Chattanooga, Tennessee Financial Account Transfer to Living Trust: A Comprehensive Guide In Chattanooga, Tennessee, a financial account transfer to a living trust is a crucial step in estate planning and ensuring your assets are managed according to your wishes. By transferring your financial accounts to a living trust, you can gain increased control, flexibility, and privacy over the distribution of your assets. Types of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Bank Accounts Transfer: This involves transferring various types of financial accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to your living trust. By designating your trust as the account's owner, you effectively place these funds under the trust's control. 2. Investment Accounts Transfer: This type of transfer encompasses a wide range of investment vehicles, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and retirement accounts such as IRAs and 401(k)s. By re-titling these accounts in the name of your living trust, you enable the trust to manage and distribute the assets without the need for probate. 3. Real Estate Transfer: Besides financial accounts, a living trust can also hold ownership of real estate properties you own in Chattanooga or other locations. By transferring the property's title to your trust, its management and disposition can be streamlined, and potential probate costs and delays can be avoided. 4. Business Accounts Transfer: If you own a business, you can transfer ownership and control of your business accounts, including partnerships, corporations, or sole proprietorship, to your living trust. By doing so, your trust becomes the legal owner and manager of these assets, ensuring a smooth transition and continued operation in case of incapacity or death. Benefits of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Avoidance of Probate: By transferring your financial accounts to a living trust, you can bypass the long and costly probate process. Probate can lead to delays, increased expenses, and reduced privacy, all of which can be mitigated through the use of a living trust. 2. Incapacity Planning: A living trust allows for continued management of your financial accounts in the event of incapacity. With a successor trustee named in the trust, the management and control of your assets seamlessly transition, preventing any disruption or uncertainty. 3. Privacy and Confidentiality: Probate proceedings are a matter of public record. By utilizing a living trust, your financial affairs and asset distribution plans remain confidential, providing a higher level of privacy for you and your beneficiaries. 4. Flexibility in Asset Distribution: A living trust enables you to determine how and when your assets are distributed to your beneficiaries. You have the freedom to specify detailed instructions, including limitations, conditions, and timing, ensuring your wishes are followed precisely. In conclusion, a Chattanooga Tennessee Financial Account Transfer to Living Trust is an essential component of a well-rounded estate plan. By exploring the different types of financial accounts that can be transferred to a living trust, you can effectively protect and manage your assets, avoid probate, ensure privacy, and provide your loved ones with clear instructions for asset distribution.

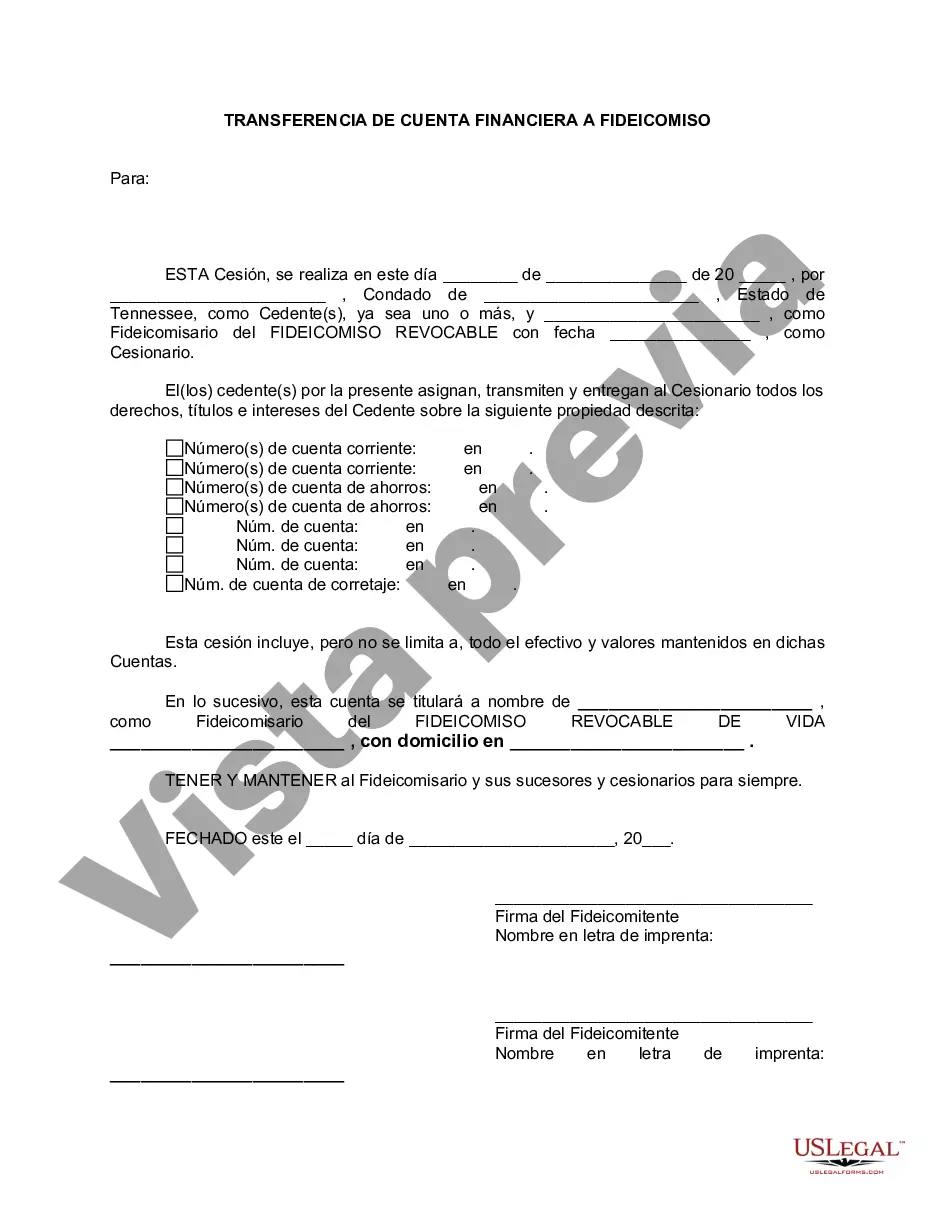

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chattanooga Tennessee Transferencia de cuenta financiera a fideicomiso en vida - Tennessee Financial Account Transfer to Living Trust

Description

How to fill out Chattanooga Tennessee Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law education to create this sort of papers from scratch, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our service offers a massive collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Chattanooga Tennessee Financial Account Transfer to Living Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Chattanooga Tennessee Financial Account Transfer to Living Trust in minutes employing our trusted service. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps prior to downloading the Chattanooga Tennessee Financial Account Transfer to Living Trust:

- Be sure the template you have chosen is good for your area considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- Log in to your account login information or create one from scratch.

- Pick the payment method and proceed to download the Chattanooga Tennessee Financial Account Transfer to Living Trust as soon as the payment is through.

You’re all set! Now you can proceed to print out the form or fill it out online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.