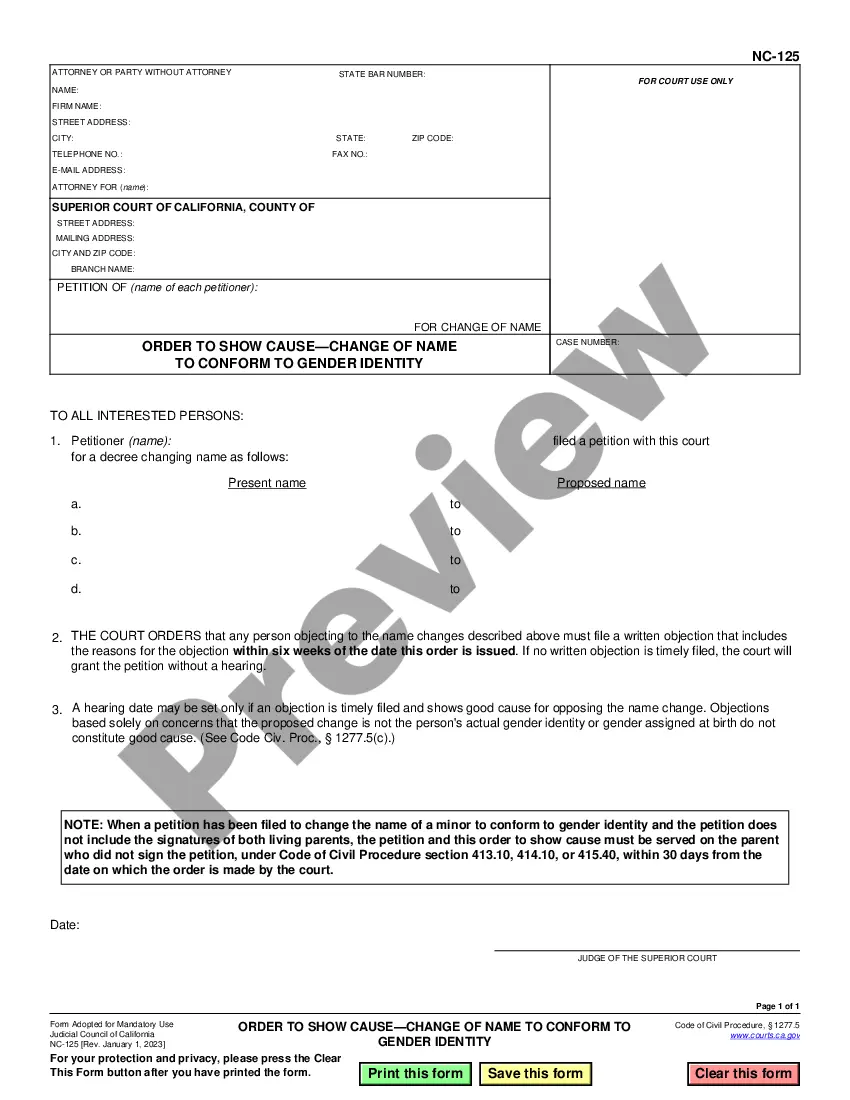

- Open the page with the form you require. Make certain that it is the form you were hoping to find: verify its headline and description, and use the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Select the format to obtain the Memphis Tennessee Living Trust for Husband and Wife with One Child and revise and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. We are always ready to assist you in any legal case, even if it is just downloading the Memphis Tennessee Living Trust for Husband and Wife with One Child.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!