Nashville Tennessee Enmienda al fideicomiso en vida - Tennessee Amendment to Living Trust

Description

How to fill out Nashville Tennessee Enmienda Al Fideicomiso En Vida?

Regardless of one's societal or occupational position, filling out legal documents is a regrettable requirement in the modern professional landscape.

Quite frequently, it’s nearly unattainable for someone lacking legal expertise to create such documents from scratch, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms comes to offer assistance.

Confirm the template you’ve chosen is relevant to your area, as the regulations of one county or state do not apply to another.

Review the form and examine a brief description (if available) regarding the cases the document may address.

- Our platform features an extensive collection with over 85,000 state-specific templates applicable to nearly any legal situation.

- US Legal Forms also acts as an invaluable resource for associates or legal advisors aiming to save time by utilizing our DIY documents.

- Whether you seek the Nashville Tennessee Amendment to Living Trust or any other document to be legally valid in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s a streamlined process for obtaining the Nashville Tennessee Amendment to Living Trust in minutes using our reliable service.

- If you’re already a member, you can simply Log In to your account to access the required form.

- Should you be new to our library, make sure to adhere to these guidelines prior to obtaining the Nashville Tennessee Amendment to Living Trust.

Form popularity

FAQ

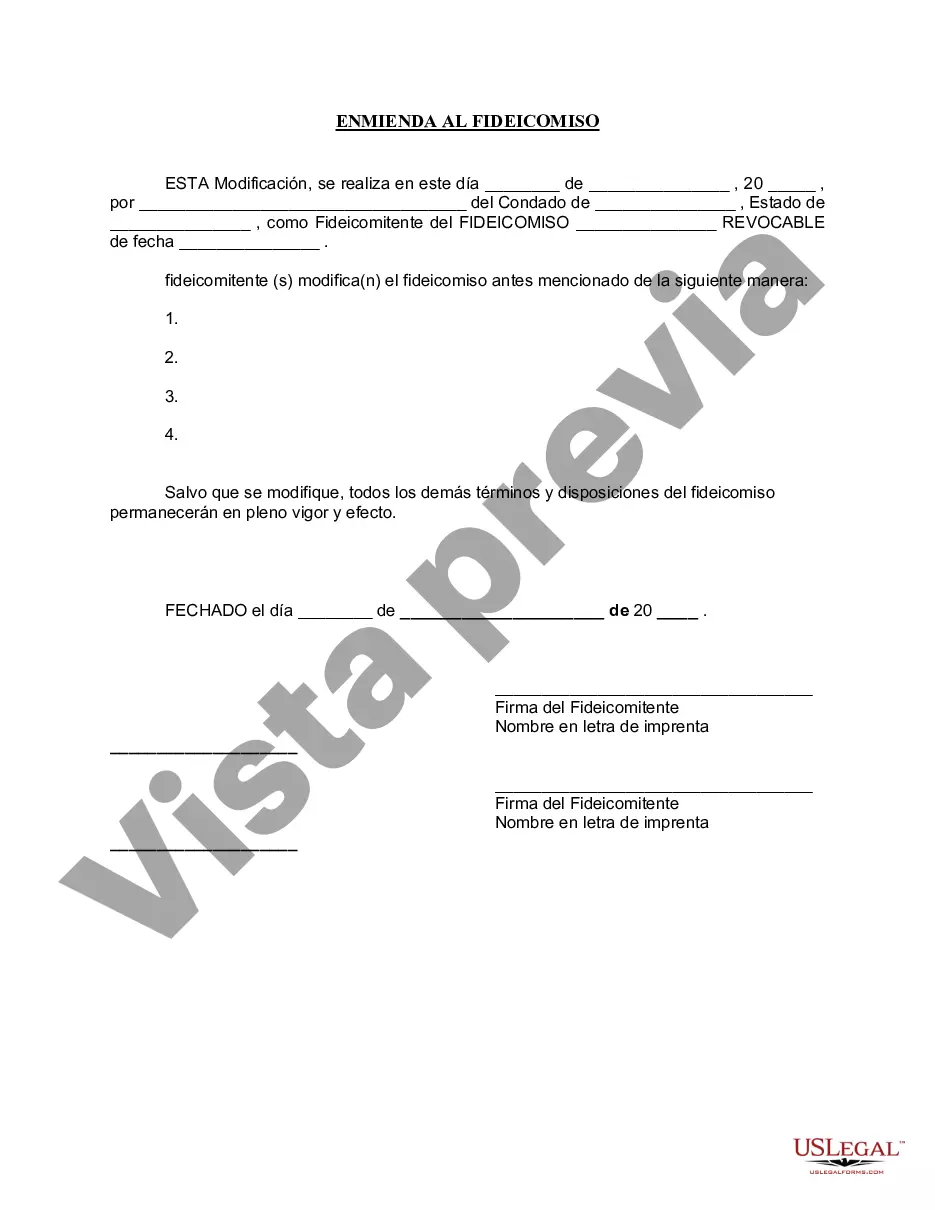

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

With the adoption of Probate Code Section 15401, that changed, and the law provided two distinct ways in which to revoke a California Trust: (1) revoke using the manner provided in the Trust instrument, or (2) revoke by any writing (other than a Will) signed by the Settlor and delivered to the trustee during the

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

How to Create a Living Trust in Tennessee Identify what should go into the trust.Choose the appropriate type of living trust.Next, choose your trustee, who will manage the trust.Now create a trust agreement.Then sign the trust document in front of a notary public. Finally, transfer your property into the trust.

Fortunately, California law allows for the amendment, modification or termination of an otherwise irrevocable trust--under the proper circumstances and using the proper procedures.

Tennessee has not adopted the Uniform Probate Code. So if your property is worth more than $50,000, a living trust will enable your heirs to avoid the state's lengthy probate period ? and legal costs. Living trusts do cost money, though, so you should weigh the benefits with the outlay of $1,000 or more.

A trust is not public record. A will is always made public record when it is probated. No one need know what assets are in your trust, who your beneficiaries are, or when the assets are distributed.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

STAND-ALONE DOCUMENTS Revocable Living Trust Amendments & Restatements: Cost starts at $350 for a simple amendment or $1,000 for a full restatement. Special Needs Trust: Cost starts at $3,000 for a stand-alone document or $1,500 when created in conjunction with a revocable living trust-based estate plan.

To transfer personal items to a trust, you or your attorney will list them on a property schedule that is referenced by and attached to the trust. However, note that it is more common to keep these assets just in your name and distribute them under your will than place them in a trust.